By Jake Lawson, LLC Formation Strategist

Louisiana might be famous for jazz and jambalaya, but they’re also serious about LLC compliance. Every Louisiana LLC owner has an annual appointment with the Secretary of State—whether you like it or not.

I’ve helped hundreds of Louisiana entrepreneurs navigate this process, and I’ve seen too many fall into the “out of good standing” trap because they missed their anniversary deadline. Let me walk you through everything you need to know about Louisiana’s annual report requirements, including the tricks that’ll save you time and headaches.

Louisiana’s Annual Reality Check: What You’re Actually Filing

Your Louisiana LLC annual report isn’t some complex financial document—it’s basically a wellness check for your business. The state wants confirmation that your LLC still exists, who’s running it, and where they can find you if needed.

What’s included in the annual report:

- Current business addresses (office and mailing)

- Registered agent information

- Member and manager details

- Basic contact information

What’s NOT included:

- Financial statements or revenue information

- Tax details or profit/loss data

- Business operations or strategy updates

Think of it as updating your business profile with the state—simple but mandatory.

The Money Talk: Filing Fees and Payment Options

Louisiana gives you two paths, each with different price tags:

Mail filing: $30 (plus postage and processing delays)

Online filing: $35 (instant processing, credit card convenience)

My recommendation: Pay the extra $5 for online filing. The time savings alone is worth it, and you get immediate confirmation instead of wondering if your check got lost in the mail.

Payment methods:

- Mail: Check or money order only

- Online: Credit card through geauxBIZ system

The Anniversary Deadline That Matters

Here’s where Louisiana gets specific: your annual report is due before your LLC’s anniversary date—not some arbitrary state deadline.

How it works:

- LLC approved March 15, 2024 → First report due before March 15, 2025

- LLC approved September 3, 2023 → Annual reports due before September 3 every year

- LLC approved December 31, 2024 → First report due before December 31, 2025

Early filing window: You can file up to 30 days before your deadline. Smart entrepreneurs use this buffer to avoid last-minute stress.

Finding your anniversary date: Check your Certificate of Organization or search Louisiana’s business database. The “Registration Date” is your anniversary.

The Penalty System: How “Good Standing” Goes Bad

Miss your anniversary deadline, and Louisiana’s penalty structure kicks in:

Immediate consequence: LLC marked as “not in good standing”

Three-year rule: Fail to file for three consecutive years, and Louisiana dissolves your LLC entirely

What “not in good standing” means:

- Cannot obtain certificates of good standing

- May face challenges opening bank accounts

- Potential issues with business licenses

- Complications for legal proceedings

The dissolution threat: Louisiana doesn’t bluff. After three years of non-compliance, your LLC gets administratively dissolved. Reinstatement is possible but requires additional paperwork and fees.

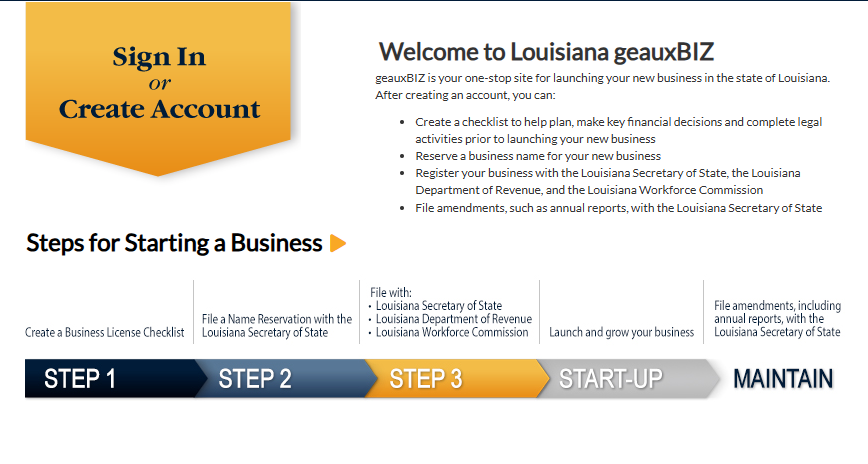

Louisiana’s Digital Evolution: geauxBIZ Explained

Louisiana modernized their system with geauxBIZ (pronounced “go-biz”)—their online portal for all business filings. If you haven’t used it yet, here’s what you need to know:

geauxBIZ advantages:

- Instant processing and confirmation

- Digital record storage

- Automatic reminders (when you set them up)

- No postal delays or lost paperwork

Browser recommendation: Louisiana suggests Google Chrome for optimal performance. I’ve seen fewer glitches with Chrome than other browsers.

Account setup: One-time registration process that links to all your Louisiana business entities.

Step-by-Step: Filing by Mail (The Old-School Method)

If you prefer paper trails and don’t mind waiting, mail filing still works:

Step 1: Download Your Pre-Filled Form

- Search your LLC in Louisiana’s business database

- Click “Details” next to your company name

- Select “Print Annual Report for Filing”

- Print the populated form

Step 2: Make Necessary Updates

Address changes: Cross out old information, write in updates clearly

Registered agent changes: Complete new agent info AND get their signature plus notarization

Member/manager changes: Add or remove names and addresses as needed

Step 3: Complete and Sign

- Sign at the bottom

- Enter title (Member, Manager, or Agent)

- Add phone number, date, mailing address, email

Step 4: Payment and Mailing

- Prepare $30 check or money order to “Secretary of State”

- Mail to: Commercial Division, PO Box 94125, Baton Rouge, LA 70804-9125

Processing time: 1-2 business days after receipt

Step-by-Step: Online Filing (The Smart Choice)

Online filing through geauxBIZ is faster, more reliable, and gives instant confirmation:

Step 1: Create Your geauxBIZ Account (First-Time Users)

- Visit geauxbiz.sos.la.gov

- Click “Sign In or Create Account”

- Select “Create an Account”

- Enter email twice, password twice

- Complete address and phone information

- Verify email through confirmation link

Step 2: Set Up Your Profile

- Select “Individual” as account type

- Enter first and last name

- Accept disclaimer terms

- Wait 10-15 seconds for automatic dashboard reload

Step 3: Link Your LLC (If Filed by Mail Originally)

- Click “My Businesses” tab

- Select “Add Existing Business”

- Search and select your LLC

- Click “Associate Business”

Step 4: File Your Annual Report

- Access “My Businesses” tab

- Click your LLC name or view icon

- Select “File Annual Report”

Step 5: Review and Update Information

Office address: Must be Louisiana location (no PO boxes)

Mailing address: Can be different from office address

Registered agent: Update if changed (triggers 7-day verification process)

Members/managers: Add or remove as needed

Step 6: Electronic Signature and Payment

- Enter full name in electronic signature field

- Specify title (Member, Manager, or Agent)

- Review all information for accuracy

- Enter credit card information

- Submit payment ($35)

Processing time: 15 minutes or less with email confirmation

The Registered Agent Change Complication

Changing registered agents during annual report filing creates additional requirements:

Mail filing: New agent must sign form AND get it notarized

Online filing: New agent receives email verification (7-day deadline to accept)

My advice: Handle registered agent changes separately from annual reports when possible. It simplifies the process and avoids timing complications.

Reminder Systems: Don’t Rely on Louisiana Alone

Louisiana stopped mailing postcard reminders in 2016. They now offer email and text notifications, but smart entrepreneurs create backup systems:

Louisiana’s reminders:

- Email notifications (approximately 30 days before deadline)

- Text message alerts (if phone number provided)

- Must be manually activated through business database

My recommended backup system:

- Calendar reminders starting 60 days before deadline

- Multiple reminder dates (60, 30, and 7 days out)

- Include filing fee in business budget annually

Record Keeping and Verification

After filing, Louisiana provides confirmation:

Mail filing: No confirmation mailed, but filing appears in business database within days

Online filing: Immediate email confirmation plus downloadable records in geauxBIZ

Essential records to maintain:

- Filing confirmation (email or database screenshot)

- Payment receipts

- Updated LLC information for your business records

Common Louisiana Annual Report Mistakes

After helping hundreds of Louisiana LLCs, these errors appear repeatedly:

Mistake #1: Missing the Anniversary Deadline

The problem: Thinking Louisiana uses calendar year deadlines

The consequence: Immediate “not in good standing” status

The solution: Know your specific anniversary date and file early

Mistake #2: Incomplete Registered Agent Changes

The problem: Changing agents without proper signatures/verification

The consequence: Rejected filing and continued non-compliance

The solution: Complete all agent change requirements before submitting

Mistake #3: Ignoring geauxBIZ Account Setup

The problem: Trying to file without proper account linking

The consequence: Unable to access filing options

The solution: Set up and verify geauxBIZ account before deadline pressure

Mistake #4: Outdated Contact Information

The problem: Filing with old addresses or member information

The consequence: State can’t reach you for important notices

The solution: Annual review of all business information accuracy

Louisiana Contact Information and Support

When issues arise, Louisiana’s commercial division provides support:

Contact details:

- Phone: 225-925-4704

- Hours: Standard business hours

- Online: Through geauxBIZ support system

Common support needs:

- geauxBIZ account problems

- Filing status questions

- Payment processing issues

- Certificate requests

Strategic Timing for Louisiana Filings

Smart Louisiana entrepreneurs develop annual compliance rhythms:

Recommended timeline:

- 60 days before deadline: Review current business information

- 30 days before deadline: File annual report (early bird approach)

- After filing: Update internal business records

- Calendar setup: Automatic reminders for following year

Coordination opportunities:

- File during slower business periods

- Coordinate with federal tax preparation

- Bundle with other business maintenance tasks

The Bottom Line: Louisiana Compliance Made Simple

Louisiana’s annual report requirement isn’t complicated—it’s just mandatory and time-sensitive. The key is understanding your specific deadlines and using the right filing method for your situation.

My recommendations for Louisiana LLC owners:

- Know your anniversary date and mark it prominently on your calendar

- File online unless you have specific reasons to use mail

- File early to avoid deadline stress and potential complications

- Keep confirmation records for your business files

- Set up multiple reminder systems because Louisiana won’t chase you

Louisiana makes compliance relatively straightforward—you just need to stay on top of the timeline. Miss your deadline, and you’ll learn why they call it the “not in good standing” penalty box.

Ready to stay compliant? Check out our Louisiana LLC formation guide for complete state requirements, or explore our registered agent services if you need reliable Louisiana representation.

Have questions about Louisiana annual reports or compliance issues? Drop me a line—I’ve probably navigated your exact situation and can point you toward the solution that saves time and stress.

Jake Lawson is an LLC Formation Strategist and founder of llciyo.com. He’s guided over 1,200 entrepreneurs through U.S. business formation and compliance, including hundreds of Louisiana LLCs through their annual reporting requirements.