By Jake Lawson | LLC Formation Strategist & Tax Advisor

Let me guess—you’re a non-US resident who just formed an LLC, and now you’re staring at the EIN application wondering how to fill in a Social Security Number you don’t have. Meanwhile, every “expert” online is either trying to sell you something or giving you conflicting advice.

I’ve helped over 400 international entrepreneurs navigate this exact situation. The good news? Getting an EIN without an SSN is completely doable and 100% legitimate. The bad news? The internet is full of expensive myths about this process.

Time to set the record straight.

The Big Fat Lies About EINs for Foreign Founders

Before we dive into the how-to, let’s demolish some myths that are costing international entrepreneurs time and money:

Myth #1: “You Need to Pay for an EIN”

Reality: EINs are FREE from the IRS. Always. Forever. Period.

If someone’s charging you $300 for an “official” EIN, they’re not selling you an EIN—they’re selling you the service of filling out a form. A form I’m about to teach you to complete yourself in 20 minutes.

Myth #2: “You Must Have an SSN or ITIN”

Reality: The IRS has been issuing EINs to foreign nationals without SSNs since before the internet existed.

You need an SSN or ITIN only if you want to apply online. There’s another way that works perfectly fine—it just involves this ancient technology called “fax.”

Myth #3: “You Need a US Address”

Reality: Your mailing address can be in Timbuktu for all the IRS cares.

That said, having a US address on your EIN letter makes opening a US bank account easier. But it’s not required for the EIN itself.

Myth #4: “You Must Hire a Third Party Designee”

Reality: Third Party Designees are for when you hire someone to get your EIN. If you’re doing it yourself (which you absolutely can), you don’t need one.

This myth alone has cost foreign founders thousands in unnecessary fees.

Myth #5: “You Can Call the IRS International Department”

Reality: That number (1-267-941-1099) is for foreign companies, not US LLCs owned by foreigners.

Your LLC was formed in the US. It doesn’t matter that you live in Singapore—as far as the IRS is concerned, it’s a US entity.

The Truth About Getting an EIN as a Non-Resident

Here’s what actually works: You’ll complete Form SS-4 and fax or mail it to the IRS. Where most people get stuck is Box 7b, which asks for an SSN, ITIN, or EIN.

The solution? Write “FOREIGN” in that box.

That’s it. That’s the big secret that formation services charge hundreds of dollars to tell you.

The IRS processes these applications all the time. They’re not confused by it. They’re not going to reject it. It’s standard operating procedure for foreign-owned US LLCs.

Your Step-by-Step EIN Application Guide

Before You Start: Timing Is Everything

Critical Rule: Make sure your LLC is approved by the state BEFORE applying for an EIN.

Why? If your LLC name gets rejected and you already have an EIN, you’ll need to cancel the first EIN and get a new one. Save yourself the headache—wait for state approval first.

Exception: Louisiana and West Virginia sometimes require an EIN before formation. Check your state’s specific requirements.

What You’ll Need

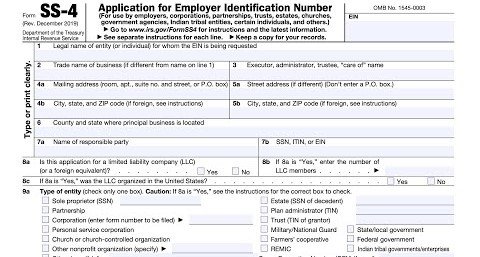

- Form SS-4 (free from the IRS website)

- Your approved LLC formation documents

- A pen (if filling by hand) or PDF editor

- Access to a fax machine or fax service

- 20 minutes of focus

Completing Form SS-4: Line by Line

Let me walk you through each field with the insider knowledge that matters:

Box 1: Legal name of entity Enter your LLC name EXACTLY as it appears on your state formation documents. Not “close enough”—exactly. Including the LLC designation.

Box 2: Trade name Leave blank unless you have a DBA. Most foreign-owned LLCs don’t.

Box 3: Executor/trustee Skip it. Doesn’t apply to LLCs.

Boxes 4a-4b: Mailing address This can be anywhere in the world. However, pro tip: Using a US address here (like your registered agent’s if they allow it) makes bank account opening smoother later.

Boxes 5a-5b: Street address Leave blank if same as mailing address.

Box 6: County and state The county where your LLC is located in the US. Google “what county is [your LLC address]” if unsure.

Box 7a: Responsible Party name Must be a human being, not a company. If you’re the owner, that’s you.

Box 7b: THE MAGIC BOX Write “FOREIGN” if you don’t have an SSN or ITIN. This is the key that unlocks everything.

Box 8a: Is this an LLC? Check “Yes” (obviously).

Box 8b: Number of members

- Single-member LLC: Enter “1”

- Multi-member LLC: Enter actual number

Box 8c: Organized in the United States? Check “Yes” (your LLC was formed in a US state).

Box 9a: Type of entity This gets technical, but here’s the simplified version:

Single-Member LLC:

- Check “Other” and write “Foreign-owned U.S. Disregarded Entity“

- This means you’ll file Form 5472 annually (important—don’t forget this)

Multi-Member LLC:

- Check “Partnership”

- You’ll file Form 1065 annually

Box 9b: State Enter the full state name where your LLC was formed. Don’t abbreviate.

Box 10: Reason for applying Check “Started new business” and describe your business type briefly.

Box 11: Date business started The date your LLC was approved by the state. Check your formation documents.

Box 12: Closing month Usually “December” for calendar year accounting.

Box 13: Employees Most foreign-owned LLCs enter “0” “0” “0” here. You’re not an employee of your own LLC just because you own it.

Box 14: Employment tax liability Leave unchecked unless you have US employees.

Box 15: First date wages paid Enter “N/A” if no employees.

Box 16: Principal activity Check the box that best describes your business or check “Other” and specify.

Box 17: More details Brief description of your main product or service.

Box 18: Applied before? Check “No” (assuming this is your first attempt).

Third Party Designee Section: Leave completely blank if you’re doing this yourself.

Signature Section:

- Sign your name

- Title: “Member” if you’re an owner

- Include your phone number (can be international with country code)

- Include fax number if faxing

The Fax vs. Mail Decision

Faxing (Faster Option)

- Timeline: 4-8 weeks currently

- Fax number: 1-855-641-6935

- No cover sheet needed

- Digital fax services work fine (I recommend Phone.com at $13/month)

Mailing (Slower but Works)

- Timeline: 6-8 weeks currently

- Address: Internal Revenue Service Attn: EIN Operation Cincinnati, Ohio 45999

- Can mail from any country

- Include your LLC approval document

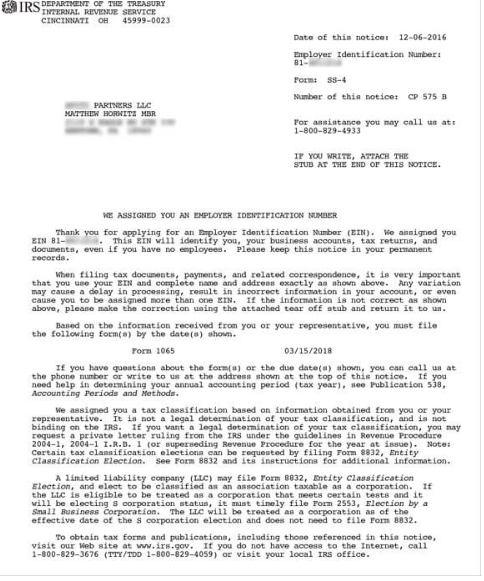

What Happens Next

If You Faxed:

The IRS will fax back your SS-4 with the EIN handwritten at the top. Yes, it looks unofficial. No, that doesn’t matter—it’s completely valid.

About 1-2 weeks later, you’ll receive the official CP 575 letter by mail.

If You Mailed:

You’ll receive the CP 575 letter directly by mail.

The “SOLE MBR” or “MBR” Thing:

Don’t panic when you see this next to your name. It just indicates single-member or multi-member LLC status. We covered this confusion in another article.

Critical Compliance: Form 5472

If you have a foreign-owned single-member LLC, you MUST file Form 5472 annually, even if your LLC had zero activity. The penalty for not filing? $25,000. Yes, you read that right.

This form reports transactions between you and your LLC. Hire an accountant familiar with foreign-owned LLCs for this. It’s not worth risking the penalty.

Opening a US Bank Account

Your shiny new EIN is primarily useful for opening a US bank account. Three main options:

- Visit the US: Most reliable but not always practical

- Online business accounts: Mercury, Wise, or similar

- Traditional banks with international options: Harder but possible

Having a US address on your EIN letter helps tremendously here. Consider using a registered agent service that allows address usage.

Common Mistakes That Delay Everything

After seeing hundreds of applications, here are the disasters to avoid:

- Applying before LLC approval: Creates a mess if your LLC name changes

- Using an entity as responsible party: Must be a human since 2018

- Leaving 7b blank instead of writing “FOREIGN”: Gets rejected

- Sending multiple applications: Creates confusion and delays

- Wrong entity type selection: Impacts your tax obligations

The Professional Help Decision

Look, I’ve just given you everything you need to get an EIN yourself for free. But if you’re running a business and your time is valuable, hiring someone for $100-200 might make sense.

Just don’t pay $500+ for “expedited processing” or “special foreign EIN services.” There’s no such thing. Everyone uses the same IRS process.

Your FAQ Lightning Round

Can I speed up the process?

No. The IRS works at one speed: theirs. Anyone promising faster processing is lying.

What if I don’t hear back after 2 months?

After 62 days, call the IRS and request a 147C EIN Verification Letter. It serves the same purpose as the CP 575.

Do I need an ITIN first?

No. In fact, you can’t get an ITIN without a reason to file US taxes, which usually comes after you have the LLC and EIN.

Can I use my registered agent’s address?

Depends on the agent. Northwest Registered Agent usually allows it. Others don’t. Ask first.

What about state taxes?

The EIN is federal only. Each state has its own tax registration requirements. That’s a separate process.

The Tax Reality Check

Getting an EIN is just the beginning of your US tax journey. Depending on your business structure and country of residence, you might need to deal with:

- Form 5472 (single-member LLCs)

- Form 1065 (multi-member LLCs)

- Form 1040NR (if you have US-source income)

- State tax filings

- Sales tax registration

- Tax treaty benefits

Find an accountant who specializes in foreign-owned US LLCs. This isn’t something to DIY unless you enjoy reading tax codes for fun.

Your Action Plan

Ready to get that EIN? Here’s your this-week schedule:

Day 1:

- Confirm LLC is approved

- Download Form SS-4

- Gather your information

Day 2:

- Complete Form SS-4

- Double-check every field

- Sign up for fax service if needed

Day 3:

- Fax or mail your application

- Keep copies of everything

- Mark your calendar for follow-up

Week 6-8:

- Start checking mail/fax

- Call for 147C if needed after day 62

The Bottom Line

Getting an EIN without an SSN isn’t complicated—it’s just different from the online process. The IRS has been doing this for decades. They’re not confused by foreign owners. They just need you to follow their process.

Write “FOREIGN” in box 7b, fax or mail the form, wait patiently, and you’ll have your EIN. It’s that straightforward.

Don’t let formation services scare you into thinking you need their “expertise” for this. You’ve got everything you need right here.

Questions about forming or managing a US LLC as a foreign national? That’s what we do at llciyo.com. We’ve guided over 1,200 entrepreneurs through US business formation, including 400+ international founders who thought they needed an SSN.

Jake Lawson has been helping international entrepreneurs navigate US business formation since 2010. When he’s not decoding IRS forms, he’s probably explaining why Delaware isn’t always the answer or calculating the real cost of “free” LLC services.