By Jake Lawson | Last Updated: August 2025

Here’s something that’ll make you love Michigan: They charge just $50 to form an LLC, and veterans pay nothing. Zero. Zilch. That’s cheaper than a tank of gas for your F-150. I’ve helped over 250 entrepreneurs launch Michigan LLCs—from tech startups in Ann Arbor to manufacturing revivals in Detroit—and I can tell you this: Michigan keeps it simple, affordable, and refreshingly straightforward.

But here’s the plot twist: Despite having one of the cheapest filing fees in America, Michigan’s online system (COFS—Corporation Online Filing System) feels like it was designed by someone who still misses dial-up internet. Today, I’m walking you through both online and mail filing options, so you can pick your poison and get your LLC formed without wanting to throw your computer into Lake Michigan.

The $50 Deal: What You’re Actually Getting

Everyone gets excited about that $50 filing fee—tied for second-cheapest nationally. But let’s talk total investment before you blow your savings on Coney dogs:

First-year costs:

- Articles of Organization: $50 (veterans: FREE)

- Registered Agent: $50-150/year (unless you’re Michigan-based)

- Annual Statement: $25 (due every year)

- Business licenses: Varies by city (Detroit’s different from Traverse City)

Total realistic investment: Around $125 for most businesses. Compare that to neighboring Illinois at $500 just to form, and Michigan looks like the promised land of affordable business formation.

Payment methods:

- Online: Credit or debit card only

- Mail: Check or money order to “The State of Michigan”

No cash, no Bitcoin, no bartering with Vernors and Better Made chips.

Online vs. Mail: The Great Lakes Showdown

Michigan offers two filing methods with identical fees and nearly identical processing times. Here’s the breakdown:

Online (COFS):

- 10 business days processing

- $50 fee

- Instant confirmation

- Get your CID and PIN immediately

- Browser from 2005 aesthetic

Mail:

- 10 business days plus mail time

- $50 fee

- Paper trail for the paranoid

- Perfect if computers hate you

- No dealing with COFS quirks

Unlike most states where online is clearly superior, Michigan’s a toss-up. COFS works, but it’s about as user-friendly as parallel parking in downtown Detroit during a Red Wings game.

Before You File: The Prep Work That Matters

Stop. Put down that form. Get these pieces locked down first:

1. Name Your Empire

Michigan’s pretty reasonable about names, but they have standards:

Requirements:

- Must be distinguishable from existing entities

- Needs an approved suffix (LLC, L.L.C., LC, L.C., Limited Liability Company)

- Can’t pretend you’re a bank, insurance company, or university

- Can include “Motor City” (but should you?)

Jake’s advice: Stick with “LLC” as your suffix. I’ve never seen anyone benefit from “Limited Liability Company” except printers charging by the letter. And please, no more businesses with “Mitten” in the name—we get it, Michigan looks like a mitten.

2. Registered Agent Requirements

You need a Michigan address staffed during business hours. Your options:

Be your own agent (if you’re Michigan-based):

- Free

- Your address goes public

- Must be available 8-5 weekdays

- Hope you never move

Commercial service (what I recommend):

- $50-150/year

- Professional document handling

- Maintains your privacy

- Can operate from anywhere

I’ve seen too many DIY agents miss critical documents because they were up north at the cabin. That $50/year for a commercial agent is cheap insurance against default judgments.

3. The Duration Decision

Michigan asks how long you want your LLC to exist. Your choices:

Perpetual (recommended):

- Continues forever until you dissolve it

- Maximum flexibility

- What 99% of businesses choose

Specific end date:

- LLC automatically dissolves on that date

- Only makes sense for project-specific LLCs

- Why create your own expiration date?

4. Management Structure

Michigan defaults to member-managed unless you specify otherwise:

Member-managed (default):

- All owners manage the business

- Simple, straightforward

- Perfect for most small businesses

Manager-managed:

- Must specify in Articles

- Designated managers run things

- Good for passive investors

Not sure? Stick with member-managed. You can always amend later.

Filing Online: Navigating COFS Without Losing Your Mind

If you’re brave enough for online filing, here’s your survival guide:

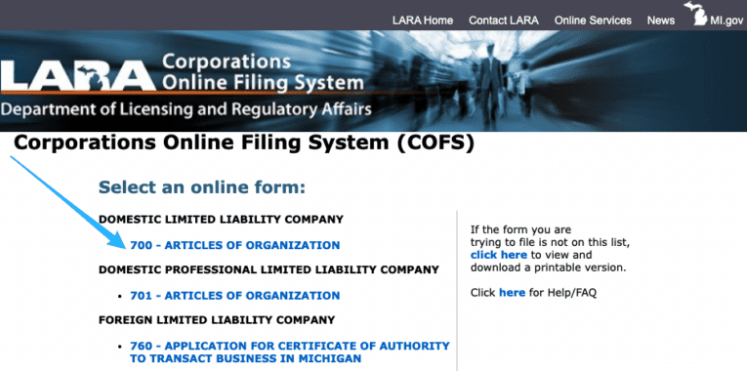

Step 1: Access COFS

Navigate to Michigan’s Corporation Online Filing System. Don’t expect modern web design—this thing looks like it time-traveled from 2005 and decided to stay.

Find “Domestic Limited Liability Company” and click “Form 700 – Articles of Organization.”

Step 2: Article I – Name

Enter your LLC name exactly as you want it everywhere. Include your chosen suffix. Double-check spelling—amendments cost money.

Step 3: Article II – Purpose

Michigan asks about your LLC’s purpose. You have two options:

Leave it blank (recommended):

- Gives you “all purpose clause”

- LLC can do any legal business

- Maximum flexibility

List specific purpose:

- Only required for Professional LLCs

- Limits what your LLC can do

- Usually unnecessary

Step 4: Article III – Duration

Leave blank for perpetual duration (recommended) or enter a specific end date if you’re forming a temporary LLC for some reason.

Step 5: Article IV – Registered Agent

Enter your registered agent’s:

- Full name (person or company)

- Michigan street address (no PO boxes)

- Mailing address if different

If using a commercial service, get their exact information—one typo causes rejections.

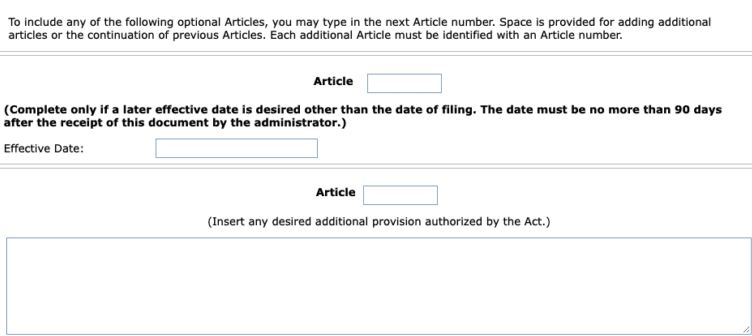

Step 6: Optional Articles

Effective Date (Article V): Want to delay when your LLC starts? Enter a future date (within 90 days). Useful if forming in December but want January 1st start for tax simplicity. Otherwise, leave blank.

Management Structure (Article V or VI): Only fill this if you want manager-managed. Enter: “This LLC shall be managed by 1 or more Managers, as provided by the Operating Agreement.“

Step 7: Organizer Signature

The organizer files the documents. Usually you, could be your attorney, could be your helpful accountant. Click “Add new entry,” enter their name, select “Organizer” from dropdown.

“Tip: Make sure your LLC Organizer(s) completes and signs the LLC Statement of Organizer.”

Step 8: Submitter Information

This is who Michigan contacts with questions:

- Your name (not LLC name)

- Mailing address (can be anywhere)

- Phone and email

- Choose email for statutory notices

This information stays private—doesn’t go public.

Step 9: Review and Pay

Review everything twice. COFS doesn’t let you fix typos for free. Pay your $50 (or $100 with expedited service) and submit.

Warning: Don’t use your browser’s back button. Ever. It clears everything. Use COFS navigation buttons only, or prepare to start over while questioning your life choices.

Mail Filing: The Analog Alternative

Prefer paper? Here’s your process:

Step 1: Get the Form

Download Form CD-700 from Michigan’s website. Print it clearly—they reject illegible forms.

Step 2: Complete the Form

Fill out the same information as online:

- Article I: LLC name with suffix

- Article II: Leave blank for general purpose

- Article III: Leave blank for perpetual duration

- Article IV: Registered agent info

- Optional articles if needed

- Organizer signature

Step 3: Prepare Payment

Write a check or money order for $50 to “The State of Michigan.” Put your LLC name on the memo line—helps prevent mix-ups.

Step 4: Mail Everything

Send to:

Michigan Corporations Division

PO Box 30054

Lansing, MI 48909-7554

Use certified mail if paranoid (smart). Regular mail if optimistic (risky).

The Veteran Advantage: Free LLC Formation

If you’re a veteran, Michigan waives the $50 fee entirely. You’ll need:

- DD-214 or other discharge papers

- Complete the standard Articles

- Include veteran documentation

- Mail filing usually easier for this

This isn’t a discount—it’s completely free. Michigan actually appreciates your service.

After Filing: The 10-Day Wait

Both online and mail filings take 10 business days. No real expedited option except paying $50 extra for 24-hour processing online (rarely worth it).

You’ll receive:

- Filing Endorsement

- Stamped Articles of Organization

- CID (Customer ID) and PIN for annual filings

Critical: Save that CID and PIN. You need them every year for your Annual Statement. Lose them and you’re calling Michigan for recovery—not fun.

Common Mistakes That’ll Delay Your Filing

After 250+ Michigan filings, here are the classics:

- Using browser back button in COFS: Clears everything, causes tears

- Wrong registered agent address: Must be Michigan street address

- Forgetting to specify manager-managed: Defaults to member-managed

- Listing business purpose unnecessarily: Limits flexibility

- Missing organizer signature: Incomplete forms get rejected

- Using old forms: Michigan updates periodically

Post-Approval: Your Michigan LLC Action Plan

Immediate Tasks:

- Get your EIN

- Free from IRS.gov

- Takes 10 minutes

- Don’t pay anyone for this

- Open business bank account

- Bring stamped Articles and EIN

- Local credit unions often best for small business

- Keep business and personal separate

- Draft Operating Agreement

- Not filed with state but legally smart

- Defines ownership and operations

- Critical for multi-member LLCs

Annual Obligations:

- Annual Statement: $25, due by February 15th (or April 15th after first year)

- Registered Agent: Keep current or face dissolution

- Local licenses: Check city requirements

Michigan Business Climate: The Reality Check

After years forming Michigan LLCs, here’s my honest assessment:

The Good:

- Second-cheapest filing fee nationally

- Veteran-friendly (free formation!)

- No publication requirements

- Reasonable annual fees

- Strong manufacturing and tech incentives

The Challenging:

- COFS system needs modernization

- Some cities have complex licensing

- Weather affects everything (seriously)

- Property taxes vary wildly by location

The Verdict: If you’re doing business in Michigan or the Great Lakes region, it’s a solid choice. Low costs, reasonable regulations, and surprising tech growth in certain cities.

When to Hire a Pro

Sometimes saving $50-100 isn’t worth the hassle:

- Multiple members with complex ownership

- Need help with Operating Agreement

- Value time over money

- Confused by COFS

- Want someone to blame if things go wrong

Northwest Registered Agent charges $39 plus the $50 state fee. For $89 total, they handle everything and include a year of registered agent service. That’s less than a decent dinner in Birmingham.

Michigan LARA: Your Point of Contact

When you need help:

Phone: 517-241-6470

Hours: Monday-Friday, 8:00 AM – 5:00 PM Eastern

Online: michigan.gov/lara

Pro tips:

- Call mid-week, mid-afternoon

- Have your entity ID ready

- Be patient—they’re helpful but busy

- Email rarely works—stick to phone

Real Talk: Is Michigan Right for Your LLC?

Here’s my assessment after 250+ Michigan LLCs:

Form in Michigan if:

- You live there

- You’re doing business primarily in Michigan

- You’re a veteran (free formation!)

- You want low ongoing costs

- You’re in manufacturing or automotive

Consider elsewhere if:

- You need maximum privacy (Wyoming)

- You’re raising venture capital (Delaware)

- You have no Michigan connection

- You hate winter (seriously, it matters)

The Bottom Line: Just Get It Filed

Michigan makes LLC formation affordable and straightforward, even if their online system needs a refresh. Whether you brave COFS or go old-school mail, you’re looking at 10 days and $50 (or free for veterans) to protect your personal assets.

Three options:

- File online: Deal with COFS, get it done

- File by mail: Avoid COFS, same timeline

- Hire help: $89 total with Northwest, skip the hassle

Whatever you choose, just choose. Every day without an LLC is another day your personal assets are exposed. And in the land of “Michigan left turns” and lake effect snow, you need all the protection you can get.

Ready to Form Your Michigan LLC?

Done reading? Good. Either download Form CD-700 and mail it in, brave the COFS system, or let Northwest handle it for less than you’ll spend on gas driving to Lansing.

Veterans—seriously, take advantage of that free formation. It’s the least Michigan can do for your service.

Either way, stop procrastinating. Your future protected self will thank you when that first liability issue pops up and your personal assets are safely separate.

Jake Lawson has helped over 1,200 entrepreneurs form LLCs across all 50 states, including 250+ in Michigan. He’s navigated COFS crashes, helped veterans file for free, and learned that “Michigan nice” is real but COFS user-friendliness is not. Get more practical business formation advice at llciyo.com.