While everyone’s obsessing over Delaware and Wyoming, Wisconsin quietly built something remarkable: instant LLC approval for $130. Not “fast.” Not “expedited.” Instant.

After walking 220+ entrepreneurs through Wisconsin’s QuickStart LLC system, I can tell you it’s the best-kept secret in business formation. File online, pay $130, and you’re official before your coffee gets cold.

But here’s the catch—Wisconsin also has a confusing OneStop system that costs more and takes longer. Half the people who contact me already started in the wrong system. Let me save you from that mess.

The Two-System Trap (And How to Avoid It)

Wisconsin offers two online filing systems, and picking wrong costs you time and money:

QuickStart LLC (The Smart Choice):

- $130 filing fee

- Instant approval

- Simple process

- No unnecessary questions

OneStop (The Complicated Mess):

- $170 filing fee (same as mail)

- Slower processing

- Demands your SSN and birthdate

- Multi-department nightmare

Why does OneStop even exist? Some bureaucrat thought combining DFI and Department of Revenue registrations would help. Instead, they created a system that’s more expensive and more complicated. Classic government.

Mail Filing (For Luddites):

- $170 filing fee

- 5 business days plus mail time

- Same form, higher cost, longer wait

My advice? Use QuickStart LLC. Always. It’s cheaper, faster, and simpler. The only reason to use OneStop is if you enjoy pain.

The Real Cost of Your Wisconsin LLC

Formation fees:

- QuickStart online: $130 (instant)

- OneStop or mail: $170 (slower)

- Expedited mail: $195 (why would you?)

Ongoing costs:

- Annual report: $25 (cheapest in the nation)

- No franchise tax

- No publication requirements

- No minimum capital requirements

Wisconsin is quietly one of the cheapest states to maintain an LLC. That $25 annual report? California charges $800 just to exist. Wisconsin respects small business.

Pre-Game Strategy: Lock This Down First

Before touching QuickStart, get these sorted:

LLC Name (More Flexible Than Most States)

Wisconsin offers 10 different name endings:

- LLC (use this one)

- L.L.C., LC, L.C.

- Limited Liability Company

- Limited Liability Co.

- Limited Company, Limited Co.

- Ltd. Liability Company

- Ltd. Liability Co.

My advice? Stick with “LLC.” Nobody needs to guess what you are.

Name must be distinguishable from existing entities. “Badger Consulting LLC” taken? Try “Badger Business Consulting LLC.” Wisconsin’s reasonable about variations.

Registered Agent Requirements

Every Wisconsin LLC needs a registered agent with a Wisconsin street address. Your options:

Commercial service ($100-200/year)

- Professional, reliable, private

- Actually present during business hours

- Handles everything properly

Yourself with Wisconsin address (Free)

- Home address goes public

- Must be available 9-5 weekdays

- Miss important docs = problems

Friend or family member (Free until it isn’t)

- They’ll regret this

- You’ll stress constantly

- Friendship-ending potential: High

After seeing too many DIY agents miss lawsuit notifications while at their day job, just hire a service. Your home address on public records is an invitation for every B2B salesperson in Wisconsin.

Management Structure (Simple Choice)

Wisconsin asks if you’re:

- Member-managed (owners run everything)

- Manager-managed (designated managers run operations)

95% of small LLCs are member-managed. Unless you have passive investors, keep it simple.

Wisconsin doesn’t require listing members or managers in the Articles. Privacy win! That info stays in your Operating Agreement.

The Organizer (That’s You)

The person filing the paperwork. Usually you. Doesn’t make you an owner, just the person clicking submit. Wisconsin’s not picky here.

Navigating QuickStart LLC: Your 10-Minute Journey

Here’s your step-by-step to instant approval:

Starting Point (No Account Needed)

Go to Wisconsin’s QuickStart LLC system. No account creation, no password to forget, no unnecessary complications. Just click and start.

This alone makes Wisconsin better than 40 other states that force account creation for one-time filings.

Article-by-Article Breakdown

Article 1: LLC Name Enter your full name including “LLC” or chosen ending. No separate suffix dropdown. Type it all out.

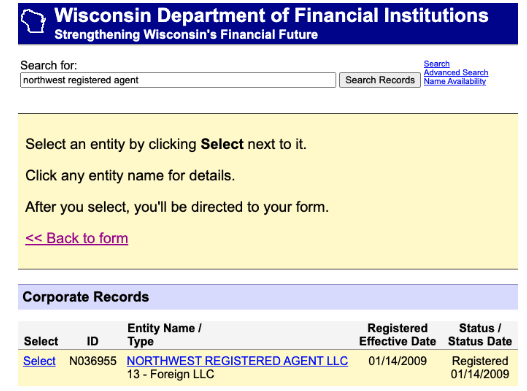

Article 3: Registered Agent

- Individual: Enter their name

- Commercial service: Click “Select Entity,” search their name, select from results

Pro tip: If using a commercial service, search their exact registered name. “Northwest” won’t find “Northwest Registered Agent LLC.”

Article 4: Registered Office Address Your registered agent’s Wisconsin street address. No PO boxes. No UPS stores. Real address only.

Article 5: Management Structure Select member-managed or manager-managed. That’s it. No names required. Beautiful simplicity.

Article 6: Organizer Your name and address. Can be anywhere—Wisconsin, another state, another country. They don’t care.

The Optional Stuff

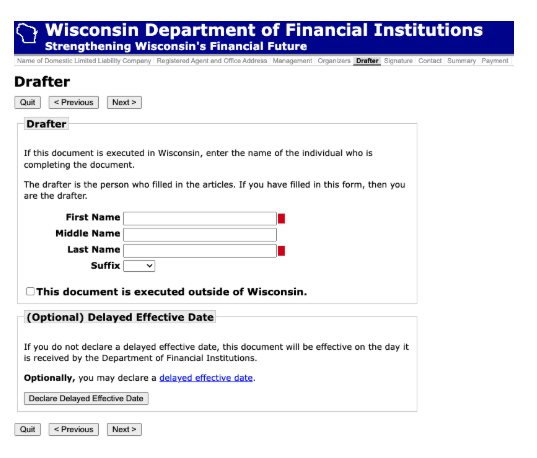

Drafter Section In Wisconsin? Enter your name. Outside Wisconsin? Check the box and skip it. Weird rule, but whatever.

Delayed Effective Date Most choose immediate effectiveness. But here’s a tax hack: Filing in November/December? Set January 1st as effective date (up to 90 days allowed). Saves you from partial-year tax filings.

Expedited Service Don’t pay $25 extra for this. Your LLC is already approved instantly. Expediting instant is like trying to make light faster.

Payment and Approval

Enter card info, pay $130, done. Your LLC exists. Check email for stamped Articles of Organization. Save in triplicate.

The whole process takes 10-15 minutes max. I’ve watched clients form their LLC during commercial breaks.

The Instant Approval Magic

This isn’t “same day” or “while you wait.” This is instant. You click submit, Wisconsin’s system approves, you get your documents.

I’ve formed LLCs in 47 states. Nobody else does true instant approval at this price point. Arizona charges $50 but has other requirements. Most states make you wait days or weeks.

Wisconsin figured out what everyone else hasn’t: LLC formation doesn’t require human review for 99% of filings. Automate the standard stuff, flag the weird stuff, everyone wins.

Post-Approval: Your Next Moves

Minute 1: Download Everything

- Stamped Articles of Organization

- Email confirmation

- Any receipts

Save everywhere. Email yourself. Print copies. You’ll need these for everything.

Day 1: EIN from IRS Free from IRS.gov. Takes 10 minutes. Don’t pay someone $200 for this.

Week 1: Operating Agreement Wisconsin doesn’t require one. Every bank and business partner will. Document ownership, voting, money. Handshake deals end badly.

Week 2: Business Bank Account Wisconsin banks know the drill. Bring Articles, EIN, Operating Agreement. Local credit unions often beat big banks on fees.

Month 1: Local Requirements Milwaukee, Madison, Green Bay—check city business license requirements. Usually $50-150 and basic forms.

Year 1: Annual Report Due exactly one year from formation. $25 online. Cheapest in the nation. Miss it? $10 late fee (not $250 like some states).

Common Mistakes That Waste Time

After seeing hundreds of Wisconsin filings:

Using OneStop Instead of QuickStart: Costs $40 more, takes longer, requires unnecessary info. Just use QuickStart.

Forgetting the LLC Suffix: “Badger Consulting” gets rejected. “Badger Consulting LLC” gets approved. Include the ending.

Selecting Expedited Service: You’re already getting instant approval. Don’t pay extra for nothing.

Complex Organizer Addresses: They accept anything—street, PO Box, international. Don’t overthink it.

Missing the Email: Check spam. Wisconsin’s approval emails sometimes hide there.

Special Situations Worth Noting

Professional LLCs

Licensed professionals (doctors, lawyers, accountants) can form regular LLCs in Wisconsin. No special PLLC requirement like Texas or California. Simple is good.

Series LLCs

Wisconsin doesn’t recognize Series LLCs. Don’t try to get clever. Form separate LLCs if needed.

Foreign LLCs

Already have an LLC in another state? You need foreign registration, not Articles of Organization. Different process, different forms, $100 fee.

Multi-Member Complexity

Wisconsin doesn’t require listing members publicly. But document everything in your Operating Agreement. I’ve seen too many partnerships explode over handshake deals.

Wisconsin’s Hidden Business Advantages

People sleep on Wisconsin, but consider:

- No franchise tax (California charges $800 minimum)

- $25 annual report (Delaware is $300)

- Instant approval (most states take days/weeks)

- Privacy-friendly (no member disclosure required)

- Reasonable regulations

- Stable business law

The cheese state is surprisingly business-friendly. They just don’t market it well.

Red Flags Requiring Help

Consider professional assistance if:

- Multiple members with complex equity

- Converting from another entity type

- Interstate operations from day one

- Regulated industries

- Any pending litigation

These aren’t necessarily problems, but mistakes here cost more than professional fees.

The Bottom Line: Wisconsin Gets It Right

Wisconsin built what every state should have: a simple, fast, affordable LLC formation system. No games, no upsells, no artificial delays.

Use QuickStart LLC. Pay $130. Get approved instantly. Maintain for $25/year. Focus on building your business instead of fighting bureaucracy.

Is Wisconsin perfect? No. The two-system confusion is stupid. The drafter rule is weird. But instant approval for $130? That’s revolutionary.

Don’t overthink this. Pick QuickStart, file your Articles, get approved while your browser’s still open. Wisconsin made it that simple.

Want someone else to handle this? I get it. Even simple processes take time. Just make sure they use QuickStart, not OneStop. The $40 savings matters.

Have Wisconsin-specific questions? Every business is unique. While I’ve covered the standard path, your situation might need special consideration. Better to know before filing.

Jake Lawson has guided over 1,200 businesses through formation, with 220+ in Wisconsin. He’s particularly impressed by Wisconsin’s instant approval system and wonders why every state hasn’t copied it. When not helping entrepreneurs navigate state requirements, he’s probably eating cheese curds and explaining why Wisconsin LLCs are underrated.