By Jake Lawson | LLC Formation Strategist & Tax Advisor

So you just got your EIN confirmation letter from the IRS, and there it is—some cryptic abbreviation next to a name that has you scratching your head. “SOLE MBR”? “MBR”? Did the IRS run out of vowels?

After fielding this question roughly 300 times (I stopped counting after that), I’m going to clear this up once and for all. Spoiler alert: It’s probably fine, you likely don’t need to panic, and the IRS isn’t coming for you.

The Short Answer That’ll Save You an Hour of Googling

Let me cut through the confusion:

- “SOLE MBR” = Sole Member (you told the IRS your LLC has one owner)

- “MBR” = Member (you told the IRS your LLC has multiple owners)

That’s it. The IRS loves abbreviations almost as much as they love making things unnecessarily complicated.

But here’s where it gets interesting—and why you’re probably still reading—these designations might not match your actual LLC structure. And that’s where the fun begins.

Where These Mysterious Abbreviations Show Up

You’ll spot these abbreviations in two places:

- During the online EIN application: On that final review screen before you hit submit

- On your CP 575 letter: That official-looking document the IRS sends confirming your EIN

The abbreviation appears right after someone’s name—usually the person listed as the “Responsible Party” for your LLC’s EIN. And that’s where things often go sideways.

The Real Problem: When Reality Doesn’t Match the Letter

Here’s what I see every week: Smart business owners getting their EIN, then having a minor panic attack when the confirmation letter doesn’t match their LLC structure. Let me walk you through the most common scenarios and—more importantly—how to fix them (or not worry about them).

Scenario 1: “It Says MBR But I’m Flying Solo”

The Mistake: You accidentally told the IRS you have multiple members when applying for your EIN, but you’re actually a single-member LLC.

The Reality Check: This happens more than you’d think. The IRS online application can be confusing, especially at 11 PM when you’re trying to get everything done.

The Fix: Just file your taxes correctly. Seriously, that’s it. When you file Schedule C with your personal 1040 (like a single-member LLC should), the IRS will figure it out. No forms to file, no letters to write, no begging for forgiveness.

Why does this work? Because the IRS ultimately follows state law. If your state says you’re a single-member LLC, that’s what you are—regardless of what you accidentally clicked online.

Scenario 2: “It Says SOLE MBR But We’re Partners”

The Mistake: You have a multi-member LLC but somehow indicated just one member when getting your EIN.

The Reality Check: Usually happens when one partner handles the EIN application and doesn’t realize they need to indicate multiple members.

The Fix: File a 1065 Partnership return when tax time rolls around. The IRS will update their records accordingly. No Form 8832 needed, no drama required.

Again, the IRS recognizes what your LLC actually is based on state law and how you file taxes, not what some abbreviation says on a letter.

Scenario 3: The Husband-Wife California Conundrum

The Situation: You and your spouse formed an LLC in a community property state like California, and now you’re not sure if you should be “SOLE MBR” or “MBR.”

The Plot Twist: In community property states, married couples can choose to be treated as either a single-member LLC (Qualified Joint Venture) or a multi-member LLC for tax purposes.

The Solution: File taxes however you want to be treated:

- Want single-member treatment? File Schedule C

- Want partnership treatment? File Form 1065

The IRS will follow your lead. They’re surprisingly flexible here—probably the only place they are.

The Parent-Child LLC Nightmare (That Isn’t Actually a Nightmare)

This one makes experienced CPAs lose sleep, but it shouldn’t.

The Setup: Your LLC owns another LLC. When getting the EIN for the child LLC, you had to list a human as the responsible party (because the IRS stopped accepting entities as responsible parties in 2018—thanks for that, guys).

The Confusion: Now some random human has “MBR” or “SOLE MBR” next to their name for an LLC they don’t personally own.

The Truth: This is completely normal and expected. The IRS knows this person isn’t the actual owner. They’ll figure out the real ownership structure when you file taxes. Your accountant will handle it correctly, treating the child LLC as a disregarded entity of the parent.

I’ve seen this scenario hundreds of times. Not once has it caused an actual problem beyond initial confusion.

When You Actually Need to Take Action

Most of the time, these abbreviation issues resolve themselves. But there are situations where you should take action:

The Wrong Human Is Listed

If your registered agent, the LLC organizer, or some random third party is listed as the responsible party, you’ll want to fix that. Use Form 8822-B to change the responsible party to an actual LLC member.

Why? Because the responsible party is your LLC’s point of contact with the IRS. You want that to be someone actually involved in the business, not your registered agent in Delaware who wouldn’t know your business from a hole in the ground.

There’s a Typo in the Name

If the IRS managed to butcher someone’s name (they’re surprisingly good at this), you’ll need to send them a letter. Include:

- Your LLC name and EIN

- The incorrect spelling and correct spelling

- Your signature and title

Mail it to their Ogden, Utah office and wait 60-90 days. Yes, it’s that slow. Welcome to government efficiency.

Missing “LLC” in Your Business Name

Forgot to add “LLC” to your business name on the EIN application? If you’ve already formed your LLC with the state, just send the IRS a letter notifying them of the correct name. If you haven’t formed your LLC yet… well, you’ve got bigger problems than an EIN letter.

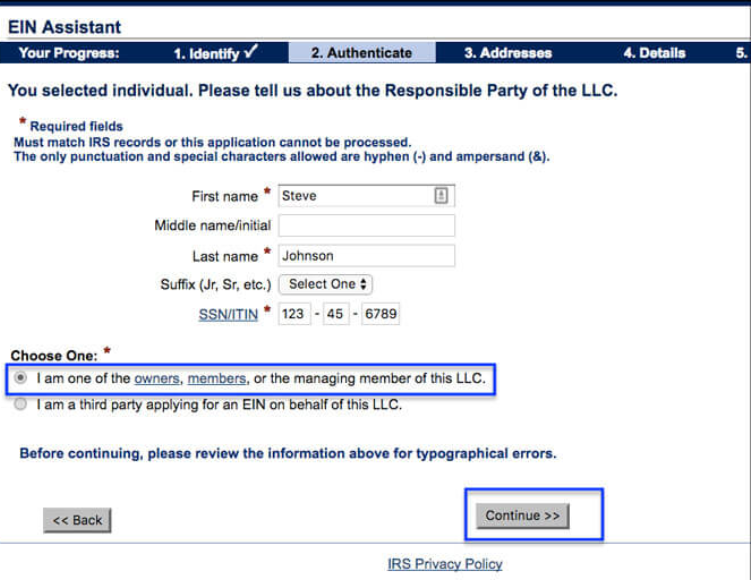

The Manager vs. Member Confusion

Here’s something that trips up LLC pros: You might be the manager of an LLC but not a member (owner). Yet when you applied for the EIN, you had to pick between:

- “I am one of the owners, members, or the managing member”

- “I am a third party”

Since you’re not a third party, you picked the first option. Now it says “MBR” next to your name even though you’re not an owner.

My Take: Don’t lose sleep over it. The IRS figures out actual ownership through tax returns, not EIN letters. As long as taxes are filed correctly, you’re golden.

Common Worries That Aren’t Worth Your Time

After 15 years in this business, here are the “problems” that aren’t actually problems:

“Will this affect my taxes?”

No. Your tax obligations are determined by your LLC’s actual structure and how you file, not by what abbreviation appears on an EIN letter.

“Do I need to file Form 8832?”

Almost never. The only time you need Form 8832 is when you’re actively choosing a different tax classification (like electing corporate taxation). You don’t need it to “fix” an EIN letter abbreviation.

“Should I get a new EIN?”

Absolutely not. Getting a new EIN because of an abbreviation issue is like buying a new car because you don’t like the license plate. It creates more problems than it solves.

“Will this affect my business credit?”How to Cancel Your EIN: The Complete Guide to Closing Your Business Account

Nope. Business credit agencies care about your EIN, payment history, and financial performance—not what abbreviation the IRS uses internally.

Your Action Plan (Or Lack Thereof)

Here’s what you actually need to do based on your situation:

If the abbreviation doesn’t match your LLC type: File your taxes correctly. Problem solved.

If the wrong person is listed: File Form 8822-B to change the responsible party.

If there’s a typo: Send a letter to the IRS.

If everything else is correct: Pour yourself a drink and move on with your life.

The Bottom Line on IRS Abbreviations

Look, I get it. When you’re running a business, every official document feels like it could be a ticking time bomb. But these abbreviations? They’re more like those “warranty expired” calls—annoying but ultimately harmless.

The IRS uses these abbreviations for their internal filing system. They’re not legal determinations of ownership. They’re not binding contracts. They’re just… abbreviations.

What matters is:

- Your LLC is properly formed with your state

- You have an EIN

- You file taxes correctly

Everything else is just paperwork gymnastics.

Real Talk: Why This System Is Broken

Between you and me, this whole system is a mess. The IRS changed their rules in 2018 about who can be a responsible party, but they never updated their online application to reflect modern business structures.

You’ve got LLCs owned by other LLCs, complex multi-member structures, and husband-wife businesses in community property states—none of which fit neatly into the IRS’s two-checkbox system.

But here’s the thing: The IRS knows this. They’re not sitting in Ogden, Utah, plotting to catch you on a technicality. They just want their tax revenue. File correctly, pay what you owe, and they’re happy.

When to Actually Worry

You should only be concerned if:

- You haven’t formed an LLC but got an EIN for one

- You’re not filing taxes at all

- You’re actively misrepresenting your business structure for tax benefits

Otherwise? That “SOLE MBR” or “MBR” designation is about as important as the font choice on your business cards.

Wrapping This Up

After helping over 1,200 entrepreneurs navigate LLC formation and EIN applications, I can tell you this: The abbreviation on your EIN letter is rarely the problem you think it is.

File your taxes based on what your LLC actually is, not what some abbreviation suggests. Keep good records. Stay consistent in how you represent your business structure.

And if you’re still losing sleep over this? Well, that’s what we’re here for at llciyo.com. We’ve seen every EIN letter variation, every IRS quirk, and every edge case you can imagine.

The IRS might be confusing, but LLC formation and management doesn’t have to be.

Jake Lawson has been decoding IRS nonsense since before online EIN applications existed. When he’s not explaining government abbreviations, he’s probably debating the merits of Wyoming vs. Nevada LLCs or trying to figure out why the IRS still requires fax machines in 2025.