Washington DC thinks they’re doing you a favor with biennial (every two years) reporting instead of annual. But here’s what actually happens: You forget something due every two years way easier than something due every year. That $300 DC LLC Biennial Report? Half of you reading this have one overdue right now.

After rescuing dozens of DC LLCs from administrative dissolution, I can tell you exactly why DC’s “easier” system is actually harder, how their confusing April 1st timeline works, and why the DLCP’s reorganization made everything more complicated.

DC’s Biennial Report: The $300 Fee That Sneaks Up on You

Let’s start with the reality check:

The facts:

- Cost: $300 every two years

- Due date: April 1st (every other year)

- Late penalty: $100 (total becomes $400)

- Final deadline: September (then dissolution)

- Processing: Instant online, 15 days by mail

Compare that $150/year average to neighboring states, and DC looks reasonable. Until you realize you’ll forget it exists.

The Every-Other-Year Problem

Annual reports are easy to remember—they’re annual. But biennial? Your brain doesn’t work that way.

Why Biennial Reports Fail

Year 1: File on time, feel proud

Year 2: “Wait, is this the year?”

Year 3: Panic-Google “when is DC biennial report due”

Year 4: Get dissolution notice

The human brain handles annual rhythms (birthdays, taxes, anniversaries). Biennial rhythms? We’re terrible at them.

The First Report Confusion

When’s your first report due? DC made this unnecessarily complicated:

If formed April – December: First report due April 1st of the NEXT year

If formed January – March: First report due April 1st of the FOLLOWING year (not this April!)

Examples:

- Form LLC October 2024 → First report April 1, 2025

- Form LLC February 2025 → First report April 1, 2026 (not 2025!)

- Form LLC March 31, 2025 → First report April 1, 2026

The trap: Form in March, think report is due in three weeks. Nope—13 months.

DC’s Bureaucratic Maze (DCRA vs DLCP)

In 2022, DC reorganized their departments because apparently things weren’t confusing enough. The DCRA (Department of Consumer and Regulatory Affairs) died, and the DLCP (Department of Licensing and Consumer Protection) took over.

What this means for you:

- Old DCRA links? Dead

- Old phone numbers? Wrong

- Old addresses? Maybe work

- Old contacts? Gone

Current reality:

- File with: DLCP

- System: CorpOnline (still works)

- Phone: 202-671-4500 (Press 1)

- Hours: 8:30-4:30 (except Thursday: 9:30-4:30)

Yes, they have different hours on Thursday. Because DC.

Filing Your DC Biennial Report Online (The Only Sane Option)

Mailing requires original signatures from ALL members and takes 15 days. Online is instant. This isn’t a hard choice.

Step 1: The Account Setup Nightmare

DC requires TWO separate accounts:

- Access DC account (the gateway)

- CorpOnline account (the actual system)

Creating Access DC account:

- Go to accessdc.dcra.dc.gov

- Register with email

- Verify email

- Create password

- Write it down (you’ll use this every 2 years)

Creating CorpOnline account:

- Login to Access DC first

- Navigate to CorpOnline

- Create ANOTHER account

- Different password required

- Write this down too

Why two accounts? Nobody knows. It’s DC.

Step 2: Starting Your Report

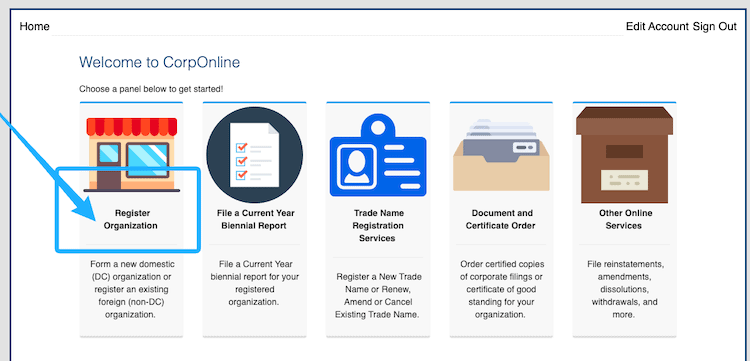

Once in CorpOnline:

- Click “File a Current Year Biennial Report”

- Review checklist (ignore mostly)

- Click “Continue”

Step 3: Find Your LLC

Search by name or file number.

Pro tip: File number search works better. Find it on formation documents.

Select your LLC from results.

Step 4: Enter Report Year

This confuses everyone. Enter the year you’re filing FOR, not the current year.

Example: Filing in 2025 for report due April 1, 2025? Enter “2025”

Step 5: Update Business Address

Your business address can be:

- DC address

- Out-of-state address

- International address

- Your home

- Registered agent address (if they allow)

Privacy hack: Some registered agents let you use their address. Keeps your home off public records.

Step 6: Registered Agent Updates

Critical section because this determines who gets reminders.

If you’re your own agent:

- Select “Yes” to non-commercial

- Enter YOUR email

- This email gets reminders

If using a service:

- Select “No” to non-commercial

- Choose from dropdown

- They handle reminders (hopefully)

Common mistake: No email listed = no reminders = missed reports.

Step 7: Organization Purpose

DC won’t accept “any lawful purpose.” They want specifics.

Good examples:

- “Real estate investment and property management”

- “IT consulting and software development”

- “Restaurant and food service operations”

Bad examples:

- “Any lawful business”

- “General business”

- “Various activities”

Keep it real but flexible.

Step 8: Beneficial Owners (The Privacy Problem)

DC wants all beneficial owners (members) listed. This becomes public record.

Minimum requirement: List at least one member

Privacy strategy: Only list one member if possible. Additional members = additional public exposure.

For each owner, enter:

- Full name

- Address (business address acceptable)

- Check “Executing Officer” for whoever’s filing

Step 9: Review and Pay

Payment:

- Credit card only online

- $300 flat fee

- No payment plans

- Instant processing

Confirmation: Email arrives immediately. Save it.

The Late Filing Disaster Timeline

Miss April 1st? Here’s what happens:

April 2 – August 31: The $100 Penalty Phase

What happens:

- $100 late fee added

- Total becomes $400

- Still can file normally

- No other consequences

Strategy: Just pay it. Don’t wait thinking you’ll save the penalty. You won’t.

September 1+: Administrative Dissolution

The death sentence:

- LLC administratively dissolved

- No liability protection

- Can’t conduct business

- Contracts void/voidable

- Banking problems immediate

Reinstatement required:

- File for reinstatement

- Pay all missed reports

- Pay all penalties

- Prove good standing

- Takes weeks

Building Your Biennial Reminder System

DC sends ONE email reminder in February. To your registered agent. Maybe. Don’t count on it.

The Calendar Strategy

Since it’s every OTHER year, you need doubled reminders:

Odd years (2025, 2027, 2029):

- January 1: “Check if DC report due this year”

- February 1: “DC report due April 1?”

- March 1: “FILE DC REPORT IF DUE”

- March 15: “FINAL WARNING – DC”

Even years (2026, 2028, 2030): Same reminders, different years

The Spreadsheet Method

Create a simple spreadsheet:

- Column A: Year

- Column B: Report Due? (Yes/No)

- Column C: Date Filed

- Column D: Confirmation Number

Pin it somewhere visible.

The Professional Solution

Registered agent services that track biennial reports:

- Send multiple reminders

- Know your schedule

- Some file for you

- Worth $150-300/year

The Buddy System

Know other DC LLC owners? Create reminder pact: “Hey, isn’t your DC report due this year?”

Common DC Biennial Report Disasters

Disaster #1: The Odd/Even Year Confusion

“Was it 2023 or 2024?” Nobody remembers. Check your last filing.

Disaster #2: The March Formation Trap

Formed in March, think report due in weeks. Actually due next year.

Disaster #3: The DCRA Website Hunt

Googling “DCRA” sends you to dead links. It’s DLCP now.

Disaster #4: The Double Account Timeout

Access DC times out while creating CorpOnline account. Start over.

Disaster #5: The “Any Lawful Purpose” Rejection

Generic purpose statements get rejected. Be specific.

DC-Specific Quirks and Features

The Thursday Hours Mystery

DLCP opens at 9:30 AM on Thursdays, not 8:30 AM. Why? It’s DC.

The Non-Commercial Agent Confusion

“Non-commercial” means individual person. “Commercial” means company. Terrible naming.

The Governor/Member Terminology

DC calls members “Governors” sometimes. Same thing. Ignore confusion.

The Public Record Reality

Everything in your report becomes public:

- Member names

- Addresses

- Business purpose

- Email contacts

Plan accordingly.

Strategic Considerations

The Cost Analysis

$300 every two years = $150/year average

Compare to:

- Maryland: $300/year

- Virginia: $50/year

- Delaware: $300/year

DC’s actually middle-of-road when annualized.

The Multi-Jurisdiction Nightmare

Own LLCs in multiple states?

- DC: Biennial on odd/even years

- Maryland: Annual every year

- Virginia: Annual every year

Tracking becomes complex. Consider consolidation.

The Inactive LLC Question

Not doing business? Still must file. Only way out:

- Formal dissolution

- Final report

- Tax clearance

- Proper closure

No “dormant” status exists.

The Banking Verification

Banks randomly check standing. Dissolution triggers:

- Account restrictions

- Credit line freezes

- Merchant account problems

- Loan complications

Your Biennial Report Action Plan

Today:

- Figure out when report is due

- Check your last filing date

- Add to calendar for next due date

- Save login credentials

February of report year:

- Watch for email reminder

- Don’t rely on it

- Plan to file in early March

March of report year:

- File by March 15th

- Pay the $300

- Save confirmation

- Calendar next report (2 years out)

If late:

- File immediately

- Pay the $400 ($300 + $100 penalty)

- Don’t wait for September

- Fix your reminder system

The Bottom Line on DC Biennial Reports

DC’s biennial report system sounds better than annual—half the filings, right? Wrong. You’ll forget something due every two years much easier than something due every year. That $300 fee isn’t terrible when annualized to $150/year, but missing it costs $100 extra plus potential dissolution.

The April 1st deadline creates confusion with tax season. The biennial schedule breaks normal annual rhythms. The DLCP reorganization left outdated information everywhere. The dual account system is unnecessarily complex.

But here’s the thing: This is what DC requires. You can complain about it, or you can system-proof yourself against forgetting. Set excessive reminders. Use a registered agent. Track everything. Whatever it takes to remember that every-other-year obligation.

Because losing your LLC over a forgotten $300 report? That’s a mistake you can’t afford in DC’s expensive market.

Jake Lawson has formed over 1,200 LLCs nationwide and considers DC’s biennial report system proof that “easier” isn’t always better. He’s seen too many LLCs dissolved because owners forgot which year their report was due. For unfiltered LLC advice and reminder strategies that actually work, visit llciyo.com.