Jake Lawson here. In my 15+ years helping entrepreneurs navigate business formation, I get asked about C-Corp taxation for LLCs regularly. Here’s my straight answer: unless you’re raising serious capital or going public, this election probably isn’t for you.

Before you start thinking about electing C-Corporation taxation for your LLC, let me save you some time and money. This tax election is one of the most misunderstood options available to LLC owners, and frankly, most small businesses get it wrong.

The bottom line upfront: C-Corp taxation creates double taxation and complexity that benefits very few small businesses. There are exceptions, but they’re rare.

What Does “LLC Taxed as C-Corp” Actually Mean?

When you form an LLC, the IRS doesn’t recognize it as a separate tax entity. Instead, they default to:

- Single-member LLCs: Taxed as sole proprietorships

- Multi-member LLCs: Taxed as partnerships

But you can elect to have your LLC taxed like a corporation using Form 8832. There are two corporate tax options:

- C-Corporation taxation (what we’re discussing here)

- S-Corporation taxation (much more popular for small businesses)

Key point: You’re not changing your LLC structure—just how the IRS taxes your profits.

The Double Taxation Problem (And Why It Usually Kills the Deal)

Here’s the brutal math of C-Corp taxation:

Step 1: Your LLC pays corporate income tax (21% federal rate) on profits

Step 2: When you take money out, you pay individual taxes again

Example scenario:

- LLC profit: $100,000

- Corporate tax (21%): $21,000

- Remaining: $79,000

- You take $79,000 as dividends

- Individual tax on dividends (let’s say 24%): $18,960

- Total taxes: $39,960 (39.96% effective rate)

Compare to LLC default taxation:

- Same $100,000 profit

- Pass-through to your personal return

- Tax rate depends on your bracket, but no double taxation

Reality check: Most small businesses lose money with C-Corp taxation.

The Disadvantages That Kill Most Small Businesses

1. Accumulated Earnings Tax (The $250,000 Trap)

If your LLC accumulates more than $250,000 in the bank account, the IRS hits you with a 20% penalty tax. Their logic: you’re hoarding money to avoid double taxation.

Exception: You can avoid this if you have documented business reasons for accumulating cash (expansion plans, equipment purchases, etc.).

2. Personal Service Corporation Penalties

If your LLC provides professional services (accounting, consulting, engineering, healthcare, law, etc.) and you own 95%+ of the business, your accumulation limit drops to $150,000.

Translation: Professional service LLCs get penalized even harder.

3. Personal Holding Company Tax

If 60%+ of your income comes from passive sources (rent, royalties, interest), you face another 20% penalty tax if you don’t distribute earnings.

The IRS logic: Corporations should run businesses, not shelter passive income.

4. No Personal Loss Deductions

Unlike default LLC taxation where business losses offset your personal income, C-Corp losses only offset corporate income. You can’t use LLC losses to reduce your personal tax bill.

5. Capital Gains Tax Issues

Corporate capital gains are taxed at the full 21% corporate rate, while personal capital gains get preferential rates for assets held over a year.

6. Conversion Back Is Expensive

If you change your mind and want to revert to default LLC taxation, the IRS treats this like liquidating the corporation.

Result: Immediate tax consequences that can be substantial.

The Rare Advantages (When C-Corp Taxation Makes Sense)

1. Fundraising and Going Public

Who this helps: LLCs planning to raise venture capital or go public

Why it matters: Investors prefer corporate structures and unlimited ownership possibilities

2. Healthcare Benefits

The advantage: Health insurance premiums and medical benefits are fully deductible for the corporation

check: This benefit exists for S-Corp taxation too, with less complexity

3. Unlimited Owners

Who needs this: Businesses planning for hundreds or thousands of owners

Small business reality: Most LLCs never approach ownership limits

4. Qualified Small Business Stock (QSBS)

Potential benefit: Up to $10 million in capital gains tax exemption under Section 1202

The catch: Complex requirements and long holding periods

5. Fringe Benefits

What’s included: Disability insurance, life insurance, education assistance, company cars

The reality: Most small businesses don’t have enough employees to make this worthwhile

Who Should Actually Consider C-Corp Taxation

Good candidates:

- LLCs planning to raise venture capital

- Businesses going public within 2-3 years

- Companies with substantial employee healthcare costs

- Businesses accumulating significant cash for major expansion

Poor candidates:

- Most service businesses

- Small retail operations

- Professional services (due to lower accumulation limits)

- Any business where owners want to extract profits regularly

What Most Smart LLC Owners Do Instead

Year 1-3: Keep default LLC taxation (sole proprietorship or partnership)

Year 4+: Consider S-Corporation taxation if net income exceeds $60,000+

Why S-Corp usually wins over C-Corp:

- Pass-through taxation (no double taxation)

- Self-employment tax savings

- Much simpler compliance

- Easier to revert if needed

How to Elect C-Corp Taxation (If You’re Still Determined)

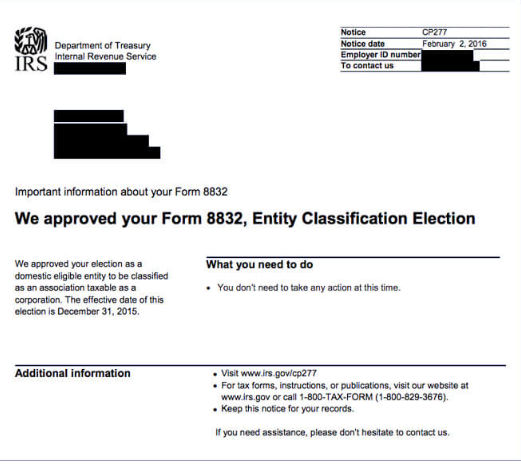

File Form 8832 with the IRS

Key information needed:

- LLC name and EIN

- Effective date of election

- Owner information

- Reason for election

Timeline: 6-8 weeks for IRS approval

Cost: No filing fee, but significant ongoing compliance costs

Critical timing: You can elect at any time, but consider the effective date carefully with your accountant.

The Ongoing Compliance Reality

If you elect C-Corp taxation, expect:

- Form 1120 corporate tax returns

- Quarterly estimated tax payments

- More complex bookkeeping

- Potential state corporate taxes

- Payroll requirements if you take salary

Annual cost increase: $2,000-$5,000+ in additional accounting and compliance fees

State Tax Considerations

The complication: 40+ states have corporate income taxes

The opportunity: Some states (Alabama, Iowa, Louisiana, Missouri) allow deductions for federal corporate taxes

My advice: Factor state taxes into your analysis. Some states make C-Corp taxation even less attractive.

Jake’s Honest Assessment

After helping over 1,200 entrepreneurs with business formation and tax strategy, I can count on two hands the number of small LLCs that benefited from C-Corp taxation.

The pattern I see:

- Entrepreneurs get excited about “corporate benefits”

- They elect C-Corp taxation without understanding the costs

- First tax season, they realize their mistake

- Reverting costs thousands in taxes and professional fees

My recommendation: Unless you’re raising institutional capital or going public, stick with default LLC taxation or consider S-Corp election when your income justifies it.

Better Alternatives for Most LLCs

Option 1: Default Taxation

Best for: New businesses, service providers, most small operations

Benefits: Simple, pass-through taxation, full loss deductions

Option 2: S-Corp Election

Best for: Profitable LLCs with $60,000+ net income

Benefits: Self-employment tax savings, still pass-through taxation

Option 3: Separate Corporate Entity

Best for: Businesses needing corporate benefits

Why consider: Actual corporations get better investor acceptance than LLCs electing corporate taxation

The Bottom Line on LLC C-Corp Taxation

C-Corporation taxation for LLCs is a specialized tool that benefits very few small businesses. The double taxation alone kills most of the potential advantages.

Before electing C-Corp taxation, ask yourself:

- Am I raising institutional capital within 2 years?

- Do I plan to go public?

- Am I accumulating significant cash for major business purposes?

- Can I justify the additional compliance costs?

If you answered “no” to most of these questions, C-Corp taxation probably isn’t right for you.

Ready to explore your LLC tax options? Check out our comprehensive guide to LLC taxation. We break down all the elections available and help you choose the strategy that actually saves money for your specific situation—because the right tax strategy can save thousands annually.

Questions about LLC taxation or business formation strategy? I’ve guided over 1,000 entrepreneurs through these exact decisions. Contact me—I’m here to help you avoid the tax elections that sound good in theory but cost real money in practice.