By Jake Lawson, LLC Formation Strategist

Here’s the good news and bad news about California’s Statement of Information requirement. Good news: it only costs $20 and you only have to file it every two years. Bad news: California will dissolve your LLC if you miss it, and the $250 penalty for late filing is nothing compared to the headache of getting a dissolved LLC reinstated.

I’ve helped dozens of California entrepreneurs navigate this requirement over the years, and I’ve seen too many business owners treat it like optional paperwork. Let me be clear: this is not optional. California takes this seriously, and you should too.

But here’s what most guides won’t tell you: the Statement of Information is also an opportunity. It’s your chance to update key business information, maintain privacy where possible, and ensure your LLC stays in perfect compliance with California’s requirements.

Let me walk you through everything you need to know about California’s Statement of Information, including strategies for protecting your privacy and avoiding the common mistakes that cause problems later.

What is California’s Statement of Information?

California’s Statement of Information (sometimes called a “Biennial Report”) is essentially the state’s way of saying: “Prove you’re still in business and update us on any changes.”

What it accomplishes:

- Updates your LLC’s contact information with the state

- Confirms current management structure

- Maintains your LLC’s good standing status

- Creates a public record of your business activities

What it’s NOT:

- Not a tax return (that’s separate)

- Not optional (despite the casual name)

- Not the same as your annual franchise tax payment

Jake’s reality check: Think of this as your LLC’s “wellness check” with California. Skip it, and California assumes your business is dead.

The Timeline: First Filing and Ongoing Requirements

First Statement of Information: The 90-Day Rule

Critical deadline: Your first Statement of Information is due within 90 days of your LLC’s approval date.

Example timeline:

- LLC approved: March 15, 2025

- First Statement due: June 13, 2025 (90 days later)

- Future Statements due: March 15, 2027, March 15, 2029, etc.

How to find your approval date:

- Check your approved Articles of Organization

- Search California’s business database for your “registration date”

- Look at your franchise tax board correspondence

Jake’s tip: Set a calendar reminder immediately after your LLC is approved. Ninety days passes faster than you think, especially when you’re busy building your business.

Ongoing Statements: Every Two Years

Good news: After your first Statement, you only file every two years.

Due date: By your LLC’s anniversary date (the same date it was originally approved).

Early filing window: You can file up to 6 months early. This is actually a smart strategy—file early when you have time, not when you’re scrambling to meet the deadline.

The Consequences of Missing Your Statement

California doesn’t mess around with Statement of Information compliance:

Grace Period and Penalties

60-day grace period: California gives you 60 days after the due date to file without penalty.

Late penalty: $250 if you file after the grace period expires.

Administrative dissolution: Continue ignoring the requirement, and California will dissolve your LLC entirely.

What Dissolution Actually Means

Loss of legal protection: Your personal assets become vulnerable to business liabilities.

Banking problems: Banks may freeze accounts for dissolved entities.

Contract issues: Existing agreements may become void or unenforceable.

Reinstatement costs: Getting your LLC back in good standing is expensive and time-consuming.

Jake’s reality check: I’ve seen entrepreneurs lose tens of thousands in legal fees and business disruption because they ignored a $20 filing requirement. Don’t be that person.

Privacy Considerations: Protecting Your Information

This is where most guides fall short. The Statement of Information becomes a public record, but you have options for protecting your privacy.

What Becomes Public Information

Always public:

- LLC name and registration details

- Business addresses (principal and mailing)

- Registered agent information

- Manager or member names and addresses

- Business purpose description

Optional public information:

- CEO details (you can leave this blank)

- California office address (if your principal office is elsewhere)

Privacy Protection Strategies

Use your registered agent’s address: If you hired a registered agent service, you can often use their address as your business address for additional privacy.

Business address vs. residential address: The form allows business OR residential addresses. Use a business address (office, registered agent, etc.) to keep your home address private.

Manager-managed structure: In a manager-managed LLC, you only list managers (not all members) in the Statement of Information. This can provide privacy for passive members.

Strategic CEO disclosure: The CEO field is optional. Consider whether listing a CEO provides business credibility or unnecessary public exposure.

Jake’s Privacy Strategy

For maximum privacy:

- Use registered agent address as business address

- Structure as manager-managed LLC if you have multiple members

- Leave CEO field blank unless there’s a business benefit

- Use a business phone number and business email address

Balance privacy with practicality: Remember, you need to actually receive mail at the addresses you list.

Step-by-Step Filing Process

California only accepts Statement of Information filings online through their BizFile system. Here’s how to navigate it efficiently:

Pre-Filing Preparation

Information you’ll need:

- Current business addresses (principal office and mailing)

- Manager or member information (names and addresses)

- Registered agent details

- Business purpose description

- CEO information (if you choose to include it)

Account access: You’ll need a BizFile account connected to your LLC. If you don’t have access, you can request it during the filing process.

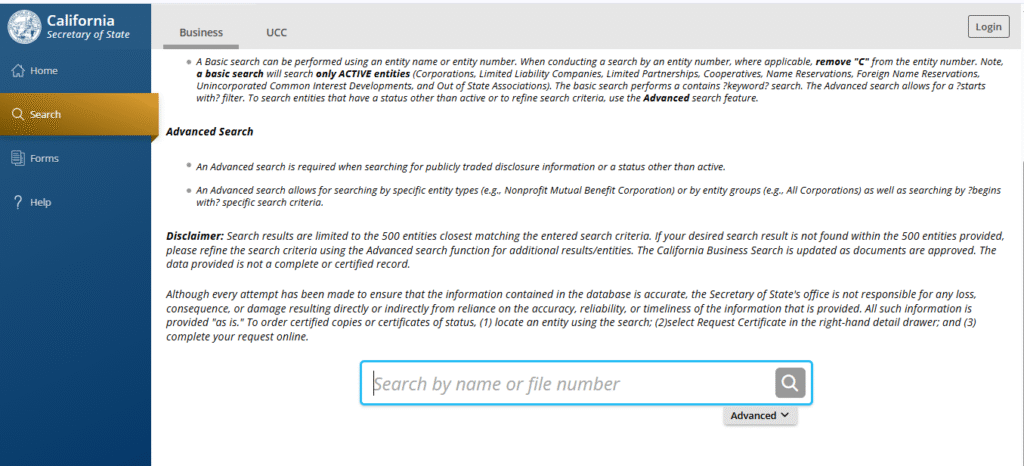

Navigating California’s BizFile System

Getting started:

- Go to BizFile California (bizfileonline.sos.ca.gov)

- Click “File Online” and then “Login”

- Select “File a Statement of Information”

- Search for your LLC by name or entity number

System quirks to know:

- BizFile can be slow during peak times (end of month, deadline periods)

- Save your work frequently—the system can time out

- Have all information ready before starting—it’s harder to research while in the system

Completing Each Section

Submitter Information (Optional): You can provide contact information for the person filing, but it’s not required. This is useful if California has questions about your filing.

Business Addresses:

- Principal Office: Must be a street address (no PO boxes)

- Mailing Address: Can be different from principal office, can be a PO box

- California Office: Only required if your principal office is outside California

Manager/Member Information:

- Manager-managed LLC: List only managers

- Member-managed LLC: List all members

- Include full names and addresses for each person

Registered Agent: Confirm your current registered agent information. This is crucial—California uses this to contact your LLC about legal matters.

Business Purpose: Brief description of your primary business activities. Keep it simple and accurate. You don’t need to list every possible thing you might do.

CEO Information (Optional): Only complete if you have a designated CEO who is separate from your managers/members.

Payment and Processing

Filing fee: $20 (no expedited options available)

Processing time: Immediate approval for online filings

Payment methods: Credit card through the BizFile system

What you’ll receive:

- Filing receipt

- Approved Statement of Information

- Business Entity Filing Acknowledgment

Strategic Timing Considerations

When to File Early

Benefits of early filing:

- Avoid last-minute deadline stress

- Ensure you have time to fix any issues

- File when business is slower, not during busy periods

Optimal timing: File 2-3 months before your deadline when you have adequate time but the information is still current.

Coordinating with Other Requirements

Consider timing with:

- Annual franchise tax payments (different deadline and process)

- Business license renewals

- Registered agent service renewals

- Operating Agreement updates

Common Statement of Information Mistakes

1. Confusing it with franchise tax: These are separate requirements with different deadlines and purposes.

2. Using outdated information: Update addresses, management changes, and business activities.

3. Inconsistent address formatting: Use consistent formatting across all California filings.

4. Forgetting about manager vs. member distinctions: Know whether your LLC is manager-managed or member-managed.

5. Not setting up renewal reminders: Two years feels far away until it’s suddenly overdue.

6. Ignoring privacy implications: Not considering what information becomes public record.

Business Changes and Statement Updates

When You Need to Update Information

Address changes: Update immediately for registered agent; update at next Statement filing for business addresses.

Management changes: New managers or members should be reflected in your next Statement.

Business purpose changes: Update if your primary business activities have significantly changed.

Structure changes: Converting from member-managed to manager-managed (or vice versa) affects what information you report.

Interim Updates vs. Statement Filings

Between Statements: Most information changes can wait until your next biennial Statement filing.

Immediate updates required: Registered agent changes must be filed immediately with a separate form and fee.

Multi-State Considerations

If your California LLC operates in other states, coordinate your compliance calendars:

Foreign LLC Registration

Other state requirements: States where you’re registered as a foreign LLC may have their own reporting requirements.

Timing coordination: Different states have different deadline patterns—create a master calendar.

Information consistency: Keep your information consistent across all state filings to avoid confusion.

Strategic Planning

Expansion planning: Consider how California’s biennial requirements fit with other states’ annual or biennial requirements.

Compliance costs: Factor California’s requirements into your multi-state cost analysis.

Technology and Organization Tips

Setting Up Renewal Systems

Calendar reminders: Set multiple reminders starting 6 months before your deadline.

Document organization: Keep all California LLC documents in one easily accessible location.

Contact information: Ensure California can reach you at the addresses you provide.

Using Professional Services

When to consider help:

- Complex multi-member LLCs

- Frequent management changes

- Privacy-sensitive situations

- Operating in multiple states

What services cost: $100-300 for professional Statement filing assistance.

DIY vs. professional: Most LLCs can handle this themselves, but complex situations benefit from professional guidance.

Integration with Other California Requirements

Franchise Tax Board Obligations

Separate requirement: The Statement of Information is filed with the Secretary of State, not the Franchise Tax Board.

Different deadlines: Franchise tax is due by the 15th day of the 4th month after your tax year ends (typically April 15th).

No connection: Filing your Statement doesn Information doesn’t satisfy franchise tax requirements and vice versa.

Business License Renewals

Coordination opportunity: Consider timing your Statement filing with business license renewals for efficiency.

Information consistency: Keep your business information consistent across all California agencies.

Compliance Calendar for California LLCs

Annual Requirements

- Franchise tax payment and return (due by April 15th typically)

- Business license renewals (varies by license type)

- Workers’ compensation reporting (if applicable)

Biennial Requirements

- Statement of Information (due on anniversary date)

As-Needed Requirements

- Registered agent changes (immediate filing required)

- Amendments to Articles of Organization

- Foreign LLC registration updates

The Bottom Line on California Statement of Information

California’s Statement of Information requirement is straightforward but non-negotiable. The $20 fee and biennial schedule make it one of the easier compliance requirements, but the consequences of missing it are severe.

Key success factors:

- Set multiple reminders starting 6 months before your deadline

- File early when you have time, not when you’re scrambling

- Keep information current and consistent across all filings

- Consider privacy implications when providing addresses and management information

- Don’t confuse it with other requirements like franchise tax

Most important point: This is not optional paperwork. California will dissolve your LLC if you ignore this requirement, and the business disruption from dissolution far exceeds the simple cost of staying compliant.

Your California Statement of Information Action Plan

Immediate Tasks (New LLCs)

- [ ] Calculate your first Statement due date (90 days from approval)

- [ ] Set calendar reminders at 60, 30, and 7 days before deadline

- [ ] Organize all LLC formation documents for easy reference

- [ ] Decide on privacy strategy for business addresses

Filing Preparation

- [ ] Create or access your BizFile account

- [ ] Gather current business information and addresses

- [ ] Confirm registered agent details are current

- [ ] Review and update business purpose description

- [ ] Decide whether to include CEO information

After Filing

- [ ] Save all confirmation documents with your LLC records

- [ ] Set reminders for next filing (2 years out)

- [ ] Update any internal business records if you made changes

- [ ] Coordinate with other California compliance requirements

Ongoing Management

- [ ] Review business information annually for accuracy

- [ ] Update registered agent immediately if changes occur

- [ ] Track any management or address changes for next filing

- [ ] Monitor for California regulatory changes that might affect requirements

Need Help with California LLC Compliance?

California’s Statement of Information is just one piece of your LLC’s compliance puzzle. While the filing itself is straightforward, maintaining good standing in California requires understanding all the interconnected requirements and deadlines.

At llciyo.com, we’ve helped hundreds of California entrepreneurs stay compliant with all state requirements while protecting their privacy and minimizing administrative burden.

Questions about your California Statement of Information? Every business situation is unique, and sometimes you need personalized guidance to ensure you’re handling everything correctly and strategically.

Managing multiple California compliance requirements? We can help you create a comprehensive compliance calendar and strategy that covers all your obligations efficiently.

Remember: This guide provides general information about California Statement of Information requirements but doesn’t constitute legal advice. California’s compliance requirements can be complex and change over time. For specific situations involving complex business structures or multiple state operations, consider consulting with a qualified business attorney familiar with California law.