By Jake Lawson, LLC Formation Strategist

Congratulations on forming your Alaska LLC! Now you need an EIN (Employer Identification Number), and you’re probably wondering if this is going to be another complicated government process. Here’s the excellent news: getting an EIN for your Alaska LLC is completely free, takes about 10 minutes online, and is refreshingly straightforward.

Alaska is already one of the most business-friendly states for LLCs—no state income tax, no franchise tax, and reasonable fees. The federal government continues this trend by making EINs free and simple to obtain. Let me show you exactly how to get yours without any unnecessary complications or fees.

Bottom line upfront: Every Alaska LLC should get an EIN, even if you’re a single-member LLC with no employees. It’s free, protects your privacy, and you’ll need it for virtually every business activity anyway.

What Is an EIN and Why Your Alaska LLC Needs One

Your EIN is essentially your LLC’s Social Security Number—a unique 9-digit identifier (formatted XX-XXXXXXX) that the IRS assigns to your business for tax and identification purposes.

Important clarification: Your EIN comes from the IRS (federal government), not the Alaska Department of Commerce. It’s completely separate from your state LLC registration.

Need an LLC? Northwest offers LLC formation services for $39 + state fee. You can also include an EIN with your order.

Already own an LLC but missing an EIN? Let Northwest handle it for you:

- I have an SSN | I don’t have an SSN

Why Every Alaska LLC Should Get an EIN

Even if you’re a single-member LLC with no employees, here’s why you need an EIN:

Essential business activities requiring an EIN:

- Opening business bank accounts (virtually all banks require it)

- Applying for business credit cards

- Getting business loans or lines of credit

- Filing tax returns (mandatory for multi-member LLCs)

- Applying for Alaska business licenses

- Setting up merchant accounts for payment processing

- Registering for Alaska business license (if required)

Privacy and security benefits:

- Protects your SSN from appearing on business documents

- Reduces identity theft risk

- Creates professional separation between personal and business finances

Jake’s Alaska insight: Alaska entrepreneurs are already smart enough to choose one of the most tax-friendly states in the country. Don’t undermine that smart choice by operating without proper federal identification. Get your free EIN and keep building on Alaska’s advantages.

Perfect Timing: When to Apply for Your EIN

The essential rule: Wait until your Alaska Articles of Organization are officially approved before applying for your EIN.

Why Timing Matters:

- Your LLC name on the EIN application must exactly match your approved Articles of Organization

- Applying too early can create name mismatches that require IRS cleanup

- If your LLC name gets rejected and changed, you’ll need a new EIN with the correct name

Jake’s recommended sequence:

- File Articles of Organization with Alaska Department of Commerce

- Wait for official approval (usually 1-2 business days for online filings)

- Apply for EIN immediately after approval

- Use EIN to open business bank account and handle other business setup

How to Get Your EIN: Complete Step-by-Step Guide

For U.S. Citizens and Residents (Online Application – Recommended)

This is the fastest method—you receive your EIN immediately upon completion.

What you’ll need ready:

- Your approved Alaska Articles of Organization

- Social Security Number (SSN) or Individual Taxpayer ID (ITIN)

- Basic LLC information (formation date, business purpose, etc.)

- 10-15 minutes of focused time

The application process:

- Go directly to irs.gov (ignore all paid service advertisements)

- Search for “Apply for EIN Online”

- Complete the user-friendly online form

- Download your EIN Confirmation Letter immediately

- Save multiple copies—you’ll need this document constantly

Jake’s firm warning: Only use the official IRS website at irs.gov. If you see ads for “EIN services” charging $50-$300, they’re scamming you for something that’s completely free. Alaska entrepreneurs are too smart to fall for these schemes.

For Non-U.S. Residents (Mail/Fax Application)

If you don’t have an SSN or ITIN, you can still get an EIN—you just can’t use the online system.

Your options:

- Form SS-4 by fax: 1-2 weeks processing time

- Form SS-4 by mail: 4-6 weeks processing time

What you’ll need:

- Completed Form SS-4 (downloadable from irs.gov)

- Copy of your approved Alaska Articles of Organization

- Clear explanation of your role as responsible party

Jake’s note: International entrepreneurs can absolutely get EINs for their Alaska LLCs. Alaska’s business-friendly environment attracts global investors, and the federal government accommodates this with straightforward processes for non-residents.

Alaska-Specific EIN Application Tips

LLC Name Formatting Must Be Exact

Your EIN application must precisely match your approved Articles of Organization:

- Exact capitalization (if your Articles say “NORTHERN LIGHTS CONSULTING LLC,” don’t put “Northern Lights Consulting LLC”)

- Punctuation matching (periods, commas, etc.)

- Spacing exactly as approved

Principal Business Activity for Alaska

Choose the classification that best describes your primary revenue source:

- Oil and gas extraction (Alaska’s traditional economic driver)

- Mining and natural resources

- Fishing and seafood processing

- Tourism and hospitality

- Transportation and logistics

- Professional services (consulting, legal, accounting)

- Technology and software (growing sector)

Tip: Be honest about your primary business activity—choose what actually generates your revenue, not what sounds most prestigious.

Single-Member vs. Multi-Member EIN Requirements

Single-Member LLCs:

- Technically optional for tax purposes (you could use your SSN)

- Practically essential for professional business operations

- Strongly recommended for privacy and credibility

Multi-Member LLCs:

- EIN is mandatory by federal law—no exceptions

- Required for Partnership tax return filing (Form 1065)

- Cannot legally operate without one

Jake’s recommendation: Regardless of your LLC structure, get an EIN. Alaska offers incredible tax advantages—protect and maximize those benefits with proper federal identification.

Common Alaska LLC EIN Mistakes (And How to Avoid Them)

Mistake #1: Applying Before Alaska LLC Approval

The problem: Name mismatches between your EIN and approved Articles

The consequence: Banking complications, IRS confusion, potential need for new EIN

The prevention: Always wait for official Alaska Department of Commerce approval first

Mistake #2: Paying for Free Services

The problem: Falling for ads offering EIN services for $100-$300

The reality: These companies have no special access—they complete the same free form you can handle yourself

The Alaska angle: You chose Alaska for its business advantages—don’t waste money on unnecessary services

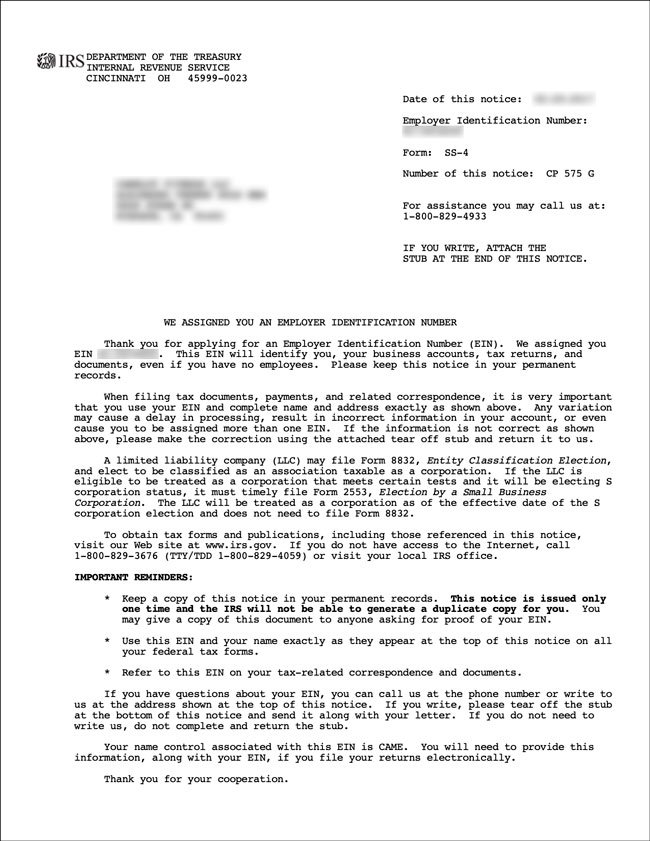

Mistake #3: Not Downloading Your Confirmation Letter

The problem: You’ll need this document for everything business-related

The consequence: Delays in banking, licensing, and business setup

The solution: Download and save multiple copies immediately after approval

Mistake #4: Thinking You Need Multiple EINs

The misconception: Some think they need different EINs for different business activities

The reality: One LLC = One EIN, regardless of how many services or products you offer

What to Do Immediately After Getting Your EIN

Priority Action Items:

- Save your EIN Confirmation Letter in multiple secure locations

- Open your Alaska business bank account

- Update all business records with your new EIN

- Notify your accountant (if you have one)

- Begin building business credit history

Banking Options in Alaska

Business banking choices for Alaska LLCs:

- Alaska USA Federal Credit Union (Alaska-based, strong local presence)

- Northrim Bank (Alaska-based community bank)

- First National Bank Alaska (statewide presence)

- Wells Fargo (major national presence in Alaska)

- KeyBank (regional presence)

- Local credit unions and community banks

Documents you’ll need for business banking:

- EIN Confirmation Letter (CP 575)

- Alaska Articles of Organization

- Operating Agreement (highly recommended)

- Personal identification

- Initial deposit (varies by bank)

Alaska banking note: Given Alaska’s remote geography, many banks offer enhanced online and mobile services to serve businesses statewide.

Alaska State Tax and Compliance Considerations

Alaska Income Tax:

Excellent news: Alaska has no state income tax on individuals or businesses. Your EIN will primarily be used for:

- Federal tax filings

- Business registration and licensing

- Banking and financial services

- Potential local municipal taxes (varies by location)

Alaska Business License:

Many businesses operating in Alaska need a state business license. Your EIN will be required for this registration with the Alaska Department of Commerce.

Alaska Sales Tax:

Alaska has no statewide sales tax, though some municipalities may have local sales taxes. Check with your specific location.

Troubleshooting Common EIN Issues

Lost Your EIN Confirmation Letter?

- You cannot get a replacement Confirmation Letter

- Request an EIN Verification Letter (Form 147C) from the IRS instead

- Banks and institutions accept this as equivalent documentation

Need to Update LLC Information?

- Name changes: Send a letter to the IRS (keep the same EIN)

- Address changes: File Form 8822-B with the IRS

- Ownership changes: May require a new EIN depending on the specific change

Made an Error on Your Application?

- Minor errors: Usually not a problem

- Major errors (like wrong business name): May need to cancel and reapply

- When uncertain: Call the IRS at 1-800-829-4933

Jake’s pro tip: Call the IRS early in the morning (right when they open at 7 AM) to avoid long hold times. Given Alaska’s time zones, this might mean very early calls for some regions.

DIY vs. Professional Services: My Honest Assessment

When to Handle It Yourself (Recommended):

- You have an SSN or ITIN

- Your LLC situation is straightforward

- You want to maximize Alaska’s cost advantages

- You have 15 minutes available

When to Consider Professional Help:

- You’re a non-resident without U.S. tax identification

- You have complex multi-entity business structures

- You’re forming multiple LLCs simultaneously

- Time is significantly more valuable than money to you

My candid opinion: The online EIN application is user-friendly and straightforward. Most entrepreneurs can easily handle this themselves. Professional services are typically unnecessary expense for this specific task—especially when you’re already benefiting from Alaska’s cost advantages.

Alaska’s Unique Business Environment for LLCs

Alaska offers exceptional advantages for LLC owners:

- No state income tax (huge benefit for profitable businesses)

- No franchise tax

- No statewide sales tax

- Natural resource opportunities

- Tourism and seasonal business potential

- Federal contracting opportunities

- Strategic location for Pacific Rim trade

EIN considerations for Alaska entrepreneurs: Alaska’s tax advantages make proper federal identification even more important for maximizing your business benefits.

International Entrepreneurs and Alaska LLCs

Alaska attracts international business, particularly in:

- Natural resource extraction and processing

- Fishing and seafood

- Tourism and hospitality

- Transportation and logistics

- International trade (especially with Asia)

EIN eligibility for non-residents: You can absolutely get an EIN for your Alaska LLC as a non-U.S. resident. Use Form SS-4 via mail or fax—it just takes longer than the online process.

Remote Business Considerations

Alaska’s geography creates unique considerations:

- Enhanced digital banking services are essential

- Online business operations are often necessary

- Shipping and logistics require careful planning

- Seasonal business patterns may affect operations

Your EIN enables access to national banking and business services that help overcome geographic challenges.

After Your EIN: Maximizing Alaska’s Advantages

With your EIN secured, your Alaska LLC is ready to capitalize on the state’s benefits:

Immediate Business Priorities:

- Open business banking relationships (consider banks with strong online services)

- Apply for necessary Alaska business licenses

- Set up proper accounting systems (crucial with no state income tax)

- Consider appropriate business insurance

- Begin establishing business credit history

Alaska-Specific Advantages to Leverage:

- No state income tax savings

- Natural resource opportunities

- Tourism and seasonal business potential

- Strategic Pacific Rim location

- Federal contracting possibilities

The Bottom Line on Alaska LLC EINs

Getting an EIN for your Alaska LLC is straightforward, completely free, and essential for professional business operations. Don’t overcomplicate it, don’t pay unnecessary fees, and don’t delay—apply as soon as your Alaska LLC is approved.

My recommendation: Block out 15 minutes after your Alaska LLC approval, go directly to irs.gov, complete the online application, and download your Confirmation Letter. Then focus your energy on building a business that takes full advantage of Alaska’s incredible tax benefits.

Alaska’s business environment is among the best in the nation for LLCs. Getting your EIN is the first step in making the most of those advantages through proper business operations and federal compliance.

Remember: Your EIN becomes a permanent part of your business identity. Keep your Confirmation Letter safe, use your EIN consistently across all business activities, and leverage Alaska’s unique advantages to build a thriving business in the Last Frontier.

Ready to form your Alaska LLC? I’ve tested every formation service and can guide you to the best option for maximizing Alaska’s advantages. Check out my comprehensive service comparisons for honest reviews and recommendations.

Questions about Alaska business requirements? After helping over 1,200 entrepreneurs with LLC formation and compliance, I’m always happy to help fellow business owners navigate the process efficiently. Feel free to reach out.

Jake Lawson is an LLC formation strategist with over 15 years of experience helping entrepreneurs navigate U.S. business regulations. He specializes in helping both domestic and international founders understand federal tax requirements and maximize state-specific business advantages, including Alaska’s unique opportunities.