By Jake Lawson, LLC Formation Strategist

Nevada chose you for a reason—no state income tax, business-friendly regulations, and stellar asset protection. Smart move. But here’s what 40% of new Nevada LLC owners miss: you’re not truly “in business” until you get your Federal Tax ID number.

I’ve helped over 1,200 entrepreneurs navigate this process, including hundreds who chose Nevada specifically for its tax advantages. Let me save you the rookie mistakes and get your EIN sorted fast.

Your Nevada LLC’s Federal Identity: Understanding EINs

Your Federal Tax ID—officially an Employer Identification Number (EIN)—is your business’s permanent federal fingerprint. The IRS issues this nine-digit code to identify your Nevada LLC in their system, completely separate from your personal Social Security Number.

Think of it like this: Nevada gave your LLC legal status, but the IRS gives it federal recognition. Without an EIN, you’re stuck in bureaucratic limbo—you can’t open business accounts, file proper tax returns, or operate like a real company.

Critical distinction: Nevada’s Secretary of State handles LLC formation, but only the IRS issues Federal Tax IDs. Different agencies, different purposes. I’ve seen confused entrepreneurs call Carson City asking about EINs—wrong office entirely.

The Name Game: EIN Variations

Government agencies love confusing terminology. Your EIN might show up as:

- Federal Employer Identification Number (FEIN)

- Business Tax ID Number

- Nevada Federal Tax ID

- Federal Tax Identification Number

- Tax ID Number

They’re all identical. Don’t let the varying labels confuse you.

Nevada-specific note: Your Federal EIN is completely separate from any Nevada business license numbers or state tax IDs you might need from the Nevada Department of Taxation. Keep them distinct.

Why Your Nevada LLC Can’t Survive Without an EIN

Here’s where I get direct with clients: operating without an EIN isn’t just inconvenient—it’s business suicide. You chose Nevada for its advantages, but you can’t access them without proper federal identification.

Banking and Financial Access

- Business bank accounts: Required by virtually every financial institution

- Commercial credit cards: Essential for expense tracking and credit building

- Business loans and lines of credit: Critical for growth financing

- Merchant services: Necessary for processing customer payments

Tax and Compliance Benefits

- Federal tax filings: Proper business tax treatment

- Nevada state compliance: Even with no state income tax, you need federal ID

- Sales tax registration: Required if you’re selling taxable goods/services

- Quarterly estimated payments: Avoiding underpayment penalties

Business Operations

- Vendor accounts: Professional supplier relationships

- Business licenses: Industry-specific permits and certifications

- Professional insurance: Liability and business coverage

- Payroll processing: Even if you’re the only team member

Risk Protection

- Identity theft protection: Shields your personal SSN from business use

- Asset separation: Maintains the corporate veil Nevada provides

- Professional credibility: Signals legitimate business operations

I’ve watched Nevada LLC owners try operating with their SSN instead. It creates unnecessary risk exposure and limits growth opportunities. Get the EIN—it’s free and takes 15 minutes.

The Price Tag: Absolutely Zero

Here’s refreshing news: the IRS charges nothing for EIN applications. Zero fees, no processing charges, completely free.

Scam alert: If someone’s charging for “EIN processing services,” they’re either providing unnecessary assistance or running a con game. I’ve reviewed dozens of formation services—legitimate companies might include EIN help in their packages, but the actual IRS application costs nothing.

Red flag warning: Avoid third-party sites masquerading as official IRS portals while charging “expediting fees.” The real IRS online system provides instant approval for qualified applicants.

Strategic Timing: When to Pull the Trigger

Here’s a mistake I see constantly: Nevada entrepreneurs applying for EINs before their LLC receives official state approval. Don’t jump the gun.

The proper sequence:

- File Articles of Organization with Nevada Secretary of State

- Receive official approval confirmation

- Apply for your Federal EIN

Why the wait matters: The IRS requires your business entity to legally exist before issuing tax identification. Apply prematurely, and you’ll create a paperwork nightmare requiring cancellation and reapplication.

Insider tip: Use the waiting period wisely. Finalize your ownership structure, prepare your Operating Agreement, and research business banking options. Changing from single-member to multi-member status after EIN issuance triggers additional IRS complexity.

The Application Process: Choose Your Path

Your application method depends entirely on your citizenship status. Here’s the breakdown:

Route 1: US Citizens and Residents (The Fast Track)

If you possess a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), you’re golden. The IRS online application is your best friend.

Why online filing wins:

- Immediate approval and EIN issuance

- 15-minute application process

- Instant confirmation letter download

- No postal delays or processing queues

The online system guides you through each question systematically. I’ve walked hundreds of Nevada entrepreneurs through this process—it’s genuinely user-friendly.

Alternative available: Mail or fax Form SS-4, but why wait weeks for something you can complete instantly?

Route 2: International Entrepreneurs (Slightly More Complex)

Non-US residents face different requirements. Without an SSN or ITIN, online filing isn’t available. Instead, you’ll submit Form SS-4 via mail or fax.

The international process:

- Download and complete Form SS-4 from IRS.gov

- Submit via mail or fax to designated IRS processing center

- Wait for confirmation letter (typically 4-12 weeks)

Myth crusher: You don’t need a “third-party designee” despite what some expensive services claim. International applicants can obtain EINs directly from the IRS without intermediaries.

Nevada’s Community Property Advantage

Here’s where Nevada gets interesting for married couples. As a community property state, Nevada offers unique tax election options unavailable in most states.

Married Nevada LLC owners can choose:

Option 1: Partnership Tax Treatment

- File as multi-member LLC

- Submit partnership tax returns

- More complex but potentially advantageous

Option 2: Qualified Joint Venture

- Elect single-member LLC treatment

- Simpler tax filing

- Both spouses report on individual returns

Your EIN application determines this election, so choose carefully. This flexibility is one reason savvy entrepreneurs pick Nevada for LLC formation.

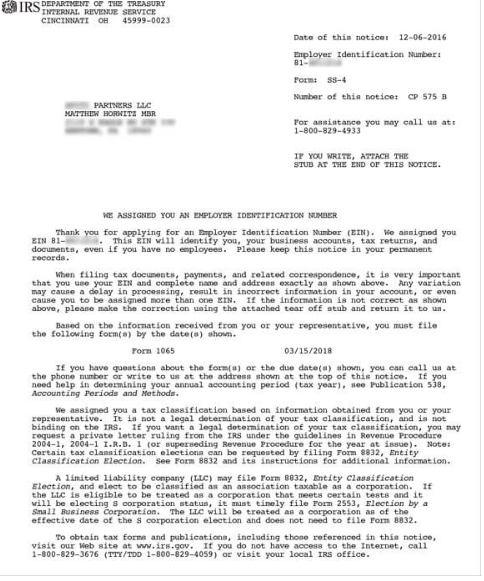

Understanding Your EIN Documentation

Once approved, you’ll receive an EIN Confirmation Letter (CP 575). This document is your LLC’s federal birth certificate—guard it carefully.

Online applicants: Download and save multiple copies immediately. The IRS doesn’t provide replacement confirmation letters.

Mail/fax applicants: Your confirmation arrives via postal service. File it securely.

Lost your paperwork? Request an EIN Verification Letter (Form 147C) from the IRS. Banks and institutions accept this as equivalent documentation.

Nevada Banking: Maximizing Your Advantages

Your EIN confirmation unlocks Nevada’s business banking landscape. Here’s where strategy matters.

Required documentation:

- EIN Confirmation Letter

- Nevada Articles of Organization

- Operating Agreement (multi-member LLCs)

- Personal identification

Nevada banking strategy: Consider both local and national options. Nevada credit unions often provide excellent business banking terms, while national banks offer broader geographic convenience. I’ve helped clients save hundreds annually through strategic bank selection.

Out-of-state banking: Many Nevada LLC owners live elsewhere. Most major banks accommodate this, but confirm their requirements before applying.

Critical Mistakes That Cost Time and Money

After 15 years of Nevada LLC consulting, these errors appear repeatedly:

Mistake #1: Premature EIN Applications

The issue: Applying before Nevada Secretary of State approval

The consequence: IRS confusion requiring cancellation and reapplication

The solution: Wait for official state confirmation

Mistake #2: Confusing EIN with LLC Formation

The issue: Thinking Federal Tax ID creation forms your LLC

The consequence: Operating as sole proprietorship unknowingly

The solution: File with Nevada first, then apply for EIN

Mistake #3: Name Inconsistencies

The issue: EIN and Nevada LLC names don’t match exactly

The consequence: Banking complications and compliance issues

The solution: Ensure perfect name consistency across all documents

Mistake #4: Post-EIN Ownership Changes

The issue: Altering membership structure after EIN issuance

The consequence: Complex IRS paperwork and tax complications

The solution: Finalize ownership before applying

Nevada LLC EIN FAQ: The Questions I Field Weekly

“Does my single-member Nevada LLC actually need an EIN?”

Legally? It’s optional. Practically? Absolutely essential.

While single-member LLCs can theoretically operate using the owner’s SSN, it’s unnecessarily risky and limiting. You chose Nevada for business advantages—don’t handicap yourself with identity exposure and banking limitations.

My recommendation after 1,200+ consultations: get the EIN. It’s free, fast, and unlocks Nevada’s full business potential.

“Are EINs mandatory for multi-member Nevada LLCs?”

Yes, without exception. Federal tax code requires all multi-member LLCs to obtain EINs. No wiggle room here.

“How do DBAs interact with EINs?”

Carefully. A DBA (Doing Business As) name can’t have its own EIN—it’s just an alias for your existing entity.

If your Nevada LLC operates under a DBA: Use your LLC’s EIN for everything. The IRS doesn’t recognize DBA names independently.

If you have a DBA without an LLC: You’re operating as a sole proprietorship or partnership, with different EIN requirements.

“My Nevada LLC has no employees. Still need an EIN?”

Absolutely. The “Employer” in Employer Identification Number is misleading—you don’t need actual employees to benefit from federal tax identification.

Remember: as an LLC owner, you’re not technically an employee of your own company.

“How should Nevada married couples handle EIN applications?”

Nevada’s community property status creates unique opportunities. You can elect either partnership treatment or qualified joint venture status.

Partnership election: File as multi-member LLC with partnership returns Joint venture election: File as single-member LLC with individual returns

Your EIN application locks in this choice, so consider the implications carefully. When in doubt, consult a Nevada-savvy tax professional.

Getting Help When Problems Arise

Sometimes EIN applications hit unexpected snags. Here’s your troubleshooting playbook:

IRS EIN Support Line: 1-800-829-4933

Operating hours: 7 AM – 7 PM, Monday through Friday

Secret to reaching humans:

- Press 1 (English language)

- Press 1 (Employer Identification Numbers)

- Press 3 (“Existing EIN inquiries”)

Option 3 is the magic button—it’s the only reliable path to live assistance.

Timing strategy: Call exactly at 7 AM to minimize hold times. I’ve waited 3+ hours during peak periods, but morning calls usually connect within 10 minutes.

The Bottom Line: Just Do It

Listen, I’ve spent 15 years helping entrepreneurs leverage Nevada’s business advantages. Here’s my unvarnished assessment: overthinking your EIN is wasted mental energy.

The application is free, the process is fast, and the benefits are immediate. You chose Nevada for its strategic advantages—don’t undermine yourself by skipping essential federal registration.

Your Nevada LLC deserves proper recognition in both state and federal systems. Get your EIN, establish your business banking relationship, and start building the enterprise you envisioned.

Nevada gives you the framework for success. Your Federal Tax ID activates it.

Ready to maximize your Nevada advantage? Explore our comprehensive Nevada LLC formation guide for complete state-specific strategies, or check out our tested formation service reviews to find the right partner for your business launch.

Got specific Nevada EIN questions I didn’t address? Reach out—I’ve probably encountered your exact scenario and can point you toward the solution.

Jake Lawson is an LLC Formation Strategist and founder of llciyo.com. He’s guided over 1,200 entrepreneurs through U.S. business formation, with particular expertise in Nevada’s unique advantages for domestic and international founders.