By Jake Lawson, LLC Formation Strategist

New Hampshire makes LLC annual reports relatively straightforward—file online between January 1st and April 1st, pay $100, and you’re done for another year. But like many state requirements, there are details that can trip you up if you’re not prepared.

I’ve helped dozens of New Hampshire LLC owners navigate their annual report obligations, and the key is understanding the process, deadlines, and consequences of missing them. Let me walk you through everything you need to know to stay compliant without the stress.

New Hampshire Annual Report Basics

Cost: $100 per year Deadline: Between January 1st and April 1st Late penalty: $50 (total cost becomes $150) Filing method: Online through NH QuickStart (recommended) or by mail Processing time: Instant online, 1-3 weeks by mail

The annual report keeps your LLC in good standing with the state and updates your basic business information on file.

Critical Deadlines You Must Know

Filing window: January 1st – April 1st (every year) Late filing penalty: $50 additional fee if filed after April 1st Dissolution risk: Administrative dissolution if you miss two consecutive years

Your first filing timeline:

- LLC formed in 2024 → First annual report due January 1 – April 1, 2025

- LLC formed in 2025 → First annual report due January 1 – April 1, 2026

Jake’s tip: Set a recurring calendar reminder for January 15th every year. This gives you plenty of time before the deadline and ensures you never forget.

Consequences of Missing the Deadline

New Hampshire doesn’t mess around with annual report compliance:

Late Filing (After April 1st)

- Your LLC status changes to “Not in Good Standing”

- Additional $50 penalty fee (total cost: $150)

- Your LLC can still be restored to good standing by filing and paying

Missing Two Consecutive Years

- Administrative dissolution of your LLC

- Loss of liability protection

- Potential loss of business name

- Complex reinstatement process required

Reality check: Missing annual reports can destroy your business structure. The $100 annual cost is cheap insurance for maintaining your LLC’s legal status.

Step-by-Step: Filing Your Annual Report Online

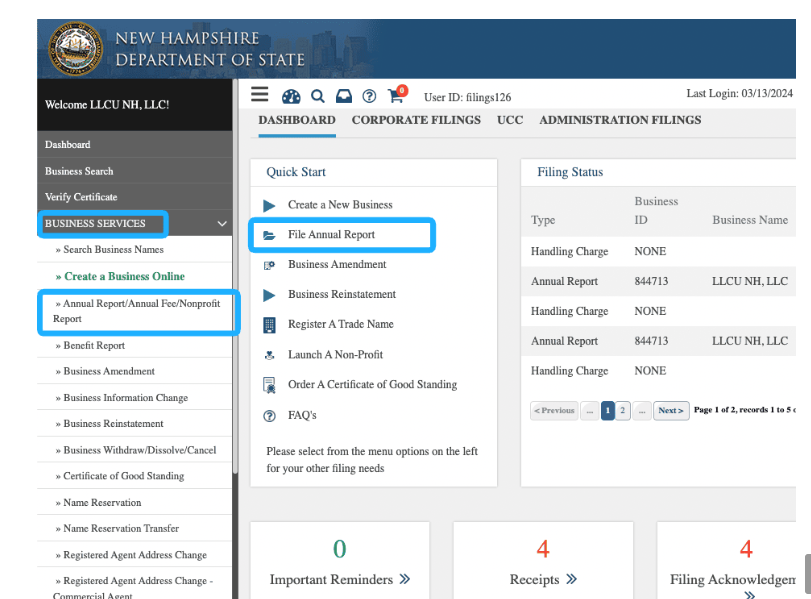

New Hampshire’s QuickStart system is efficient once you understand the process. Here’s how to navigate it:

Step 1: Access the System

- Go to New Hampshire QuickStart (quickstart.sos.nh.gov)

- Log into your existing account or create one if needed

- Navigate to “File Annual Report” or find it under “Business Services”

Step 2: Locate Your LLC

- Search by LLC name (enter first few words, omit “LLC”)

- Or search by Business ID number

- Select your LLC from the results and continue

Step 3: Review Principal Purposes

The system will show your LLC’s stated business purposes. Important: You can’t change these through the annual report.

Jake’s advice: Don’t worry if your actual business activities have evolved beyond your original stated purpose. You’re not legally restricted to only those activities, and paying $35 for a Certificate of Amendment is usually unnecessary.

Step 4: Verify Registered Agent Information

Review your registered agent details. If changes are needed, you’ll have to file separately—the annual report can’t update registered agent information.

Step 5: Update Principal Office Information

This is where you can update your business addresses if they’ve changed. Click “Edit” to make changes, then save your updates.

Step 6: Add Email Address (Optional)

You can provide an email for state communications, but it’s not required.

Step 7: Review Member/Manager Information

- Current members/managers are listed below the input fields

- To remove someone: Click the “remove” icon

- To add someone: Enter their information and click “Save Selection”

Step 8: Certification and Signature

- Check the certification box

- Enter your name and select your title (usually “Member” or “Manager”)

- The effective date is automatically set to today

Step 9: Review and Submit

Double-check all information for accuracy. You have two submission options:

Option 1: Online Payment (Recommended)

- Click “Add to Shopping Cart and Checkout”

- Pay $100 by credit card

- Processing is instant

- Download receipt and filed report immediately

Option 2: Mail Payment

- Click “Mail with Check”

- Print the report and mail with $100 check to the Secretary of State

- Processing takes 1-3 weeks

The Certificate of Good Standing Option

During checkout, you’ll be offered a Certificate of Good Standing for $5. This document proves your LLC is in good standing with the state.

When you might need it:

- Opening business bank accounts

- Applying for business loans

- Entering into contracts that require proof of good standing

- Registering as a foreign LLC in other states

Jake’s take: Skip it unless you have an immediate need. You can always order one later if required.

State Reminders: Helpful but Not Reliable

New Hampshire sends courtesy reminders after January 1st, but don’t rely on them:

- Reminders go to the address/email from your Certificate of Formation

- They’re courtesy only—you’re still responsible if you don’t receive one

- Address changes might not be reflected in their system

Set your own reminders. Don’t depend on the state to remind you of your legal obligations.

Changing Your Registered Agent

If you need to change your registered agent, this requires a separate filing from your annual report:

Online Change ($15 fee)

- Use QuickStart system under “Business Services”

- Choose appropriate option based on your situation

- Pay $15 processing fee

Mail Change (Free during filing season)

- Complete Statement of Change form

- File between January 1st – April 1st: No fee

- File outside this window: $15 fee

Strategic timing: If you need to change your registered agent, do it when you file your annual report to avoid the fee.

Common Annual Report Mistakes

1. Waiting Until the Last Minute

Don’t file on March 31st. Give yourself buffer time in case of technical issues or questions.

2. Using Outdated Information

Review all information carefully. Outdated addresses or member information can cause problems later.

3. Ignoring Address Changes

If your business has moved, update your addresses in the annual report. Stale information can cause you to miss important state communications.

4. Assuming Reminders Will Come

Set your own calendar reminders rather than depending on state notices.

5. Mixing Up Annual Reports with Tax Returns

Your annual report is a state compliance filing separate from tax returns. Both are required but serve different purposes.

What Happens After Filing

Successful Online Filing

- Immediate confirmation page

- Email with filed report copy

- Downloadable receipt

- LLC status updated to “Good Standing”

If There Are Errors

- State sends notification within 30 days

- You get 30 days to correct and refile

- No additional fees for corrections

Lost Documents

- Search your LLC on the Secretary of State’s website

- Access “Filing History” to download past reports

- Contact the state office if you need additional copies

Planning and Budgeting

Annual Costs to Budget

- Annual report fee: $100

- Registered agent service (if used): $100-300

- Professional preparation (if hired): $50-150

Multi-Year Planning

Consider setting aside $100 each year specifically for your annual report. This ensures the money is available when filing time comes.

Professional Help: When It’s Worth It

Most LLC owners can handle their annual report themselves, but consider professional help if:

- You have complex member/manager changes

- Your business has undergone significant restructuring

- You’re managing multiple LLCs with different filing requirements

- You want ongoing compliance monitoring

Integration with Other Business Requirements

Your annual report is just one piece of your compliance puzzle:

- Federal tax returns (March 15th for partnerships, April 15th for single-member LLCs)

- State tax obligations (if any)

- Local business license renewals

- Professional license renewals

Coordinate these deadlines to avoid missing important requirements.

The Bottom Line

New Hampshire’s annual report requirement is straightforward and reasonably priced at $100. The online filing system works well, processing is fast, and the January-April filing window gives you flexibility.

The key is treating this as a non-negotiable business obligation. Set up systems to ensure you never miss the deadline, keep your information current, and view the annual cost as essential business insurance.

Missing your annual report can destroy your LLC’s legal status and cost far more to fix than the $100 annual cost. Stay on top of this requirement, and it becomes a simple annual task rather than a source of stress.

Ready to File Your New Hampshire Annual Report?

The process is straightforward once you understand the system and requirements. Most LLC owners can complete their annual report in 15-20 minutes using New Hampshire’s online system.

Need help staying on top of your New Hampshire LLC compliance requirements? At Llciyo.com, we work with experienced professionals who can handle your annual reports and ensure you never miss critical deadlines that could jeopardize your business.

Don’t let a missed $100 filing destroy your LLC’s legal status—get the systems in place to handle this requirement reliably every year.

Jake Lawson has guided over 160 New Hampshire LLC owners through annual report compliance, helping them establish systems to meet deadlines consistently while avoiding costly penalties and dissolution risks.