Let’s talk about Tennessee’s $300 annual report—one of the most expensive in the nation. While Wyoming charges $60 and Montana asks for just $20, Tennessee wants $300 every single year. And if you have more than six members? Add $50 per person. It’s highway robbery, but here’s the thing: missing this report will cost you way more than $300.

I’ve watched too many Tennessee LLCs get dissolved for missing this deadline. Let me show you exactly how to file it, when to file it, and why Tennessee’s aggressive dissolution timeline means you can’t afford to forget.

The Tennessee Annual Report Reality Check

Here’s what Tennessee demands from every LLC, every year:

The basics:

- Cost: $300 for 1-6 members

- Additional members: $50 each for members 7+

- Due date: April 1st (for most LLCs)

- Grace period: 60 days before warnings

- Dissolution: 120 days after due date

Translation: Miss this by four months and your LLC is dead. Tennessee doesn’t mess around.

Why Tennessee’s Annual Report Costs So Much

Tennessee has no state income tax on wages. Zero. They make up for it with high fees on businesses. Your $300 annual report is essentially a business tax disguised as a filing fee.

Comparison shopping:

- Delaware: $300 (but they have prestige)

- California: $800 minimum tax (okay, Tennessee looks better)

- Wyoming: $60 (much more reasonable)

- Montana: $20 (basically free)

- Tennessee: $300 (pure revenue grab)

My take: It’s expensive, but still cheaper than state income tax if you’re making decent money. Consider it the price of Tennessee’s other benefits.

When Your Annual Report Is Actually Due

Tennessee uses fiscal year calculations, which confuses everyone.

The Standard Timeline

For calendar year LLCs (99% of you):

- Due: April 1st every year

- Can file: Starting March 2nd (30 days early)

- Warning sent: June 1st (60 days late)

- Dissolution: August 1st (120 days late)

First-Year Confusion

Your first annual report is due the year AFTER formation:

- Form LLC in January 2025 → First report due April 1, 2026

- Form LLC in November 2025 → First report due April 1, 2026

- Form LLC in December 2025 → First report due April 1, 2026

Key insight: Formation month doesn’t matter. Everyone files by April 1st.

The Member Count Trap

Tennessee’s sliding scale based on members catches people off guard:

Pricing tiers:

- 1-6 members: $300 flat

- 7 members: $350

- 8 members: $400

- 10 members: $500

- 20 members: $1,000

Strategy: Keep membership under 7 if possible. That seventh member costs you $50 extra every year forever.

Step-by-Step: Filing Your Tennessee Annual Report Online

Forget mailing anything. File online through TNCaB (Tennessee’s business portal). Here’s the real-world process:

Step 1: Access TNCaB

Go to: tncab.tnsos.gov/portal

First-timer?

- Click “Create Account”

- Use a real email (they’ll send confirmations)

- Create a password you’ll remember

- Verify your email immediately

Pro tip: Use your business email, not personal. You’ll get important notices here.

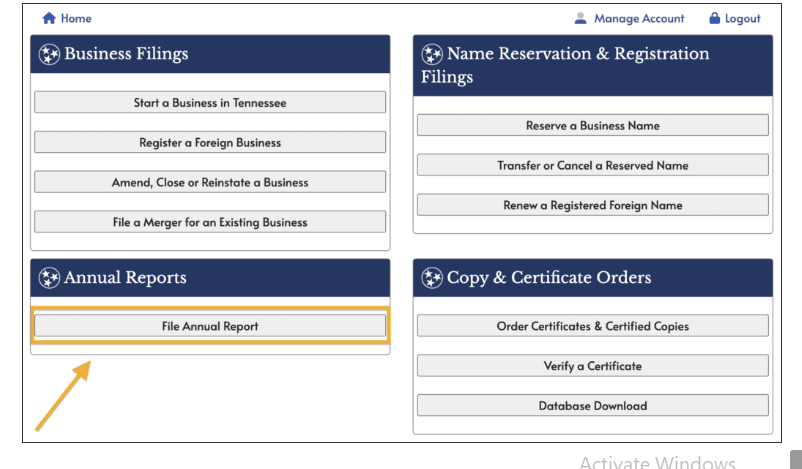

Step 2: Navigate to Annual Report

Once logged in:

- Click “Business Filings”

- Select “File Annual Report”

- Search for your LLC by name

- Select it and click “Add Items”

Common problem: Can’t find your LLC? You might be searching the exact name. Try partial searches.

Step 3: Update Entity Information

Principal Office Address:

- Where your business actually operates

- Can be anywhere (not just Tennessee)

- Home address is fine

- Update if you’ve moved

Mailing Address:

- Where you want mail sent

- Can be PO Box

- Often same as principal office

Email Address:

- Critical—this gets dissolution warnings

- Use an email you actually check

- Update if it changes

Step 4: The NAICS Code Decision

Tennessee asks for NAICS codes (industry classifications).

My advice: Leave it blank. Here’s why:

- Not required

- Business focus often changes

- Updating it annually is pointless

- No benefit to providing it

If you already have one listed and want to remove it, select “Yes” to changes and delete it.

Step 5: Member Count (This Matters)

Tennessee needs to know how many members you have for pricing.

Critical points:

- Be honest (they can verify through other filings)

- Count all members, even silent partners

- Spouse counts as separate member

- Single-member means literally one person

If membership changed:

- Update the count

- Price adjusts automatically

- No documentation needed

Step 6: Officer Information

List at least one person in charge:

Member-Managed LLC:

- List a member

- Title: “Member”

- Include full name and address

Manager-Managed LLC:

- List a manager

- Title: “Manager”

- Can be member or non-member

Privacy note: This becomes public record. Use business address if privacy matters.

Step 7: Registered Agent Confirmation

Verify your registered agent information:

If unchanged:

- Select “No” to changes

- Move on

If changing agents:

- Select “Yes”

- Choose type (Individual vs Organization)

- Enter new information

- Confirm Tennessee address

Common mistake: Using out-of-state address. Registered agents MUST have Tennessee address.

Step 8: Sign and Certify

Who can sign:

- Any member (member-managed)

- Any manager (manager-managed)

- “Authorized Person” works for anyone

Title options:

- Member

- Manager

- Authorized Person

- Managing Member

Just pick one and be consistent.

Step 9: Payment

Payment options:

- Credit/debit card (adds ~2% fee, about $7)

- E-check/ACH (no extra fee)

My recommendation: Eat the $7 card fee. Instant confirmation is worth it.

Step 10: Save Everything

After submission:

- Download the filed report

- Save the confirmation email

- Print a copy for records

- Set next year’s reminder immediately

What Happens If You’re Late

Tennessee’s dissolution process is swift and merciless:

0-60 Days Late (April 2 – May 31)

- No penalty

- No warning

- Still in good standing

- File immediately

60-120 Days Late (June 1 – July 31)

- Warning email sent

- Warning letter mailed

- Still fixable

- No extra fees yet

120+ Days Late (August 1+)

- Administrative dissolution

- LLC legally dead

- Must file reinstatement

- Costs $75 extra plus the $300 report

The Reinstatement Process

If dissolved:

- File reinstatement application ($75)

- Pay all missed annual reports

- Update registered agent if needed

- Wait for approval (usually quick)

Reality check: During dissolution, you lose liability protection. You’re personally exposed. Don’t let this happen.

Strategic Considerations for Tennessee Annual Reports

The Multi-State Question

Operating in multiple states? You might face multiple annual reports:

- Tennessee: $300 by April 1

- Other states: Various amounts and dates

- Track everything or hire a service

The Registered Agent Solution

Good registered agents remind you about annual reports. For $100-200/year, they’ll:

- Send multiple reminders

- Sometimes file for you

- Never let you miss deadline

- Worth it for peace of mind

The Calendar Hack

Don’t rely on Tennessee to remind you. Set your own reminders:

- February 1: First reminder

- March 1: Second reminder

- March 15: Final warning

- March 25: File no matter what

The Member Management Strategy

Before adding that seventh member, consider:

- Extra $50/year forever

- Could you make them a profit participant instead?

- Is membership necessary?

- Can you use a holding company structure?

Common Tennessee Annual Report Mistakes

Mistake #1: Assuming Formation Date Matters

Everyone files April 1st, regardless of when you formed.

Mistake #2: Forgetting Email Updates

That warning goes to your email on file. Old email = missed warning.

Mistake #3: Counting Members Wrong

Husband-wife LLC = 2 members, not 1. Count everyone.

Mistake #4: Ignoring the 30-Day Window

You can file starting March 2nd. Don’t wait until March 31st.

Mistake #5: Not Updating After Filing

Moved? Changed agents? Update immediately, don’t wait for next year.

Tennessee-Specific Quirks

No Biennial Option

Some states let you file every two years. Tennessee wants their money annually.

No Lifetime Option

You can’t prepay multiple years. Annual requirement, period.

Public Record Reality

Your annual report becomes public. Anyone can see members, addresses, etc.

The Nashville Processing

Everything processes through Nashville. No local offices, no expedited options.

Professional Services: When They Make Sense

Registered Agent Services

For $100-200/year, they’ll:

- Remind you relentlessly

- Accept service of process

- Forward important documents

- Some file the report for you

Recommended if:

- You’re forgetful

- Multiple LLCs

- Out-of-state owner

- Value convenience

Formation Services

Companies like Northwest or ZenBusiness often include:

- First year registered agent free

- Annual report reminders

- Compliance calendar

- Worth considering

CPA or Attorney

Usually overkill for annual reports unless:

- Complex ownership changes

- Merger or conversion

- Dissolution issues

- Tax implications

The Bottom Line on Tennessee Annual Reports

Yes, $300 annually is expensive. Yes, it’s basically a business tax. But missing it costs way more than $300—you’ll lose your LLC, your liability protection, and possibly your business.

Survival strategy:

- Accept the cost as part of doing business in Tennessee

- File early (March) every year

- Set multiple reminders

- Keep member count under 7

- Update information immediately when changes occur

Final reality: Tennessee offers no state income tax, reasonable formation costs, and a business-friendly environment. That $300 annual report is the price you pay. Don’t love it, but don’t miss it either.

The entrepreneurs who succeed in Tennessee budget for this fee from day one. The ones who fail forget about it and wake up to a dissolved LLC. Which one will you be?

Jake Lawson has helped form over 1,200 LLCs nationwide and has seen every possible annual report disaster. He thinks Tennessee’s $300 fee is excessive but acknowledges it beats paying state income tax. For unfiltered LLC advice and formation strategies, visit llciyo.com.