By Jake Lawson, LLC Formation Strategist

Changing your Pennsylvania LLC’s registered office address should be simple, but Pennsylvania’s online filing system makes it more complicated than necessary. I’ve helped hundreds of Pennsylvania business owners navigate this process, and honestly, it’s one of the more frustrating state systems I deal with.

The good news? Once you understand Pennsylvania’s quirky requirements and get through their Keystone Login maze, the actual address change only costs $5 and takes about 10 days to process.

Let me walk you through the entire process, including the post-filing updates that most people forget about.

Understanding Pennsylvania’s Registered Office Requirements

First, let’s clarify what we’re actually changing. In Pennsylvania, your “registered office” is the official address where the state can send legal documents and where you can be served with lawsuits. This is the same concept as a registered agent address in other states.

Important distinction: Your registered office address is NOT necessarily your business mailing address or the address where you conduct business day-to-day. Many LLCs use their registered agent’s address for this purpose.

When You Need to Change Your Registered Office

Common scenarios I see:

- You moved your business to a new location

- You’re switching from using your home address to a virtual office

- You hired a professional registered agent service

- You’re firing your current registered agent and going with a new one

- Your registered agent moved their office

Critical requirement: Your registered office MUST be a Pennsylvania address. You cannot use an out-of-state address, even if that’s where you now live or operate your business.

The Real Cost of Changing Your Address

Pennsylvania state filing fee: $5 (whether you file online or by mail)

Additional costs you might encounter:

- New business checks: $50-$150

- Updated business cards and stationery: $100-$300

- Professional registered agent service: $100-$300 annually

- Expedited processing: Not available for this filing type

Total realistic budget: $150-$500 depending on what else you need to update

Option 1: File Online (Recommended but Complicated)

Pennsylvania’s online system is faster than mail filing, but setting up access is unnecessarily complex. Here’s how to navigate it:

Step 1: Create Your Keystone Login

Pennsylvania replaced their old PENN File system with “Keystone Login” in 2020. If you haven’t filed anything since then, you’ll need to start fresh.

Note: Before the introduction of Keystone Login, Pennsylvania used the older PENN File system for online filings. However, since May 2020, all users are required to create a Keystone Login, and PENN File has been replaced by the new Business Filing Services system.

- Go to the PA Business One-Stop Hub

- Click “Register” to create a new account

- Complete the registration form

- Check your email and click the verification link

- Log back in and select “Business Owner” as your user type

- Choose “Department of State’s Business Filing Services”

Jake’s tip: Keep your login credentials somewhere safe. You’ll need them for annual reports and future filings.

Step 2: Request Access to Your LLC

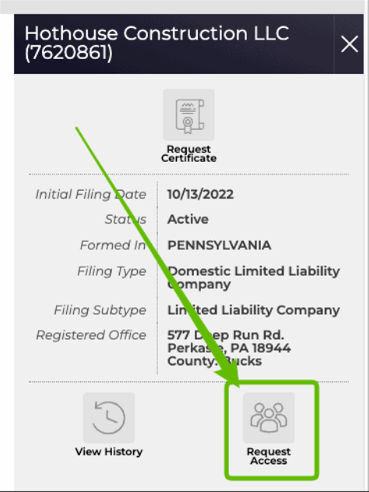

This is where Pennsylvania gets unnecessarily complicated. Even though it’s your LLC, you need to “request access” to modify it.

- Search for your LLC in the Business Search tool

- Click on your LLC name in the results

- Click “Request Access”

- Confirm you’re an authorized person

- Request a PIN

The waiting game: Pennsylvania will email you a PIN, but it can take anywhere from 10 minutes to 4 hours. The PIN is case-sensitive and may include both letters and numbers.

Pro tip: Don’t close your browser while waiting. Keep the tab open and check your email periodically.

Step 3: File the Change of Registered Office

Once you have access to your LLC record:

- Click “File Amendment”

- Select “Change of Registered Office” from the form list

- Complete the filing information:

For self-service registered office:

- Select the first option about the proposed registered office address

- Enter your new Pennsylvania address

- Include the county where the address is located

For professional registered agent service:

- Select the second option about Commercial Registered Office Provider

- Search for your registered agent company in their database

- Select the correct county (ask your agent if you’re unsure)

- Review all information carefully

- Add your electronic signature

- Pay the $5 fee online

Processing time: 7-10 business days for approval

Option 2: File by Mail (Slower but Simpler)

If Pennsylvania’s online system drives you crazy, you can file by mail:

- Download the Change of Registered Office form

- Complete the form by hand or type in the information

- Include a check for $5 payable to “Department of State”

- Mail to:

Department of State

Bureau of Corporations and Charitable Organizations

401 North Street, Room 206

Harrisburg, PA 17120

Processing time: 10-15 business days (including mail time)

The Critical Post-Filing Updates

Here’s where most Pennsylvania LLC owners mess up: they think filing with the Bureau of Corporations handles everything. It doesn’t.

Update #1: Pennsylvania Department of Revenue (Required)

Your LLC is registered for taxes with a completely separate state department. You MUST update your address there too.

Online option: Use the myPath system

Mail option: File Form REV-854

Why this matters: If you don’t update this, you’ll miss important tax notices and could face penalties.

Update #2: IRS (If Using Registered Office for Federal Purposes)

If your registered office address is the same address you gave the IRS for your EIN, you need to file Form 8822-B to update your federal records.

When to skip this: If you use a different mailing address with the IRS (like your home or business address), you don’t need to update anything federal.

Update #3: Other Government Agencies

Local tax offices: Update with your city, county, or township tax collector

Business licenses: Update any professional licenses or permits

Workers’ compensation: If you have employees, update your workers’ comp carrier

Your Complete Address Change Checklist

I recommend creating a spreadsheet to track all the places you need to update. Here’s my standard checklist:

Government Agencies (High Priority)

- [ ] PA Department of Revenue (Form REV-854 or myPath)

- [ ] IRS (Form 8822-B, if applicable)

- [ ] Local tax offices

- [ ] Business license authorities

- [ ] Professional licensing boards

Financial Institutions (High Priority)

- [ ] Business bank accounts

- [ ] Business credit cards

- [ ] PayPal, Stripe, and other payment processors

- [ ] Business loans or lines of credit

- [ ] Business insurance policies

Business Operations (Medium Priority)

- [ ] Accountant and attorney

- [ ] Business website and Google My Business

- [ ] Vendor and supplier accounts

- [ ] Customer databases

- [ ] Utility companies

Marketing Materials (Lower Priority)

- [ ] Business cards and letterhead

- [ ] Email signatures

- [ ] Social media profiles

- [ ] Online directory listings

- [ ] Website contact pages

Special Considerations for Different Scenarios

Scenario 1: Moving from Home Address to Virtual Office

This is common as businesses grow and want to separate personal and business addresses.

Additional considerations:

- Set up mail forwarding from your old address

- Update your Operating Agreement if it references the old address

- Consider privacy implications of your new address choice

Scenario 2: Switching to Professional Registered Agent

Benefits of professional service:

- Privacy protection (your home address stays private)

- Mail scanning and digital delivery

- Professional appearance for legal documents

- No need to file address changes when you move personally

What to expect:

- Annual fees ranging from $100-$300

- Setup may take a few days to coordinate

- You’ll receive login credentials for online mail access

Scenario 3: Moving Out of State but Keeping PA LLC

Critical point: Your registered office MUST remain in Pennsylvania. You cannot change it to an out-of-state address.

Your options:

- Hire a Pennsylvania registered agent service

- Maintain a Pennsylvania address through a friend or family member

- Keep a Pennsylvania business address if you still operate there

Common Mistakes That Waste Time and Money

Mistake #1: Not Getting PIN Access

Many people try to file the address change without first requesting access to their LLC record. This wastes time and creates confusion.

The fix: Always start by requesting access and waiting for your PIN before trying to file amendments.

Mistake #2: Using Wrong County Information

If you’re using a registered agent service, you need to know what county their address is in. Guessing wrong can delay your filing.

The fix: Ask your registered agent service for their county information before starting the filing.

Mistake #3: Forgetting About Tax Agencies

The Bureau of Corporations doesn’t communicate with the Department of Revenue. You must update both separately.

The fix: Always plan to update at least two Pennsylvania agencies plus the IRS (if applicable).

Mistake #4: Not Setting Up Mail Forwarding

Even after changing your registered office, some mail might still go to your old address for months.

The fix: Set up USPS mail forwarding immediately, especially if you’re leaving a residential address.

Professional Help vs. DIY

When to DIY

- Simple address change within Pennsylvania

- You’re comfortable with online government systems

- You have time to deal with Pennsylvania’s filing system quirks

When to Hire Help

- You’re switching between multiple types of registered office arrangements

- You need to update numerous licenses and permits

- You’re not comfortable with Pennsylvania’s online system

- Your time is worth more than the service fees

If you hire help: Expect to pay $75-$150 for a service to handle the state filing. They’ll still need your cooperation to update other agencies and private companies.

Timeline: What to Expect

Week 1: File with Pennsylvania Bureau of Corporations

Week 2: Receive approval, begin updating other agencies

Week 3-4: Update tax agencies, banks, and major vendors

Month 2: Complete updates to marketing materials and minor accounts

Total process: Plan for 6-8 weeks to completely transition your address everywhere it matters.

Troubleshooting Pennsylvania’s System

“I Can’t Find the Change of Registered Office Option”

This usually means you haven’t completed the PIN access process. Make sure you:

- Requested access to your LLC record

- Received and entered the PIN correctly

- Are logged into the correct Business Filing Services account

“My PIN Isn’t Working”

Pennsylvania PINs are case-sensitive and may expire. Try:

- Copy and paste the PIN exactly as received

- Request a new PIN if the old one is more than 24 hours old

- Clear your browser cache and try again

“I Don’t See My Registered Agent Service in the List”

Not all registered agent services are listed in Pennsylvania’s database. Contact your service provider for their exact listing name or consider filing by mail.

The Bottom Line on Pennsylvania LLC Address Changes

Pennsylvania’s process is more complicated than it needs to be, but once you understand the system, it’s manageable. The key is patience with their online system and remembering that the $5 state filing is just the beginning—you’ll need to update multiple agencies and private companies.

Most importantly: Don’t let the address change intimidate you into avoiding necessary updates. Keeping your address current protects your LLC’s good standing and ensures you receive important legal and tax notices.

Ready to Keep Your Pennsylvania LLC Compliant?

Changing your registered office address is just one aspect of maintaining your Pennsylvania LLC in good standing. From annual reports to tax obligations, staying compliant requires ongoing attention.

Need help with Pennsylvania LLC compliance? Our comprehensive guides cover everything from formation through ongoing maintenance, including annual report requirements and tax obligations.

Looking for reliable registered agent service? We work with professional registered agents who understand Pennsylvania’s requirements and can help you maintain compliance while protecting your privacy.

Jake Lawson has guided over 1,200 entrepreneurs through business formation and compliance across all 50 states. His Pennsylvania expertise comes from 15+ years of working with business owners who’ve navigated the state’s unique filing requirements and system changes. This information is for educational purposes only and should not replace professional legal advice.