By Jake Lawson, LLC Formation Strategist

Congratulations—you’ve formed your Indiana LLC! Now comes the next critical step that many entrepreneurs overlook: securing the proper business licenses and permits. After helping over 1,200 business owners navigate post-formation compliance across all 50 states, I can tell you that Indiana takes a refreshingly practical approach to business licensing.

The Hoosier State doesn’t burden you with a blanket business license requirement, but they do maintain specific industry and location-based requirements that can make or break your business launch. Miss these, and you could face fines, shutdowns, or worse—losing customers who discover you’re operating without proper authorization.

Prefer a done-for-you approach? MyCompanyWorks offers LLC name change filing services for $119 plus state fees.

Why Indiana Business Licensing Matters More Than You Think

Here’s what most entrepreneurs don’t realize: your LLC formation is just the legal foundation. Business licenses are what give you permission to actually operate:

- Legal protection – Operating without required licenses exposes you to penalties and shutdowns

- Customer confidence – Proper licensing builds trust and credibility

- Market access – Many customers and suppliers require proof of licensing

- Insurance requirements – Most business insurance policies require proper licensing

- Growth enablement – Licenses often become requirements for scaling operations

The good news? Indiana’s approach is more business-friendly than many states, but that doesn’t mean you can skip the research.

Understanding Indiana’s Three-Tier Licensing System

Indiana operates a logical, three-level licensing structure that most entrepreneurs can navigate successfully:

Level 1: State Requirements

- No general business license (huge relief for most businesses)

- Industry-specific occupational licenses (only if your business requires them)

- Professional licensing (for regulated professions)

Level 2: Local Requirements

- Municipal business licenses (city, county, township level)

- Zoning permits (if applicable to your location/business type)

- Industry-specific local permits (restaurants, daycares, etc.)

Level 3: Federal Requirements

- Industry-specific federal licenses (limited to certain sectors)

- EIN number (required for all LLCs)

- Tax compliance (standard for all businesses)

The Indiana Advantage: No General Business License

Unlike states that hit every business with a blanket licensing fee, Indiana doesn’t require a general state business license. This means:

What you DON’T need: A general “permission to do business” license from the state

What you might need: Specific licenses based on your industry or location

Bottom line: Many Indiana LLCs operate legally without any state-level business licenses

This business-friendly approach saves entrepreneurs both time and money, but don’t let it make you complacent about research.

State-Level Occupational Licenses: Industry-Specific Requirements

Indiana requires occupational licenses for specific industries that impact public safety, health, or welfare. Here’s how to determine if you need one:

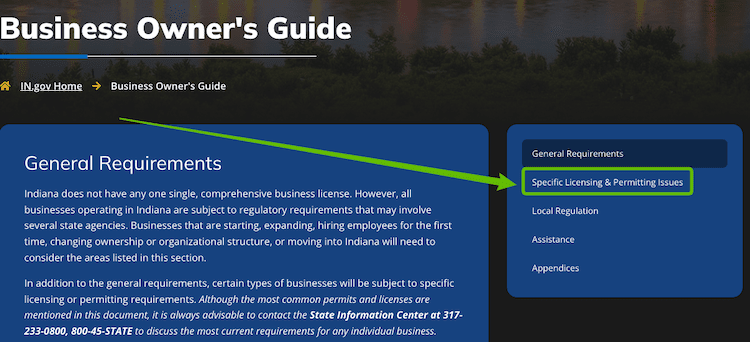

Step 1: Check the Business Owner’s Guide

Indiana provides a comprehensive Business Owner’s Guide that covers licensing requirements by industry.

Navigate to: “Specific Licensing & Permitting Issues”

Look for: Your business type or industry

Find: Contact information for relevant licensing agencies

Step 2: Review Professional Licensing Agency Requirements

The Indiana Professional Licensing Agency (PLA) regulates numerous professions. Check their List of Professions to see if your business requires PLA licensing.

Common PLA-regulated businesses include:

- Healthcare providers

- Real estate professionals

- Contractors and tradespeople

- Financial services providers

- Beauty and wellness services

Step 3: Contact Indiana’s Information Center

When in doubt, call Indiana’s state information center at 317-233-0800. They can provide current guidance on licensing requirements for your specific business type.

Municipal Licensing: Local Rules That Matter

This is where many entrepreneurs get tripped up. Even if Indiana doesn’t require a state license, your local municipality might have its own requirements.

Types of Municipal Licenses

General municipal licenses:

- Some cities/counties require all businesses to obtain a basic business license

- Usually involves a simple application and modest fee

- Provides local tax registration and basic compliance tracking

Industry-specific municipal licenses:

- Restaurants and food services

- Childcare facilities

- Home-based businesses

- Retail establishments

- Service businesses with public interaction

How to Research Municipal Requirements

Step 1: Identify your municipality (city, township, county)

Step 2: Contact your County Recorder’s office

Step 3: Ask specifically about business licensing requirements for your business type

Step 4: Inquire about zoning compliance (especially important for home-based businesses)

Pro tip: Don’t assume neighboring municipalities have the same rules—requirements vary significantly across Indiana’s 92 counties.

Indiana Sales Tax License: The Revenue Requirement

If you sell products in Indiana, you’ll likely need a Sales Tax License (officially called a Retail Merchant Certificate).

When You Need Sales Tax Registration

Product sales to consumers:

- Physical products sold in Indiana

- Digital products (in many cases)

- Online sales to Indiana customers

- Services that include tangible products

When you DON’T need it:

- Pure service businesses (consulting, legal, etc.)

- B2B sales of services

- Exempt organizations

How to Register

Use Indiana’s Register a New Business guide through the Department of Revenue.

What you’ll need:

- Your LLC information

- EIN number

- Business description

- Expected sales volume

Important: Indiana’s remote seller rules mean online businesses selling to Indiana customers may need registration even if located out-of-state.

Federal Licensing: Limited but Critical

Most Indiana businesses don’t need federal licenses, but certain industries have strict federal requirements:

Industries Requiring Federal Licenses

Transportation & Logistics:

- Interstate trucking

- Aviation services

- Maritime shipping

Communications:

- Radio/TV broadcasting

- Telecommunications

Financial Services:

- Banking

- Investment services

- Insurance

Regulated Products:

- Alcohol production/distribution

- Firearms

- Pharmaceuticals

Agriculture & Food:

- Meat processing

- Interstate food sales

- Organic certification

Federal Requirements for All Businesses

EIN Number: Required for all LLCs (even single-member)

Tax Compliance: Federal income tax, employment taxes (if applicable)

Industry-Specific Regulations: OSHA, EPA, etc. (based on your business activities)

Common Indiana Business License Mistakes to Avoid

After working with hundreds of Indiana entrepreneurs, here are the mistakes I see most often:

Mistake 1: Assuming No License Means No Research

Just because Indiana doesn’t require a general business license doesn’t mean you’re exempt from all licensing. Always research your specific situation.

Mistake 2: Ignoring Municipal Requirements

State-level research isn’t enough. Local requirements can be just as important and are often overlooked.

Mistake 3: Mixing Up Business Formation and Licensing

Your LLC formation creates your business entity. Licenses give you permission to operate. They’re separate requirements.

Mistake 4: Delaying License Applications

Some licenses take weeks or months to process. Apply early in your business launch process.

Mistake 5: Forgetting Renewal Requirements

Most licenses require periodic renewal. Set up systems to track renewal dates.

Strategic Approach to Indiana Business Licensing

Here’s my recommended systematic approach:

Phase 1: Industry Analysis (Week 1)

- Research your industry’s specific requirements

- Check both state and federal licensing databases

- Identify all applicable regulatory agencies

- Create a comprehensive requirements checklist

Phase 2: Location Research (Week 2)

- Contact your municipal government

- Verify zoning compliance

- Research local business license requirements

- Understand any location-specific restrictions

Phase 3: Application Process (Weeks 3-4)

- Gather all required documentation

- Submit applications in logical order (some licenses depend on others)

- Track application status and follow up as needed

- Prepare for inspections or additional requirements

Phase 4: Ongoing Compliance (Ongoing)

- Set up renewal reminders

- Monitor regulatory changes in your industry

- Maintain required documentation

- Update licenses when your business changes

When to Get Professional Help

Consider hiring licensing professionals when:

Your business is complex: Multiple locations, diverse services, regulated industry

Time is critical: You need to launch quickly and can’t afford mistakes

Regulations are unclear: Conflicting information or complex requirements

Stakes are high: Heavy penalties for non-compliance in your industry

Professional services I recommend:

- Industry-specific attorneys for complex regulatory environments

- Local business consultants for municipal licensing

- Specialized services for multi-state operations

Indiana’s Business-Friendly Licensing Environment

Indiana’s approach reflects their commitment to supporting business growth:

Advantages:

- No general business license requirement

- Clear, accessible information resources

- Helpful state information center

- Reasonable fee structures

- Streamlined online processes

Considerations:

- Municipal requirements vary significantly

- Some industries have complex regulatory frameworks

- Professional licensing requirements are comprehensive

- Federal requirements still apply for regulated industries

Cost Expectations for Indiana Business Licenses

State-level costs:

- General business license: $0 (not required)

- Occupational licenses: Varies by industry ($50-$500+ typical range)

- Professional licenses: Varies by profession ($100-$1,000+ typical range)

Municipal costs:

- General business license: $25-$200 (varies by municipality)

- Industry-specific permits: $50-$500+ (depending on business type)

- Zoning permits: $50-$300 (if required)

Federal costs:

- Most businesses: $0 (beyond standard EIN and tax requirements)

- Regulated industries: $500-$5,000+ (highly variable)

Remember: Many businesses need no licenses beyond basic tax registration, so your total cost could be $0.

Tip: Want to simplify sales tax? Consider using TaxJar. They can handle registration, collection, and filing for you.

Ready to Launch Your Indiana Business Compliantly?

Indiana’s business-friendly licensing environment makes it easier to operate legally, but proper research and planning are still essential. The key is taking a systematic approach that covers all three levels of potential requirements.

Need professional guidance? I’ve helped hundreds of Midwest entrepreneurs navigate post-formation compliance, from simple service businesses to complex regulated industries. My team understands both Indiana’s specific advantages and the critical requirements that can’t be overlooked.

[Get expert Indiana business licensing guidance →]

Don’t let licensing oversights derail your business launch. With proper research, strategic planning, and professional guidance when needed, you can ensure your Indiana LLC operates with full legal authorization from day one.

Jake Lawson has guided over 1,200 entrepreneurs through successful business formation and compliance across all 50 states, with extensive experience in Indiana’s business-friendly regulatory environment. His systematic approach ensures businesses launch with proper licensing while avoiding unnecessary complexity and costs. Connect with Jake and the llciyo.com team for personalized Indiana business compliance guidance.