So you’re trying to get your EIN—that magical nine-digit number that makes your LLC official in the eyes of the IRS—and boom, you hit an error. Welcome to the club. After helping over 800 entrepreneurs navigate these cryptic IRS reference numbers, I can tell you this: you’re not alone, and most of these errors are fixable.

The IRS online EIN system is like a 1990s website that somehow still runs on dial-up logic. One wrong keystroke, a business name that’s vaguely similar to another company in Arkansas, or trying to apply at 3 PM on a Tuesday when Mercury is in retrograde, and you’ll get slapped with a reference number instead of your EIN.

Let me decode these error messages for you—in plain English, not government-speak.

Why EIN Errors Happen (And Why They’re Getting Worse)

First, let’s address the elephant in the room: the IRS EIN system wasn’t built for the modern business world. It’s processing millions of applications with technology that probably remembers when fax machines were cutting-edge.

The system gets overwhelmed. It crashes. It decides your perfectly legitimate LLC name conflicts with “Bob’s Plumbing” from 1987. And instead of helpful error messages, you get reference numbers that sound like robot serial codes.

Here’s what’s really happening: every time you apply for an EIN online, the IRS system runs your information through multiple databases, checking for conflicts, duplicates, and potential fraud. Hit any tripwire, and you’re kicked out with a reference number.

The Master List of EIN Reference Numbers (And What They Actually Mean)

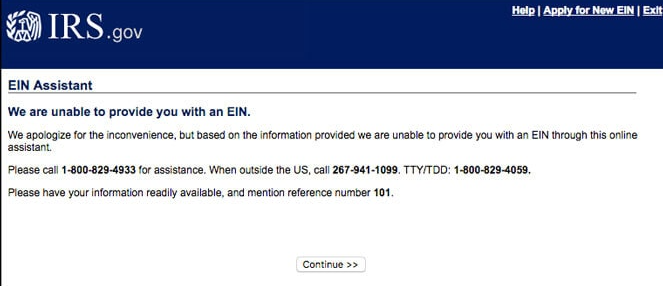

Reference Number 101: The Name Game Gone Wrong

What it means: The IRS thinks your business name is too similar to another entity in their database. Maybe “Summit Peak Ventures LLC” conflicts with “Summit Peaks Venture Corp” from Idaho. The system doesn’t care that you’re in different states or industries.

The reality: This is the most common error, hitting about 30% of applications. Your state approved your LLC name, but the IRS has a national database with millions of entries dating back decades.

The fix: Stop trying online—you won’t win this fight. File Form SS-4 by fax (855-641-6935) or mail. Include your state-approved LLC formation documents to prove you’re legitimate. Yes, it’ll take 2-3 months. No, there’s no faster way.

Pro tip: One client tried 47 times with slight name variations. Don’t be that person. Once you get 101, you’re done with online applications.

Reference Number 102: The Identity Crisis

What it means: Your Social Security Number or ITIN doesn’t match the name you entered. Maybe you’re using your maiden name, nickname, or the IRS has different records than you think.

The reality: This often happens with recently naturalized citizens, name changes after marriage/divorce, or simple typos. The IRS is comparing against Social Security Administration records.

The fix: Triple-check your name matches EXACTLY what’s on your Social Security card. Not your driver’s license, not your business card—your SS card. If it still fails, file Form SS-4 by fax or mail.

Reference Number 103: The Company Identity Mixup

What it means: You’re listing an existing company as the responsible party, but the EIN and company name don’t match in IRS records.

The reality: Common when one company owns another. Maybe the parent company changed names, or you’re using an old EIN.

The fix: Verify the exact company name and EIN from the original CP 575 letter. If you can’t find it, call the IRS at 800-829-4933 to verify before trying again.

Reference Number 104: The Third-Party Trap

What it means: You’re using a third-party designee (someone helping you get the EIN), and they’ve used the same contact info as the business.

The reality: The IRS wants to ensure the third party is actually a separate entity, not just you pretending to be your own representative.

The fix: The third party must use their own address and phone number, not the LLC’s. If you’re doing it yourself, don’t select third-party designee at all.

Reference Number 105: The “Try, Try Again” Penalty

What it means: You’ve attempted too many times with the same SSN/ITIN/EIN, triggering the system’s fraud prevention.

The reality: Usually happens after hitting other errors repeatedly. The system thinks you’re either attacking it or desperately confused.

The fix: Wait 24 hours for the system to reset. If it still fails, you’re locked out—file Form SS-4 by fax or mail.

Reference Numbers 106 & 107: The Single-Member LLC Confusion

What they mean: Your single-member LLC either needs a sole proprietorship EIN (106) or has too many EINs already (107).

The reality: These are rare and usually involve LLCs with employees trying to navigate complex tax structures.

The fix: Call the IRS directly. These require human intervention to untangle the mess.

Reference Numbers 109, 110, 112, 113: The “It’s Not You, It’s Us” Errors

What they mean: Technical difficulties. The IRS system is having a bad day.

The reality: Server overload, maintenance, or general government IT issues. Peak times (Monday mornings, tax deadlines) trigger these frequently.

The fix: Try at odd hours—6 AM Eastern often works. If you get these errors repeatedly over 24 hours, the system might be down for extended maintenance.

Reference Number 114: The One-Per-Day Rule

What it means: You’ve already gotten an EIN today using this SSN as the responsible party.

The reality: The IRS limits each person to one EIN per day to prevent fraud and system abuse.

The fix: Wait until tomorrow. No exceptions, no workarounds. Plan accordingly if you’re forming multiple LLCs.

Reference Number 115: The Morbid Mistake

What it means: The IRS thinks the responsible party is deceased.

The reality: Database error, identity theft, or someone with a similar SSN has passed away.

The fix: Call the IRS immediately. This requires proving you’re alive, which is as surreal as it sounds. Have identification ready.

Advanced Troubleshooting Strategies

The Time Zone Hack

The IRS system operates on Eastern Time and has peak usage patterns. Best success rates:

- 6-7 AM Eastern (before East Coast businesses wake up)

- 11 PM-Midnight Eastern (after West Coast businesses close)

- Saturday mornings (yes, it sometimes works on weekends)

The Browser Battle

The IRS website has compatibility issues that would make a web developer cry. Use:

- Chrome or Firefox (updated versions)

- Clear cookies and cache before attempting

- Disable ad blockers and VPNs

- Use incognito/private mode to avoid stored data conflicts

The Information Precision Protocol

Every field matters:

- Legal name must match formation documents EXACTLY

- Address format must be consistent (St. vs Street matters)

- No special characters except standard punctuation

- Phone numbers: (555) 555-5555 format works best

When to Give Up on Online Applications

Stop wasting time online if:

- You’ve hit Reference 101 (name conflict)

- You’ve tried three times with different errors

- Your business name contains unusual characters

- You’re a foreign entity or non-resident alien

- The system seems perpetually down

Just file Form SS-4 by fax or mail. Yes, it takes longer. No, there’s no secret workaround.

The Form SS-4 Escape Route

When online fails, Form SS-4 is your backup. Here’s the reality:

Fax to: 855-641-6935

Processing time: 45-60 business days currently

Mail time: 60-90 business days

Include:

- Completed Form SS-4 (no errors, no white-out)

- Copy of state-approved LLC formation documents

- Cover letter explaining any complications

Pro tip: After 45 business days, call the IRS and request an EIN Verification Letter (147C). It’s not the official CP 575, but most banks and institutions accept it.

The Hidden Costs of EIN Errors

Every day without an EIN costs money:

- Can’t open business bank account

- Can’t file for necessary licenses

- Can’t hire employees officially

- Can’t establish business credit

- Can’t file taxes properly

One tech startup lost a $50,000 contract because they couldn’t provide an EIN during due diligence. Their Reference 101 error turned into a two-month wait that killed the deal.

Common Myths About EIN Reference Numbers

Myth: “Keep trying, it might work eventually”

Reality: Once you hit certain errors (101, 115), online is permanently blocked for that entity

Myth: “Call the IRS and they’ll give you the EIN over the phone”

Reality: Phone EINs stopped years ago due to fraud

Myth: “Pay a service to expedite it”

Reality: No one can expedite IRS processing, despite what they claim

Myth: “Use a different SSN as responsible party”

Reality: That’s fraud, and the IRS will catch it

Alternative Solutions That Actually Work

The Multiple LLC Strategy

Forming multiple LLCs? Space them out:

- One EIN per day maximum

- Use different responsible parties if possible

- File some on paper to avoid the daily limit

- Plan 2-3 weeks for multiple entities

The Responsible Party Shuffle

If you have business partners:

- Alternate who applies as responsible party

- Each person can get one EIN daily

- Reduces bottlenecks for multiple entities

- Maintains legitimate ownership structure

The Professional Service Option

Some scenarios justify professional help:

- Foreign entities without SSN/ITIN

- Complex ownership structures

- Time-sensitive transactions

- Multiple state registrations

But understand: they can’t bypass IRS timelines. They just handle the paperwork correctly.

What Nobody Tells You About EIN Applications

The IRS tracks patterns. Multiple failed attempts from the same IP address trigger additional scrutiny. Using VPNs often causes problems. Business names with certain keywords (“United States,” “Federal,” “National”) face extra review.

The system has undocumented quirks. LLCs formed on federal holidays sometimes glitch. Names starting with numbers face higher rejection rates. Addresses in certain zip codes trigger manual review.

Your Action Plan When You Hit an Error

- Document everything: Screenshot the error, note the reference number, save your application data

- Wait 24 hours: Many errors self-resolve

- Try once more: Use the troubleshooting tips above

- Switch to paper: If second attempt fails, file Form SS-4

- Mark your calendar: Note when to call for verification letter

- Keep operating: Don’t let EIN delays stop business planning

The Bottom Line on EIN Reference Numbers

EIN reference numbers are the IRS’s way of saying “computer says no” without explaining why. They’re frustrating, time-consuming, and seemingly arbitrary. But they’re not insurmountable.

Most errors stem from the system being overwhelmed or overly cautious, not from actual problems with your application. The key is knowing when to keep trying and when to switch tactics.

Remember: every successful business has dealt with bureaucratic nonsense. Your EIN error is just today’s version. Handle it systematically, don’t take it personally, and keep building your business while the paperwork processes.

The entrepreneurs who succeed aren’t the ones who never hit obstacles—they’re the ones who navigate around them efficiently and keep moving forward.

Jake Lawson has guided over 1,200 businesses through federal tax ID acquisition, including untangling some of the most complex EIN reference number situations imaginable. When he’s not decoding IRS error messages, he’s probably explaining why paying $300 for “expedited EIN service” is like paying for “premium air.” Need real solutions for EIN problems? Find them at llciyo.com.