Jake Lawson here. In my 15+ years helping entrepreneurs navigate business formation, I’ve seen too many Arizona LLC owners try to operate without an EIN. Big mistake. Let me explain why this number is absolutely critical—and how to get it right the first time.

You’ve formed your Arizona LLC—congratulations. But if you think you’re done with paperwork, think again. Your next critical step is getting an Employer Identification Number (EIN) from the IRS.

The bottom line upfront: Your EIN is your LLC’s Social Security Number. Without it, you can’t open business bank accounts, file taxes properly, or operate like a legitimate business.

What Is an EIN (And Why Every Arizona LLC Needs One)

An EIN is your LLC’s federal tax identification number. Think of it as your business ID card that proves to banks, vendors, and the government that you’re a real entity.

Common EIN aliases you’ll encounter:

- Federal Tax ID Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Tax Identification Number

They all mean the same thing. Don’t get confused by the jargon.

Critical distinction: Your EIN comes from the IRS, not Arizona. This is a federal number, completely separate from any Arizona state tax IDs you might need.

Why Your Arizona LLC Absolutely Needs an EIN

I’ve heard the argument: “Single-member LLCs don’t technically need EINs.” Technically true, practically stupid.

Here’s what you can’t do without an EIN:

- Open a business bank account (try explaining to Wells Fargo why you don’t have one)

- Apply for business credit cards (mixing personal and business credit is a nightmare)

- Get business loans or lines of credit

- File certain tax returns (depending on your tax election)

- Obtain business licenses (many applications require an EIN)

- Handle payroll (if you ever hire employees)

- Build business credit (separate from your personal credit)

Plus, using your Social Security Number for business is like painting a target on your back for identity thieves.

Getting an EIN takes 15 minutes and costs nothing. There’s literally no reason not to get one.

The Free vs. Paid EIN Trap

Here’s where I save you money: Getting an EIN is completely free when you apply directly with the IRS.

The IRS doesn’t charge application fees. If someone’s asking for payment, you’re either dealing with a middleman or getting scammed.

Services like Northwest can handle this for you, but it’s unnecessary unless you’re swamped or don’t have a U.S. Social Security Number.

When to Apply for Your EIN (Timing Matters)

Critical rule: Don’t apply for an EIN until your Arizona LLC is officially approved by the Corporation Commission.

I see entrepreneurs mess this up constantly. They get excited, apply for the EIN immediately after filing their Articles of Organization, then discover their LLC name was rejected. Now they need to cancel the EIN and start over.

Wait for your approval confirmation. Then apply. Trust me on this one.

How to Get Your EIN: Two Paths

Path 1: Online Application (For U.S. Citizens/Residents)

If you have a Social Security Number or Individual Taxpayer Identification Number (ITIN), apply online. It’s the fastest method—you’ll get your EIN immediately upon completion.

The process:

- Go to the IRS EIN online application

- Answer questions about your LLC

- Provide your SSN or ITIN

- Get your EIN instantly

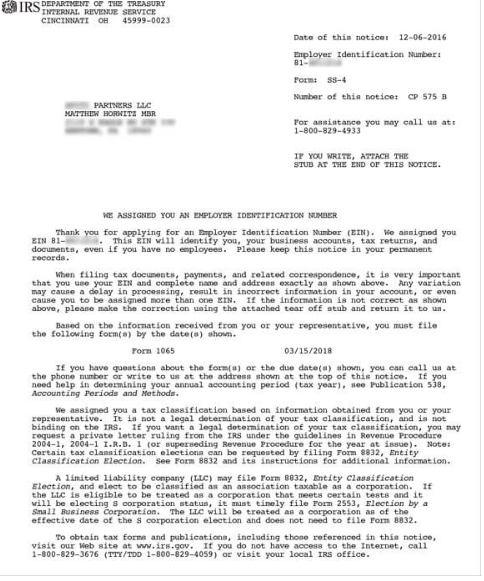

- Download your EIN Confirmation Letter (CP 575)

Pro tip: Apply early in the day. The IRS online system can get overwhelmed during peak hours.

Path 2: Mail/Fax Application (For Non-U.S. Residents)

If you don’t have an SSN or ITIN, you’ll need to mail or fax Form SS-4 to the IRS.

Processing time: 4-6 weeks by mail, 4-5 business days by fax.

Myth buster: You don’t need a “third-party designee” to get an EIN without an SSN. That’s a service some companies sell, but it’s unnecessary. You can do this yourself.

Your EIN Confirmation Letter: Guard It With Your Life

Once approved, you’ll receive Form CP 575 (EIN Confirmation Letter). This document is gold—banks, lenders, and licensing agencies will all ask for it.

If you applied online: Download and save multiple copies immediately. The IRS doesn’t provide additional copies.

If you applied by mail/fax: They’ll mail your confirmation letter to the address you provided.

Lost your confirmation letter? You can request Form 147C (EIN Verification Letter) as a replacement. Both forms serve the same purpose.

Opening Your Arizona LLC Business Bank Account

Your EIN is the key to separating your personal and business finances—something the IRS cares about deeply for tax purposes.

Most Arizona banks require:

- Your EIN Confirmation Letter

- Arizona Articles of Organization

- Valid photo ID

- Initial deposit

Banking tips for Arizona LLCs:

- Shop around—fees and requirements vary significantly

- Consider both national banks and local credit unions

- Ask about business banking incentives for new LLCs

Non-U.S. residents: Yes, you can still open a U.S. bank account with your Arizona LLC and EIN. Some banks are more international-friendly than others.

Common Arizona EIN Mistakes (And How to Avoid Them)

Mistake 1: Applied Before LLC Approval

If your LLC gets approved with the exact name you used on your EIN application, you’re fine. If the name changes or gets rejected, you’ll need a new EIN.

Mistake 2: Forgot to Include “LLC” in the Name

The IRS wants your complete legal name, including “LLC.” If you missed this, apply for a new EIN and cancel the incorrect one.

Mistake 3: Thinking the EIN Forms Your LLC

An EIN doesn’t create an LLC. It’s just a tax number. If you got an EIN but never filed Articles of Organization with Arizona, you’re operating as a sole proprietorship, not an LLC.

Mistake 4: Getting Multiple EINs

One LLC = One EIN. Don’t get confused by DBAs or different business activities. Your LLC uses one EIN for everything.

Single-Member vs. Multi-Member Arizona LLCs

Multi-Member LLCs: Must get an EIN. No exceptions.

Single-Member LLCs: Technically optional for basic tax purposes, practically essential for everything else.

Married couples in Arizona: You have options since Arizona is a community property state. You can choose to be taxed as a single-member LLC (Qualified Joint Venture) or as a partnership. How you complete your EIN application determines this choice.

DBAs and EINs: A Quick Clarification

DBAs (Doing Business As names) don’t get their own EINs. A DBA is just a nickname for your business.

If your Arizona LLC operates under a DBA, use your LLC’s EIN for everything. The IRS doesn’t recognize DBAs as separate entities.

Arizona State Tax Considerations

Remember: Your EIN is for federal purposes. You may also need to register with the Arizona Department of Revenue for state tax purposes using their Joint Tax Application.

Your EIN will be used for:

- Federal income tax returns

- Arizona state income tax

- Sales tax reporting (if applicable)

- Payroll taxes (if you have employees)

Need Help? Where to Get Real Answers

IRS Business Line: 1-800-829-4933 (7 AM – 7 PM, Monday-Friday)

To reach a human: Press 1 for English, then 1 for Employer Identification Numbers, then 3 for existing EIN questions. That’s the only option that connects you to a real person.

Call early: Right when they open to avoid hold times.

What they will help with: EIN application process, technical questions

What they won’t help with: Legal advice, tax strategy, business formation

The Bottom Line on Arizona LLC EINs

Getting an EIN for your Arizona LLC isn’t complicated, but it’s non-negotiable if you want to operate like a real business.

My process:

- Wait for your Arizona LLC approval confirmation

- Apply online if you have an SSN/ITIN (mail/fax if you don’t)

- Download and save your confirmation letter

- Use it to open your business bank account immediately

Time investment: 15 minutes online, 4-6 weeks by mail

Cost: Free (if you apply directly with the IRS)

Value: Immeasurable for legitimate business operations

Don’t overthink this. Get your EIN, get your business bank account, and start building something great.

The bigger picture: Your EIN is just one piece of proper Arizona LLC setup. Make sure you understand all your ongoing requirements—annual reports, tax obligations, and compliance issues that keep your LLC in good standing.

Ready to form your Arizona LLC first? Check out our comprehensive Arizona formation guide. We break down every requirement and help you avoid the mistakes that cost time and money—because proper setup prevents expensive problems later.

Questions about Arizona LLCs or EIN applications? I’ve guided over 1,200 entrepreneurs through this exact process. Contact me—I’m here to help you avoid the expensive mistakes I see every day.