Jake Lawson here. In my 15+ years helping entrepreneurs launch LLCs, I’ve seen too many Oregon business owners stumble on one critical step: getting their Federal Tax ID. Here’s everything you need to know—no fluff, just facts.

Look, I get it. The IRS isn’t exactly known for user-friendly processes. But here’s the thing—getting an Employer Identification Number (EIN) for your Oregon LLC is actually straightforward once you know the ropes. I’ve walked over 1,200 business owners through this exact process, and I’m about to save you hours of confusion.

What Exactly Is an EIN and Why Your Oregon LLC Needs One

Think of your EIN as your business’s social security number. It’s a unique nine-digit identifier (formatted like 12-3456789) that the Internal Revenue Service assigns to your LLC. This isn’t some optional paperwork—it’s the key that unlocks pretty much everything you’ll need to do as a legitimate business.

Here’s what I tell my clients: Without an EIN, your LLC is basically a very expensive piece of paper.

The Real-World Impact of Having an EIN

After helping hundreds of Oregon entrepreneurs, I can tell you exactly what having an EIN allows you to do:

Banking and Finance:

- Open a dedicated business bank account (required by virtually every bank)

- Apply for business credit cards and build company credit

- Secure business loans and lines of credit

- Set up merchant accounts for payment processing

Legal and Tax Operations:

- File federal and Oregon state tax returns

- Handle payroll if you hire employees

- Register for Oregon employment department services

- Apply for business licenses and permits

Professional Credibility:

- Separate your personal and business finances (crucial for liability protection)

- Provide vendors and clients with a professional tax ID

- Protect your personal SSN from unnecessary exposure

EIN vs. Other Tax IDs: Clearing Up the Confusion

Let me set the record straight on something that trips up a lot of my clients. Your EIN is different from:

- Oregon State Tax ID: Issued by Oregon Department of Revenue (not the IRS)

- Sales Tax Permit: For businesses selling taxable goods in Oregon

- Business License: Required for specific business activities

Don’t mix these up. Your EIN comes from the feds, everything else comes from the state.

How Much Does an Oregon LLC EIN Cost? (Spoiler: It’s Free)

Here’s where I save you from getting scammed: The IRS doesn’t charge a penny for EIN applications. Zero. Nada. Zilch.

If someone’s trying to charge you $50, $100, or more for an EIN, they’re selling you a service you can get for free. Sure, some companies will handle the paperwork for you, but you’re paying for convenience, not because it’s required.

Pro tip from Jake: I’ve seen too many entrepreneurs waste money on “expedited” EIN services. The IRS online application takes 15 minutes and gives you the EIN immediately. Can’t get more expedited than that.

When Should You Apply for Your EIN?

Critical timing alert: Don’t apply for your EIN until your Oregon LLC is officially approved by the Secretary of State.

I’ve helped dozens of clients fix this mistake, and trust me—it’s a headache you want to avoid. Here’s why:

- Your EIN application must match your LLC’s exact legal name

- If your LLC name gets rejected or modified, your EIN won’t match

- Fixing mismatched names requires canceling the old EIN and starting over

Wait for that approval email from Oregon. Then apply for your EIN. That’s the Jake Lawson way.

Step-by-Step: Getting Your Oregon LLC EIN

Option 1: Online Application (For US Citizens and Residents)

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), this is your path:

The Process:

- Visit the official IRS website (not a third-party site)

- Complete Form SS-4 online

- Submit your application

- Download your EIN Confirmation Letter immediately

What You’ll Need:

- Your Oregon LLC’s exact legal name (from your Articles of Organization)

- Your SSN or ITIN

- Business formation date

- Principal business activity

- Reason for applying (new LLC)

Timeline: Instant. You’ll get your EIN number at the end of the online session.

Option 2: Mail/Fax Application (For Non-US Residents)

If you’re an international entrepreneur without a US tax ID, you’ll need to use the paper route:

The Process:

- Download Form SS-4 from the IRS website

- Fill it out completely (no blank fields)

- Mail or fax to the IRS

- Wait for your EIN Confirmation Letter

Timeline: 4-6 weeks by mail, 2-3 weeks by fax.

Jake’s insight: I’ve helped over 200 non-US residents get EINs this way. Ignore anyone telling you that you need a “third-party designee”—that’s outdated information.

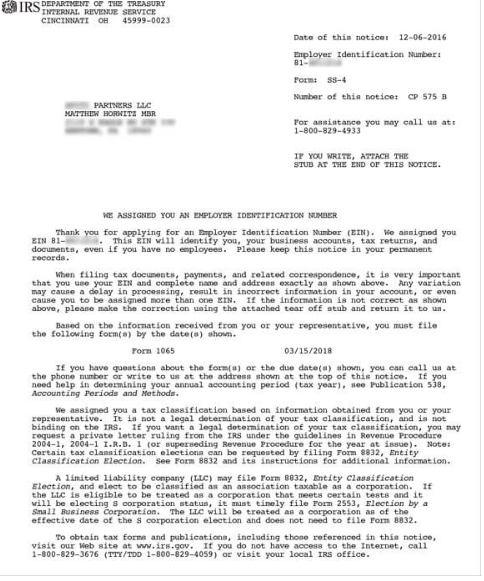

Understanding Your EIN Confirmation Letter

Once approved, you’ll receive an EIN Confirmation Letter (form CP 575). This document is gold—treat it like your business birth certificate.

What it contains:

- Your nine-digit EIN

- Your LLC’s legal name

- Business address

- Tax classification

Important: Banks, vendors, and government agencies will ask for this letter. Keep multiple copies and store one digitally.

Common Oregon LLC EIN Questions (From My Client Files)

“Do Single-Member LLCs Really Need an EIN?”

Short answer: Yes, get one anyway.

Long answer: Technically, the IRS says single-member LLCs can use the owner’s SSN for tax purposes. But here’s reality—try opening a business bank account with just your SSN. Most banks will laugh you out the door.

Plus, using your EIN instead of SSN provides an extra layer of identity theft protection. For something that’s free and takes 15 minutes, why risk it?

“We’re Married and Own the LLC Together. Now What?”

Oregon isn’t a community property state, so married couples with an LLC must be treated as a multi-member LLC taxed as a partnership. No exceptions.

This means you’ll need an EIN and will file partnership tax returns. Don’t try to get creative here—the IRS has specific rules for this situation.

“I Applied for an EIN Before My LLC Was Approved. Did I Mess Up?”

Relax. If your LLC name matches exactly what you put on the EIN application, you’re fine. If not, you’ll need to cancel the old EIN and apply for a new one after your LLC is approved.

From my experience: This happens to about 1 in 10 of my clients. It’s fixable, just annoying.

Banking After Your EIN: What Oregon Entrepreneurs Need to Know

Getting your EIN is step one. Opening a business bank account is step two. Here’s what I recommend to my Oregon clients:

Best Banks for Oregon LLCs:

- US Bank (strong Oregon presence)

- Wells Fargo (nationwide convenience)

- Local credit unions (often better fees)

What to Bring:

- EIN Confirmation Letter

- Oregon LLC Articles of Organization

- Operating Agreement (if you have one)

- Personal ID

- Initial deposit

Non-US Residents: Yes, you can still open a US business bank account. Some banks are more international-friendly than others—I maintain a current list of the best options.

Red Flags: EIN Scams to Avoid

In my years of practice, I’ve seen every EIN scam in the book. Here are the ones targeting Oregon business owners:

- “Urgent” renewal notices: EINs don’t expire. Ever.

- Paid filing services: Claiming the free IRS application doesn’t exist

- Fake IRS websites: Look for .gov in the URL

- “Express” processing: The real IRS application is already instant

Jake’s rule: If it sounds too good to be true or creates false urgency, it’s probably a scam.

Oregon-Specific Considerations

State Tax Registration: Remember, your federal EIN is different from Oregon state tax requirements. You may need separate registration with Oregon Department of Revenue depending on your business activities.

Employment Department: If you plan to hire employees, you’ll need to register with the Oregon Employment Department using your EIN.

Business Licenses: Oregon has specific licensing requirements for certain businesses. Your EIN will be required for most professional license applications.

What If You Make a Mistake?

Mistakes happen. Here’s how to fix the most common ones:

Wrong LLC name on EIN: Cancel the incorrect EIN and apply for a new one with the correct name.

Lost your EIN: Request an EIN Verification Letter (Form 147C) from the IRS.

Need to change business structure: You’ll likely need a new EIN. The IRS has specific rules about when this is required.

Getting Help: When to DIY vs. Hire a Pro

DIY if:

- You have an SSN or ITIN

- Your LLC is straightforward (no complex ownership structure)

- You’re comfortable with online forms

Consider professional help if:

- You’re a non-US resident

- You have a complex business structure

- You’ve made mistakes before and want to avoid repeating them

Final Thoughts: Making Your Oregon LLC Official

Here’s what I tell every client: Your EIN isn’t just a number—it’s your business’s passport to legitimacy. Without it, you’re stuck in entrepreneurial limbo.

The process isn’t complicated, but the details matter. Follow the steps I’ve outlined, avoid the common pitfalls, and you’ll have your EIN in hand faster than you can say “Pacific Northwest entrepreneur.”

Ready to get started? The IRS online application is waiting. Just remember—LLC first, then EIN. Do it in that order, and you’ll thank me later.

About Jake Lawson: I’ve guided over 1,200 entrepreneurs through US business formation, including hundreds of Oregon LLCs. My goal is simple: give you the straight facts without the sales pitch. No upsells, no gimmicks—just practical advice that works.

Need help with Oregon LLC formation? Check out our comprehensive guide to forming an Oregon LLC, or browse our reviews of the top LLC formation services for 2025.

Questions about your specific situation? The information above covers 95% of cases, but every business is unique. Consider consulting with a qualified tax professional for complex scenarios.