By Jake Lawson | LLC Formation Strategist & Tax Advisor

Your LLC without an EIN is like a car without keys—technically exists, but completely useless for actually doing business. After helping 900+ entrepreneurs secure their federal tax IDs, I can tell you this nine-digit number is the most important free thing you’ll ever get from the government.

Here’s what kills me: The IRS gives out EINs for free, takes 15 minutes online, and yet I still see people paying $300 to “EIN services” or waiting two months because they filed the wrong form. Let’s fix that right now.

What an EIN Actually Is (And Why Everyone Gets This Wrong)

An EIN (Employer Identification Number) is your LLC’s federal tax identification number. Think of it as your business’s Social Security number—except it won’t get you retirement benefits and the government won’t lose it in a data breach.

The name confusion game: People call this thing everything:

- Federal Tax ID (accurate)

- FEIN (just adds “Federal”)

- Tax ID Number (redundant but fine)

- Business Tax ID (getting warmer)

- Employer ID (misleading—you don’t need employees)

Critical fact: Despite being called an “Employer” Identification Number, you don’t need employees to get one. The IRS just never updated the name from 1974.

Format breakdown:

- SSN: 123-45-6789 (3-2-4 digits)

- EIN: 12-3456789 (2-7 digits)

Small difference, massive implications for your business operations.

Why Your LLC Desperately Needs an EIN

Without an EIN, your LLC can’t:

- Open a business bank account (99% of banks require it)

- File proper tax returns

- Hire employees (obviously)

- Build business credit

- Apply for business licenses

- Open merchant accounts

- Get business insurance

- Sign most B2B contracts

The privacy angle nobody mentions: Using an EIN instead of your SSN on W-9 forms keeps your Social Security number out of dozens of vendor databases. That alone is worth the 15 minutes to apply.

When You MUST Have an EIN (IRS Requirements)

The IRS legally requires an EIN if your LLC:

- Has multiple members (partnership taxation)

- Elects S-Corp or C-Corp taxation

- Has or will have employees

- Withholds income for non-resident aliens

- Has retirement plans

- Files excise, alcohol, tobacco, or firearms taxes

Single-member exception: Technically, a single-member LLC with no employees can use the owner’s SSN for federal taxes. But good luck finding a bank that’ll open an account without an EIN. I’ve seen maybe two banks in ten years that allow it.

The Three Ways to Get Your EIN (And Which Actually Works)

Method 1: Online Application (The Smart Choice)

Requirements: SSN or ITIN

Time: 15 minutes

Cost: Free

Receive EIN: Immediately

This is your first choice if you qualify. Apply during business hours (7am-10pm Eastern), get your number instantly, download the confirmation letter. Done.

The online system quirks:

- Only works Monday-Friday, 7am-10pm ET

- One EIN per responsible party per day

- System crashes if you use back button

- Times out after 15 minutes of inactivity

Method 2: Fax Application (The Backup Plan)

Requirements: Access to fax

Time: 4-7 business days

Cost: Free (plus fax costs)

Form: SS-4

When online fails (EIN Reference Number 101 error, foreign address issues, system down), faxing is your next best option.

Fax strategy that works:

- Use digital fax services (HelloFax, Fax.Plus)

- Send early in the week

- Include clear contact information

- Keep confirmation page

Method 3: Mail Application (The Last Resort)

Requirements: Patience of a saint Time: 4-8 weeks (or longer) Cost: Free (plus postage) Form: SS-4

Only use this if online and fax aren’t options. The IRS mail room moves at glacial speed, especially during tax season.

The Correct Order: LLC First, Then EIN

Here’s where people constantly mess up: They get an EIN before their LLC is approved. Now you have a tax ID attached to nothing.

The proper sequence:

- File LLC with state

- Wait for state approval

- Get LLC documentation

- Apply for EIN

- Open bank account

The two exceptions:

Every other state: LLC first, EIN second. Period.

Special Situations That Complicate Everything

Foreign-Owned LLCs (No SSN/ITIN)

Can’t apply online. Must use Form SS-4 via fax or mail with specific language:

Line 7b: Write “FOREIGN” or leave blank Line 9a: “Foreign-owned U.S. Disregarded Entity“

Processing time doubles. Consider professional help—the rejection rate for foreign-filed SS-4s is astronomical.

Husband-Wife LLCs in Community Property States

You have options:

- File as partnership (default for 2 members)

- Elect Qualified Joint Venture (QJV) status

- Have one spouse own 100% (single-member)

Each has different tax implications. QJV can simplify filing but limits certain deductions. Discuss with your accountant.

LLC Owned by Another Company

The parent company can’t be the responsible party anymore (IRS changed this in 2019). You need an individual with an SSN/ITIN from the parent company to be the responsible party.

Common mistake: Using parent company’s EIN as responsible party. Instant rejection.

Converting from Sole Proprietorship

Your sole prop EIN doesn’t transfer. You need:

- New EIN for the LLC

- Cancel old sole prop EIN after final tax filing

- Update all vendor relationships

- Transfer bank accounts or open new ones

Don’t try to “convert” the EIN—it doesn’t work that way.

The Online Application Walk-Through

Since 90% of you should apply online, let’s navigate the system:

Step 1: Entity Type Select “Limited Liability Company” (not Sole Proprietorship, even for single-member LLCs)

Step 2: LLC Members

- One owner = 1

- Multiple owners = actual number

- Husband/wife in community property state wanting QJV = 1

Step 3: State of Organization Where you formed the LLC, not where you live or do business

Step 4: Reason for Applying “Started new business” for new LLCs Select the best match for business type

Step 5: Responsible Party Must be an individual with SSN/ITIN Becomes IRS point of contact Can be any LLC member

Common online errors:

- Using browser back button (starts over)

- Taking too long (15-minute timeout)

- Applying outside business hours

- Multiple applications same day

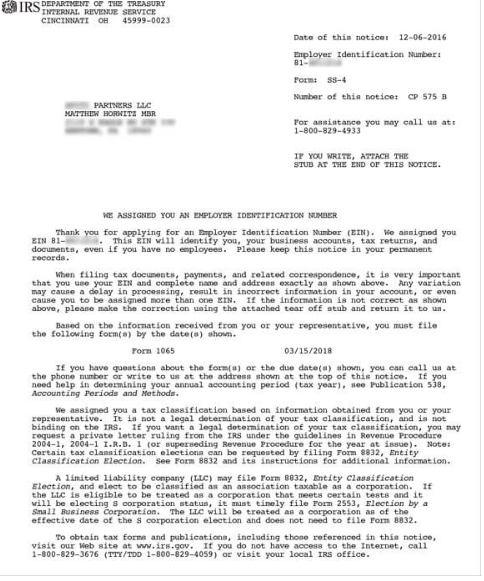

Understanding Your EIN Confirmation Letter

When approved, you’ll see:

- Your LLC name

- Nine-digit EIN

- “SOLE MBR” (single-member) or “MBR” (multi-member)

The designation confusion: “SOLE MBR” next to your name doesn’t mean you’re personally liable. It’s IRS shorthand indicating single-member LLC status. Ignore the paranoia online—it’s normal.

Post-EIN Critical Steps

Open That Bank Account Immediately

What to bring:

- EIN Confirmation Letter (CP 575)

- State-approved LLC documents

- Operating Agreement

- Personal ID

- Initial deposit

Bank shopping priorities:

- No monthly fees

- Online banking quality

- Integration with accounting software

- Business credit card options

- Physical branch access (if needed)

Update Your Tax Elections

Default taxation might not be optimal:

- Single-member: Consider S-Corp election at ~$70k net income

- Multi-member: Evaluate S-Corp vs partnership

- Special situations: C-Corp election (rare but sometimes necessary)

File elections within required timeframes or wait until next tax year.

State Tax Registration

Your EIN handles federal obligations. States want their own registrations:

- Sales tax permit

- Employer accounts (if applicable)

- Income tax withholding

- Unemployment insurance

Each state differs. Don’t assume federal registration covers state requirements.

Common EIN Disasters and Recovery Plans

Disaster 1: Got EIN Before LLC Approved LLC gets rejected, now you have orphan EIN

Recovery: Cancel EIN, fix LLC issues, reapply

Disaster 2: Wrong Tax Classification Selected Told IRS you’re sole proprietor instead of LLC

Recovery: Cancel and reapply, or send correction letter

Disaster 3: Multiple EINs for Same LLC Applied twice thinking first didn’t work

Recovery: Cancel duplicate, keep original

Disaster 4: Lost EIN Confirmation Letter Can’t remember number, bank needs proof

Recovery: Call IRS for 147C verification letter

Disaster 5: Wrong Responsible Party Listed Used someone who’s no longer involved

Recovery: File Form 8822-B to update

The “Do I Need a New EIN?” Decision Tree

You DON’T need a new EIN for:

- LLC name changes

- Address changes

- Adding/removing members

- Changing registered agent

- Moving to a new state (same LLC)

You DO need a new EIN for:

- Converting from sole prop to LLC

- Forming a new LLC (even with same name)

- After LLC termination and reformation

- Changing from LLC to corporation (not tax election)

Professional Help: When It’s Worth the Money

Consider outsourcing if:

- You’re foreign without SSN/ITIN

- Multiple entities with complex structures

- Previous EIN applications were rejected

- Time is worth more than $50-100

- You need it done yesterday

Legitimate services:

- Northwest Registered Agent: $35-50

- Your formation service: Often included

- Your accountant: Should include with setup

- Your attorney: Part of formation package

Avoid:

- Services charging over $100 for basic EIN

- Anyone promising “expedited” processing

- Companies requiring recurring fees

- Services that won’t explain the process

Your EIN Action Checklist

Before applying:

- [ ] LLC approved by state

- [ ] Have LLC exact legal name

- [ ] Know number of members

- [ ] Decide responsible party

- [ ] Have SSN/ITIN ready

- [ ] Choose tax year (usually calendar)

During application:

- [ ] Apply during business hours (online)

- [ ] Don’t use browser back button

- [ ] Complete within 15 minutes

- [ ] Download confirmation immediately

- [ ] Print multiple copies

After receiving EIN:

- [ ] Open business bank account

- [ ] Register with state tax agencies

- [ ] Update accounting software

- [ ] File tax elections if needed

- [ ] Store confirmation letter safely

- [ ] Add EIN to all business documents

The Bottom Line

Your EIN is free, essential, and easier to get than a library card. If you have an SSN or ITIN, you’re 15 minutes away from having your federal tax ID. No excuse for delays, no reason to pay someone hundreds of dollars.

Just remember the golden rule: LLC first, EIN second (unless you’re in Louisiana or West Virginia). Get them in the right order, use the online system when possible, and keep that confirmation letter safer than your birth certificate.

Your LLC needs its federal identity to function in the business world. Stop procrastinating, stop overthinking, and get your EIN today. Your business bank account is waiting.

Jake Lawson has guided over 1,200 entrepreneurs through federal tax ID acquisition and LLC formation. When he’s not explaining why you can’t share EINs between businesses, he’s probably debating the merits of S-Corp election timing or investigating why the IRS still calls it an “Employer” ID.

Need your EIN handled professionally? Skip the learning curve and potential mistakes. Get your EIN through trusted services and receive your federal tax ID without the hassle.