Jake Lawson here. After helping over 1,200+ entrepreneurs get their LLCs up and running, I can tell you this: an EIN isn’t optional—it’s oxygen for your business. Let me walk you through getting yours without the government jargon.

What Exactly Is an EIN? (And Why You Actually Need One)

Think of an EIN (Employer Identification Number) as your LLC’s social security number. The IRS uses this 9-digit identifier to track your business for tax purposes, banking, and pretty much everything else that matters.

Here’s what trips people up: the IRS issues your EIN, not West Virginia. The Mountain State handles your LLC formation, but Uncle Sam controls the tax ID game.

Other Names for the Same Thing

Don’t get confused when you see these terms—they’re all referring to your EIN:

- Federal Tax ID Number

- Federal Employer Identification Number (FEIN)

- Business Tax ID

- Federal Tax Identification Number

Pro tip from 15 years of experience: When someone says “tax ID,” always clarify if they mean your federal EIN or West Virginia’s state tax ID. They’re different animals entirely.

Why Your West Virginia LLC Desperately Needs an EIN

Let me be blunt: operating without an EIN is like driving without a license. Sure, you might get away with it temporarily, but you’re setting yourself up for major headaches.

Here’s what you cannot do without an EIN:

Essential Business Functions

- Open a business bank account (this is non-negotiable)

- File your federal tax returns properly

- Apply for business credit cards or loans

- Hire employees and handle payroll

- Get your West Virginia Business Registration Certificate (required to legally operate)

The Banking Reality Check

I’ve watched countless entrepreneurs hit this wall: you form your LLC, get excited, then walk into a bank only to be turned away because you don’t have an EIN. Don’t be that person.

Every major bank—Wells Fargo, Chase, Bank of America—requires an EIN for business accounts. No exceptions.

The Real Cost of Getting an EIN (Spoiler: It’s Free)

Here’s where I save you from getting scammed: the IRS charges exactly $0 for an EIN application.

Yet I constantly see people paying $50-$300 to “EIN services” that do nothing but fill out the same free form you can complete yourself in 15 minutes.

My rule: Never pay for something the government provides for free. Use that money for something that actually matters, like a good registered agent or business insurance.

When to Get Your EIN: West Virginia’s Quirky Timing

Most states let you form your LLC first, then get your EIN. West Virginia decided to be different (because why make things simple?).

If You’re Following the Smart Formation Process:

- Get verbal LLC name approval from West Virginia Secretary of State

- Apply for your EIN (yes, before filing)

- File your Articles of Organization

- Use your EIN to get your Business Registration Certificate

If Your LLC Already Exists:

Get your EIN immediately. You’ll need it for the Business Registration Certificate, and you can’t legally operate in West Virginia without that certificate.

Reality check: I’ve seen people wait months to get their EIN, essentially operating in legal limbo. Don’t be that entrepreneur.

How to Get Your EIN: The Step-by-Step Breakdown

For U.S. Citizens and Residents (The Easy Route)

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), you’ve got the golden ticket: online application.

The process takes about 15 minutes, and you get your EIN instantly.

Here’s my recommended approach:

- Go to the official IRS website (irs.gov—not some copycat site)

- Navigate to the EIN online application

- Have your LLC information ready (formation date, members, etc.)

- Complete the application

- Download your EIN confirmation letter immediately

Jake’s warning: Make sure you know how many LLC members you have before applying. Changing from single-member to multi-member (or vice versa) later requires paperwork, amended agreements, and potential tax headaches.

For International Entrepreneurs (The Scenic Route)

Non-U.S. residents without an SSN or ITIN can’t use the online system. You’ll need to mail or fax Form SS-4 to the IRS.

Don’t believe the myths: You don’t need to hire a “third-party designee” or pay someone to apply for you. I’ve helped hundreds of international clients get their EINs directly.

Processing time: 4-6 weeks by mail, 4-5 business days by fax.

My tip: Always fax if possible. Mail can disappear into the IRS black hole, but fax gives you a transmission confirmation.

Your EIN Confirmation Letter: Guard It Like Gold

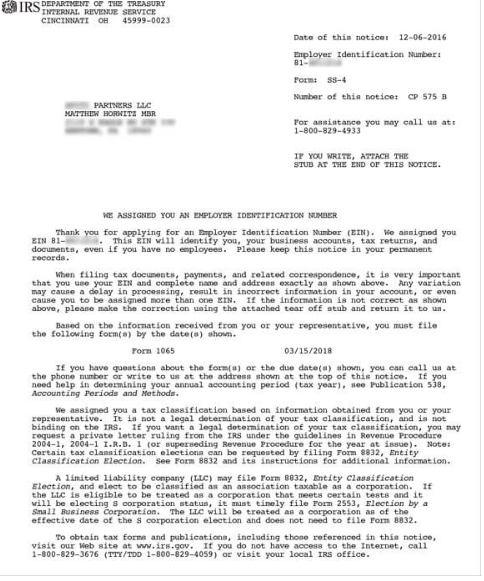

Once approved, you’ll receive an EIN Confirmation Letter (Form CP 575). This isn’t just paperwork—it’s your business’s birth certificate.

Critical point: If you lose this letter, the IRS won’t issue another one. You can request an EIN Verification Letter (Form 147C) instead, but save yourself the hassle by downloading/printing multiple copies immediately.

Banking After Your EIN: Making It Official

With EIN in hand, you can finally open that business bank account. But here’s what the banks don’t advertise: they’re picky about documentation.

What to Bring:

- EIN Confirmation Letter or Verification Letter

- Your LLC’s Articles of Organization

- Operating Agreement (even if not required by West Virginia)

- Valid government-issued ID

My Bank Recommendations:

Based on working with 1,200+ clients, these banks consistently provide the best LLC banking experience:

- Chase Business Complete Banking (great online platform)

- Wells Fargo Business Choice Checking (branch accessibility)

- Bank of America Business Advantage (integration with other services)

For international entrepreneurs: Mercury and Relay offer excellent online business banking for non-U.S. residents.

Common EIN Mistakes That’ll Cost You

Mistake #1: Thinking an EIN Forms Your LLC

Getting an EIN doesn’t create your LLC. The EIN is just a tax identifier. You still need to file Articles of Organization with West Virginia.

Mistake #2: Single-Member LLC Confusion

Yes, single-member LLCs need EINs in West Virginia. While the IRS technically allows single-member LLCs to use the owner’s SSN, West Virginia requires an EIN for the Business Registration Certificate.

Mistake #3: Husband and Wife LLC Complications

In West Virginia (a non-community property state), married couples can’t elect “Qualified Joint Venture” status. Your husband-and-wife LLC will be taxed as a partnership, period.

FAQs: The Questions I Get Daily

“Do I really need an EIN if I don’t have employees?”

Yes. The name “Employer Identification Number” is misleading—you don’t need employees to need an EIN. Think of it as a “Business Identification Number.”

“Can I use my EIN for a DBA?”

No. DBAs can’t have their own EINs because they’re just business nicknames, not separate legal entities. Your LLC gets the EIN; the DBA just uses it.

“What if I forget my EIN?”

Call the IRS at 1-800-829-4933. Press 1 for English, then 1 for EIN questions, then 3 to speak with a human. They can help you retrieve it.

Contact the IRS (When You Actually Need To)

IRS Business Line: 1-800-829-4933

Hours: 7 AM – 7 PM, Monday-Friday

Pro tip: Call right at 7 AM to avoid the hold times. The IRS won’t give tax advice, but they’ll answer EIN application questions.

The Bottom Line

Your West Virginia LLC needs an EIN. Period. It’s free, it’s relatively painless, and it’s absolutely essential for legitimate business operations.

Don’t overthink it, don’t pay for it, and definitely don’t operate without it.

Need help with your West Virginia LLC formation? I’ve tested every major formation service so you don’t have to. Check out my detailed reviews and state-by-state guides—because launching smart beats launching fast every time.

Jake Lawson has guided over 1,200 entrepreneurs through U.S. business formation. His reviews and recommendations are independent and unbiased—no upsells, ever.