By Jake Lawson, LLC Formation Strategist

Hawaii’s LLC annual reporting system is refreshingly straightforward—once you understand their unique quarterly due date structure. After helping over 1,200 entrepreneurs maintain compliance across all 50 states, I can tell you that Hawaii strikes a nice balance between staying informed and not being overly bureaucratic.

The good news? At just $15 per year, Hawaii has one of the most affordable annual report fees in the country. The potential gotcha? Their due dates are based on when your LLC was approved, not a standard calendar date like most states.

But here’s what I really appreciate about Hawaii: they’re reasonable with late fees and actually send you reminder postcards. Not many states do that anymore.

Let me walk you through everything you need to know to keep your Hawaii LLC in good standing without any surprises.

Hawaii LLC Annual Report Essentials

Filing frequency: Every year, no exceptions

Cost: $15 annually (one of the cheapest in the nation)

Where to file: Hawaii Business Registration Division

Methods: Online (recommended) or by mail

Processing time: 1-3 business days (expedited) or 6-8 weeks (normal)

Why this matters: Annual reports keep your LLC in good standing and maintain your legal protections. Skip this, and Hawaii can administratively dissolve your business.

Understanding Hawaii’s Unique Quarterly Due Date System

This is where Hawaii differs from most states. Your due date isn’t December 31st or the anniversary of your formation—it’s based on the quarter when your LLC was approved.

Due Date Schedule

Q1 LLCs (approved January 1 – March 31): Due by March 31st every year

Q2 LLCs (approved April 1 – June 30): Due by June 30th every year

Q3 LLCs (approved July 1 – September 30): Due by September 30th every year

Q4 LLCs (approved October 1 – December 31): Due by December 31st every year

Pro tip from my experience: Put this date in your calendar immediately after forming your LLC. Hawaii’s quarterly system catches many entrepreneurs off guard because it’s different from the standard December 31st deadline most states use.

Finding Your Approval Quarter

Not sure when your LLC was approved? Here’s how to find out:

- Visit the Hawaii Business Entity and Documents search

- Search for your LLC name

- Look for the “Registration Date”

- Determine which quarter that date falls into

If you’re still stuck: Call Hawaii’s Business Registration Division at 808-586-2727 (Monday-Friday, 7:45am-4:30pm Hawaii time). They’re actually quite helpful.

Hawaii’s Reasonable Late Fee Structure

Here’s where Hawaii shows some aloha spirit—they don’t immediately hammer you with maximum penalties.

Official penalty authority: Up to $100 late fee (per state law)

Actual practice: $10 late fee for the first year, $20 if you’re 2 years late

Administrative dissolution: After 2 years of non-filing

My take: Hawaii is more laid-back about penalties than most states, but don’t count on this lasting forever. State policies can change, and it’s always better to file on time.

Hawaii’s Helpful Reminder System

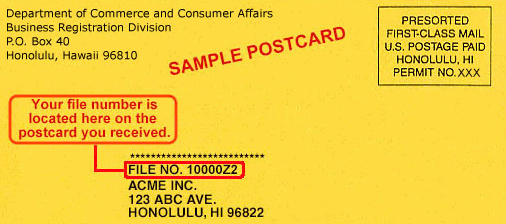

Unlike many states that leave you to remember on your own, Hawaii actually sends reminder postcards at the beginning of your LLC’s approval quarter.

What to expect:

- Postcard reminders mailed to your registered agent address

- Sent at the start of your quarter (so you have the full quarter to file)

- Clear instructions on how to file online or by mail

Jake’s advice: Don’t rely solely on these postcards. Addresses change, mail gets lost, and you’re ultimately responsible for filing on time regardless of whether you received a reminder.

Filing Your Hawaii LLC Annual Report: Step-by-Step

Option 1: Online Filing (Recommended)

Why I recommend online:

- Faster processing

- Immediate confirmation

- No risk of mail delays

- Easier record keeping

Getting started: Visit Hawaii’s Annual Business Reports portal

Step 1: Find Your Business

- Search by LLC name or file number

- Click on your LLC from the results

- Click “Begin Annual Report”

Step 2: Verify Company Information

- Review all displayed information carefully

- Click “edit” to update any incorrect details

- Common updates: address changes, registered agent changes, member changes

- Check the certification box and enter your signature

- Click “Next”

Important: This step is where you can update your LLC’s information with the state. Don’t skip reviewing everything—it’s easier to correct it now than to file amendments later.

Step 3: Choose Processing Speed

Normal processing: 6-8 weeks, standard $15 fee

Expedited processing: 1-3 business days, additional $25 fee (total $40)

My recommendation:

- File early in your quarter? Choose normal processing and save the $25

- Cutting it close to the deadline? Pay for expedited to avoid late fees

- Need immediate proof of filing for banking/contracts? Expedited might be worth it

Step 4: Payment and Submission

- Select “Pay and Submit Online”

- Click “Add to Cart & Checkout”

- You can create a myHawaii account or continue as guest

Jake’s pro tip: Skip creating the myHawaii account unless you file multiple entities regularly. It’s unnecessarily complicated for most entrepreneurs, and the guest checkout works perfectly fine.

Payment process:

- Select credit/debit card

- Enter your contact information

- Enter payment and billing details

- Submit your annual report

Confirmation: You’ll receive an email receipt and a PDF copy of your processed annual report once Hawaii completes processing.

Option 2: Mail Filing

When to consider mail filing:

- You prefer paper records

- You don’t have reliable internet access

- You’re filing multiple entities and want to batch them

Requirements:

- Download Form C5

- Complete all sections accurately

- Include check or money order for $15 payable to “Department of Commerce and Consumer Affairs”

Mail to: Annual Filing – BREG

PO Box 40

Honolulu, HI 96810

My advice on mail filing: Only use this if you have a specific reason to avoid online filing. The online system is faster, more reliable, and gives you immediate confirmation.

When to File Early vs. On Time

Filing Early Strategy

When it makes sense:

- You want the task off your plate

- You’re planning extended travel during your due quarter

- You’re batching all your LLC compliance tasks

Earliest filing date: Beginning of your approval quarter

Example: If you’re a Q2 LLC (due June 30th), you can file as early as April 1st.

Filing Close to Deadline Strategy

When you might wait:

- Cash flow management (keep the $15 longer)

- Waiting to see if business information changes

- You’re super organized and comfortable with tight deadlines

My professional recommendation: File by the middle of your quarter. This gives you a buffer for any processing delays while still being reasonably current.

Verification and Record Keeping

Confirming Your Filing Was Processed

- Visit Hawaii Business and Entity Documents search

- Search for your LLC

- Click your LLC name

- Select the “Annual Filing” tab

- Look for “Processed” status in green

Building Your Compliance System

Essential records to maintain:

- Email confirmation from Hawaii

- PDF copy of processed annual report

- Payment confirmation/receipt

- Calendar reminder for next year’s filing

My system recommendation: Create a digital folder for each LLC with annual subfolders. Store all compliance documents there, and you’ll never lose track of your filings.

Setting Up Your Annual Reminder System

The biggest risk with Hawaii’s quarterly system is forgetting your unique due date. Here’s my foolproof approach:

Calendar Setup Strategy

Primary reminder: Set a recurring annual calendar event 60 days before your due date

Secondary reminder: Set another reminder 30 days before

Final warning: Set a third reminder 7 days before

Example for Q2 LLC (due June 30th):

- May 1st: Primary reminder to prepare filing

- June 1st: Secondary reminder to complete filing

- June 23rd: Final warning to submit immediately

Multiple LLC Management

If you have LLCs in multiple states:

- Create a master compliance calendar

- Color-code by state

- Include filing fees in your budget planning

- Consider using a compliance service for complex portfolios

Common Hawaii LLC Annual Report Mistakes

After helping hundreds of entrepreneurs with compliance, here are the mistakes I see most often:

Mistake 1: Assuming December 31st Due Date

Many entrepreneurs expect all states to use December 31st deadlines. Hawaii’s quarterly system catches people off guard.

Mistake 2: Relying Only on Reminder Postcards

Mail gets lost, addresses change, and Hawaii isn’t responsible if you don’t receive reminders.

Mistake 3: Not Updating Information During Filing

The annual report is your chance to update registered agent, address, and member information. Don’t skip this step.

Mistake 4: Waiting Too Long to File

Don’t assume Hawaii’s lenient late fee structure will always stay the same. File on time.

Mistake 5: Not Keeping Proper Records

Save your confirmation emails and processed annual reports. You’ll need them for taxes, banking, and potential compliance audits.

Strategic Considerations for Hawaii LLCs

Multi-State LLC Portfolio Management

If you have LLCs in multiple states:

- Hawaii’s $15 fee is among the cheapest you’ll encounter

- Their quarterly system requires separate tracking from other states

- Consider professional compliance services if managing 10+ entities

Tax Considerations

Important note: Filing your Hawaii LLC annual report doesn’t handle your tax obligations. You still need to:

- File Hawaii general excise tax returns (if applicable)

- Handle federal tax obligations

- Manage any county-level requirements

When to Consider Professional Help

DIY makes sense when:

- You have one Hawaii LLC

- Your information rarely changes

- You’re comfortable with online systems

- You have reliable calendar reminders

Consider professional help when:

- Managing multiple LLCs across different states

- Your business structure changes frequently

- You want to outsource all compliance tasks

- You’re traveling extensively during filing periods

The Bottom Line on Hawaii LLC Annual Reports

Hawaii’s annual report system is entrepreneur-friendly once you understand their quarterly due date structure. At $15 per year with reasonable late fees and helpful reminders, they make compliance as painless as possible.

Key success principles:

- Know your specific quarterly due date

- Set up reliable calendar reminders

- File online for speed and convenience

- Use the annual report to update your information

- Keep thorough records of all filings

Remember: Staying compliant with Hawaii’s annual report requirement protects your LLC’s legal status and maintains your business’s good standing. It’s a small investment that preserves all the benefits of your LLC structure.

The aloha state makes it easy to stay compliant. Take advantage of their reasonable system and keep your paradise business in good standing.

Jake Lawson is an LLC Formation Strategist and Tax Advisor who has successfully helped over 1,200 entrepreneurs maintain compliance across all 50 states. He specializes in creating streamlined compliance systems that prevent costly mistakes and provides unbiased reviews of formation and compliance services at llciyo.com.