By Jake Lawson, LLC Formation Strategist

Congratulations on forming your Montana LLC! Now comes the crucial next step that separates successful businesses from those that face compliance issues down the road: securing the proper business licenses and permits. After helping over 1,200 entrepreneurs navigate post-formation requirements across all 50 states, I can tell you that Montana takes a refreshingly practical approach to business licensing.

The Big Sky State doesn’t burden businesses with unnecessary general licenses, maintains no statewide sales tax, and focuses licensing requirements on industries where public safety and professional standards truly matter. But Montana’s vast geography and diverse economy mean licensing requirements can vary dramatically based on your location and business type.

Why Montana Business Licensing Matters for Your Success

Montana’s approach to business licensing reflects the state’s values: minimal government interference with maximum protection where it counts. Here’s why getting this right matters:

- Legal operation – Operating without required licenses exposes you to penalties and potential business closure

- Customer confidence – Proper licensing builds credibility in Montana’s relationship-based business culture

- Market access – Many clients and contracts require proof of proper licensing

- Insurance protection – Most business insurance policies require compliance with licensing requirements

- Growth enablement – Proper licensing creates the foundation for scaling your operations

The advantage? Montana’s system is more streamlined than most states, but that doesn’t eliminate the need for thorough research.

Understanding Montana’s Multi-Level Licensing Framework

Montana operates a sensible, three-tier licensing system designed to minimize bureaucracy while maintaining necessary oversight:

Level 1: State Requirements

- No general business license (major advantage for most businesses)

- Industry-specific occupational licenses (focused on regulated professions)

- Professional licensing through Department of Labor & Industry

- Special permits through Department of Revenue (alcohol, tobacco, etc.)

Level 2: Local Requirements

- Municipal business licenses (city, county, township level)

- Zoning compliance (especially important in tourist areas)

- Industry-specific local permits (restaurants, lodging, etc.)

Level 3: Federal Requirements

- Industry-specific federal licenses (limited to certain sectors)

- EIN number (required for all LLCs)

- Federal tax compliance (standard for all businesses)

The Montana Advantage: No General Business License Required

Unlike states that hit every business with a blanket licensing fee, Montana doesn’t require a general state business license. This creates significant advantages:

What you DON’T need: A basic “permission to do business” license from the state

What you might need: Specific licenses based on your industry, profession, or location

Bottom line: Many Montana LLCs operate legally without any state-level business licenses

This business-friendly approach saves entrepreneurs both time and money while focusing regulatory attention where it’s actually needed.

State-Level Licensing: Montana’s Focused Approach

Montana requires licenses for specific industries and professions where public safety, professional standards, or regulatory oversight provide clear value.

Department of Revenue Licensing

Montana’s Department of Revenue handles licenses for businesses dealing with regulated products:

eStop Business License Program covers:

- Food service and sales

- Tobacco products

- Lottery products

- Alcoholic beverages

- Plant nurseries and growing operations

Application process: Single streamlined application through the eStop system

Advantage: One application can cover multiple license types

Contact: Montana Department of Revenue for guidance

Department of Labor & Industry – Professional Licensing

The Professional Boards & Licensing Division regulates numerous professions requiring specialized knowledge or presenting public safety concerns:

Common licensed professions include:

- Healthcare providers (doctors, nurses, dentists, etc.)

- Construction professionals (contractors, electricians, plumbers)

- Financial services (insurance agents, real estate professionals)

- Beauty and wellness services (cosmetologists, massage therapists)

- Transportation services (commercial drivers, vehicle dealers)

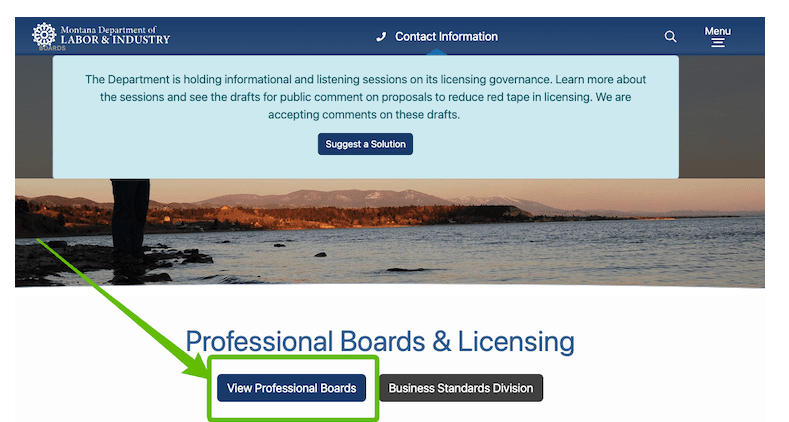

Research tool: Use their “View Professional Boards” feature to find your specific profession

Application: Online system available at ebiz.mt.gov/pol/ Contact: 406-444-2840 for professional licensing questions

Specialized Montana Requirements

Construction Contractor Registration: Required for any LLC doing construction work in Montana Separate from general licensing requirements Managed through Employment Relations Division

Interactive Business Checklist: Montana provides an online tool at app.mt.gov/businesschecklist Requires MT.gov account creation Personalized guidance based on your specific business type

Municipal Licensing: Local Rules That Vary Significantly

Montana’s 56 counties and hundreds of municipalities can have dramatically different licensing requirements. This is where many entrepreneurs get surprised.

Types of Municipal Requirements

General municipal licenses:

- Some cities require all businesses to obtain a basic operating license

- Usually involves simple application and modest fee

- Provides local tax registration and regulatory compliance

Industry-specific municipal licenses:

- Tourism and hospitality businesses (especially in resort areas)

- Food service and retail establishments

- Home-based businesses (zoning compliance critical)

- Seasonal operations (common in tourist areas)

Research Strategy for Municipal Requirements

Step 1: Identify your exact location (county, city/town, township)

Step 2: Use Montana Association of Counties resources:

Step 3: Contact Montana League of Cities and Towns:

Step 4: Call your specific municipality directly

Pro tip: Tourist areas like Bozeman, Missoula, and communities near Glacier and Yellowstone often have more complex requirements than rural agricultural areas.

The No Sales Tax Advantage: What This Means for Your Business

Montana is one of only five states with no general statewide sales tax. This creates significant advantages:

What you DON’T need:

- Sales tax license registration

- Monthly/quarterly sales tax filings

- Sales tax collection systems

- Related compliance headaches

What you still might need:

- Specific tax permits for certain products (alcohol, tobacco)

- Local option taxes in some municipalities

- Federal tax compliance for regulated products

Business advantage: Simplified pricing, reduced administrative burden, competitive advantage in retail operations.

Federal Licensing: Limited but Critical Requirements

Most Montana businesses don’t need federal licenses, but certain industries have strict federal oversight:

Industries Requiring Federal Licenses

Transportation & Logistics:

- Interstate trucking operations

- Aviation services (important in Montana’s vast geography)

- Commercial shipping

Natural Resources:

- Interstate transport of wildlife, plants, biotechnology

- Commercial fishing operations

- Environmental services

Communications & Technology:

- Broadcasting (radio, TV)

- Telecommunications services

- FCC-regulated communications

Regulated Products:

- Alcohol production and distribution

- Firearms and explosives

- Pharmaceuticals and controlled substances

Universal Federal Requirements

EIN Number: Required for all LLCs, even single-member

Tax Compliance: Federal income tax, employment taxes if applicable

Industry-Specific Regulations: OSHA, EPA, etc., based on your operations

Common Montana Business License Mistakes to Avoid

After working with hundreds of Montana entrepreneurs, here are the critical mistakes I see repeatedly:

Mistake 1: Assuming No License Means No Research

Montana’s lack of a general business license doesn’t mean you’re exempt from all licensing. Industry-specific and local requirements still apply.

Mistake 2: Ignoring Geographic Variations

Licensing requirements can vary dramatically between Billings and a small ranch town. Don’t assume statewide uniformity.

Mistake 3: Overlooking Seasonal Considerations

Many Montana businesses are seasonal (tourism, agriculture, etc.). Plan licensing for peak operation periods.

Mistake 4: Mixing Up Formation and Licensing

LLC formation creates your business entity. Licenses give you permission to operate specific activities. They’re separate requirements.

Mistake 5: Forgetting Renewal Requirements

Professional licenses often require continuing education and periodic renewal. Build these into your business operations.

Strategic Approach to Montana Business Licensing

Here’s my systematic approach for Montana entrepreneurs:

Phase 1: Industry Analysis

- Research your specific industry’s state-level requirements

- Check both Department of Revenue and Department of Labor & Industry databases

- Identify all applicable regulatory agencies

- Create comprehensive requirements checklist

Phase 2: Geographic Research

- Identify all jurisdictions where you’ll operate

- Contact municipal governments directly

- Verify zoning compliance (critical for home-based businesses)

- Understand seasonal operation implications

Phase 3: Application Strategy

- Gather all required documentation

- Apply for licenses in logical sequence (some depend on others)

- Use Montana’s streamlined online systems where available

- Plan for processing times and potential delays

Phase 4: Ongoing Compliance

- Set up renewal reminder systems

- Monitor regulatory changes in your industry

- Maintain required documentation and records

- Update licenses when business operations change

When to Get Professional Help in Montana

Consider hiring licensing professionals when:

Your business is complex: Multiple locations, diverse services, regulated industry

Geography is challenging: Operating across multiple counties or tourist areas

Professional stakes are high: Licensed professions with strict regulatory oversight

Seasonal operations: Complex timing requirements for seasonal businesses

Montana-specific professional resources:

- Small Business Development Centers (SBDC) throughout the state

- Industry-specific attorneys familiar with Montana regulations

- Local business consultants in major metropolitan areas

Montana’s Business-Friendly Licensing Environment

Montana’s approach reflects their commitment to supporting business growth while maintaining necessary protections:

Advantages:

- No general business license requirement

- No statewide sales tax compliance

- Streamlined online application systems

- Focused regulatory oversight where it matters

- Helpful state resources and guidance

Considerations:

- Geographic variations can be significant

- Tourist areas may have more complex requirements

- Seasonal business considerations

- Professional licensing requirements are comprehensive

- Federal requirements still apply for regulated industries

Cost Expectations for Montana Business Licenses

State-level costs:

- General business license: $0 (not required)

- Professional licenses: $100-$500+ (varies by profession)

- eStop program licenses: $50-$300+ (varies by license type)

- Construction contractor registration: $200-$400+

Municipal costs:

- General business license: $25-$150+ (varies by municipality)

- Industry-specific permits: $50-$400+ (depends on business type and location)

- Zoning permits: $50-$200+ (if required)

Federal costs:

- Most businesses: $0 (beyond standard EIN and tax requirements)

- Regulated industries: $500-$5,000+ (highly variable)

Remember: Many businesses need no licenses beyond basic tax registration, so your total cost could be $0.

Ready to Launch Your Montana Business Compliantly?

Montana’s practical approach to business licensing makes it easier to operate legally while focusing regulatory attention where it truly matters. The key is conducting thorough research that accounts for both Montana’s business-friendly state policies and the significant variations that exist across the state’s diverse geography and economy.

Need professional guidance? I’ve helped hundreds of Western entrepreneurs navigate post-formation compliance, from Billings manufacturing operations to Bozeman tech startups to seasonal tourism businesses throughout the state. My team understands both Montana’s specific advantages and the critical requirements that vary by location and industry.

[Get expert Montana business licensing guidance →]

Don’t let licensing oversights limit your Montana business success. With proper research, strategic planning, and professional guidance when needed, you can ensure your Montana LLC operates with full legal authorization while taking advantage of the Big Sky State’s business-friendly environment.

Jake Lawson has guided over 1,200 entrepreneurs through successful business formation and compliance across all 50 states, with extensive experience in Montana’s unique geographic and regulatory environment. His systematic approach ensures businesses launch with proper licensing while avoiding unnecessary complexity and costs. Connect with Jake and the llciyo.com team for personalized Montana business compliance guidance.