By Jake Lawson, LLC Formation Expert

Just launched your Minnesota LLC? Fantastic choice—you’ve established your business in the Land of 10,000 Lakes, one of the most innovative and business-supportive states in the Upper Midwest. But here’s what every Minnesota entrepreneur needs to understand: getting your EIN (Employer Identification Number) is your next critical step, and it’s far simpler than most people realize.

After helping dozens of Minnesota business owners from Minneapolis to Duluth navigate the EIN process, I can tell you this: the IRS makes it straightforward and completely free, but there are Minnesota-specific considerations that can catch North Star State businesses off guard. Let me walk you through everything you need to know.

What Is an EIN and Why Your Minnesota LLC Must Have One

Think of an EIN as your business’s Social Security Number for the federal government. It’s a unique 9-digit identifier (formatted XX-XXXXXXX) that distinguishes your LLC from millions of other business entities nationwide.

Don’t be confused by “Employer” in the name—you don’t need employees to get an EIN.

Your Minnesota LLC Needs an EIN to:

- Open business bank accounts (absolutely required by all financial institutions)

- File federal tax returns and Minnesota state tax returns

- Apply for business credit cards and commercial financing

- Obtain Minnesota business licenses and local permits

- Register for Minnesota sales tax with the Department of Revenue

- Set up payroll systems when hiring employees

- Establish business credit separate from your personal credit

- Protect your personal Social Security Number from business exposure

Jake’s reality check: I’ve seen Minnesota entrepreneurs try to operate using only their SSN, especially in Greater Minnesota outside the Twin Cities. This creates tax complications, limits banking options, and exposes you to identity theft—a particular concern in Minnesota’s tech-savvy business environment.

Minnesota EIN vs Minnesota Tax ID: Know the Difference

This distinction confuses many new Minnesota business owners:

Federal EIN (what we’re covering here):

- Issued by the IRS for federal tax identification

- Used nationwide for business identification

- Required for banking and federal compliance

- Always free directly from the government

Minnesota State Tax ID:

- Issued by Minnesota Department of Revenue

- Required for Minnesota state taxes and business registrations

- Separate application process from federal EIN

- Different numbering system from your EIN

You’ll need both for complete Minnesota business compliance. They serve different purposes and come from different government agencies.

The Great News: EINs Are Always Free

Absolute fact: The IRS never charges for EINs. Period. It’s a free government service, like getting a fishing license.

Major scam warning: Ignore any website charging $50-$500 for “EIN processing services” or “expedited filing.” These are predatory companies selling you something the government provides free. I’ve seen Minnesota business owners pay $400 for a 15-minute process that costs nothing.

Red flags to avoid:

- Websites designed to mimic IRS.gov but aren’t official

- “Guaranteed instant approval” promises (most applications are approved automatically)

- Rush processing fees (online applications provide instant results)

- Upfront payment requirements before services

- Cold calls claiming “EIN renewal” is required (EINs don’t expire)

Perfect Timing for Your Minnesota EIN Application

Critical rule: Wait until your Minnesota LLC is officially approved by the Minnesota Secretary of State before applying for your EIN.

Why timing matters:

- IRS requires your exact LLC name as approved by Minnesota

- Premature applications create complications if your name gets modified during state approval

- Name mismatches trigger IRS reviews and potential processing delays

- Minnesota processing times can vary by filing volume and seasonal factors

My recommended timeline:

- File your Minnesota Articles of Organization with the Secretary of State

- Wait for official approval confirmation (typically 5-10 business days)

- Apply for EIN using the exact approved LLC name

- Begin Minnesota state tax registrations and business banking immediately

What if you applied too early? Don’t panic. If your LLC gets approved with the identical name you used on your EIN application, you’re fine. Name changed? You’ll need to apply for a new EIN.

Step-by-Step EIN Application Process

For US Citizens and Residents (SSN/ITIN Holders):

Apply online at IRS.gov—it’s the fastest, most reliable method available.

Essential Information to Gather:

- Your Minnesota LLC approval documents

- Social Security Number or Individual Taxpayer Identification Number

- LLC formation date and state (Minnesota)

- Principal business address (anywhere in Minnesota)

- Responsible party information (typically you as the LLC owner)

- Clear description of your business activities

- Expected number of employees (zero is perfectly acceptable)

The Online Application Process (15-20 minutes):

Step 1: Navigate to IRS.gov and search “Apply for EIN Online”

Step 2: Select “Limited Liability Company (LLC)” as your entity type

Step 3: Enter LLC information exactly as shown on Minnesota documents

Step 4: Provide responsible party details (person authorized to receive tax information)

Step 5: Answer business activity questions accurately but concisely

Step 6: Review all information meticulously and submit application

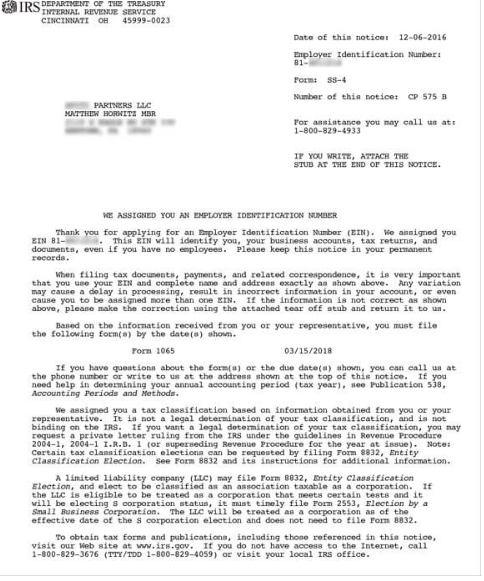

Instant results: You’ll receive your EIN immediately upon approval and can download your official EIN Confirmation Letter (CP 575) right away.

For Non-US Residents (No SSN/ITIN):

You must apply by mail or fax using Form SS-4.

Required Documentation:

- Completed Form SS-4 (Application for Employer Identification Number)

- Copy of your Minnesota LLC approval documents

- Copy of passport or government-issued photo identification

- Valid US mailing address for IRS correspondence

- Cover letter explaining your non-resident status and business purpose

Processing Timeline:

- Mail application: 4-6 weeks typical processing time

- Fax application: 4-5 business days to (855) 641-6935

- Central Time Zone: Minnesota businesses benefit from convenient IRS processing hours

Jake’s tip for international entrepreneurs: Consider obtaining an ITIN first, which enables online EIN applications. While it adds a preliminary step, it dramatically speeds up your overall business setup process.

Common Minnesota LLC EIN Mistakes

Mistake 1: Wrong Entity Type Selection

The error: Selecting “Corporation” instead of “Limited Liability Company”

The consequence: IRS processing delays and incorrect federal tax classification

The prevention: Always carefully select “Limited Liability Company” for all LLC applications

Mistake 2: Using Trade Names Instead of Legal Names

The error: Applying with your DBA or trade name rather than registered LLC name

The consequence: EIN gets associated with incorrect entity

The solution: Use exactly the name appearing on your Minnesota Articles of Organization

Mistake 3: Rushing the Application Process

The error: Applying before Minnesota Secretary of State officially approves your LLC

The consequence: Name discrepancies and potential compliance complications

The fix: Practice patience—wait for official Minnesota approval confirmation

Mistake 4: Incorrect Responsible Party Information

The error: Listing someone without legal authority to bind the LLC

The consequence: Future IRS compliance and communication problems

The correction: List an LLC member or manager with actual legal authority

Single-Member vs Multi-Member Minnesota LLCs

Single-Member LLCs:

Federal tax treatment: Disregarded entity (taxed like sole proprietorship)

EIN requirement: Technically optional, but practically essential

Key benefits: Banking access, identity protection, business credibility

Minnesota specifics: Still subject to Minnesota business registration requirements

Multi-Member LLCs:

Federal tax treatment: Partnership taxation (unless you elect corporate treatment)

EIN requirement: Absolutely mandatory per federal tax regulations

Tax obligations: Must file Form 1065 partnership return annually

Minnesota requirements: Additional state partnership tax filings required

Married Couples in Minnesota:

Important clarification: Minnesota is NOT a community property state, so married couples have limited options:

- Standard approach: Multi-member LLC with partnership taxation

- Not available: Qualified Joint Venture election (reserved for community property states)

Professional guidance: Consult with a Minnesota tax professional about the most advantageous structure for your specific business situation and Minnesota’s tax landscape.

Your EIN Confirmation Letter: Guard It Carefully

After approval, you’ll receive an EIN Confirmation Letter (CP 575)—one of your most critical business documents.

Absolutely Essential For:

- Opening all business bank accounts in Minnesota

- Applying for business credit cards and commercial loans

- Filing federal and Minnesota state tax returns

- Obtaining Minnesota business licenses and local permits

- Registering for Minnesota sales tax with Department of Revenue

- Setting up merchant accounts and payment processing

- Establishing vendor relationships and business contracts

If You Lose Your CP 575:

Critical information: You cannot obtain another CP 575 from the IRS. However, you can request an EIN Verification Letter (147C), which serves the same purpose for virtually all business needs.

Protection strategy: Immediately save digital copies in multiple secure locations and maintain physical copies in your primary business filing system.

Opening Your Minnesota LLC Bank Account

Next essential step: Establish dedicated business banking using your new EIN.

Required Documentation:

- EIN Confirmation Letter (CP 575)

- Minnesota Articles of Organization

- Operating Agreement (especially important for multi-member LLCs)

- Personal identification for all authorized signers

- Initial deposit (varies by financial institution)

Minnesota Banking Landscape:

Regional leaders: U.S. Bank (Minnesota headquarters), Wells Fargo (strong Minnesota presence)

Community banks: Bremer Bank, Bell Bank (excellent personalized service and local decision-making)

Twin Cities focused: TCF Bank (now Huntington), Associated Bank (strong metro presence)

Credit unions: Affinity Plus FCU, Hiway Credit Union (competitive rates and member benefits)

Jake’s Minnesota banking insight: Minnesota’s banking market is highly competitive with excellent options for businesses. U.S. Bank’s Minnesota headquarters means superior local knowledge, while community banks often provide the most personalized service for smaller businesses.

Minnesota-Specific EIN Considerations

Minnesota Business Registration:

All Minnesota LLCs conducting business in the state must register with the Minnesota Secretary of State and may need to register with the Department of Revenue.

Sales Tax Registration:

Minnesota requires sales tax registration for businesses selling taxable goods or services. Your EIN is essential for proper Department of Revenue registration.

Professional LLCs in Minnesota:

Minnesota allows Professional LLCs (PLLCs) for licensed professionals. The EIN application process is identical to regular LLCs.

Multiple Minnesota Businesses:

Each separate LLC requires its own unique EIN. Never attempt to share EINs across different business entities.

Multi-State Business Operations:

If your Minnesota LLC operates in multiple states (common given Minnesota’s border proximity), you may need additional state registrations while using the same federal EIN.

Troubleshooting Common EIN Application Issues

“Cannot Complete Your Application Online” Error

Typical causes:

- SSN/ITIN verification problems with IRS databases

- Multiple previous EIN applications under the same SSN

- Technical issues with IRS online systems

Effective solutions:

- Verify all personal information matches IRS records exactly

- Call IRS Business & Specialty Tax Line: (800) 829-4933

- Consider mail/fax application as backup approach

Business Name Already Taken Error

If IRS claims your Minnesota LLC name is unavailable:

- Double-check your Minnesota Secretary of State documents for exact spelling

- Ensure you’re using the complete legal name, not abbreviated version

- Contact IRS directly if you believe there’s a database error

Lost or Incorrect EIN Information

For lost EINs: Request EIN Verification Letter (147C) from IRS

For incorrect details: File Form 8822-B for address changes, call IRS for name corrections

For Minnesota address updates: Update both federal EIN records and Minnesota state registrations

Professional Services vs DIY Approach

DIY Approach Makes Sense When:

- You have valid SSN or ITIN

- Your LLC structure is straightforward

- You’re comfortable with online government applications

- You want to save unnecessary service fees

- You have time to handle the administrative process personally

Consider Professional Help When:

- You’re a non-US resident without ITIN

- You have complex multi-member ownership structures

- You’ve made previous mistakes requiring corrections

- You prefer to delegate administrative tasks to experts

- Time has extremely high opportunity cost for your business

Cost reality check: Professional EIN services charge $150-$500 for something that’s completely free and takes 15 minutes. Only consider this if your time is extraordinarily valuable.

Post-EIN Essential Action Items

Immediate High-Priority Tasks:

- Securely store EIN documentation (multiple digital and physical copies)

- Open Minnesota business bank account using EIN confirmation

- Register with Minnesota Department of Revenue for applicable taxes

- Apply for required Minnesota business licenses specific to your industry and location

- Establish business credit cards to build separate business credit history

Ongoing EIN Management Best Practices:

- Consistent usage: Include EIN on all official business documents

- Security protocols: Never share EIN unless absolutely necessary for legitimate business purposes

- Record maintenance: Keep EIN documentation with other essential business records

- Annual reviews: Ensure EIN information remains current and accurate across all registrations

Minnesota LLC Tax Landscape Overview

Federal Tax Responsibilities:

Single-member LLCs: Report business income/expenses on Schedule C with personal Form 1040

Multi-member LLCs: File Form 1065 partnership return with individual K-1 distributions

Corporate elections: File appropriate corporate returns if S-Corp or C-Corp election made

Minnesota State Tax Requirements:

- Individual income tax: Minnesota residents pay state income tax on LLC pass-through income (rates vary by income level)

- Business registration: Required for most business activities in Minnesota

- Sales tax: 6.875% state rate plus local taxes on taxable goods and services

- Employment taxes: Required if hiring employees in Minnesota

Your EIN serves as the common identifier connecting all these tax obligations across federal, state, and local jurisdictions.

Minnesota Business Environment Advantages

Innovation and Technology Hub:

- Fortune 500 headquarters: Home to major corporations like 3M, Target, General Mills

- Technology sector: Strong fintech, healthcare tech, and agricultural tech industries

- Research institutions: University of Minnesota and Mayo Clinic drive innovation

- Startup ecosystem: Robust venture capital and business incubator networks

Economic Strengths:

- Healthcare and medical devices: Global leader in medical technology

- Agriculture and food processing: Major agricultural production and processing

- Manufacturing: Precision manufacturing and industrial equipment

- Financial services: Insurance, banking, and financial technology

Business-Friendly Policies:

- Skilled workforce: High education levels and strong work ethic

- Infrastructure: Excellent transportation and telecommunications

- Quality of life: Consistently ranked among best states for business and living

- Government support: Various programs to support business development

Minnesota Regional Considerations

Twin Cities Metropolitan Area:

- Business services: Sophisticated professional services and corporate headquarters

- Financial institutions: Full range of business banking and financing options

- Technology sector: Growing tech startup ecosystem and corporate innovation centers

- Transportation: Excellent highway, rail, and airport infrastructure

Greater Minnesota:

- Agriculture focus: Rich farmland and agricultural processing facilities

- Natural resources: Mining, forestry, and renewable energy opportunities

- Tourism: Hospitality and outdoor recreation businesses

- Manufacturing: Distributed manufacturing and industrial operations

Border Region Advantages:

- Multi-state access: Easy access to Wisconsin, Iowa, North Dakota, and South Dakota markets

- Canadian trade: Proximity to Canadian markets and trade opportunities

- Transportation corridors: Major highways and rail lines for distribution

The Jake Lawson Bottom Line

Getting an EIN for your Minnesota LLC is straightforward, completely free, and absolutely essential for legitimate business operations in the Land of 10,000 Lakes. Don’t let scam services complicate what the federal government designed to be simple and accessible.

My proven Minnesota approach:

- Wait for Minnesota Secretary of State approval before applying for federal EIN

- Apply online directly through IRS.gov if you have SSN/ITIN

- Use your exact legal LLC name from Minnesota registration documents

- Immediately save confirmation documentation upon approval

- Begin Minnesota state registrations and banking within days of receiving EIN

Key insight: Your EIN is the foundation of your business’s financial and legal identity in Minnesota and nationwide. Handle this correctly from the beginning, and everything else becomes significantly easier.

North Star State reality check: This is one of the simplest business compliance tasks you’ll face as a Minnesota entrepreneur. Don’t overthink it, don’t pay scammers for it, and don’t delay completing it.

Ready to get your Minnesota LLC EIN? Navigate directly to IRS.gov and search “Apply for EIN Online.” Completely ignore all the paid middlemen trying to charge you for this free government service.

Need more Minnesota LLC guidance? Check out our comprehensive Minnesota LLC formation guide or explore our Minnesota business tax overview to understand your complete compliance obligations in the Land of 10,000 Lakes.

Questions about Minnesota LLC EINs? Ask in the comments below—I personally respond to every legitimate business question.