By Jake Lawson, LLC Formation Strategist

Congratulations on forming your North Carolina LLC! Now you need an EIN (Employer Identification Number), and you’re probably wondering if it’s going to be another painful bureaucratic process. Here’s the good news: getting an EIN for your North Carolina LLC is completely free, takes about 10 minutes online, and you can do it right now.

After helping over 1,200 entrepreneurs navigate the EIN process, I can tell you that this is actually one of the easiest parts of starting your business. Let me walk you through exactly what you need to know, when to apply, and how to avoid the common mistakes that create problems later.

Bottom line upfront: Every North Carolina LLC should get an EIN, even single-member LLCs without employees. It’s free, protects your privacy, and you’ll need it for practically everything business-related anyway.

What Is an EIN and Why Your North Carolina LLC Needs One

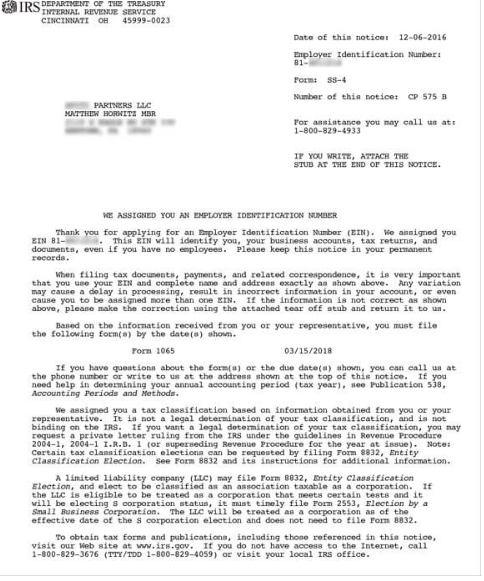

Think of your EIN as your LLC’s Social Security Number. It’s a unique 9-digit identifier (formatted XX-XXXXXXX) that the IRS assigns to your business for tax and identification purposes.

Key point:

Your EIN comes from the IRS (federal government), not the North Carolina Secretary of State. It’s completely separate from your state LLC registration.

Why Every North Carolina LLC Should Get an EIN

Even if you’re a single-member LLC with no employees, here’s why you need an EIN:

Essential business activities requiring an EIN:

- Opening business bank accounts (virtually all banks require it)

- Applying for business credit cards

- Getting business loans or lines of credit

- Filing tax returns (mandatory for multi-member LLCs)

- Applying for business licenses in North Carolina

- Setting up merchant accounts for payment processing

- Hiring employees (if you expand later)

Privacy and security benefits:

- Keeps your SSN private on business documents

- Reduces identity theft risk

- Creates clear separation between personal and business finances

Jake’s reality check: I’ve had clients try to operate without an EIN to “keep things simple.” They all ended up getting one within 3-6 months because banks, vendors, and clients kept asking for it. Just get it from the start.

Perfect Timing: When to Apply for Your EIN

The golden rule: Wait until your North Carolina Articles of Organization are officially approved before applying for your EIN.

Why Timing Is Critical:

- Your LLC name on the EIN application must match your approved Articles exactly

- Applying too early can create name mismatches requiring IRS cleanup

- If your LLC name gets rejected and changed, you’ll need a new EIN

Jake’s recommended timeline:

- File Articles of Organization with North Carolina Secretary of State

- Wait for official approval (usually 1-3 business days online)

- Apply for EIN immediately after approval

- Use EIN to open business bank account

How to Get Your EIN: Step-by-Step Guide

For U.S. Citizens and Residents (Online – Recommended)

This is the fastest method—you get your EIN immediately upon completion.

What you’ll need before starting:

- Your approved North Carolina Articles of Organization

- Social Security Number (SSN) or Individual Taxpayer ID (ITIN)

- Basic LLC information (formation date, business activity, etc.)

- About 10-15 minutes of uninterrupted time

The application process:

- Go directly to irs.gov (ignore ads for paid services)

- Search for “Apply for EIN Online“

- Complete the online application

- Download your EIN Confirmation Letter immediately

- Save multiple copies—you’ll need this document constantly

Jake’s warning: Only use the official IRS website. If you see ads for “EIN services” charging $50-$300, they’re selling you something that’s free. Don’t fall for it.

For Non-U.S. Residents (Mail/Fax Application)

If you don’t have an SSN or ITIN, you can still get an EIN—you just can’t use the online system.

Your options:

- Form SS-4 by fax: 1-2 weeks processing

- Form SS-4 by mail: 4-6 weeks processing

What you’ll need:

- Completed Form SS-4 (downloadable from irs.gov)

- Copy of your North Carolina Articles of Organization

- Clear explanation of your responsible party role

Jake’s note: International entrepreneurs can absolutely get EINs for their North Carolina LLCs. Don’t let anyone convince you otherwise or try to sell you unnecessary “third-party designee” services.

North Carolina-Specific EIN Application Tips

LLC Name Formatting

Your EIN application must exactly match your approved Articles of Organization:

- Exact capitalization (if your Articles say “SMITH CONSULTING LLC,” don’t put “Smith Consulting LLC”)

- Punctuation matching (periods, commas, etc.)

- Spacing consistency

Principal Business Activity for North Carolina

Choose the classification that best describes your primary revenue source:

- Professional services (consulting, legal, accounting)

- Technology and software

- Manufacturing (textiles, furniture, chemicals)

- Agriculture and forestry

- Financial services

- Healthcare and social assistance

- Tourism and hospitality

Tip: Be honest about your primary business activity—don’t pick something you think sounds better.

Single-Member vs. Multi-Member EIN Requirements

Single-Member LLCs:

- Technically optional for tax purposes (you can use your SSN)

- Practically mandatory for business operations

- Strongly recommended for privacy and professionalism

Multi-Member LLCs:

- EIN is required by law—no exceptions

- Needed for Partnership tax return filing (Form 1065)

- Cannot operate without one

Jake’s recommendation: Regardless of your LLC structure, get an EIN. The benefits far outweigh the 10 minutes it takes to apply.

Common North Carolina LLC EIN Mistakes

Mistake #1: Applying Before LLC Approval

The problem: Name mismatches between your EIN and approved Articles The consequence: IRS confusion, banking problems, potential need for new EIN The fix: Always wait for official North Carolina approval first

Mistake #2: Paying for Free Services

The problem: Falling for ads offering EIN services for $100+ The reality: These companies have no special access—they fill out the same free form you can complete yourself The savings: Keep that $100+ in your business account where it belongs

Mistake #3: Not Downloading Your Confirmation Letter

The problem: You’ll need this document for everything business-related

The consequence: Delays in banking, licensing, and other business activities

The solution: Download and save multiple copies immediately

Mistake #4: Thinking You Need Multiple EINs

The misconception: Some people think they need different EINs for different services

The reality: One LLC = One EIN, regardless of how many services you offer

What to Do After Getting Your EIN

Immediate Action Items:

- Save your EIN Confirmation Letter in multiple secure locations

- Open your North Carolina business bank account

- Update your business records with the EIN

- Notify your accountant (if you have one)

Banking in North Carolina

Popular business banking options for North Carolina LLCs:

- BB&T/Truist (major regional presence)

- Bank of America (headquartered in Charlotte)

- First Citizens Bank (North Carolina-based)

- Wells Fargo

- SunTrust/Truist

- Local credit unions and community banks

Documents you’ll need for business banking:

- EIN Confirmation Letter (CP 575)

- North Carolina Articles of Organization

- Operating Agreement (recommended)

- Personal identification

- Initial deposit

North Carolina State Tax Considerations

North Carolina Income Tax:

Your EIN will be used for North Carolina state tax filings if your LLC:

- Has multiple members (requires Partnership return)

- Elects corporate taxation

- Meets certain income thresholds

North Carolina Sales Tax:

If you’re selling taxable goods or services in North Carolina, you’ll need to register separately with the North Carolina Department of Revenue. This registration will use your EIN but is a different process.

Troubleshooting Common EIN Issues

Lost Your EIN Confirmation Letter?

- You cannot get a replacement Confirmation Letter

- Request an EIN Verification Letter (Form 147C) from the IRS instead

- Banks and institutions accept this as equivalent documentation

Need to Update LLC Information?

- Name changes: Send a letter to the IRS (keep the same EIN)

- Address changes: File Form 8822-B

- Ownership changes: May require a new EIN depending on the change

Made an Error on Your Application?

- Minor errors: Usually not a problem

- Major errors (like wrong name): May need to cancel and reapply

- When in doubt: Call the IRS at 1-800-829-4933

Jake’s tip: Call the IRS early in the morning (right when they open at 7 AM) to avoid long hold times.

Professional Services vs. DIY

When to Handle It Yourself (Recommended):

- You have an SSN or ITIN

- Your LLC setup is straightforward

- You want to save money and learn the process

- You have 15 minutes to spare

When to Consider Professional Help:

- You’re a non-resident without U.S. tax identification

- You have complex multi-entity structures

- You’re forming multiple LLCs simultaneously

- Time is more valuable than money to you

My honest assessment: The online EIN application is user-friendly and straightforward. Most entrepreneurs can easily handle this themselves. Professional services are usually unnecessary for this specific task.

International Entrepreneurs and North Carolina

North Carolina is increasingly popular with international entrepreneurs because of:

- Growing tech sector (Research Triangle, Charlotte fintech)

- Business-friendly environment

- Reasonable costs and regulations

- No restrictions on foreign LLC ownership

- Strategic East Coast location

EIN eligibility for non-residents: You can absolutely get an EIN for your North Carolina LLC as a non-U.S. resident. Use Form SS-4 via mail or fax—it just takes longer than the online process.

After Your EIN: Next Steps for Success

With your EIN secured, your North Carolina LLC is ready for serious business:

Immediate Priorities:

- Open business banking accounts

- Apply for necessary business licenses

- Set up accounting systems

- Consider business insurance

- Build business credit history

North Carolina Business Advantages:

- No franchise tax on LLCs

- Reasonable annual report fees

- Growing business ecosystem

- Access to major East Coast markets

- Strong infrastructure and workforce

The Bottom Line on North Carolina LLC EINs

Getting an EIN for your North Carolina LLC is straightforward, free, and essential for professional business operations. Don’t overthink it, don’t pay unnecessary fees, and don’t delay—apply as soon as your LLC is approved.

My recommendation: Block out 15 minutes after your North Carolina LLC approval, go straight to irs.gov, complete the online application, and download your Confirmation Letter. Then you can focus on growing your business instead of worrying about paperwork.

North Carolina offers excellent opportunities for LLCs, from the Research Triangle’s tech boom to Charlotte’s financial sector growth. Getting your EIN is just the first step in taking advantage of everything the Tar Heel State offers entrepreneurs.

Remember: Your EIN is a permanent part of your business identity. Keep your Confirmation Letter safe, use your EIN consistently across all business activities, and enjoy the professional credibility it provides.

Ready to form your North Carolina LLC? I’ve tested every formation service and can help you choose the best option for your specific needs. Check out my comprehensive service comparisons for honest reviews and recommendations.

Questions about North Carolina business requirements? After helping over 1,200 entrepreneurs with LLC formation and compliance, I’m always happy to help fellow business owners navigate the process efficiently. Feel free to reach out.

Jake Lawson is an LLC formation strategist with over 15 years of experience helping entrepreneurs navigate U.S. business regulations. He specializes in helping both domestic and international founders understand federal tax requirements and streamline business compliance.