By Jake Lawson | Last Updated: August 2025

Here’s something that’ll make you question Washington’s efficiency: They charge $200 to form an LLC (one of the highest fees in the nation) and then make you wait 5-6 weeks for approval. That’s right—six weeks. In the same state that gave us Amazon’s two-day shipping, the government takes six weeks to stamp a piece of paper. After helping over 230 entrepreneurs form Washington LLCs—from tech startups in Seattle to wineries in Walla Walla—I can tell you this wait time is the worst part of an otherwise decent system.

But here’s the silver lining: Washington’s online system actually works well, they include your Initial Report for free (saving $30), and once you’re through the marathon wait, you’ve got one of the most business-friendly LLC structures in the country. No income tax, strong privacy laws, and courts that actually understand business.

Today, I’m walking you through Washington’s Certificate of Formation process, showing you how to navigate their CCFS system (that’s Corporations & Charities Filing System—catchy, right?), and helping you avoid the mistakes that’ll add even more weeks to that already painful wait time.

The Seattle-Sized Price Tag: Understanding Washington’s Costs

Let’s talk money before you commit to the Evergreen State:

Formation costs:

- Certificate of Formation: $200 (includes Initial Report)

- Annual Report: $73 every year

- Registered Agent: $50-150/year (unless you’re Washington-based)

- Business license: Varies by city (Seattle’s particularly expensive)

Total first-year reality: Around $325-425. That’s before any local licenses, and trust me, Washington municipalities love their licensing fees.

Payment breakdown:

- Online filing: $180 base + $20 “rapid processing” (mandatory) = $200

- Mail filing: $200 flat (but why wait even longer?)

Payment methods:

- Online: Credit or debit card only

- Mail: Check or money order to “Secretary of State”

The Six-Week Wait: Why Washington Takes Forever

Before we dive into the how-to, let’s address the elephant in the room—that ridiculous processing time:

Current reality:

- Online filing: 5-6 weeks

- Mail filing: 5-6 weeks plus mail time

- Expedited option: Doesn’t exist (welcome to Washington)

I’ve formed LLCs in all 50 states. Wyoming takes 1 day. Montana takes 5 days. Even California, with all its bureaucracy, manages 10 days. Washington? Six weeks minimum. Plan accordingly.

Before You Start: Essential Washington Prep

The CCFS system requires creating an account first, and once you start filing, there’s no saving and returning. Get these ready:

1. Your Business Name

Washington’s strict about names but reasonable:

Requirements:

- Must be distinguishable from existing entities

- Needs LLC, L.L.C., or Limited Liability Company suffix

- Can’t imply you’re a bank, insurance company, or government agency

- Can include “Northwest,” “Puget,” or “Cascade” (everyone does)

Jake’s reality check: Just use “LLC” without periods. Clean, simple, professional. Nobody’s impressed by “Limited Liability Company” except lawyers billing by the word.

2. Registered Agent Decision

You need a Washington address staffed during business hours:

DIY Agent (if you’re Washington-based):

- Free but completely public

- Must be available 8-5 weekdays

- Hope you never travel during business hours

- Your address on every marketing list

Commercial Service (what I recommend):

- $50-150/year

- Professional document handling

- Maintains privacy

- Won’t miss documents during Seahawks games

I’ve seen DIY agents miss lawsuits because they were skiing at Crystal Mountain. That default judgment costs more than decades of agent fees.

3. Principal Office Strategy

Washington requires a principal office address. This becomes public record. Your options:

- Home address (privacy gone forever)

- Office address (if you have one)

- Registered agent’s address (if they allow it—Northwest does)

- Virtual office (technically not allowed but rarely enforced)

4. Governor Decisions

Washington calls LLC members and managers “Governors” because they like being different. You must list at least one. Think carefully—this goes public.

5. The Initial Report Bundle

Washington bundles your Initial Report with formation. Smart move—saves you $30 and prevents forgetting it later. Don’t check the “defer” box unless you enjoy paying extra.

Creating Your CCFS Account: Welcome to 2010

First, you need an account with Washington’s system:

Step 1: Account Creation

Navigate to Washington’s CCFS login page. Click “Create a User Account.”

Select:

- User type: Individual

- Create username and password (write these down!)

- Enter contact info

- Skip optional address fields (causes confusion)

Step 2: Email Verification

Check your email. Click the activation link. Standard stuff, but the email sometimes takes 30 minutes. Be patient.

Step 3: Login and Navigate

Once verified, login. The dashboard looks outdated because it is. Click “Create or Register a Business” in the left sidebar.

Filing Your Certificate: The Digital Marathon Begins

Now for the main event. Block out 45 minutes and let’s go:

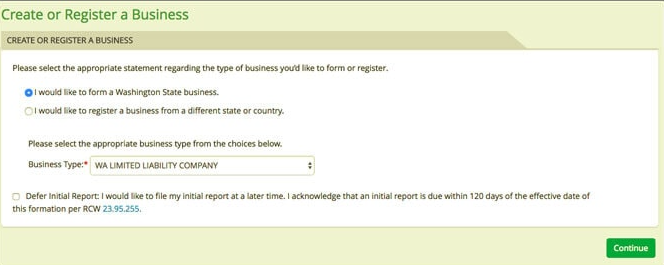

Step 1: Business Type Selection

Choose “I would like to form a Washington state business” (unless you’re registering a foreign LLC).

Select “WA Limited Liability Company.”

Critical: Don’t check “Defer Initial Report.” That costs you $30 later.

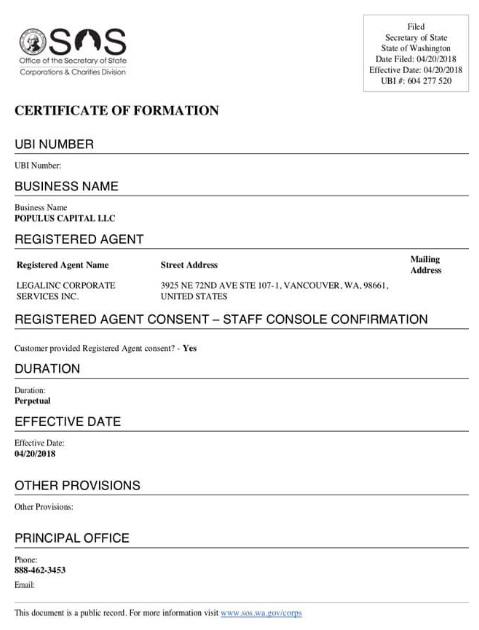

Step 2: UBI Number

Washington asks if you have a UBI (Unified Business Identifier). You don’t. Check “No.” They’ll assign one after approval.

Step 3: Name Entry and Search

Enter your desired name with suffix. Click “Look Up.”

The system shows similar names. If yours shows “Available,” you’re golden. If “Not Available,” back to the drawing board.

Warning: The search isn’t always accurate. I’ve seen “available” names get rejected weeks later. Double-check using their separate business search tool.

Step 4: Registered Agent Consent

Washington requires documented consent from your registered agent. Your options:

If you’re the agent: Select “I am the Registered Agent. Use my Contact Information.” Enter your Washington street address.

If using someone else: Select second option. They need a signed consent form (keep with records).

If using commercial service: Select “Commercial Registered Agent.” Search and select from list. They’ve pre-consented.

Step 5: Certificate Upload (Skip This)

System asks if you have a prepared Certificate to upload. You don’t. Select “No.” You’re creating it electronically.

Step 6: Other Provisions

Unless your attorney gave you specific language, leave blank. Most people don’t need special provisions.

Step 7: Principal Office

Enter email twice (why twice? Washington logic).

Address Confidentiality Program: Don’t check unless you’re actually in this victim protection program.

Street Address: Physical address required. No PO boxes, no PMBs. Can be anywhere globally but goes public.

Mailing Address: Only if different from street address.

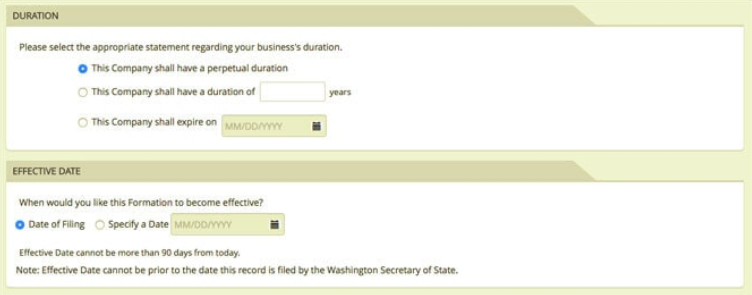

Step 8: Duration and Effective Date

Duration: Choose “perpetual” unless you want your LLC to auto-dissolve someday. Why would anyone want that?

Effective Date:

- Upon filing (most common)

- Future date (up to 90 days)

Tax strategy: Forming October-December? Consider January 1st effective date. Avoids partial year tax filings.

Step 9: LLC Executor (Organizer)

Washington calls the organizer an “Executor” because they’re fancy. This is who’s filing the documents.

Select “Individual” (not your LLC—it doesn’t exist yet). Enter your name and address. Click “Add Executor.”

Step 10: LLC Governors

Must list at least one “Governor” (member or manager). Banks often want all members listed here, but it’s not legally required.

Privacy consideration: List one governor publicly, keep full ownership details in your Operating Agreement.

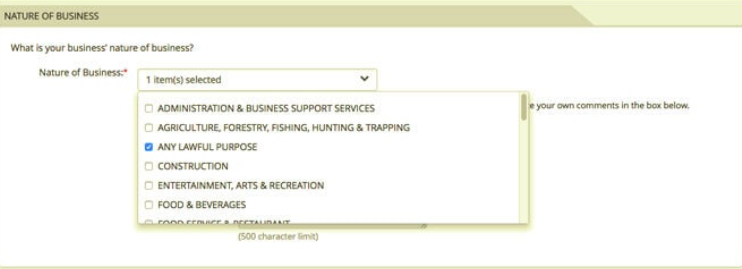

Step 11: Nature of Business

Select from dropdown or check “Other” and describe your business. Can be simple: “consulting,” “real estate,” “e-commerce.”

Or select “Any Lawful Purpose” for maximum flexibility.

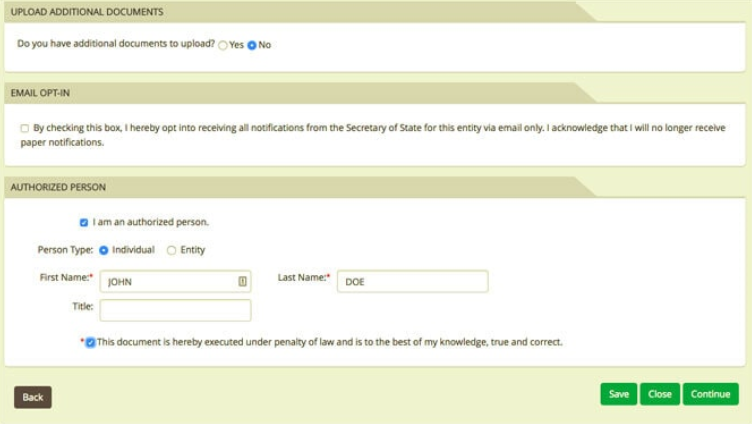

Step 12: Optional Sections

Return Address: Leave blank unless you want approval docs somewhere specific.

Additional Documents: Skip unless your attorney says otherwise.

Email Opt-in: Check if you want electronic annual report reminders instead of mail.

Step 13: Authorization

Check “I am an authorized person.” Enter your name. Certify information is correct. Click “Continue.”

Step 14: Review and Payment

Review everything carefully. Amendments cost money and time.

Add to cart (yes, they use a shopping cart for government filings). Proceed to checkout. Pay your $200. Submit.

The Waiting Game: What Happens Next

You’ve submitted. Now the marathon wait begins:

Week 1-2: Nothing happens. Don’t call.

Week 3-4: Still nothing. Still don’t call.

Week 5-6: Maybe something happens.

Week 6+: Now you can call if nothing’s arrived.

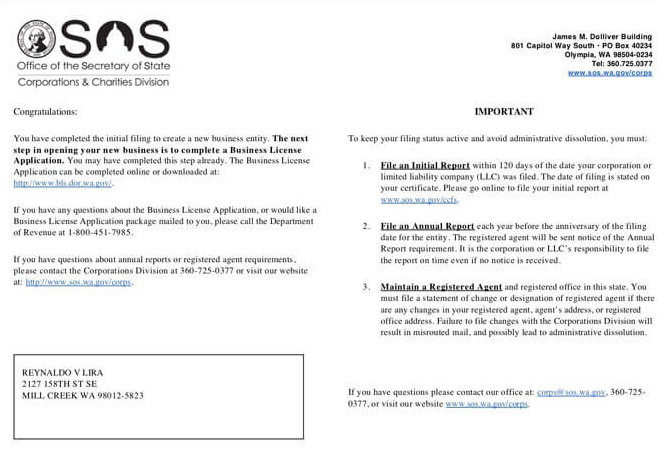

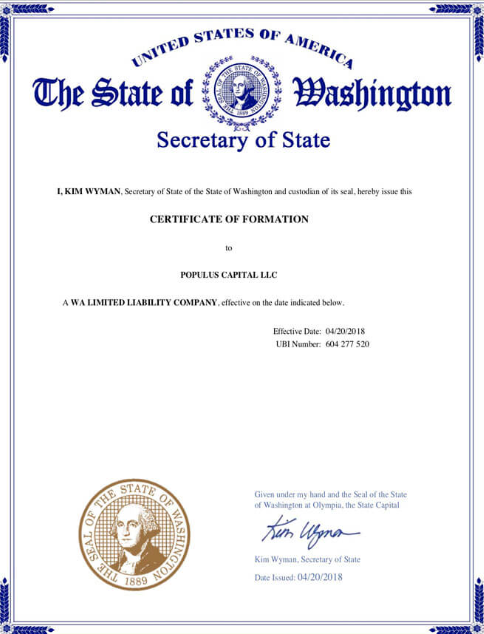

You’ll eventually receive:

- Congratulations letter

- Certificate of Filing

- Stamped Certificate of Formation with Initial Report

Documents arrive by email and mail to your registered agent.

Common Washington Disasters

After 230+ Washington LLCs, here are the classic failures:

- Deferring Initial Report: Costs $30 extra later

- Wrong agent address: Must be Washington physical address

- PMB/CMRA for principal office: Gets rejected

- Name too similar: “Tech Solutions” vs “Tech Solution” both rejected

- Missing consent form: Agent must formally consent

- Impatience during wait: Calling week 2 doesn’t speed anything up

Post-Approval: Your Washington Action Plan

Immediate Tasks:

- Save everything

- Download from CCFS

- Print physical copies

- Back up digitally

- Get your EIN

- Free from IRS.gov

- 10 minutes online

- Required for banking

- Open business bank account

- Local credit unions often best

- Bring Certificate and EIN

- Keep finances separate

- Get business license

- State license from Department of Revenue

- City license (Seattle’s complex)

- Industry-specific licenses

- Draft Operating Agreement

- Not filed with state

- Defines ownership/management

- Critical for multi-member LLCs

Annual Obligations:

- Annual Report: $73 every year

- Registered Agent: Keep current

- Business licenses: Renew as required

- No income tax: But B&O tax exists

The Washington Reality Check

After years forming Washington LLCs, here’s my honest assessment:

The Good:

- No state income tax

- Strong LLC laws

- Business-friendly courts

- Tech hub advantages

- Beautiful state (if that matters)

The Painful:

- 5-6 week wait time (worst in nation)

- High formation fee ($200)

- Complex city licensing (especially Seattle)

- High cost of everything

The Verdict: Great for Washington-based businesses. For out-of-state folks, unless you need Washington specifically, consider Oregon (cheaper) or Wyoming (faster and better privacy).

When to Hire a Pro

Sometimes that $200 DIY filing isn’t worth the hassle:

- Need it faster than 6 weeks (spoiler: you can’t)

- Want maximum privacy

- Multiple members with complex structure

- Confused by CCFS system

- Value time over money

Northwest Registered Agent charges $39 plus the $200 state fee. For $239 total, they handle everything and include registered agent service. Plus, they’re actually based in Washington—Spokane, specifically.

Washington Secretary of State: Your Contact

When you finally need to check on your filing:

Phone: 360-725-0377

Hours: Monday-Friday, 8:00 AM – 5:00 PM Pacific

Online: sos.wa.gov

Pro tips:

- Don’t call before week 5

- Have your filing number ready

- Be patient—they’re swamped

- Online chat sometimes faster than phone

The Bottom Line: Patience Pays in Washington

Washington tests your patience with that six-week wait, but you get a solid LLC structure in a business-friendly state with no income tax. If you can handle the wait and the cost, it’s worth it.

Your options:

- File online yourself: Navigate CCFS, wait 6 weeks

- Hire Northwest: Pay $239 total, still wait 6 weeks

- Form elsewhere: If Washington isn’t mandatory for your business

Whatever you choose, start now. That six-week clock doesn’t start until you file, and every day without an LLC is another day your personal assets are exposed.

Remember: In the state that gave us Microsoft, Amazon, and Starbucks, the government still takes six weeks to process a simple form. Plan accordingly, and maybe grab a coffee—you’ll need it for the wait.

Ready to Form Your Washington LLC?

The six-week marathon starts the moment you file. Head to Washington’s CCFS system with this guide open, or let Northwest handle it while you focus on actually building your business.

Either way, get started. That approval isn’t getting any faster, and your competition already filed six weeks ago.

Jake Lawson has helped over 1,200 entrepreneurs form LLCs across all 50 states, including 230+ in Washington. He’s explained the six-week wait time more times than he can count, helped clients navigate CCFS crashes, and still doesn’t understand why the state that pioneered e-commerce can’t process forms faster. Get more practical business formation advice at llciyo.com.