By Jake Lawson | LLC Formation Strategist & Tax Advisor

Let’s get one thing straight: The IRS gives out EINs for free. Always has, always will. If someone’s charging you $297 for an “expedited EIN,” they’re selling you a $297 form-filling service for something you can do yourself in 15 minutes.

After walking 500+ LLC owners through the online EIN application, I can tell you exactly where people get stuck, what the IRS actually cares about, and how to avoid the dreaded reference number that sends you back to square one.

Who Can Actually Use the Online EIN System?

Before we dive in, let’s see if you qualify for the fast lane:

You CAN apply online if:

- You have a Social Security Number (SSN)

- You have an Individual Taxpayer Identification Number (ITIN)

- Your LLC is already approved by your state

- You’re applying during IRS hours (Monday-Friday, 7am-10pm Eastern)

You CAN’T apply online if:

- You’re a non-US resident without an SSN/ITIN

- You’re getting your second EIN today (one per day limit)

- The IRS website is down (happens more than you’d think)

Non-US residents: Don’t panic. You can still get an EIN by fax or mail. Different process, same result, just takes 4-8 weeks instead of 15 minutes.

Pre-Flight Checklist: What You Need Before Starting

Gather this stuff before you click anything:

- Your approved LLC documents (Articles of Organization or Certificate of Formation)

- Your SSN or ITIN

- LLC’s physical address (PO Boxes don’t work)

- County where your LLC is located (Google it if unsure)

- 15 minutes of uninterrupted time (you can’t save and return)

The Step-by-Step Process (With Actual Helpful Commentary)

Step 1: Navigate to the Real IRS Website

Go to IRS.gov and search for “apply for EIN online.”

Critical Warning: There are dozens of lookalike sites that show up in Google ads. They’ll charge you $200+ for the “service.” The real IRS site never charges. Ever.

Click “Apply Online Now” and then “Begin Application.”

Step 2: Identify Your Entity Type

Select “Limited Liability Company” from the options.

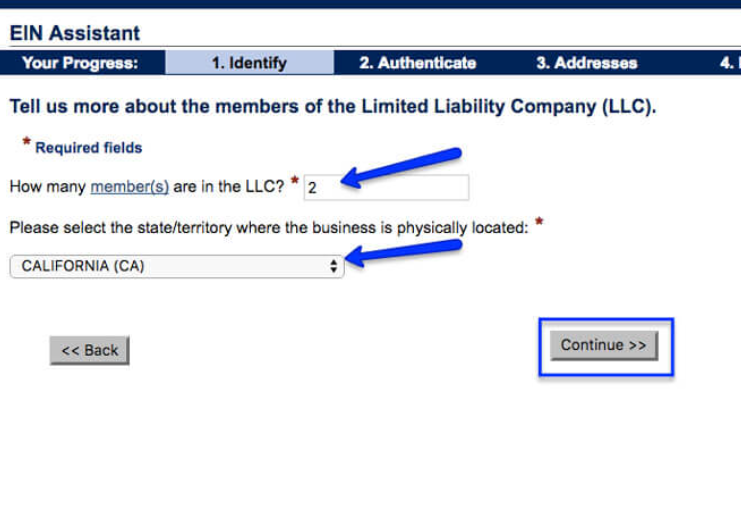

They’ll ask follow-up questions:

- Number of members: Be accurate here. This determines your default tax classification

- State of formation: Where you filed your LLC, not where you live

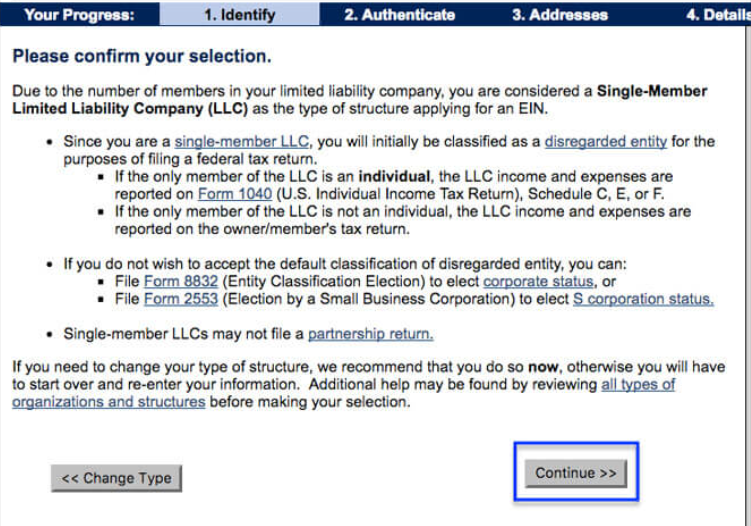

Single-Member LLC: You’ll be taxed as a disregarded entity (sole proprietorship) by default

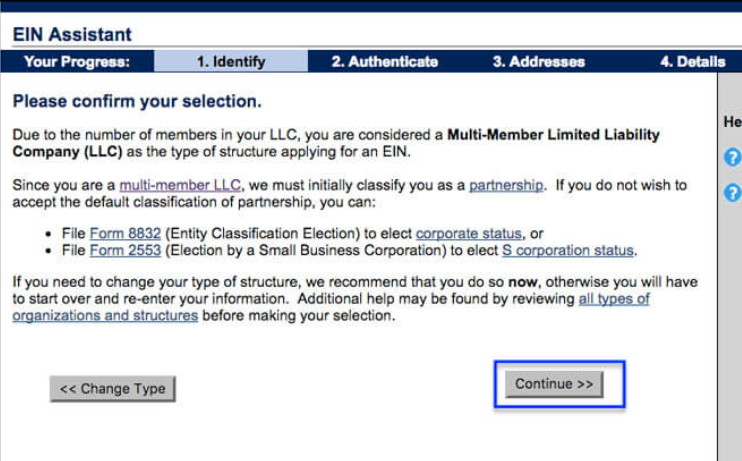

Multi-Member LLC: You’ll be taxed as a partnership by default

Don’t panic about tax elections. You can change these later with Form 8832 or 2553 if needed.

Step 3: The Responsible Party Section

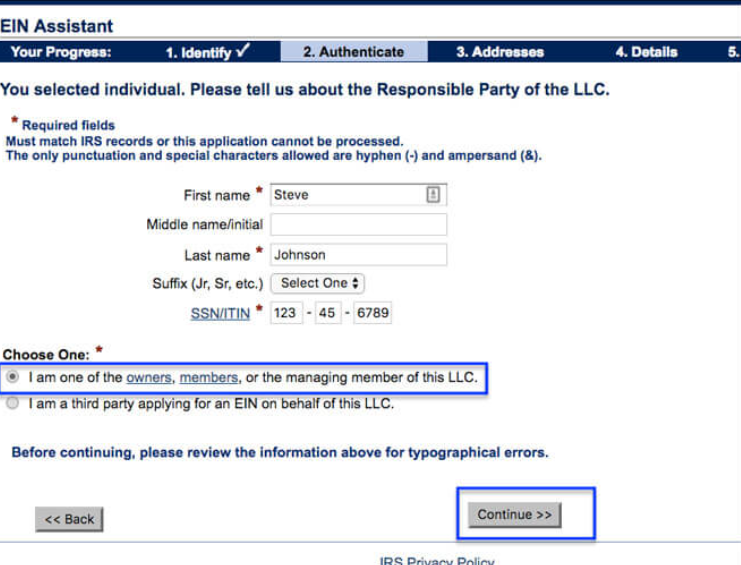

This trips up 40% of applicants. Here’s what you need to know:

The “Responsible Party” is the IRS’s contact person for your LLC. Must be a human, not another company.

For Single-Member LLCs: That’s you. No debate.

For Multi-Member LLCs: Pick one member. Usually whoever handles the books.

For LLCs owned by other LLCs: List an owner of the parent company (yes, this creates the “SOLE MBR” confusion on your letter—ignore it).

Enter your name and SSN/ITIN. Select “I am one of the owners, members, or the managing member.”

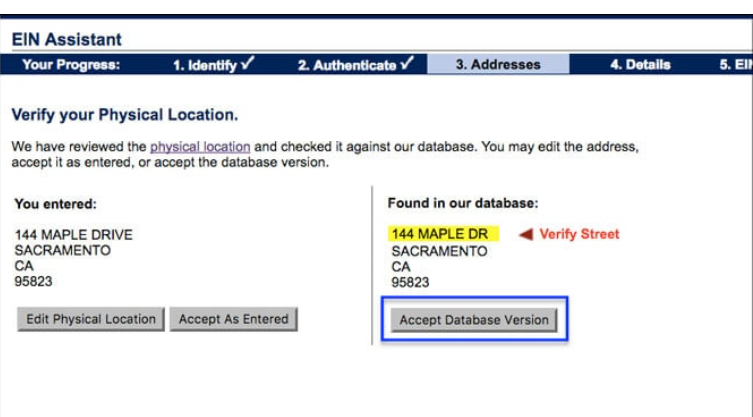

Step 4: Address Information

Physical Location: Where your LLC actually operates. Home office? Use that. Virtual business? Use your home address.

Different Mailing Address: Only check this if you want IRS mail going somewhere else.

Special Characters: The IRS system is from 1982. Only hyphens and forward slashes work. No hashtags, no periods in addresses. “Apt. #3” becomes “Apt 3” or “Apt-3.”

Step 5: LLC Details (Where Dreams Go to Die)

This section kills more applications than any other:

Legal Name of LLC:

- Enter EXACTLY as it appears on state documents

- No periods or commas (even if your state filing has them)

- “ABC Services, LLC” becomes “ABC Services LLC”

- Special characters get replaced:

- “.com” becomes “dot com”

- “&” is allowed

- “+” becomes “plus”

- Apostrophes just disappear

Trade Name/DBA: Leave blank unless your LLC has filed a separate DBA after formation. This isn’t for your old sole proprietorship’s DBA.

County: The county where your LLC is located. Not country. County. I see this mistake weekly.

State Where LLC is Located: Usually same as formation state unless you’re a foreign LLC.

LLC Start Date: The date your state approved your LLC, not when you had the idea or filed. Check your stamped documents.

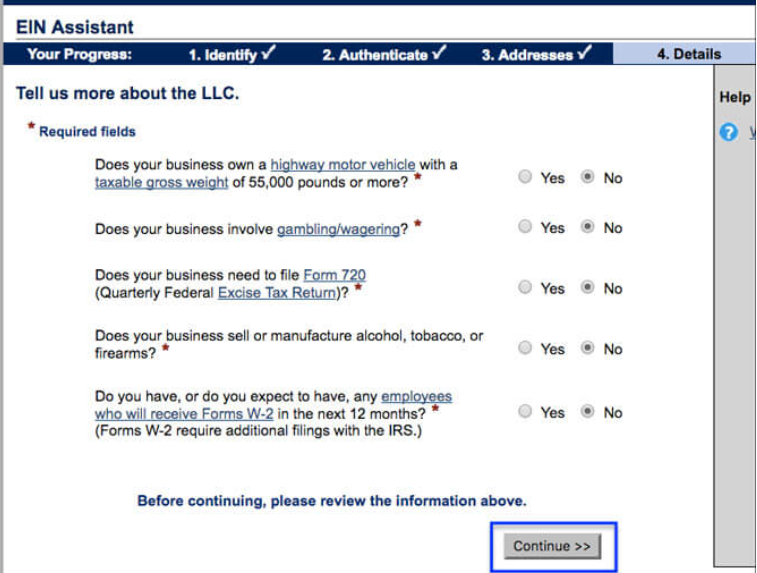

Step 6: The Weird Questions Nobody Expects

The IRS asks about specific business activities:

- Highway motor vehicle over 55,000 pounds? Unless you’re trucking, it’s no

- Gambling/wagering? Your fantasy football league doesn’t count

- Excise taxes? Usually no unless you’re in tobacco, alcohol, or firearms

- Employees in next 12 months? W-2 employees only, not 1099 contractors

Step 7: Business Activity

Pick from their dropdown or select “Other” and describe your business in 2-3 words. This isn’t legally binding—they just want to categorize you for statistics.

Step 8: Review and Submit

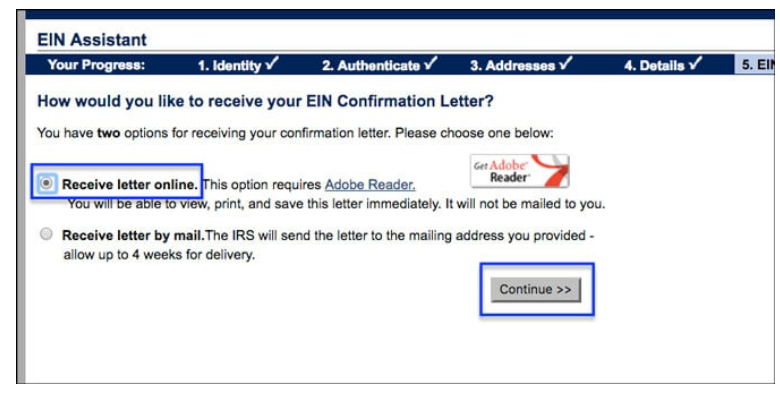

CRITICAL: Select “Receive letter online” for instant gratification.

Review everything. Submit.

If successful, you’ll see a confirmation page with your EIN.

IMMEDIATELY download and save your CP 575 letter. Save it in three places. Email it to yourself. Print it. This is your proof of EIN.

Common Error Messages and What They Actually Mean

Reference Number 101

The generic “we can’t process this” error. Usually means:

- Name conflict with another entity

- Technical glitch (try different browser)

- System timeout

Solution: Try again tomorrow or call IRS

Reference Number 109

“You already applied today” or system thinks you did.

Solution: Wait 24 hours

Reference Number 110

Your ITIN isn’t recognized in their system.

Solution: File Form SS-4 by fax instead

The “Oh Shit” Scenarios and How to Fix Them

“I Forgot to Add LLC to the Name”

Happens constantly. Two options:

- Quick fix: Cancel this EIN, apply for new one immediately

- Slow fix: Send letter to IRS requesting name correction (2-3 months)

I recommend option 1.

“I Said 1 Member But It’s Actually 2”

This matters for tax classification. File taxes correctly (as partnership) and the IRS will auto-correct their records. No forms needed.

“My LLC is Owned by Another LLC”

The system will show you as “SOLE MBR” even though you don’t personally own it. This is normal. The IRS hasn’t updated their system since 2018. File taxes correctly and ignore the letter’s designation.

“I Put My Old DBA in the Trade Name Field”

Unless the DBA is owned by the LLC (filed after LLC formation), this is wrong. Get a new EIN if it bothers you, or just ignore it—the IRS mostly will.

Post-EIN Reality Check

Your EIN is just the beginning. Here’s what’s next:

Immediate Actions:

- Download and save your CP 575 letter (did I mention this already?)

- The IRS will mail a duplicate in 4-5 weeks

- Open your business bank account

- Register for state taxes if needed

Common Misconceptions:

- You don’t need employees to get an EIN

- Single-member LLCs can have EINs

- Your EIN doesn’t expire

- You keep the same EIN even if you change your LLC name

- You DON’T get a new EIN if ownership changes

The Banking Bridge

With your EIN in hand, you’re ready for business banking. You’ll need:

- EIN Confirmation Letter (CP 575)

- State-approved LLC documents

- Operating Agreement (even if single-member)

- Personal ID

- Initial deposit

Pro tip: Call ahead. Some banks have weird additional requirements.

State Tax Registration (The Step Everyone Forgets)

Your EIN is federal. Most states want their own registration:

- Sales tax permit (if selling physical goods)

- Employer registration (if hiring)

- State income tax account (varies by state)

Each state is different. Budget an hour to figure out your requirements.

Special Situations Decoded

Husband-Wife LLCs in Community Property States

You get to choose:

- File as partnership (select 2 members)

- File as disregarded entity/qualified joint venture (select 1 member)

Most couples choose qualified joint venture to avoid partnership returns.

Converting from Sole Proprietorship

You’re starting fresh. Select “Started new business” not “Changed organization type.” Your LLC is a new entity, regardless of your business history.

Multiple LLCs

You can get multiple EINs, just not on the same day. The system limits one EIN per responsible party per day. Space them out.

The Professional Help Question

Can you do this yourself? Absolutely. The online system works well if you can follow instructions.

Should you hire someone? Only if:

- You’re billing $500+/hour and can’t spare 15 minutes

- You have complex foreign ownership

- You’ve failed multiple times

- You enjoy lighting money on fire

Services charging $200+ for EIN filing are earning $800/hour for data entry. Your call.

Your EIN Action Plan

Right Now:

- Confirm your LLC is state-approved

- Gather required documents

- Block 15 minutes during IRS hours

- Apply online at IRS.gov

After Approval:

- Save CP 575 letter everywhere

- Open business bank account

- Register for state taxes

- Update your records

This Month:

- Ensure all business accounts use EIN (not SSN)

- Set up proper bookkeeping

- Understand your tax obligations

- Consider tax elections if beneficial

The Bottom Line

Getting an EIN online is free and takes 15 minutes if you have an SSN/ITIN and follow the instructions. The IRS website looks like it’s from 1995, but it works.

Don’t overthink it. Don’t pay someone $200 to do it. Just follow the steps, enter information exactly as it appears on your state documents, and download your confirmation letter immediately.

Your EIN is your business’s Social Security number. Treat it with respect, but don’t be afraid of the process. It’s designed to be simple—the IRS wants to give you an EIN so you can pay taxes.

Questions about EINs or LLC formation? That’s what we’re here for at llciyo.com. We’ve guided over 1,200 entrepreneurs through the business formation maze, including 500+ through the EIN process.

Jake Lawson has been helping entrepreneurs navigate IRS requirements since 2010. When he’s not explaining why you can’t use hashtags in IRS forms, he’s probably telling someone they don’t need a new EIN just because they moved to Colorado.