Let me start with something that catches 90% of first-timers off guard: Pennsylvania doesn’t just want your Certificate of Organization. They demand a Docketing Statement too. Miss that second document, and you’ll get a rejection letter that’ll make you question your life choices.

After shepherding 280+ entrepreneurs through Pennsylvania’s Business Filing Services portal (formerly PENN File, because they love changing things), I can tell you exactly where the landmines are and how to sidestep them.

Here’s the real deal on forming your Pennsylvania LLC—without the bureaucratic doublespeak or surprise rejections.

The $125 Reality (Plus What They Don’t Tell You)

Formation fee: $125 whether you file online or by mail. Pennsylvania doesn’t play the expedited game—everyone waits the same 5-7 business days. Democracy in action, I suppose.

But here’s what’s coming down the pipeline:

- Annual report: Currently free (yes, really)

- Decennial report: $70 every 10 years (weird flex, but okay)

- Local business licenses: Varies by municipality ($50-300)Organizers

- Philadelphia privilege tax: If you’re in Philly, budget for pain

Veterans get free LLC formation in Pennsylvania. If you served, use it. It’s one of the few states that actually thanks vets with meaningful benefits.

The Two-Document Tango

Pennsylvania requires:

- Certificate of Organization – The main event

- Docketing Statement – The sneaky requirement

Most states just want one form. Pennsylvania wants two because… Pennsylvania. The Docketing Statement goes to the Department of Revenue to set up your tax account. Skip it, and you’ll get that rejection letter I mentioned.

Here’s the kicker: The rejection doesn’t refund your $125. They hold it as a “credit” for 30 days while you scramble to fix things. Miss that window? Pay again. It’s like a bureaucratic video game where losing costs real money.

Speed Reality Check: The 5-7 Day Promise

Pennsylvania promises 5-7 business days for online filing. From my tracking:

- Monday filings: Usually approved by Friday

- Tuesday filings: Following Monday or Tuesday

- Friday filings: The next Friday (weekends don’t exist in government time)

No expedited option. No paying extra for speed. Everyone gets the same treatment, which is either refreshingly fair or frustratingly slow, depending on your deadline.

Mail filing? Add another week minimum. The postal service treats government mail like it’s radioactive—slowly and carefully.

Before You Start: The Prep Work That Prevents Pain

Don’t be the person who starts the online form at 11 PM without these ready:

LLC Name (The First Rejection Point)

Pennsylvania wants your name “distinguishable” from existing entities. Their definition of distinguishable is surprisingly reasonable—if a reasonable person could confuse the two, it’s too similar.

Required designators:

- LLC (use this—it’s universal)

- L.L.C. (if periods make you happy)

- Limited Liability Company (for people who hate abbreviations)

- Ltd., LTD. (trying to be different)

Pro tip: Avoid the fancy variations. One client used “Ltd. Liability Co.” thinking it sounded sophisticated. Six months later, everyone thought they were a British company. Stick with “LLC.”

Business Purpose (The Second Rejection Point)

Here’s where Pennsylvania gets picky. Write “any lawful purpose” and you’re getting rejected faster than a bad pickup line. They want specifics.

Bad examples that get rejected:

- “Any lawful purpose”

- “General business”

- “Various activities”

Good examples that pass:

- “Real estate investment and property management”

- “Online retail and e-commerce sales”

- “Restaurant and food service operations”

- “Consulting services in marketing and business development”

You’re not locked into this forever. Just give them something specific to make them happy.

The Registered Agent Decision

Pennsylvania calls it a “Registered Office” because they have to be different. Same thing as a registered agent. You need a Pennsylvania street address that’s staffed during business hours.

Your real options:

Commercial Registered Office Provider (CROP) – $100-250/year

- Professional, reliable, private

- They’re actually there when needed

- Keeps your home off public records

Your PA address – Free but risky

- Must be available 9-5 weekdays

- Your address goes public forever

- Miss one lawsuit notification = disaster

That friend who owes you a favor – Free until it isn’t

- They’ll forget they agreed to this

- They’ll panic when legal documents arrive

- You’ll scramble for a replacement

After watching too many DIY registered agents miss critical documents because they were at their day job, just hire a CROP. It’s cheap insurance.

The Tax Responsible Party

This goes on the Docketing Statement. It’s who gets the tax forms. Usually you. Use your real address—this doesn’t go public, it goes to the Department of Revenue. They’re not sharing your info with marketers.

Navigating the Keystone Login Maze

Pennsylvania killed PENN File and replaced it with Business Filing Services accessed through Keystone Login. Because nothing says “business friendly” like forcing you to create yet another government account.

Account Creation (One-Time Suffering)

- Go to Pennsylvania’s Business One-Stop Shop

- Click “Register” (not “Login”—rookie mistake)

- Create credentials you’ll actually remember

- Verify your email (check spam—it likes to hide there)

- Login and find “Business Filing Services”

The system logs you out after 20 minutes of inactivity. Nothing worse than filling out forms for 19 minutes, grabbing coffee, and starting over. Save frequently.

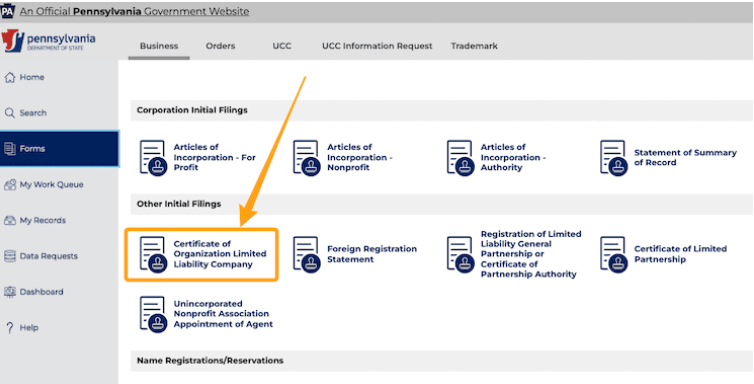

The Certificate of Organization Dance

Business Type Select “Limited Liability Company” not “Professional Services LLC” unless you’re a licensed professional (doctor, lawyer, accountant). Picking the wrong one = rejection.

Name Entry Did you reserve a name? No? Good, nobody does. It’s a waste of $70. Just enter your desired name twice and confirm it’s available.

Effective Date Most choose “when filed”—your LLC exists once approved.

Tax hack: Forming in November or December? Set January 1st as your effective date. Saves you from filing a partial-year tax return for two months of existence. You can future-date up to 90 days, but you can’t backdate even one day.

Registered Office If using a CROP, search their exact name. “Northwest Registered Agent” won’t find “Northwest Registered Agent LLC“—the system is that literal.

For county selection, Erie County is common for many CROPs. If unsure, call them or check your account dashboard.

Organizer Info This is just who’s filing the paperwork. Usually you. Not necessarily an owner. The person clicking submit. Add yourself, move on.

The Docketing Statement Minefield

This is where dreams go to die. Pennsylvania wants:

Business Activity Description Be specific or be rejected. “Technology services” isn’t enough. “Software development and IT consulting services for small businesses” passes.

Tax Year End Most small businesses use December 31 (calendar year). Fancy fiscal years are for corporations with CFOs.

EIN/FEIN Leave blank. You can’t get an EIN until your LLC exists, but Pennsylvania asks anyway. Government logic at its finest.

Common Rejection Reasons (Learn From Others’ Pain)

After seeing hundreds of rejections:

Code 103: Vague business purpose. Solution: Be specific about what you actually do.

Missing Docketing Statement: Forgot the second document. Solution: Always submit both forms together.

Name Too Similar: Your clever variation isn’t different enough. Solution: Actually search the database first.

Wrong County for CROP: Guessed the wrong county for your registered agent. Solution: Call them and ask.

Professional LLC Mistake: Picked PLLC when you’re not a licensed professional. Solution: Read carefully before selecting.

Post-Approval Reality

Once approved (5-7 business days), you get:

- Acknowledgment Letter – Basic confirmation

- Certificate of Organization – Your official formation document

- PA Revenue Welcome Letter – Arrives 3-4 weeks later with your PA Revenue ID

The Certificate of Organization is understated—no fancy seal, no impressive formatting. Just a basic document that says your LLC exists. Banks accept it, but they always look disappointed.

Your Action Plan Post-Formation

Day 1: Get your EIN Free from IRS.gov. Takes 10 minutes. Anyone charging for this is running a scam.

Week 1: Operating Agreement Pennsylvania doesn’t require one. Every bank will demand one. Download a template, customize it, sign it.

Week 2: Business Bank Account Bring your Certificate, EIN letter, and operating agreement. Local credit unions often beat big banks on fees and service.

Month 1: Local Business License Philadelphia, Pittsburgh, and most townships want their cut. Check local requirements. Usually $50-200 and a simple form.

Year 1: Tax Registrations Sales tax, employer accounts, local taxes—Pennsylvania has layers. Get an accountant who knows PA tax law.

The Veteran Advantage

If you’re a veteran, Pennsylvania waives the $125 LLC fee. Not a discount—completely free. You’ll need:

- DD-214 or other discharge papers

- Check the veteran box during filing

- Upload proof of service

One of the few meaningful benefits states offer vets. Use it if you’ve earned it.

Multi-Member Considerations

Pennsylvania doesn’t require listing members in public filings (privacy win!). But document everything in your operating agreement:

- Ownership percentages

- Capital contributions

- Voting rights

- Distribution rules

Handshake deals end in lawsuits. Paper trails prevent problems.

The Bottom Line: Pennsylvania Makes You Work For It

Pennsylvania isn’t the worst state for LLC formation, but it’s not winning any simplicity awards. The two-document requirement trips up newcomers. The specific business purpose requirement causes rejections. The 5-7 day wait with no expedite option tests patience.

But once you know the game, it’s manageable. File online through Business Filing Services. Submit both documents. Be specific about your business purpose. Wait your 5-7 days. Done.

The $125 fee is reasonable. The process is predictable. The system, while clunky, works. Sometimes that’s all you need.

Don’t overthink it. Follow the steps, avoid the common mistakes, and get back to building your business. Pennsylvania wants your tax revenue more than they want to reject your filing.

Need someone to handle this maze? I get it. Sometimes $100 saved isn’t worth the aggravation. Pick a service familiar with Pennsylvania’s quirks—especially that Docketing Statement requirement.

Have specific questions about your situation? Every business is unique. While I’ve covered the standard path, your circumstances might need special attention. Better to know before filing than fix after rejection.

Jake Lawson has guided over 1,200 businesses through formation, including 280+ in Pennsylvania. He has a special appreciation for states that keep things simple, which Pennsylvania decidedly does not. When not decoding the Keystone State’s dual-document requirements, he’s probably eating a cheesesteak and wondering why they can’t just use one form like normal states.