Jake Lawson here. Nevada markets itself as ultra-business-friendly, but here’s what they don’t advertise: every LLC must pay $200 annually for a state business license, plus potential municipal and regulatory licenses. The “no state income tax” marketing hides the reality that Nevada gets its revenue through business fees instead. Let me show you the real licensing landscape.

Nevada requires more business licensing than most “business-friendly” states, but they’ve built efficient systems to handle the complexity. Understanding what you actually need versus what gets overhyped is crucial for cost-effective compliance.

Nevada Business License Reality Check

The surprise: Every Nevada LLC must have a $200 annual state business license

The complexity: Municipal and regulatory licenses vary dramatically by location and industry

The system: Nevada’s SilverFlume portal streamlines the research process

The cost: $200-$2,000+ depending on your business type and location

Bottom line: Nevada isn’t as “license-free” as the marketing suggests, but they’ve made compliance relatively straightforward.

The Required Nevada State Business License

State Business License: $200 Annually

Required for: Every Nevada LLC, no exceptions

Cost: $200 per year (included in initial Articles of Organization filing)

Renewal: Annual requirement to maintain good standing

What it covers: General privilege to do business in Nevada

Jake’s insight: This $200 annual fee is Nevada’s version of franchise tax that other states charge. It’s not optional, and there are no exemptions based on business size or type.

Comparison context:

- Wyoming: $0 annual business license

- Delaware: $0 general business license (but $300 franchise tax)

- Florida: $0 state business license requirement

- Nevada: $200 annual state business license (mandatory)

Nevada’s “business-friendly” reputation needs this context.

Additional Nevada Licensing Requirements

Municipal and County Licenses

Nevada has 16 counties and numerous municipalities, each with potentially different requirements:

Major Urban Areas:

- Clark County (Las Vegas): Comprehensive licensing requirements, business license required

- Washoe County (Reno): Business registration and various permits

- Carson City: City business license and zoning compliance

Rural Counties:

- Often simpler requirements

- May require basic business registration

- Lower fees but still compliance obligations

Professional and Regulatory Licenses

Nevada requires licenses for regulated professions and industries:

Common Licensed Professions:

- Healthcare: Doctors, nurses, dentists, pharmacists, therapists

- Legal services: Attorneys, court reporters, notaries

- Financial services: CPAs, tax preparers, insurance agents, real estate professionals

- Construction: Contractors, electricians, plumbers, HVAC technicians

- Personal services: Barbers, cosmetologists, massage therapists

Industry-Specific Licenses:

- Gaming: Casinos, gaming equipment, sports betting (highly regulated)

- Food service: Restaurants, catering, food trucks, retail food

- Transportation: Taxis, limousines, moving companies, freight

- Security services: Private investigators, security guards, alarm companies

- Environmental: Waste management, water systems, mining operations

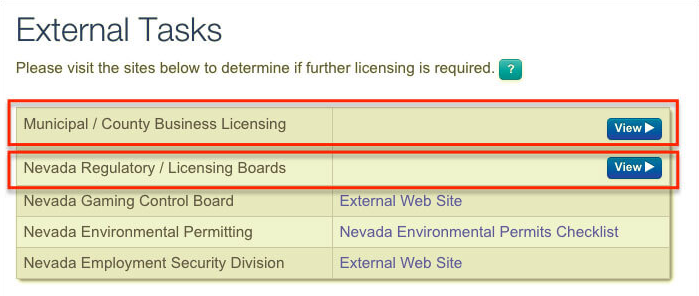

Nevada’s SilverFlume System: Your Research Tool

What SilverFlume Does:

Common Business Registration (CBR) helps you:

- Identify municipal and county licensing requirements

- Register for sales and use tax (if applicable)

- Obtain workers’ compensation coverage information

- Register with Nevada Department of Taxation

- Research regulatory licensing needs

How to Use SilverFlume Effectively:

Step 1: Preparation

- Have your LLC formation documents ready

- Obtain your federal EIN first

- Know your primary business activities and location

- Understand your NAICS code (business classification)

Step 2: Business Information Input

- Enter accurate NAICS code for your industry

- Specify primary business location (determines municipal requirements)

- Indicate if you’ll operate in multiple counties

- Specify employee status (affects labor law requirements)

Step 3: Review Requirements

- System generates customized licensing requirements

- Provides contact information for relevant agencies

- Shows estimated costs where available

- Gives timeline expectations for license processing

Jake’s experience:

SilverFlume is actually helpful—better than most states’ licensing research tools. Use it instead of paying $99+ for “license research services.”

Nevada Licensing Costs: Real Numbers

Guaranteed Costs (Every LLC):

- Nevada State Business License: $200 annually (no exceptions)

- Federal EIN: Free (apply directly through IRS)

Typical Additional Costs:

- Municipal business licenses: $50-$500 (varies dramatically by location)

- Professional licenses: $100-$1,000+ (varies by profession)

- Regulatory permits: $200-$2,000+ (industry-dependent)

- Sales tax permit: Free registration, but compliance costs vary

What Most Nevada LLCs Actually Pay:

Simple service businesses: $200 (just state license)

Professional services: $400-$1,200 (state + professional + municipal)

Retail businesses: $300-$800 (state + municipal + sales tax compliance)

Food service: $600-$1,500 (state + health permits + municipal licenses)

Gaming-related: $1,000-$10,000+ (heavily regulated industry)

Industry-Specific Nevada Licensing

Online/Digital Businesses:

- Required: Nevada State Business License ($200)

- Likely needed: Sales tax registration if selling to Nevada customers

- Probably not needed: Additional licenses unless in regulated industry

Professional Services:

- Required: State business license + professional licensing

- Likely needed: Municipal business registration

- Consider: Professional liability insurance requirements

Retail/E-commerce:

- Required: State business license + sales tax permit

- Likely needed: Municipal business license, zoning clearance

- Consider: Reseller permits for wholesale purchases

Food Service:

- Required: State license + health department permits

- Always needed: Municipal permits, food handler certifications

- Consider: Liquor licenses if serving alcohol

Gaming Industry:

- Required: Extensive Nevada Gaming Commission licensing

- Always needed: Background checks, financial investigations

- Consider: One of the most regulated industries in Nevada

Construction:

- Required: State license + contractor licensing

- Always needed: Municipal permits, bonding requirements

- Consider: Workers’ compensation insurance

Municipal Licensing Variations

Las Vegas (Clark County):

- Business license required for most operations

- Zoning compliance certificates

- Health permits for applicable businesses

- Entertainment and gaming-related permits

- Cost range: $100-$1,000+ depending on business type

Reno (Washoe County):

- Business registration requirements

- Various industry-specific permits

- Health and safety compliance

- Cost range: $75-$500 typical

Smaller Nevada Cities:

- Often simpler requirements

- May require basic business registration

- Lower fees but still compliance obligations

- Cost range: $25-$200 typical

Rural Nevada:

- Minimal licensing requirements beyond state license

- May require county business registration

- Often more personal service from clerks

- Cost range: $0-$100 beyond state requirements

The Nevada Tax Registration Component

Sales Tax Permit:

Required for: Businesses selling taxable goods or services in Nevada

Cost: Free registration

Process: Through SilverFlume Common Business Registration

Ongoing: File and pay sales tax as collected

Nevada sales tax rates:

- State rate: 4.6%

- Local rates: Up to 3.775% additional

- Total range: 4.6% to 8.375% depending on location

Modified Business Tax:

Nevada’s version of payroll tax for businesses with employees

- Threshold: Applies to businesses paying over $50,000 quarterly in wages

- Rate: 1.17% on wages exceeding the threshold

- Filing: Quarterly through Nevada Tax Center

Common Nevada Licensing Mistakes

Mistake #1: Assuming “Business-Friendly” Means License-Free

Problem: Missing the required $200 annual state business license

Solution: Every Nevada LLC needs this license—no exceptions

Mistake #2: Ignoring Municipal Requirements

Problem: Focusing only on state requirements while missing local permits

Solution: Use SilverFlume to research local requirements for your specific location

Mistake #3: Underestimating Gaming Regulation

Problem: Thinking Nevada gaming licensing is simple because gambling is legal

Solution: Gaming industry requires extensive licensing, background checks, and compliance

Mistake #4: Not Using SilverFlume Effectively

Problem: Paying for license research services instead of using Nevada’s free tools

Solution: SilverFlume provides comprehensive licensing research at no cost

Mistake #5: Forgetting Annual Renewals

Problem: Missing renewal deadlines for licenses and permits

Solution: Create renewal calendar for all required licenses

Your Nevada LLC Licensing Action Plan

Phase 1: State Requirements (Week 1)

- Ensure state business license is included in LLC formation

- Obtain federal EIN directly from IRS (free)

- Research professional licensing requirements for your industry

- Access SilverFlume and set up your business account

Phase 2: Common Business Registration (Week 2)

- Complete SilverFlume CBR with accurate business information

- Identify municipal requirements based on your location

- Research regulatory licensing needs for your industry

- Register for sales tax if selling taxable goods/services

Phase 3: License Applications (Week 3-4)

- Apply for professional licenses (often take longest to process)

- File municipal applications as required by your location

- Obtain regulatory permits for specialized industries

- Complete tax registrations as identified through CBR

Phase 4: Ongoing Compliance Setup (Week 4)

- Create renewal calendar for all licenses and permits

- Set up tax filing systems for sales tax and other obligations

- Establish record-keeping for license compliance

- Review insurance requirements related to licensing

Nevada vs. Other “Business-Friendly” States

Cost Comparison:

Nevada:

- $425 LLC formation + $200 annual business license = $625 first year

- $350+ annually ongoing (business license + annual list)

Wyoming:

- $100 LLC formation + $60 annual report = $160 first year

- $60 annually ongoing

Delaware:

- $90 LLC formation + $300 franchise tax = $390 first year

- $300 annually ongoing

Jake’s analysis: Nevada’s total costs are higher than other business-friendly states when you include the mandatory business license.

What Nevada Provides for the Premium:

- No state income tax: Personal and corporate

- Asset protection laws: Strong LLC and trust protections

- Business-friendly courts: Experience with complex business litigation

- Gaming industry access: If relevant to your business

- Strategic location: Access to California and western markets

Special Nevada Considerations

Gaming Industry Licensing:

If your business touches gaming in any way:

- Nevada Gaming Commission oversight: Extensive background checks

- Multiple license types: Gaming licenses, manufacturing, distribution

- High costs: Can range from thousands to millions depending on scope

- Ongoing compliance: Detailed record-keeping and reporting requirements

Mining Industry:

Nevada’s significant mining industry has specific requirements:

- Environmental permits: Extensive regulatory compliance

- Safety licensing: Worker safety and environmental protection

- Bonding requirements: Financial guarantees for environmental restoration

- Multiple agency coordination: Federal, state, and local oversight

Home-Based Business Rules:

Nevada is generally accommodating to home-based businesses:

- Zoning compliance: Check local zoning requirements

- HOA restrictions: Many neighborhoods have business restrictions

- Professional services: Often allowed with proper licensing

- No additional state fees: Beyond standard business license

When to Get Professional Help

Handle Yourself:

- Basic SilverFlume Common Business Registration

- Simple municipal business license applications

- Federal EIN application

- Basic sales tax registration

Consider Professional Help:

- Complex professional licensing (healthcare, legal, financial)

- Gaming industry licensing and compliance

- Multi-location operations across counties

- Food service with multiple permit requirements

Definitely Get Help:

- Gaming Commission licensing applications

- Complex regulatory compliance (mining, environmental)

- Multi-state tax planning involving Nevada incorporation

- Large-scale operations with extensive permit requirements

The Bottom Line on Nevada Licensing

Nevada’s licensing requirements are more extensive than the “business-friendly” marketing suggests, but the state has built efficient systems to handle the complexity. The mandatory $200 annual business license is significant, but the overall framework is manageable with proper planning.

Key insights:

- Every Nevada LLC pays $200 annually for state business license (no exceptions)

- SilverFlume provides excellent free research tools

- Municipal requirements vary dramatically by location

- Professional and regulated industries have substantial additional requirements

- Total licensing costs can range from $200-$2,000+ depending on business type

Budget realistically: $200-$1,500 covers most Nevada LLCs’ licensing needs, depending on industry and location.

Research strategy: Use Nevada’s SilverFlume system instead of paying for basic license research services.

Ready to Navigate Nevada Licensing?

Research Nevada business licenses →

Get my complete Nevada LLC guide →

Download my Nevada licensing checklist →

Questions about Nevada business licensing or need help understanding specific requirements for your industry? Contact me directly—I’ve helped dozens of Nevada entrepreneurs understand the real licensing landscape behind the marketing hype.

Legal Disclaimer: This information is for educational purposes only and doesn’t constitute legal or tax advice. Nevada business licensing requirements can change over time and vary by location and industry. Always verify current requirements with appropriate Nevada agencies and consult qualified professionals for specific legal and tax matters.