By Jake Lawson, LLC Formation Strategist

Listen up, Garden State entrepreneurs: I’ve helped form over 200 New Jersey LLCs, and here’s what nobody tells you upfront—your LLC isn’t really “in business” until it has a Federal Tax ID number.

The IRS calls it an EIN (Employer Identification Number), but I call it your business passport. Without it, you’re basically running a lemonade stand in the eyes of banks, lenders, and pretty much anyone who matters in the business world.

The good news? Getting your New Jersey LLC‘s EIN is completely free and takes about 15 minutes. The bad news? The process is riddled with landmines that can cost you time, money, and major headaches if you step wrong.

I’m about to walk you through the entire process, step-by-step, so you can avoid the expensive mistakes I’ve seen entrepreneurs make over and over again.

What Is an EIN and Why Does Your New Jersey LLC Need One?

Your EIN is a 9-digit identifier (formatted like 12-3456789) that the IRS assigns to your business. Think of it as your LLC’s Social Security Number—it’s how Uncle Sam keeps track of your business for tax purposes.

Here’s what blows people’s minds: your EIN doesn’t come from New Jersey. Nope. While the Garden State handles your LLC formation through the Division of Revenue and Enterprise Services, your federal tax ID comes straight from the IRS in Washington, D.C.

This creates confusion I see all the time. People think filing their Certificate of Formation automatically gets them an EIN. Wrong. The state creates your LLC; the feds give it a tax identity. Two completely different processes.

The Many Faces of Your Federal Tax ID

The government loves their acronyms, and your EIN goes by more names than a witness protection participant:

- EIN (Employer Identification Number)

- FEIN (Federal Employer Identification Number)

- Federal Tax ID Number

- Federal Tax Identification Number

- Business Tax ID

They’re all the same thing. Don’t get confused when your accountant asks for your “FEIN” and you only see “EIN” on your paperwork—it’s like asking for a soda vs. a Coke.

Critical distinction: Your federal EIN is completely separate from any New Jersey state tax ID you might need from the Division of Revenue. Think federal passport vs. state driver’s license—different purposes, different agencies.

Why Your New Jersey LLC Actually Needs an EIN (It’s Not Just About Taxes)

After working with hundreds of New Jersey businesses, I can tell you that an EIN unlocks opportunities you didn’t even know existed. Here’s what becomes possible:

Business Banking (Non-Negotiable Territory)

Try walking into any bank in Newark, Jersey City, or Trenton without an EIN. They’ll look at you like you’re speaking Martian.

Every legitimate financial institution requires an EIN to open a business account. Your personal SSN won’t cut it, and mixing personal and business finances is like playing hopscotch in a minefield—eventually, you’re going to get hurt.

Business Credit and Financing

Want a business credit card? Commercial loan? Line of credit for equipment? Your EIN is the key that unlocks the door to business financing.

Lenders use your EIN to evaluate your business credit profile separately from your personal credit score. Start building that business credit history from day one.

Professional Licensing and Permits

New Jersey has licensing requirements for everything from hair salons to construction companies. Most business licenses and permits require an EIN during the application process.

Whether you’re opening a restaurant in Atlantic City or a consulting firm in Princeton, that 9-digit number is going on official paperwork.

Employment and Payroll

Planning to hire employees? Your EIN becomes mandatory for payroll taxes, unemployment insurance, and workers’ compensation.

Even if you’re starting as a solopreneur, get the EIN now. Trust me—adding employees later with the EIN already in place is infinitely easier than scrambling to get one when you need it.

Tax Compliance (The Obvious One)

Federal returns, New Jersey state taxes, quarterly filings—your EIN ties everything together in the government’s system.

The Real Cost of Getting an EIN (Spoiler: It Should Be Zero)

Here’s where I start seeing red: the IRS charges absolutely nothing for EIN applications. Zero dollars. Free. Gratis.

Yet I constantly watch New Jersey entrepreneurs get scammed by “EIN services” charging $75, $150, even $400 for filling out a free government form. It’s like paying someone $100 to dial 911 for you.

These services prey on people’s confusion and impatience. Don’t be their next victim. The process is straightforward once you understand it, and I’m about to show you exactly how to do it yourself.

The Timing Game: When to Apply for Your New Jersey EIN

This is where most people mess up: do NOT apply for your EIN until your New Jersey LLC is officially formed and approved.

Here’s the correct sequence for New Jersey:

- File your Certificate of Formation with New Jersey Division of Revenue

- Wait for approval (usually 24-48 hours for online filings)

- Receive your filed Certificate with the state file number

- Apply for your EIN using the exact approved business name

- Complete your New Jersey LLC Registration (required within 120 days)

Notice the EIN comes AFTER formation but BEFORE registration. This timing matters because banks and other institutions will want to see your EIN before you complete your registration process.

Why this order matters: If you apply for an EIN before your LLC is approved, you risk name mismatches, processing delays, and potential rejection. I’ve seen people waste weeks fixing these timing mistakes.

How to Get Your EIN: Two Distinct Paths

Your citizenship status determines which route you take. Let me break down both options:

Path 1: U.S. Citizens and Residents (The Express Lane)

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), you get the VIP treatment: instant online processing.

Why this rocks:

- Takes 10-15 minutes total

- Get your EIN immediately upon completion

- Download confirmation letter instantly

- No waiting for mail delivery

- Works 24/7 (unlike phone or mail options)

The step-by-step process:

- Navigate to IRS.gov (ignore those paid sites in the search results)

- Find “Apply for an EIN Online”

- Complete Form SS-4 electronically

- Submit and receive your EIN instantly

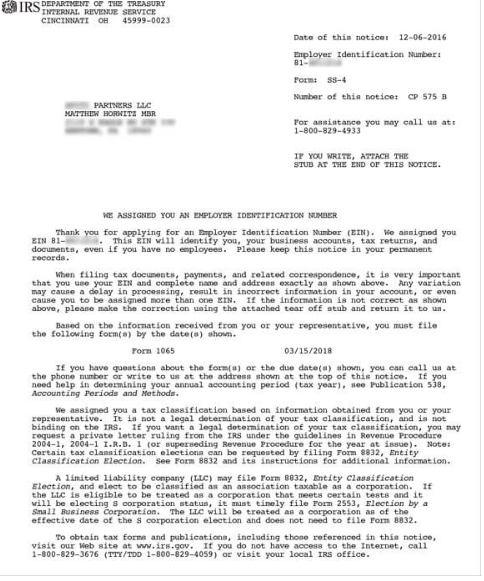

- Download your EIN Confirmation Letter (CP 575)

Pro tip from the trenches: Complete the entire application in one session. The IRS system times out if you step away, and you’ll have to start over. Clear your schedule, grab some coffee, and power through it.

Path 2: Non-U.S. Residents (The Paper Route)

No SSN or ITIN? You can still get an EIN for your New Jersey LLC, but you’ll need to go old-school with Form SS-4 via mail or fax.

The reality check:

- Processing takes 4-6 weeks

- Must use Form SS-4 (paper application)

- Mail or fax to the IRS

- Confirmation arrives by postal mail

- Still completely free (despite the extra steps)

Myth-busting moment: Ignore any website claiming you need a “third-party designee” or that it’s impossible without expensive services. That’s pure nonsense designed to separate you from your money.

Before You Apply: Lock Down Your LLC Details

Here’s a mistake that creates massive headaches later: changing your LLC’s ownership structure after getting an EIN.

Switching from single-member to multi-member (or vice versa) after getting your EIN requires:

- Filing additional forms with the IRS

- Updating your New Jersey registration

- Amending your operating agreement

- Potentially getting a new EIN altogether

Make these decisions BEFORE hitting submit on your EIN application:

- How many members will your LLC have?

- What percentage ownership for each member?

- How will you handle management structure?

- Any plans to add partners in the near future?

Get it right the first time, and save yourself bureaucratic nightmares later.

Your EIN Confirmation Letter: The Golden Ticket

Once approved, you’ll receive an EIN Confirmation Letter (officially Form CP 575). This document is like your business birth certificate—guard it with your life.

If you applied online: Download it immediately and save multiple copies. Email yourself a copy, save it to cloud storage, print physical copies. Seriously.

If you mailed Form SS-4: The IRS will mail your confirmation to the address you provided. This can take 1-2 weeks on top of the processing time.

Lost your confirmation letter? The IRS won’t issue duplicates, but you can request an EIN Verification Letter (Form 147C) which serves the same purpose. Banks and institutions accept either document.

Opening Your New Jersey Business Bank Account

Your new EIN gets its first real-world test when you open a business bank account. Here’s what you’ll need:

Required documents:

- EIN Confirmation Letter (or EIN Verification Letter)

- Filed Certificate of Formation from New Jersey

- Operating Agreement (recommended even though New Jersey doesn’t require it)

- Valid government-issued photo ID

- Initial deposit (varies by bank)

For international entrepreneurs: Yes, you can absolutely open a U.S. business bank account for your New Jersey LLC as a non-resident. Some banks make it easier than others, but it’s definitely achievable with proper documentation and patience.

New Jersey banking tip: Many local and regional banks in New Jersey are more entrepreneur-friendly than the big national chains. Consider institutions like Investors Bank, OceanFirst, or PNC—they often have better small business programs.

The New Jersey LLC Registration Wrinkle

Here’s something unique about New Jersey that catches people off-guard: you need to complete an LLC Registration within 120 days of formation.

This registration is separate from your initial Certificate of Formation and requires your EIN. The sequence looks like this:

- Form LLC (Certificate of Formation)

- Get EIN (what we’re discussing here)

- Complete LLC Registration (using your new EIN)

Missing the 120-day registration deadline can result in administrative dissolution of your LLC. Don’t let bureaucratic paperwork kill your business before it starts.

Common New Jersey EIN Mistakes (And How to Fix Them)

After 15 years in this business, I’ve seen every mistake in the book. Here are the biggies:

Mistake #1: “Getting an EIN Forms My LLC”

This confusion runs rampant. Getting an EIN does NOT create your LLC. The EIN only gives your already-formed LLC a tax identity.

If you got an EIN without forming an LLC first, you’re operating as a sole proprietorship, and that EIN is tied to you personally.

The fix: Form your New Jersey LLC properly first, then get a new EIN for the LLC entity.

Mistake #2: “I Applied Before My LLC Was Approved”

If your LLC gets approved with the exact name you used on the EIN application, you’re fine. But name changes or rejections mean you need a new EIN.

The fix: Wait for LLC approval, then apply for the EIN using the exact approved name from your filed Certificate of Formation.

Mistake #3: “I Can’t Remember My EIN”

Lost paperwork happens to everyone. Request an EIN Verification Letter (Form 147C) from the IRS—it serves the same purpose as your original confirmation.

Mistake #4: “I Missed the Registration Deadline”

If you blow past the 120-day LLC Registration deadline, your LLC might face administrative dissolution.

The fix: File the registration immediately and include any late fees. If your LLC has been dissolved, you may need to reinstate it before proceeding.

FAQ: The Questions Every New Jersey Entrepreneur Asks

Do Single-Member LLCs Really Need an EIN?

Technically, no. Single-member LLCs can use the owner’s SSN for tax purposes.

Practically, absolutely yes. Here’s why I always recommend getting an EIN:

- Identity protection: Keeps your SSN off business documents

- Banking requirements: Most banks won’t open business accounts without an EIN

- Business credit building: You can’t establish business credit using your personal SSN

- Future planning: Adding members or employees later requires an EIN anyway

- Professional credibility: Vendors and clients expect legitimate businesses to have EINs

Getting an EIN takes 15 minutes and costs nothing. There’s literally no downside.

What About Married Couples?

New Jersey isn’t a community property state, so married couples can’t elect “Qualified Joint Venture” status for single-member tax treatment.

Husband-and-wife LLCs in New Jersey automatically get treated as multi-member partnerships for tax purposes, which means an EIN is mandatory, not optional.

Can I Use My EIN for Multiple Businesses?

No. Each business entity needs its own EIN. Your New Jersey LLC gets one EIN for life (unless you change the fundamental structure).

If you form multiple LLCs, each one needs its own separate EIN.

Do I Need an EIN for a DBA?

This confuses people constantly. A DBA (Doing Business As) cannot have its own EIN—it’s just a trade name.

If your New Jersey LLC operates under a DBA, the LLC itself uses its EIN for everything. The DBA is just a marketing name, not a separate tax entity.

What If I Have No Employees?

Despite the name “Employer Identification Number,” you don’t need employees to get an EIN.

Think of it as a “Business Identification Number” and it makes more sense. Even solo entrepreneurs should get an EIN for all the reasons mentioned above.

When Things Go Sideways: Fixing EIN Problems

Canceling an EIN

Sometimes you need a do-over. Maybe you got an EIN for a business that never launched, or you made an error in the application.

The IRS makes cancellation difficult but not impossible. You’ll need to write a formal letter explaining why you want to cancel the EIN, including:

- Your EIN

- Business name

- Reason for cancellation

- Your signature and date

Getting Human Help from the IRS

Need to talk to an actual person at the IRS? Here’s the secret formula:

Phone: 1-800-829-4933

Hours: 7 AM – 7 PM, Monday-Friday

The magic sequence to reach a human:

- Press 1 for English

- Press 1 for Employer Identification Numbers

- Press 3 for “If you already have an EIN, but can’t remember it”

Option 3 is the only reliable path to a live person. Call right at 7 AM to minimize hold times.

Your New Jersey EIN Action Plan

Here’s your step-by-step roadmap:

- Form your New Jersey LLC (file Certificate of Formation and wait for approval)

- Gather required information (LLC details, member information, business purpose)

- Apply for your EIN (online if you have SSN/ITIN, mail/fax if you don’t)

- Download and save your confirmation letter (multiple copies, multiple locations)

- Open your business bank account (separate those finances immediately)

- Complete your New Jersey LLC Registration (within 120 days of formation)

Remember: the only money you should spend is New Jersey’s state filing fee. The EIN itself costs absolutely nothing.

New Jersey-Specific Considerations

State Tax Requirements

New Jersey has some unique tax obligations for LLCs:

- Annual Report filing (due by the last day of your anniversary month)

- Potential Gross Income Tax registration

- Sales tax registration (if applicable to your business)

Your EIN will be required for all of these state-level obligations.

Local Business Licenses

Many New Jersey municipalities require local business licenses or permits. Cities like Newark, Jersey City, Paterson, and Elizabeth have their own requirements.

Your EIN will likely be required for these local applications, so get it early in your formation process.

Professional LLCs

If you’re forming a Professional LLC (PLLC) in New Jersey for licensed professionals like doctors, lawyers, or accountants, you’ll still need an EIN following the same process outlined above.

Ready to Launch Your New Jersey LLC Right?

Getting your EIN is just one piece of the New Jersey LLC formation puzzle. The Garden State has some unique requirements and opportunities that can make or break your business setup.

Need help navigating New Jersey’s LLC formation process? I’ve spent years testing and reviewing every major formation service, and I know which ones actually deliver value versus which ones are just expensive middlemen.

Wondering about New Jersey vs. other states for your business? Delaware gets all the hype, but New Jersey might actually be better for your specific situation. The right choice depends on your business model, tax situation, and long-term goals.

Looking for the most efficient way to get everything set up properly? I’ve helped entrepreneurs from all 50 states and 40+ countries establish U.S.-based businesses. Whether you’re a Garden State local or an international entrepreneur, the strategy depends on your unique circumstances.

Jake Lawson is an LLC Formation Strategist and Tax Advisor with over 15 years of experience helping entrepreneurs establish U.S.-based businesses. He’s guided over 1,200 LLCs to successful launch and provides independent, unbiased formation advice at llciyo.com. Connect with Jake for strategic LLC formation guidance tailored to your specific situation.