By Jake Lawson | LLC Formation Strategist & Tax Advisor

Mississippi just did something remarkable—they killed paper filings entirely. While Tennessee and Oregon are still playing with stamps and envelopes, the Magnolia State went full digital. No more mail options, no more “the check’s in the mail” excuses. Just pure, efficient online filing for your LLC name change at fifty bucks flat.

I’ll admit, I was shocked when Mississippi leapfrogged other states technologically. But after walking 140+ Mississippi business owners through their digital name changes, I can tell you this: they got it right. Fast processing, clear interface, reasonable pricing. Now if only they could teach Oregon a thing or two about modernization.

The Real Cost of Rebranding Your Mississippi LLC

Fifty dollars. That’s Mississippi’s ticket to a fresh business identity. Not the cheapest (Tennessee wins at $20), not the priciest (looking at you, New York at $60), but solidly middle-of-the-road. Here’s what that actually means for your wallet:

The upfront hit:

- State filing fee: $50

- Processing time: 1-2 business days (seriously, that fast)

The hidden costs nobody mentions:

- New business checks: $35-60

- Updated business cards: $50-250

- Website domain variations: $15-60

- Marketing material refresh: $200-600

- Your time: Priceless (or about 4-6 hours total)

Total realistic investment: Budget $400-1,000 for the complete rebrand journey. The state fee is just the cover charge—the real party costs more.

Why Mississippi Businesses Pull the Name-Change Trigger

Last quarter, I helped a Jackson tech startup rebrand after discovering their name was one letter off from a Fortune 500 trademark. Another Gulfport restaurant realized their clever wordplay didn’t translate well to their Hispanic customer base. And a Tupelo manufacturer? They pivoted industries and their old name made zero sense anymore.

Your reason might be different—market evolution, merger fallout, or that 3 AM naming decision that seemed brilliant after bourbon but terrible in daylight. Whatever brought you here, Mississippi makes fixing it surprisingly painless.

Your Seven-Stage Mississippi Rebrand Journey

Changing your LLC name isn’t just about filing one form—it’s about updating your business identity across every system that matters. Miss a step, and you’ll be explaining mismatches to confused vendors for months.

Stage 1: The Digital Filing Dance

- Verify name availability online

- Navigate Mississippi’s online system

- Submit your amendment

- Wait 24-48 hours for approval

Stage 2: Federal Tax Tango

- Update the IRS (keep that EIN!)

- Maintain federal compliance

Stage 3: State Revenue Shuffle

- Sync with Mississippi Department of Revenue

- Update state tax accounts

Stage 4: Banking Revolution

- Update checking and savings

- Modify credit lines and cards

- Sync payment processors

Stage 5: License Liberation

- Professional certifications

- Local permits

- Industry-specific approvals

Stage 6: Vendor Voyage

- Supplier accounts

- Service contracts

- Insurance policies

Stage 7: Marketing Metamorphosis

- Digital presence overhaul

- Physical collateral updates

- Brand consistency check

Step 1: Claiming Your New Identity (Name Availability)

Mississippi enforces what I call the “distinctiveness doctrine”—your name must be distinguishable from every other registered entity. Not just different, but distinguishable enough that nobody gets confused.

The professional search method:

- Access Mississippi’s Business Entity Search

- Start with partial name searches

- Try phonetic variations

- Check common misspellings

- Test with and without entity identifiers

Real-world collision: A Biloxi spa wanted “Gulf Coast Wellness LLC” but found “Gulfcoast Wellness Center LLC” already taken. Too similar. They successfully pivoted to “Biloxi Bay Wellness LLC”—geographically specific and clearly distinct.

Jake’s Mississippi naming strategy: Avoid overused terms like “Southern,” “Delta,” and “Magnolia”—half of Mississippi businesses use them. Instead, try county names, local landmarks, or Mississippi River references. “Pearl River,” “Pine Belt,” or “Golden Triangle” add local flavor without the cliché.

Step 2: Conquering the Online Amendment System

Mississippi shocked everyone by going fully digital. No paper option, no mailing alternative—just straightforward online filing. After helping dozens navigate this system, I can guide you through without the usual stumbling blocks.

Creating Your Digital Gateway

First time in the system? You’ll need to create an account at Mississippi Business Services. Use an email you actually check—they’ll send your approval there.

Already have an account from your initial formation? Perfect. Log in and let’s roll.

Finding Your Business ID Number

Before starting the amendment, you need your Mississippi Business ID Number. This isn’t optional—it’s your digital key to the amendment door.

Quick retrieval process:

- Open the Business Entity Search in a new tab

- Search your current LLC name

- Note the Business ID number

- Keep this tab open—you might need it again

Navigating the Amendment Portal

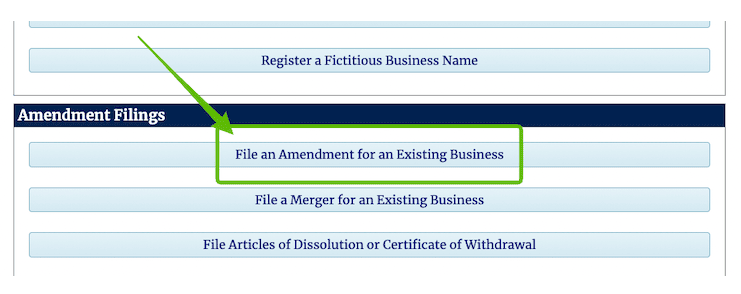

From your dashboard, scroll to “Amendment Filings” and select “File an Amendment on an Existing Business.”

Enter your Business ID Number. Double-check it—wrong numbers cause immediate rejection.

The Business Details Section

Current name display: Your existing LLC name appears here. This is what you’re changing FROM, not TO.

The name change moment: Click “Edit” next to the business name field. Enter your new LLC name with appropriate suffix:

- LLC (most common, my recommendation)

- L.L.C. (formal but acceptable)

- Limited Liability Company (wordy but legal)

The system immediately checks availability. Green means go. Red means back to the drawing board.

Pro tip: If you get a red flag, try adding geographic or industry modifiers. “Smith Construction LLC” might be taken, but “Smith Commercial Construction LLC” or “Smith Coastal Construction LLC” might be available.

The Voting and Adoption Section

Adoption date: When did members approve this change? Yesterday works if you’re a single-member LLC. For multi-member LLCs, use the actual date of your vote—even if that vote happened via group text at midnight.

Future effective date: Leave blank for immediate effect upon approval. Only use future dating (up to 90 days) if you have strategic timing needs—like aligning with a marketing campaign or fiscal year.

NAICS Codes (Usually Skip This)

Unless your business pivot includes changing industries, ignore this section. Your NAICS codes can stay the same even with a new name.

Digital Signature Process

Click “Click to sign” (yes, that’s really what it says).

Enter your details and select your title:

- Member = Owner in member-managed LLC

- Manager = Manager in manager-managed LLC

- Organizer = Authorized third party (rare for name changes)

Confused about your role? If you own part of the LLC and make decisions, you’re probably a Member. If you run the LLC but don’t own it, you’re likely a Manager.

Submission and Payment

Four options appear, but only one matters:

“Submit Document Electronically and Pay Online” ← Choose this

The others are legacy options from the paper era. Mississippi keeps them active but won’t actually process paper filings anymore.

Enter payment information. The system accepts all major credit cards and some debit cards. No PayPal, no Venmo, no cryptocurrency (yet).

The Waiting Game (Barely)

Mississippi processes amendments in 1-2 business days. Not weeks. Not “5-7 business days.” Usually 24-48 hours. I’ve seen approvals come through in under 18 hours during slow periods.

You’ll receive email confirmation when approved. Check your spam folder—sometimes legitimate state emails end up there.

Step 3: The IRS Notification (Don’t Panic)

The IRS relationship with your LLC is like a marriage—the name can change, but the social security number (your EIN) stays the same. Here’s how to update them without triggering unnecessary scrutiny:

For most Mississippi LLCs: Draft a simple letter containing:

- Your EIN

- Old LLC name

- New LLC name

- Signature of authorized person

Mail to the IRS address for Mississippi businesses. No special forms, no fees, no drama.

For single-member LLCs on Schedule C: Even easier—use the new name on your next tax filing. The IRS auto-updates their records.

Critical warning: Never, NEVER apply for a new EIN when changing names. I’ve spent countless hours fixing this mistake for clients. New EINs create duplicate records, flag potential fraud, and turn routine filings into audit triggers. Your EIN is forever tied to your entity, regardless of name changes.

Step 4: Mississippi Department of Revenue Sync

Every Mississippi LLC should already be registered with the Department of Revenue. Now you need to update that registration with your new name.

Three update paths:

- Online (if you’re already in their system)

- Phone (quick but no paper trail)

- Written notice (slow but documented)

I recommend calling first for instructions specific to your tax situation, then following up with written confirmation. Mississippi’s revenue agents are surprisingly helpful when you’re proactive about updates.

Step 5: The Banking Battlefield

Banks treat name changes like identity changes—suspiciously until you prove legitimacy. Come prepared and you’ll breeze through. Come empty-handed and you’ll make multiple trips.

Your ammunition checklist:

- Approved amendment from Mississippi (printed or digital)

- Updated Operating Agreement showing new name

- EIN letter (proves you’re the same entity)

- Government ID

- Account numbers (all of them)

Financial relationships to update:

- Business checking/savings accounts

- Credit lines and term loans

- Business credit cards

- Merchant services accounts

- Payment gateways (PayPal, Stripe, Square)

- Investment accounts

- Bookkeeping software connections

Banking hack: Update your primary operating account first. Many banks can then cascade the change to linked accounts internally. Also, keep old checks temporarily—they’ll work during transition, though some vendors might question the name mismatch.

Step 6: License and Permit Patrol

Mississippi doesn’t require a general business license (small government win), but specific industries face their own requirements.

State professional licenses: Mississippi has boards for everything from architects to veterinarians. Each board has different procedures—some amend existing licenses, others issue new ones. Contact your specific board directly.

Local business permits: Jackson, Gulfport, Southaven, Hattiesburg—every city has unique requirements. Some update permits over the phone, others require formal applications. Call your city clerk for specific procedures.

Industry-specific approvals: Alcohol permits, health department licenses, fire marshal certificates—these often require formal amendments with supporting documentation.

Step 7: The Everything Else Expedition

This is where organization saves sanity. Create a master tracking spreadsheet listing every place your LLC name appears. Update methodically, not frantically.

Digital ecosystem:

- Domain names (grab variations immediately)

- Website content

- Email addresses

- Google My Business (critical for local SEO)

- Social media handles

- Online directory listings

- Review platform profiles

Vendor relationships:

- Supplier accounts

- Software subscriptions

- Professional memberships

- Insurance policies (never forget these)

- Lease agreements

- Equipment financing

- Service contracts

Marketing materials:

- Business cards

- Letterhead

- Email signatures

- Invoice templates

- Proposal templates

- Vehicle graphics

- Storefront signage

Efficiency trick: Batch updates by category. Handle all software subscriptions together, then all vendor accounts, then all marketing materials. Task-switching kills productivity.

Operating Agreement: The Forgotten Essential

Your Operating Agreement needs the new name too. Mississippi doesn’t require filing it with the state, but banks and vendors often request it.

Two approaches:

- Quick amendment: Add an addendum page noting the name change, all members sign and date

- Complete refresh: Draft new agreement with updated name and current terms

I prefer option two. It’s an opportunity to update outdated language and clarify any provisions that have caused confusion.

Lightning Round FAQs

“How many times can I change names?” Unlimited. Mississippi doesn’t restrict rebrands. Just pay $50 each time. I have a client who changed three times in two years (they were incredibly indecisive).

“Why can’t I file by mail anymore?” Mississippi eliminated paper filing to streamline processing. It’s actually faster and more efficient—embrace the digital age.

“Do all members need to approve?” Technically yes, but “approval” can be informal. Email consensus counts. Group text agreement works. Just document it somehow.

“Can I reserve a name before filing?” Yes! Mississippi allows 180-day name reservations for $25. Smart move if you’re planning a future rebrand.

“What about my DBA?” DBAs are separate from LLC names. Sometimes adding a DBA is easier than changing the LLC name entirely.

“Multiple state registrations?” Each state requires separate foreign LLC updates. Different forms, different fees, exponential hassle. Consider professional help for multi-state operations.

When Professional Help Makes Sense

I’m all for DIY when practical. But sometimes outsourcing is the smarter business decision.

Consider professional assistance if:

- Your time bills at more than $100/hour

- You operate in multiple states

- Complex ownership structure needs navigation

- You’re juggling major business operations

- Paperwork makes your eye twitch

Reliable solution: Services like MyCompanyWorks handle the entire Mississippi filing for about $119 plus state fee. They know the system inside-out and prevent rookie mistakes.

Your Mississippi LLC Name Change Checklist

Print this. Use it. Thank me later.

- [ ] Search name availability

- [ ] Create/access online account

- [ ] Locate Business ID Number

- [ ] Complete online amendment

- [ ] Pay $50 fee

- [ ] Receive approval (1-2 days)

- [ ] Update IRS records

- [ ] Notify Department of Revenue

- [ ] Change bank accounts

- [ ] Update payment processors

- [ ] Modify credit accounts

- [ ] Revise professional licenses

- [ ] Update local permits

- [ ] Change insurance policies

- [ ] Notify vendors

- [ ] Update Operating Agreement

- [ ] Revise marketing materials

- [ ] Update digital presence

- [ ] Celebrate your rebrand

The Final Word

Mississippi surprised everyone by modernizing their LLC amendment process. Fifty dollars and 48 hours gets you a completely new business identity—at least with the state. The real work comes after approval, updating every other system that knows your business.

Take it systematically. Use the checklist. Batch similar updates. Don’t stress about catching everything immediately—your old name remains functional during transition.

Remember: Same LLC, same EIN, same ownership—just a fresh name that better represents what you’ve become.

Now stop procrastinating. Check that name availability and get your Mississippi rebrand moving. Your newly named LLC awaits, and with Mississippi’s processing speed, you could be official by Friday.

Jake Lawson has guided over 1,200 entrepreneurs through LLC formation and maintenance across all 50 states. When he’s not applauding Mississippi’s digital progress, he’s probably comparing state filing systems or debating the merits of Delaware versus Wyoming incorporation.

Skip the digital learning curve. Get your Mississippi LLC name change handled by professionals who navigate the online system daily. Start your rebrand today while you focus on running your business.