Jake Lawson here. After helping 300+ Wisconsin entrepreneurs navigate annual report requirements, I can tell you this: Wisconsin’s quarterly system confuses a lot of business owners. Let me clear up the confusion and show you exactly how to stay compliant.

Running a Wisconsin LLC? Then you need to understand the state’s annual report requirements. Wisconsin has a unique quarterly filing system that determines your deadline based on when your LLC was formed. Miss the pattern, and you might file at the wrong time or face administrative dissolution.

The bottom line: Wisconsin annual reports cost $25 and are due quarterly based on your LLC’s formation date. There are no late fees, but skip filing for three years and Wisconsin will shut down your LLC automatically.

Let me walk you through Wisconsin’s system so you never miss a deadline or lose your LLC status.

Wisconsin’s Quarterly Annual Report System

Unlike most states with fixed annual deadlines (like December 31st), Wisconsin divides the year into quarters and assigns your deadline based on when your LLC was approved.

How Wisconsin Determines Your Deadline:

If your LLC was approved:

- January 1 – March 31: Annual reports due March 31st every year

- April 1 – June 30: Annual reports due June 30th every year

- July 1 – September 30: Annual reports due September 30th every year

- October 1 – December 31: Annual reports due December 31st every year

Jake’s example: My client formed their LLC on February 15, 2024. Their first annual report was due March 31, 2025, and every March 31st thereafter.

Finding Your LLC’s Formation Date:

Check your formation documents: Look for “Effective Date” on your approved Articles of Organization

Search online: Use Wisconsin’s OneStop Business Portal to look up your LLC and find the “Registered Effective Date”

Still can’t find it? Call Wisconsin DFI at 608-261-7577 for assistance

Pro tip: Add your annual report deadline to your calendar with annual recurring reminders. Don’t rely on the state’s postcard reminders—they sometimes get lost in the mail.

Wisconsin Annual Report Requirements

Who Must File:

✅ Every Wisconsin LLC (regardless of business activity)

✅ LLCs with no income (still required to file)

✅ Dormant LLCs (inactive businesses still need to file)

✅ Multi-member and single-member LLCs

❌ Dissolved LLCs (no longer required after official dissolution)

Filing Details:

- Cost: $25 per year

- Due date: Based on formation quarter (see chart above)

- Filing window: Can file anytime during the quarter it’s due

- Late fees: None (but consequences for extended non-filing)

- Processing time: Immediate online, 5 business days by mail

Jake’s compliance note: Even if your LLC never makes money or conducts business, Wisconsin still requires annual reports. Don’t assume “inactive” means “exempt.”

Step-by-Step: Filing Your Wisconsin Annual Report Online

Getting Started

Access the system:

- Visit Wisconsin OneStop Business Portal

- Search for your LLC by name

- Click on your LLC in the search results

- Verify your business information and click “Next”

Completing Your Annual Report

Section 1: Registered Agent Information

Review current registered agent details:

- Name and address of current registered agent

- Confirm information is current and accurate

Your options:

- Keep current agent: Select “Use current registered agent” if no changes needed

- Update agent address: Select current agent option and modify address

- Change to individual: Select this if switching to a person as registered agent

- Change to service company: Select this if hiring a professional registered agent service

Jake’s registered agent advice: If you’ve moved or your registered agent service has changed addresses, update this information. Outdated registered agent information can cause you to miss important legal documents.

Section 2: Principal Office Address

Enter your LLC’s main business address:

- Must be current and accurate

- Can be anywhere in the US (doesn’t have to be in Wisconsin)

- Can be your home address, office address, or registered agent’s address

Common address options:

- Your home office

- Physical business location

- Virtual office address

- Registered agent’s address (if they allow it)

Section 3: Management Structure

Select your LLC’s management type:

- Member-managed: All owners participate in daily operations (most common)

- Manager-managed: Designated managers run the business

If member-managed: No additional information required

If manager-managed: Enter manager names and contact information

Jake’s management tip: If you’re unsure which structure you chose originally, check your Articles of Organization or Operating Agreement.

Section 4: Business Purpose and Activities

Describe your business activities:

- Brief description of what your LLC does

- Can be general (“consulting services”) or specific (“digital marketing for restaurants”)

- One sentence is usually sufficient

Trade restraint question:

- Select “No” unless your business has engaged in anti-competitive practices

- This refers to price-fixing, market manipulation, or monopolistic behavior

- 99.9% of legitimate businesses select “No”

Section 5: Contact Information

Provide contact details for report communications:

- Name of person handling LLC matters

- Complete address and phone number

- Email address for electronic delivery of approved report

Important: This contact receives the approved annual report and any state communications about your filing

Section 6: Signature and Certification

Who can sign:

- Member-managed LLC: Any member can sign

- Manager-managed LLC: A designated manager must sign

Electronic signature process:

- Enter signer’s title (Member or Manager)

- Select current date

- Check agreement box

- Type full name as electronic signature

Payment and Submission

Review your information:

- Double-check all addresses and contact information

- Verify management structure selection

- Confirm business description accuracy

Submit payment:

- $25 annual report fee

- Credit or debit card accepted

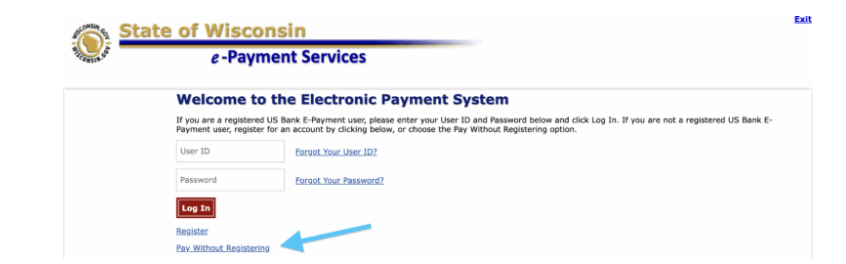

- You’ll be redirected to Wisconsin e-Payment Services

- Select “Pay Without Registering” for one-time payment

Confirmation:

- Immediate processing for online filings

- Approved report emailed to contact address

- Keep confirmation for your records

Jake’s filing tip: File during regular business hours for immediate processing confirmation. Evening and weekend filings may not process until the next business day.

Mail Filing Option (If You Prefer)

Required Documents:

- Completed Form 5 (Wisconsin LLC Annual Report)

- $25 filing fee (check or money order payable to “Wisconsin Department of Financial Institutions”)

Mailing Address:

Wisconsin Department of Financial Institutions

Division of Corporate & Consumer Services

4822 Madison Yards Way, North Tower

Madison, WI 53705

Processing Time:

- 5 business days after receipt

- No immediate confirmation

- Approved report mailed to business address

Jake’s recommendation: Unless you’re uncomfortable with online systems, use the online filing. It’s faster, provides immediate confirmation, and reduces the chance of lost mail.

What Happens If You Don’t File?

Year 1-2 Late: No Immediate Penalties

Good news: Wisconsin doesn’t charge late fees for annual reports

Requirements to get current:

- File all missing annual reports

- Pay $25 for each missed year

- LLC returns to “good standing” status

Year 3+ Late: Administrative Dissolution Risk

The consequence: Wisconsin can administratively dissolve your LLC

This means: Your LLC loses its legal status and protections

Timeline: After 3 consecutive years of non-filing

Jake’s reality check: I’ve helped several clients deal with administrative dissolution. It’s fixable, but it’s a hassle that’s easily avoided by filing annually.

LLC Reinstatement Process

If Your LLC Gets Administratively Dissolved:

Option 1: Let It Stay Dissolved

- No penalties or additional filings required

- File final tax returns to close out tax obligations

- Notify banks, vendors, and clients of dissolution

Option 2: Reinstate Your LLC

- File Application for Reinstatement

- Pay $100 reinstatement fee

- Pay $25 for each missed annual report

- Must file by mail (no online option for reinstatement)

Reinstatement Requirements:

Contact Wisconsin DFI first: Call 608-261-7577 to request reinstatement forms

Required documents:

- Application for Reinstatement

- All missing annual reports

- Payment for all fees

Potential complications:

- If another business took your LLC name while dissolved, you’ll need to choose a new name

- Some banks and vendors may require additional documentation after reinstatement

Jake’s reinstatement advice: If you want to keep your LLC active, don’t wait to reinstate. The longer you wait, the more likely someone else will register your business name.

Wisconsin Annual Report Reminders and Calendar Management

State Reminder System:

Postcard reminders: Mailed to registered agent about 2 weeks after quarter begins

Reliability: Generally good, but don’t rely solely on state reminders

Setting Up Your Own Reminders:

Calendar reminders: Set annual recurring reminders 30 days before deadline

Phone reminders: Use smartphone annual alerts

Business calendar: Include annual report deadlines in business planning

Jake’s reminder strategy:

- Set primary reminder 60 days before deadline

- Set secondary reminder 30 days before deadline

- Set final reminder 7 days before deadline

- Include annual report costs in business budgeting

Quarterly Deadline Quick Reference:

Q1 Filers (due March 31):

- Set reminders for February 1st and March 15th

Q2 Filers (due June 30):

- Set reminders for May 1st and June 15th

Q3 Filers (due September 30):

- Set reminders for August 1st and September 15th

Q4 Filers (due December 31):

- Set reminders for November 1st and December 15th

Common Wisconsin Annual Report Mistakes

Mistake 1: Filing at Wrong Time

Problem: Assuming December 31st deadline like many states

Solution: Determine your quarter-based deadline and stick to it

Mistake 2: Outdated Registered Agent Information

Problem: Using old addresses or discontinued services

Solution: Verify registered agent information annually

Mistake 3: Incorrect Management Structure

Problem: Selecting wrong management type on annual report

Solution: Review your Operating Agreement to confirm structure

Mistake 4: Missing Contact Information Updates

Problem: Wisconsin can’t reach you about filing issues

Solution: Keep all contact information current

Mistake 5: Forgetting About Inactive LLCs

Problem: Assuming dormant LLCs don’t need annual reports

Solution: File annual reports for all LLCs until officially dissolved

From my experience: 80% of Wisconsin annual report problems come from confusion about deadline timing or outdated contact information.

Wisconsin Annual Report vs. Tax Obligations

Annual Report vs. Annual Franchise Tax:

Annual Report: $25 compliance filing with Wisconsin DFI

Franchise Tax: Only applies to corporations and LLCs electing corporate taxation

Most Wisconsin LLCs: Only pay the $25 annual report fee

LLCs taxed as corporations: May owe both annual report and franchise tax

Annual Report vs. Income Tax:

Separate obligations: Annual reports don’t replace income tax filings

Federal taxes: File based on LLC’s tax election (usually personal returns)

Wisconsin state taxes: File Wisconsin income tax returns separately

Jake’s tax reminder: Annual reports keep your LLC compliant with Wisconsin corporate law. You still need to handle federal and state income tax obligations separately.

Cost Analysis: Wisconsin Annual Reports

Annual Costs:

Wisconsin annual report: $25 per year

Professional filing service: $100-200 per year (if you hire help)

Comparison with Other States:

- Wisconsin: $25 (no late fees)

- Delaware: $300 franchise tax

- Nevada: $325 list filing fee

- California: $20 biennial report + $800 franchise tax

- Illinois: $75 annual report

Jake’s cost analysis: Wisconsin offers excellent value with low annual compliance costs and no late fees.

ROI of Staying Compliant:

Cost of compliance: $25 per year

Cost of reinstatement: $100+ plus hassle and potential name loss

Value of maintaining good standing: Access to banking, contracts, legal protections

Professional Services vs. DIY

DIY Makes Sense If:

- You’re comfortable with online systems

- You track deadlines reliably

- Your LLC information rarely changes

- You want to save money

Consider Professional Help If:

- You manage multiple entities

- You travel frequently and might miss deadlines

- You prefer to outsource compliance tasks

- You want comprehensive business support

Professional service costs:

- Annual report filing: $75-150 per year

- Full compliance packages: $200-400 per year (includes registered agent, filing reminders, etc.)

My philosophy: Annual reports are straightforward enough for most entrepreneurs to handle themselves. Save the money unless you really value the convenience.

Wisconsin Business Environment Context

Why Wisconsin Requires Annual Reports:

- Keeps business registry current and accurate

- Ensures state can contact businesses when needed

- Maintains public record of active businesses

- Generates revenue for state business services

Wisconsin’s Business-Friendly Approach:

- No late fees (unlike many states)

- Reasonable filing costs

- Simple online filing system

- Flexible quarterly deadline system

Economic Development Impact:

- Current business registry supports economic development

- Accurate data helps with business recruitment

- Maintains Wisconsin’s reputation for business efficiency

Action Plan: Staying Compliant

For New Wisconsin LLCs:

- Determine your filing quarter based on formation date

- Set up calendar reminders for annual report deadlines

- Budget $25 annually for compliance costs

- Keep registered agent information current

For Existing Wisconsin LLCs:

- Check if you’re current on annual report filings

- Update any outdated information during next filing

- Set up reliable reminder system if you don’t have one

- Consider professional help if you’ve missed filings before

For LLCs Behind on Filings:

- File immediately to avoid administrative dissolution

- Pay all outstanding fees ($25 per missed year)

- Set up prevention system for future compliance

- Consider reinstatement if already dissolved

Final Thoughts: Mastering Wisconsin LLC Compliance

Wisconsin’s quarterly annual report system seems complicated at first, but it’s actually quite logical once you understand the pattern. The key is knowing your specific deadline and creating reliable systems to meet it every year.

My philosophy: Annual reports are a small price to pay for maintaining your LLC’s legal status and protections. Don’t let a $25 filing derail your business.

Whether you’re running a Madison tech startup, a Milwaukee restaurant, or a Green Bay consulting practice, staying compliant with Wisconsin’s annual report requirements protects your investment in your business structure.

Action steps:

- Find your LLC’s formation date and determine your filing quarter

- Calculate your specific annual report deadline

- Set up multiple calendar reminders

- File your annual report on time every year

- Keep registered agent and contact information current

The Wisconsin business community is supportive and the state makes compliance relatively painless. Don’t let simple administrative requirements become business obstacles.

Ready to file? Follow the step-by-step process above, double-check your information, and submit with confidence. Your Wisconsin LLC will stay in good standing and ready for whatever opportunities come next.

About Jake Lawson: I’ve guided over 1,200 entrepreneurs through business formation and compliance, including 300+ Wisconsin LLCs. My goal is simple: help you navigate state requirements efficiently so you can focus on growing your business.

Need ongoing Wisconsin business support? Check out our comprehensive Wisconsin LLC guide, or browse our reviews of the top business compliance services for 2025.

This guide covers standard Wisconsin LLC annual report requirements. Some LLCs with special tax elections may have additional reporting obligations. Consider consulting with a Wisconsin business attorney or accountant for complex situations.