North Dakota’s Annual Report should be simple. $50 fee. November 15th deadline. File online. Done. But after helping 145+ North Dakota LLC owners untangle themselves from the FirstStop system, I can tell you the reality is far messier.

The killer? That PIN number requirement. If you formed your LLC by mail, through a service, or before FirstStop existed, you’re locked out of your own business records until you get a magic PIN. And getting that PIN? It’s like pulling teeth from a frozen walrus.

Let me show you how to navigate North Dakota LLCs Annual Report without losing your sanity or your LLC.

The $50 Fee That Becomes $100 (Or Worse)

North Dakota keeps their Annual Report fee reasonable at $50. But here’s how it spirals:

The Real Cost Progression:

File on time: $50 File one day late: $100 ($50 fee + $50 penalty)

Miss the 6-month grace period: LLC revoked

Reinstatement: $135 + $100 (past report and penalty) = $235 minimum

Over 1 year revoked: Court order required (thousands in legal fees)

Fargo entrepreneur ignored his Annual Report thinking “what’s the worst that could happen?” LLC revoked. Bank account frozen. Had to get a court order after 14 months. Total cost: $3,500 in legal fees plus state fees.

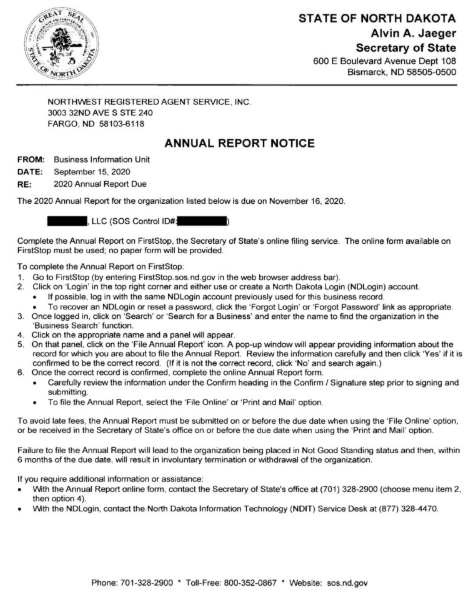

The November 15th Universal Deadline

Unlike states with rolling deadlines, every North Dakota LLC faces the same November 15th date. Farm/Ranch LLCs? Different story – April 15th. But for everyone else, it’s November or nothing.

The timing trap:

- Reminder arrives September (if you’re lucky)

- You can file starting mid-September

- System crashes November 14-15

- No extensions, no excuses

The FirstStop PIN Disaster: North Dakota’s Worst-Kept Secret

Here’s what drives LLC owners insane: North Dakota requires a PIN to access your LLC online, but they don’t tell you this during formation.

Scenario 1: You Formed Online Through FirstStop

Congratulations, you’re fine. Your account is already connected. Skip the PIN circus.

Scenario 2: You Formed By Mail/In-Person

Welcome to hell. You need a PIN that was supposedly mailed to your principal office. Lost it? Never got it? Moved offices? You’re locked out.

Scenario 3: A Service Formed Your LLC

Double hell. The service might have access, might not. You need to request access, which requires… a PIN you probably never received.

Bismarck consultant formed through LegalZoom. Never got a PIN. Spent three weeks and five phone calls getting access to his own LLC. Nearly missed the deadline.

The “Request Access” Maze Nobody Explains

Need a PIN? Here’s the bureaucratic obstacle course:

Step 1: Create a FirstStop Account

- Choose username (can’t change later)

- Complex password requirements

- Email verification (check spam)

- Activation code drama

Step 2: Find Your LLC and Request Access

- Search your business

- Click “Request Access”

- System sends PIN to address on file

- Wait 1-2 weeks for mail

Step 3: The Problems Begin

Wrong address on file? PIN goes to old location

Commercial registered agent? They might have control

Multiple owners? First one locks out others

Lost PIN after receipt? Can’t request another

Minot restaurant owner had three partners. First partner claimed the LLC online. Locked out the other two. Took weeks of calls to resolve.

The Commercial Registered Agent Complication

Here’s what North Dakota doesn’t advertise: Many commercial registered agents were given automatic access to client LLCs. Sounds helpful? It’s not.

The Problems This Creates:

- You request access → System says someone already owns it

- That “owner” → Your registered agent company

- They must approve → Could take days/weeks

- They don’t respond → You’re stuck

The Workaround:

Call the Secretary of State directly (701-328-4284) and explain the situation. They can sometimes override, but it requires patience and persistence.

Grand Forks LLC owner discovered Northwest Registered Agent had control of his LLC online. Northwest didn’t respond to access requests for two weeks. Almost missed Annual Report deadline.

The “Character of Business” Requirement That Gets Reports Rejected

North Dakota demands you be “specific” about your business purpose. But how specific? They won’t tell you.

What Gets Rejected:

- “Any lawful purpose”

- “General business”

- “Various activities”

- “LLC activities”

What Gets Approved:

- “Pizza restaurant in Fargo specializing in deep dish”

- “Residential property management in Bismarck”

- “Online marketing consulting for dental practices”

- “Buying, renovating, and selling single-family homes”

The stupid part: You can change this every year. So why the strictness? Revenue generation through rejection and re-filing.

Williston oil services LLC put “oilfield services.” Rejected for being too vague. Changed to “providing equipment maintenance and repair services to oil drilling operations in western North Dakota.” Approved.

The Management Section Confusion

North Dakota offers three management structures, but their system fights you on all of them:

Member-Managed (90% of LLCs):

- List all members

- Use title “Member” or “Managing Member”

- Addresses become public

Manager-Managed:

- List only managers

- Can’t list members

- Changing structure requires amendment

Board-Managed (The Unicorn):

- Rarely used

- System barely supports it

- Requires governors, not members

Privacy disaster: Whatever you enter becomes publicly searchable. Home addresses, names, everything.

Devils Lake LLC owner listed all five family members with home addresses. Within months: targeted sales calls, junk mail, and unwanted visitors.

The Farm/Ranch LLC Exception Nobody Knows About

Got agricultural operations? Different rules apply:

Farm/Ranch LLC Timeline:

- Initial Farm Report required at formation

- Annual Report due April 15 (not November)

- Different form in FirstStop

- Same penalties for late filing

The trap: Regular LLC doing some farming? Doesn’t count. Must be designated Farm/Ranch LLC from formation.

Jamestown LLC bought farmland thinking they’d qualify for Farm/Ranch status. Nope. November 15th deadline still applied. Found out the hard way.

The System Crashes and Glitches

FirstStop is held together with digital duct tape and prayer. Here’s what to expect:

Common Technical Disasters:

November 14-15: System overload, timeouts constant

Payment processing: Often shows failure despite charging card

PDF generation: Downloads corrupt files regularly

Session timeouts: Loses data mid-filing

Browser compatibility: Only Chrome works reliably

Survival Strategy:

- File in October (avoid the rush)

- Screenshot everything

- Save drafts externally

- Use Chrome exclusively

- Have backup payment method

The Late Filing Penalty Structure

Miss November 15th by even one minute? Here’s the damage:

Days 1-180 Late:

- $50 penalty (100% increase)

- Still fillable online

- Good standing lost

- Banking may be affected

Days 181-365:

- LLC revoked

- Must file reinstatement

- $235 minimum cost

- Potential name loss

Beyond 365 Days:

- Court order required

- Legal representation needed

- $2,000-5,000 typical cost

- No guarantee of reinstatement

Multi-LLC Management in North Dakota

Got multiple LLCs? FirstStop makes this unnecessarily painful:

The Complications:

- Each needs separate PIN

- No bulk filing option

- Same November 15th deadline

- One account can manage all (if you can get access)

Management Strategy:

- Request all PINs simultaneously

- Connect all LLCs in October

- File all reports same day

- Document everything

Dickinson real estate investor with six LLCs spent entire week just getting access to all of them. Two had wrong addresses. One was controlled by former partner. Nightmare.

The Paper Filing Alternative (Don’t Bother)

Technically, you can print and mail your Annual Report. Here’s why you shouldn’t:

Paper Filing Problems:

- Still must start online

- Longer processing time

- No immediate confirmation

- Higher error risk

- Check might get “lost”

- Still need PIN to start process

Only exception: International filers with payment issues. Everyone else should suffer through the online system.

When Professional Help Makes Sense

At $50, you’d think everyone should file their own Annual Report. But consider help if:

You Need Help When:

- PIN access is complicated

- Multiple LLCs to manage

- Prior revocation issues

- System repeatedly fails

- Time value exceeds hassle

Cost Analysis:

- DIY: $50 + hours of frustration

- Service: $125-175 total

- Value: Guaranteed compliance, zero PIN drama

Your North Dakota Annual Report Battle Plan

60 Days Before (September 15):

- Verify FirstStop access

- Request PIN if needed

- Update all addresses

- Gather management info

30 Days Before (October 15):

- Log into FirstStop

- File Annual Report

- Screenshot confirmation

- Save all downloads

Day Of (November 15):

- If not filed, panic appropriately

- File before 11:59 PM CT

- Pay the $50

- Pray system works

Day After:

- Verify filing success

- Download all documents

- Set next year’s reminder

- Celebrate survival

The Bottom Line on North Dakota Annual Reports

North Dakota’s Annual Report isn’t expensive or complicated in theory. In practice? The PIN requirement, FirstStop glitches, and November bottleneck create unnecessary chaos.

File in October. I cannot stress this enough. October filing avoids:

- System crashes

- Support unavailability

- Deadline panic

- Technical failures

- Stress-induced errors

The $50 fee is reasonable. The November 15th deadline is clear. But the PIN access system is garbage, and FirstStop barely functions under load.

Action Steps for Success

Right Now:

- Check if you have FirstStop access

- Find your LLC formation documents

- Locate PIN letter (if it exists)

- Set calendar reminders for October

If You Need a PIN:

- Request immediately (2-week delivery)

- Have backup plan if it doesn’t arrive

- Call state if problems arise

- Document all interactions

Every October:

- File between October 1-15

- Avoid November at all costs

- Keep confirmation forever

- Update calendar for next year

Final Reality Check

North Dakota’s Annual Report represents everything wrong with government technology. A simple $50 form becomes a complex battle with PINs, system crashes, and bureaucratic nonsense.

But here’s the thing: Missing it destroys your LLC. The state doesn’t care about your PIN problems, FirstStop failures, or November 14th system crashes. File on time or face the consequences.

Smart entrepreneurs file in October, document everything, and accept the system’s flaws as the cost of doing business in North Dakota.

Need help navigating the PIN nightmare? Northwest Registered Agent includes Annual Report filing assistance. For those who value sanity over $50, LegalZoom handles everything for about $125 total.

Questions about North Dakota’s Annual Report chaos? Comment below. I respond within 48 hours because November 15th doesn’t wait for anyone.

Remember: An LLC in Delaware isn’t magic. And a North Dakota LLC without Annual Report compliance isn’t an LLC after six months.

About Jake Lawson: 15+ years battling state filing systems across all 50 states. Over 1,200 businesses formed, 145+ in North Dakota. Former compliance consultant who’s spent countless hours on hold with Bismarck trying to solve PIN problems. I’ve seen FirstStop crash more times than a Windows 95 computer. Based in Austin, but I know North Dakota’s system well enough to navigate it blindfolded (which is sometimes easier than using FirstStop).