By Jake Lawson, LLC Formation Strategist

Lost your EIN confirmation letter? Bank demanding “official proof” of your EIN? Welcome to one of the most frustrating aspects of running an LLC.

In 15+ years of helping entrepreneurs, I’ve walked hundreds of clients through getting EIN verification letters. The good news: it’s completely doable. The bad news: the IRS makes it unnecessarily complicated.

Here’s what nobody tells you upfront: You can’t get a replacement of your original EIN confirmation letter (CP 575). The IRS only issues those once. But you can get something just as good—an EIN Verification Letter (147C)—and I’ll show you exactly how.

The Truth About EIN Letters (What Most People Don’t Know)

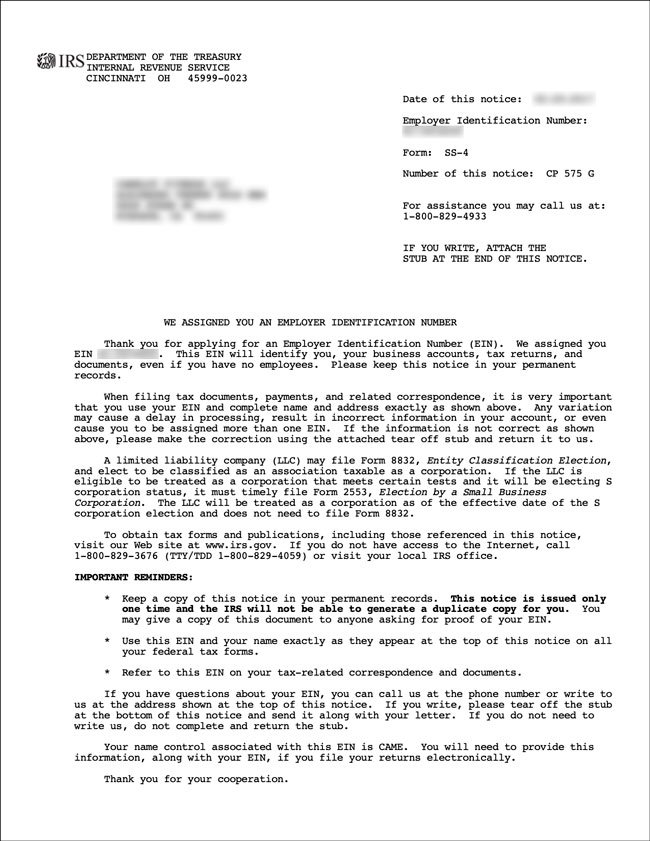

When you first get your EIN, the IRS sends you an EIN Confirmation Letter (CP 575). This is the golden document banks love to see.

Here’s the problem: The CP 575 is issued exactly once. Lose it, and it’s gone forever. The IRS can’t recreate it, even if you beg.

The solution: Request an EIN Verification Letter (147C). It serves the same purpose and carries the same weight as the CP 575. Banks, lenders, and other institutions accept it without question.

Why You Might Need an EIN Verification Letter

From my experience helping 1,200+ entrepreneurs, here are the most common reasons:

Banking Requirements:

- Opening business bank accounts

- Applying for business credit cards

- Setting up merchant services

- Securing business loans

Business Operations:

- Payroll setup

- State tax registration

- Business license applications

- Vendor agreements

Common Scenarios I See:

- “I got my EIN online but my session timed out before I could download the CP 575”

- “My formation service got my EIN but never sent me the confirmation letter”

- “I’ve had my EIN for years but lost the original paperwork in a move”

- “The bank says my EIN number isn’t enough—they want official IRS documentation”

How to Get Your EIN Verification Letter (147C): Two Methods

The IRS gives you two options for getting a 147C letter. Here’s the real scoop on both:

Method 1: Call the IRS (Recommended)

Why I recommend this: You get your 147C immediately by fax, and it’s free.

The downside: IRS phone support is… challenging. Expect long hold times and occasional disconnects.

My strategy for getting through:

- Best times to call: 7:00-10:00 AM or 3:00-7:00 PM (their local time)

- Avoid Mondays (busiest day of the week)

- Multiple attempts: Don’t give up after one try

Step-by-step phone process:

- Call: 1-800-829-4933 (IRS Business & Specialty Tax Line)

- Press 1 for English

- Press 1 for Employer Identification Numbers

- Press 3 for “If you already have an EIN but can’t remember it, etc.”

- Wait for a human (this is the hard part)

What the IRS agent will ask:

- Your LLC’s legal name

- Your EIN (if you know it)

- The address on file with the IRS

- Your role in the LLC

- Sometimes your Social Security Number

Jake’s insider tips:

- For single-member LLCs: Call yourself the “owner” (not “member”)

- For multi-member LLCs: Call yourself a “partner” (not “member”)

- Have your information ready: LLC name, EIN, address, SSN

- Be patient: The agents are usually helpful once you reach them

Delivery options:

- Fax: Instant delivery while you’re on the phone

- Mail: 4-6 weeks (longer during busy periods)

Method 2: Mail a Written Request

When to use this: If you absolutely can’t get through by phone after multiple attempts.

Timeline: 4-6 weeks (sometimes longer)

What to include in your letter:

- Today’s date

- Your LLC’s complete legal name

- Your EIN number

- Clear request for “EIN Verification Letter (147C)”

- Your signature

Sample letter format:

[Date]

Internal Revenue Service

[Address – see below]

Re: Request for EIN Verification Letter (147C)

Dear IRS Representative:

I am requesting an EIN Verification Letter (147C) for my LLC:

Business Name: [Your LLC’s Legal Name]

EIN: [Your EIN Number]

Please mail the 147C letter to the address you have on file for this entity.

Thank you for your assistance.

Sincerely,

[Your signature]

[Your printed name]

[Your title – Owner/Member/Manager]

Where to Mail Your 147C Request (State-Specific)

The IRS has two processing centers. Here’s which one to use:

Mail to Kansas City, MO if your LLC is in:

Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Address:

Internal Revenue Service

333 West Pershing Rd.

Mail Stop 6055 S-2

Kansas City, MO 64108

Mail to Ogden, UT if your LLC is in:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming (or anywhere outside the US)

Address:

Internal Revenue Service

Stop 6273

Ogden, UT 84201

Common Problems and How to Solve Them

“I Can’t Get Through to the IRS by Phone”

Reality check: This is the #1 complaint I hear. The IRS phone system is overwhelmed.

My proven strategy:

- Call multiple times per day

- Try different times (early morning works best)

- Don’t give up after one day—keep trying all week

- Consider calling during their less busy periods (Tuesday-Thursday)

“The IRS Agent Said They Can’t Help Me”

Common causes:

- You’re not listed as the EIN Responsible Party

- Your LLC information doesn’t match their records

- You can’t provide adequate identification

Solutions:

- Have all your LLC formation documents ready

- Call back and speak to a different agent

- Consider updating your EIN Responsible Party first

“My Name/Address is Wrong on the 147C”

What happened: There’s likely an error in your original EIN application or IRS records.

Fix it: Write to the IRS explaining the error and requesting a correction. Include documentation proving the correct information.

“I’m Not in the US—Can I Still Get a 147C?”

Yes, but it’s trickier. Non-US residents can request 147C letters, but you’ll need to provide additional identification and may face longer processing times.

What Your 147C Letter Will Look Like

The EIN Verification Letter (147C) contains:

- Your LLC’s legal name

- Your EIN number

- The date the EIN was assigned

- IRS letterhead and official formatting

- Statement that this serves as verification of your EIN

Important:

Banks and institutions accept the 147C exactly like they would a CP 575. There’s no functional difference

Special Situations and Pro Tips

For Foreign Nationals

- You can request a 147C even as a non-US resident

- Have your passport and formation documents ready

- Processing may take longer than domestic requests

For DBAs and Trade Names

- The 147C shows your LLC’s legal name, not any DBA names

- If you need DBA verification, that’s a separate state-level process

For Old LLCs

- No time limit: You can request a 147C for EINs issued decades ago

- Change in ownership: New owners can request 147C letters with proper documentation

For Multiple EINs

- If your LLC has multiple EINs (rare but possible), specify which one you need verified

- The IRS will ask which EIN you’re requesting verification for

Cost Breakdown: What This Actually Costs You

IRS fees: $0 (completely free)

Your time investment:

- Phone method: 30 minutes to 2+ hours (depending on hold times)

- Mail method: 10 minutes to write letter + 4-6 weeks waiting

Potential costs:

- Certified mail (recommended): ~$7

- Fax service (if you don’t have fax): $5-15

- Time value of multiple call attempts: Varies

Jake’s Complete 147C Success Strategy

After helping hundreds of clients through this process, here’s my proven approach:

Phase 1: Preparation (5 minutes)

- Gather all LLC information

- Confirm your role in the LLC

- Clear your calendar for potential hold time

Phase 2: Phone Attempt (1-3 days)

- Call during optimal times

- Make multiple attempts if necessary

- Don’t get discouraged by busy signals

Phase 3: Mail Backup (if needed)

- Write formal request letter

- Send via certified mail

- Set reminder to follow up in 6 weeks

Phase 4: Follow-up

- Confirm receipt with your bank/institution

- Make copies for your records

- Store securely for future needs

When NOT to Request a 147C

Don’t request a 147C if:

- You already have your CP 575 and it’s acceptable to your bank

- You can find your EIN confirmation in old emails/documents

- Your bank will accept just the EIN number without additional documentation

Save yourself the hassle if you don’t actually need it.

The Bottom Line on EIN Verification Letters

Here’s what 15+ years of business formation experience has taught me: The 147C process is annoying but necessary.

The IRS phone system is frustrating, but the agents are generally helpful once you reach them. The letter serves its purpose perfectly—banks and institutions treat it exactly like your original CP 575.

My honest advice: Try the phone method first. Yes, you might wait on hold. Yes, you might have to call multiple times. But getting your 147C immediately by fax is worth the hassle.

If phone doesn’t work after several attempts, mail your request and wait. It’s not ideal, but it works.

What to Do After You Get Your 147C

Immediate steps:

- Make several copies for your records

- Send copy to your bank/financial institution

- Store the original safely with your other LLC documents

Pro tip: Scan it and save digital copies in multiple locations. You don’t want to go through this process again.

Need help with your LLC beyond EIN issues? I’ve tested every major formation and compliance service. For ongoing support, I recommend Northwest Registered Agent for their excellent customer service, or LegalZoom if you prefer working with a household name.

Questions about EIN verification letters? The IRS is your best resource for specific situations, but I hope this guide saves you time and frustration in the process.

Jake Lawson is an LLC formation strategist who has guided over 1,200 entrepreneurs through U.S. business formation and compliance. He provides unbiased advice and tested recommendations at llciyo.com.