By Jake Lawson, LLC Formation Strategist

Tennessee’s LLC filing system is refreshingly straightforward once you understand their unique member-based fee structure. After helping over 1,200 entrepreneurs form LLCs across all 50 states, I can tell you that Tennessee strikes a nice balance between being comprehensive and not overly bureaucratic.

The standout feature? Immediate approval when you file online. The potential gotcha? Their filing fees increase based on the number of LLC members, and they have a unique county recording requirement that catches many entrepreneurs off guard.

But here’s what I really appreciate about Tennessee: their TNCaB online system is intuitive, and at $300 for most small businesses, the fees are reasonable compared to coastal states.

Let me walk you through the entire Tennessee LLC formation process, including the county recording step that most guides skip.

Tennessee LLC Filing Fees: Understanding the Member-Based Structure

Tennessee uses a tiered fee structure based on your LLC’s membership:

1-6 Members: $300 total

7+ Members: $300 + $50 for each additional member

Examples:

- 4 members: $300

- 7 members: $350 ($300 + $50)

- 10 members: $500 ($300 + $200)

Why this matters: Most small businesses stay under the 6-member threshold, keeping costs predictable. But if you’re planning a larger ownership structure, budget accordingly.

Jake’s take: This structure is actually entrepreneur-friendly for most small businesses, since the majority of LLCs I help form have 1-3 members.

Tennessee LLC Approval Times: Speed Matters

Online filing: Immediate approval (my strong recommendation)

Mail filing: 3-5 business days plus mail time

Why I always recommend online:

- Instant confirmation and documents

- No risk of mail delays

- Easier to correct mistakes immediately

- You get your approved documents in PDF format instantly

When mail might make sense: If you’re absolutely not comfortable with online systems. But honestly, Tennessee’s TNCaB system is one of the more user-friendly state portals I’ve used.

Step-by-Step Tennessee LLC Filing Guide

Getting Started with TNCaB

Tennessee uses their TNCaB (Tennessee Consolidated Administrative Business) system for all business filings.

Access the system: Visit tncab.tnsos.gov

Creating Your TNCaB Account

If you’re a first-time user:

- Click “Create Account”

- Enter your personal information (name, email, phone, address)

- Check your email for verification link

- Set your password

- Log in to access your dashboard

Pro tip: Keep your login credentials secure—you’ll use this same account for annual reports and other Tennessee business filings.

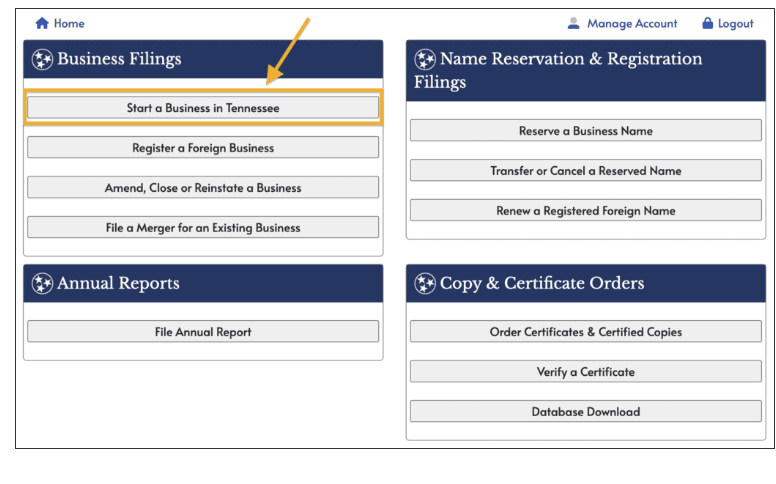

Starting Your LLC Filing

- Click “Business Filings” in the left menu

- Select “Start a Business in Tennessee”

- Choose “Limited Liability Company” from the dropdown

Essential Filing Information

Business Name Requirements

Your LLC name must include one of these designators:

- LLC (most popular choice)

- L.L.C.

- Limited Liability Company

Comma flexibility: Both “Grand Olive Oil LLC” and “Grand Olive Oil, LLC” are acceptable.

Name availability: Make sure you’ve already confirmed your name is available using Tennessee’s business search tool.

Reserved Name Section

My recommendation: Select “No” unless you specifically reserved a name.

Why: Tennessee name reservations are usually unnecessary and a waste of money. Most entrepreneurs can move straight to filing once they’ve confirmed name availability.

Series LLC Designation

My recommendation: Select “No” unless you specifically need a Series LLC.

Why: Series LLCs are complex structures with limited case law. Most small businesses are better served with traditional LLCs.

Fiscal Year Selection

Most common choice: December

Why: This aligns with the calendar year (January 1 – December 31), making taxes and accounting simpler. Unless you have specific business reasons for a different fiscal year, stick with December.

Duration Period

My strong recommendation: Select “Perpetual”

Why: This gives your LLC permanent existence. Setting an expiration date is rarely useful and can create unnecessary complications.

Address Information

Principal Office Address

What this is: Where your primary business activities take place

Important note: This can be located anywhere—Tennessee, another state, or even another country.

Common misconception: Many people think this must be in Tennessee. It doesn’t.

Mailing Address

Efficiency tip: If your mailing address is the same as your principal office, check the box to avoid duplicate entry.

Email Address

Why this matters: Tennessee uses this to send annual report reminders. Use an email address you monitor regularly.

Business Details

NAICS Code

My professional recommendation: Leave this blank.

Why:

- It’s not required

- Business activities often evolve over time

- Constantly updating NAICS codes is a hassle

- Many entrepreneurs feel unnecessarily limited by their selected code

Management Structure

Your options:

- Member-managed (most common)

- Manager-managed

- Director-managed (rarely used)

Quick decision guide:

- Member-managed: All owners participate in day-to-day decisions

- Manager-managed: Designate specific people to run daily operations

- Director-managed: Board of directors structure (uncommon for small businesses)

Most small businesses choose: Member-managed

Member Count Confirmation

Critical for fees: Confirm whether you have 6 or fewer members.

Why this matters: This determines your filing fee. If you select incorrectly, you’ll either overpay or underpay.

Obligated Member Entity (OME)

My recommendation: Select “No”

Why: OME registration is for specific regulatory situations that don’t apply to most small businesses.

Advanced Sections

Other Provisions

My recommendation: Leave blank unless instructed otherwise by an attorney.

Why: Most standard LLCs don’t need additional provisions. Adding unnecessary language can create complications.

Delayed Effective Date

Standard approach: Select “No” for immediate effectiveness

Strategic option: If filing late in the year (October-December) with no immediate business activity, consider setting January 1st as the effective date to simplify tax obligations.

Limitation: Can’t be more than 90 days in the future, and no backdating allowed.

Registered Agent Information

Critical requirement: Must have a Tennessee address (no P.O. boxes allowed)

Your Options:

Option 1: LLC as its own registered agent

- Select “Yes” if your LLC will receive its own legal documents

- Must provide a Tennessee street address

Option 2: Individual registered agent

- Select “No,” then “Individual”

- Can be yourself, family member, friend, or employee

- Must have Tennessee address and be available during business hours

Option 3: Professional registered agent service

- Select “No,” then “Organization”

- Search for your service provider in Tennessee’s database

- More expensive but provides privacy and reliability

My professional recommendation: If you have a reliable Tennessee address and will be available during business hours, serving as your own registered agent saves money. Otherwise, professional services provide valuable peace of mind.

Final Steps

Organizer Signature

What this means: The organizer is simply whoever signs and submits the documents.

Important distinction: Being the organizer doesn’t automatically make you an LLC member. Membership is determined by your operating agreement.

Payment Process

Recommended method: Pay online with credit/debit card

Processing: Payment is processed immediately, and you receive instant confirmation.

The Critical County Recording Requirement

Here’s where most guides fail you: Tennessee requires an additional step that many entrepreneurs miss.

Requirement: You must record a copy of your approved Articles of Organization with the Register of Deeds in the county where your principal office is located.

Cost: Usually under $20

Process:

- Contact your county’s Register of Deeds office

- Ask about recording fees and procedures

- Send them a copy of your approved Articles of Organization

- Pay the recording fee

How to find your Register of Deeds: Google “[Your County] Tennessee Register of Deeds”

Example: If your principal office is in Nashville (Davidson County), you’d record with the Davidson County Register of Deeds.

Jake’s pro tip: Don’t skip this step. It’s required by Tennessee law, and failing to complete it can create complications later.

Post-Filing Checklist

Immediate Tasks (Same Day)

- [ ] Download and save your approved Articles of Organization

- [ ] Download and save your Acknowledgment Letter

- [ ] Contact your county Register of Deeds to arrange recording

Week 1 Tasks

- [ ] Complete county recording requirement

- [ ] Apply for your federal EIN

- [ ] Draft your LLC Operating Agreement

Month 1 Tasks

- [ ] Open business bank account

- [ ] Set up accounting system

- [ ] Research business license requirements

- [ ] Set annual report reminder (Tennessee requires annual reports)

Common Tennessee LLC Filing Mistakes

After helping hundreds of entrepreneurs through this process, here are the mistakes I see most often:

Mistake 1: Ignoring the County Recording Requirement

Many people think filing with the Secretary of State is sufficient. Tennessee requires both state and county recording.

Mistake 2: Incorrect Member Count

Getting the member count wrong affects your filing fee and can cause processing delays.

Mistake 3: Using P.O. Box for Registered Agent

Tennessee specifically prohibits P.O. boxes for registered agent addresses.

Mistake 4: Skipping the Operating Agreement

While not filed with the state, your operating agreement is crucial for multi-member LLCs and provides important protections.

Mistake 5: Not Setting Up Annual Report Reminders

Tennessee requires annual reports. Set up calendar reminders immediately.

Strategic Considerations

Timing Your Filing

Best practices:

- File early in the year if possible (simplifies first-year taxes)

- Avoid December filings unless you have immediate business needs

- Consider delayed effective dates for late-year filings

Multi-State Considerations

If you’ll do business in multiple states:

- Tennessee LLC can operate in other states as a foreign LLC

- Consider where you’ll pay the most taxes

- Evaluate annual report requirements across states

Professional vs. DIY Filing

DIY makes sense when:

- You have one simple LLC

- You’re comfortable with online systems

- You have time to handle the county recording

Consider professional help when:

- You have a complex ownership structure

- You’re forming multiple entities

- You want to ensure all steps are completed correctly

- You value time over the cost savings

Formation Service Recommendations

For professional assistance: Based on my extensive testing, Northwest Registered Agent provides excellent Tennessee LLC formation services, including help with the county recording requirement.

For comprehensive packages: LegalZoom offers full-service Tennessee formation, though at a higher price point.

DIY approach: Tennessee’s TNCaB system is user-friendly enough for most entrepreneurs, just don’t forget the county recording step.

The Bottom Line on Tennessee LLC Formation

Tennessee offers a well-designed, entrepreneur-friendly LLC formation process with immediate online approval and reasonable fees for most small businesses. The key to success is understanding their member-based fee structure and completing the often-overlooked county recording requirement.

Key success principles:

- File online for immediate approval

- Understand the member-based fee structure

- Don’t skip the county recording requirement

- Keep detailed records of all filings

- Set up annual report reminders immediately

Remember: Your Articles of Organization create your LLC’s legal existence, but your operating agreement defines how it operates. Don’t neglect the operating agreement just because it’s not filed with the state.

Tennessee’s business-friendly environment extends to their LLC formation process. Take advantage of their efficient system and solid legal framework to build a strong foundation for your business.

Jake Lawson is an LLC Formation Strategist and Tax Advisor who has successfully guided over 1,200 entrepreneurs through U.S. business formation. He specializes in creating comprehensive formation strategies that prevent costly mistakes and provides unbiased reviews of formation services at llciyo.com.