By Jake Lawson, LLC Formation Strategist

Montana might be known for wide open spaces and rugged independence, but when it comes to your LLC’s federal tax identification, you’re still dealing with the same IRS bureaucracy as everyone else. The good news? Montana’s business-friendly approach means fewer state complications while you navigate federal requirements.

I’ve helped hundreds of Montana entrepreneurs secure their EINs, and here’s what I’ve learned: Montana LLCs face the same federal tax ID requirements as every other state, but Montana’s streamlined state processes make the overall experience more manageable. Let me walk you through everything you need to know about getting your Montana LLC’s Federal Tax ID right.

Understanding Your Montana LLC’s Federal Identity

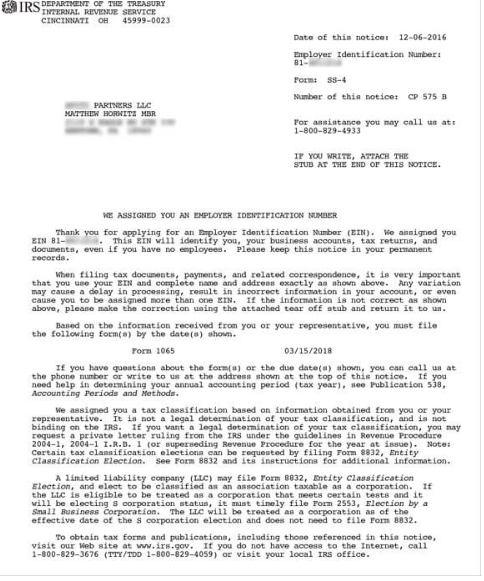

Your Federal Tax ID—officially called an Employer Identification Number (EIN)—is your LLC’s permanent identifier in the federal system. Think of it as your business’s Social Security number for dealing with the IRS, banks, and other federal agencies.

The key distinction: Montana handles your LLC formation, but only the IRS issues Federal Tax IDs. These are completely separate processes with different agencies and requirements.

Montana advantage: Unlike states with complex publication requirements or additional business licenses, Montana keeps LLC formation simple, which means you can focus on getting your federal requirements handled quickly.

Why Your Montana LLC Needs an EIN

Federal compliance: Required for tax filings, regardless of your LLC’s income level

Banking necessity: Montana banks require EINs for business account opening

Business credibility: Professional vendors and clients expect federal tax identification

Future planning: Essential for hiring employees, obtaining loans, or seeking investment

Montana-specific benefit: With Montana’s low-regulation business environment, your EIN often represents your primary ongoing compliance requirement.

The Federal vs. State Tax ID Distinction

This confusion trips up many Montana entrepreneurs, so let’s clarify the difference:

Federal Tax ID (EIN)

- Issued by: Internal Revenue Service (IRS)

- Purpose: Federal tax reporting and business identification

- Required for: All LLCs conducting business activities

- Cost: Free (directly from IRS)

Montana State Tax ID

- Issued by: Montana Department of Revenue

- Purpose: State tax reporting and business licensing

- Required for: Businesses with Montana tax obligations

- Integration: Separate from federal EIN requirements

Bottom line: You’ll need both if your LLC has Montana tax obligations, but they serve different purposes and come from different agencies.

Montana’s EIN Application Advantages

Montana entrepreneurs enjoy several advantages when applying for federal EINs:

State Process Simplicity

Quick LLC approval: Montana’s efficient Secretary of State processing means faster EIN eligibility

Clear documentation: Montana provides straightforward Articles of Organization that the IRS easily recognizes

Minimal complications: No publication requirements or additional state business licenses to delay EIN applications

Geographic Considerations

Mountain Time Zone: Aligns well with IRS business hours for phone support

Rural internet: Most Montana areas have sufficient internet connectivity for online EIN applications

Professional services: Growing network of Montana-based professionals familiar with federal requirements

Application Methods: Choosing Your Path

Your EIN application method depends entirely on your citizenship and residency status.

Online Applications (US Citizens and Residents)

Eligibility requirements:

- Valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Access to reliable internet connection

- Ability to complete application during IRS business hours

The process:

- Access IRS online EIN application system

- Complete business information accurately

- Receive instant EIN upon approval

- Download confirmation letter immediately

Montana advantages:

- Mountain Time Zone works well with IRS Eastern Time business hours

- Most Montana areas have adequate internet infrastructure

- Simple state documentation speeds federal processing

Mail/Fax Applications (International Entrepreneurs)

When required:

- Non-US residents without SSN or ITIN

- Applicants who encounter online system errors

- Those preferring paper documentation trails

The process:

- Complete Form SS-4 accurately

- Mail or fax to designated IRS processing center

- Wait 4-8 weeks for processing

- Receive EIN confirmation via mail

Montana considerations:

- Rural areas may have limited fax access

- Postal service reliability varies by location

- Consider using registered mail for tracking

Step-by-Step Application Strategy

Success with EIN applications requires proper preparation and timing.

Pre-Application Checklist

LLC documentation ready:

- Approved Montana Articles of Organization

- Clear record of LLC name and formation date

- Registered agent information if applicable

Personal information prepared:

- SSN or ITIN for online applications

- Current address and contact information

- Clear understanding of your role in the LLC

Business details clarified:

- Number of LLC members and ownership structure

- Primary business activities and industry classification

- Expected start date for business operations

Optimal Application Timing

Sequence matters:

- File Montana Articles of Organization

- Receive state approval confirmation

- Apply for federal EIN immediately

- Open business banking with EIN confirmation

Montana timing advantages:

- Relatively quick state processing (1-3 business days online)

- No waiting periods for publication or additional requirements

- Can proceed to EIN application without delays

Common Montana EIN Challenges and Solutions

Even with Montana’s business-friendly environment, certain challenges arise:

Rural Connectivity Issues

Challenge: Limited internet access in remote Montana locations

Solution: Use public internet at libraries, coffee shops, or business centers

Alternative: Mail/fax applications if online access remains problematic

Seasonal Business Complications

Challenge: Montana’s seasonal economy creates confusion about business start dates

Solution: Use actual operation start date, not seasonal ramp-up date

Consideration: Plan EIN timing around actual business activity commencement

Multi-State Operation Planning

Challenge: Montana LLCs expanding to other states need proper federal identification

Solution: Obtain EIN based on Montana formation, register as foreign LLC in expansion states

Advantage: Montana EIN provides foundation for multi-state growth

Montana Husband-Wife LLC Considerations

Montana’s non-community property status affects how married couples should approach EIN applications.

Tax Election Limitations

Montana reality: As a non-community property state, husband-wife LLCs must elect partnership taxation

EIN implications: Cannot elect Qualified Joint Venture status available in community property states

Filing requirements: Must file partnership returns and issue K-1s to both spouses

Strategic Considerations

Single vs. joint ownership: Consider single-member LLC structure if tax simplification is priority

Professional guidance: Consult Montana tax professionals familiar with state-specific implications

Documentation requirements: Ensure EIN application reflects chosen ownership structure accurately

Banking Integration: Montana-Specific Considerations

Montana’s banking landscape presents unique opportunities and challenges for new LLCs.

Montana Banking Options

National banks: Wells Fargo, Bank of America, and US Bank have Montana presence

Regional banks: First Interstate Bank and Stockman Bank offer local expertise

Credit unions: Many Montana credit unions provide excellent business banking services

Online options: Digital banks increasingly serve Montana entrepreneurs

Banking Preparation

Required documentation:

- EIN Confirmation Letter

- Montana Articles of Organization

- Operating Agreement (recommended)

- Personal identification

Montana banking advantages:

- Relationship-focused banking culture

- Understanding of seasonal and agricultural business cycles

- Competitive rates due to lower overhead costs

Tax Implications for Montana LLCs

Understanding tax obligations helps you use your EIN effectively.

Federal Tax Requirements

Pass-through taxation: Montana LLCs default to pass-through status for federal taxes

Self-employment tax: Montana LLC profits typically subject to SE tax

Quarterly estimates: Required if annual tax liability exceeds $1,000

Montana State Tax Integration

State income tax: Montana imposes state income tax on LLC profits

Business equipment tax: Some Montana LLCs may owe local business equipment taxes

Coordination: Use EIN for both federal and state tax reporting

International Entrepreneurs: Montana Advantages

Montana’s business climate attracts international entrepreneurs, but federal requirements remain standard.

Montana Benefits for International Applicants

Business-friendly environment: Simplified state processes reduce overall complexity

Geographic appeal: Montana’s reputation attracts international investment and attention

Professional network: Growing community of professionals experienced with international business formation

Federal Requirement Reality

EIN necessity: International entrepreneurs must obtain EINs for US business operations

Application process: Must use mail/fax method rather than online system

Documentation: May require additional identity verification and documentation

Avoiding Common Montana EIN Mistakes

These errors appear frequently among Montana entrepreneurs:

Mistake #1: Applying Before LLC Approval

The problem: Submitting EIN applications before Montana Secretary of State approval

The consequence: IRS confusion and potential application rejection

The solution: Wait for official Montana LLC approval before applying

Mistake #2: Incorrect Business Purpose Description

The problem: Unclear or overly broad descriptions of business activities

The consequence: Potential IRS follow-up questions or delays

The solution: Provide specific, accurate descriptions of intended business operations

Mistake #3: Address Confusion

The problem: Using registered agent addresses inappropriately or inconsistently

The consequence: Communication issues and potential compliance problems

The solution: Use actual business operating address when possible, registered agent address when necessary

Mistake #4: Timing Misalignment

The problem: Poor coordination between state filing and federal applications

The consequence: Delays in business banking and operational setup

The solution: Plan integrated timeline for state formation and federal identification

Professional Assistance: When It Makes Sense

Montana’s straightforward processes make DIY approaches viable, but consider professional help for:

Complex Situations

- Multi-member LLCs with complicated ownership structures

- International entrepreneurs unfamiliar with US systems

- Businesses planning immediate multi-state operations

- LLCs with specific tax election considerations

Time Constraints

- Urgent business banking needs

- Approaching deadlines for business opportunities

- Seasonal businesses with limited setup windows

- Entrepreneurs focused on business development over administrative tasks

Long-Term EIN Management

Your EIN is permanent, but understanding ongoing obligations prevents future complications.

Ongoing Federal Responsibilities

Annual tax filings: Use EIN for all federal tax returns

Employment compliance: Required for payroll and employment tax reporting

Banking relationships: EIN remains constant across banking relationships

Business credit: EIN forms foundation of business credit profile

Montana-Specific Integration

State tax coordination: Use EIN for Montana state tax filings

Business licensing: Some Montana business licenses reference federal EIN

Compliance reporting: Maintain consistent federal identification across all Montana requirements

The Bottom Line: Montana EIN Success

Montana’s business-friendly environment makes LLC formation straightforward, and obtaining your federal EIN should be equally smooth with proper preparation and understanding.

My recommendations for Montana entrepreneurs:

- Complete state formation first: Secure Montana LLC approval before federal applications

- Choose appropriate application method: Online for US residents, mail/fax for international applicants

- Prepare thoroughly: Gather all required documentation before starting applications

- Plan integration: Coordinate EIN receipt with business banking and operations launch

- Maintain consistency: Use EIN consistently across all federal and state requirements

Montana gives you a great foundation for business success—make sure your federal tax identification supports that foundation properly.

Ready to get your Montana LLC’s federal identification sorted? Check out our Montana LLC formation guide for complete state requirements, or explore our EIN application services for professional assistance with federal requirements.

Have questions about Montana EIN applications or federal tax identification for your specific situation? Drop me a line—I’ve probably helped someone with your exact Montana business model navigate these federal requirements successfully.

Jake Lawson is an LLC Formation Strategist and founder of llciyo.com. He’s guided over 1,200 entrepreneurs through U.S. business formation, including hundreds of Montana LLCs through both state formation and federal tax identification requirements.