By Jake Lawson, LLC Formation Strategist

Getting an EIN for your Ohio LLC should cost exactly zero dollars and take about 10 minutes online. Yet I constantly meet entrepreneurs who paid $200+ to companies that simply filled out the same free government form you can complete yourself.

The confusion around EINs (Employer Identification Numbers) creates a perfect environment for scammers to prey on new business owners. They build official-looking websites, charge hefty fees, and provide nothing you can’t do yourself for free through the IRS website.

I’ve helped 300+ Ohio LLC owners get their EINs over the past decade, and I’m going to show you exactly how to do it right—plus the critical mistakes that can cost you time, money, and major headaches down the road.

What Is an EIN and Why Every Ohio LLC Needs One

An EIN (Employer Identification Number) is your LLC’s Social Security number for tax and business purposes. It’s a 9-digit identifier that the IRS assigns to your business entity for federal reporting and identification.

Don’t let the name confuse you: “Employer” doesn’t mean you need employees. Every legitimate business entity—even single-member LLCs with no employees—benefits from having an EIN.

Your Ohio LLC needs an EIN for:

- Opening business bank accounts (absolutely required)

- Filing federal tax returns

- Filing Ohio state tax returns (if applicable)

- Applying for business credit cards or loans

- Obtaining business licenses and permits

- Setting up payroll systems if you hire employees

- Building business credit separate from personal credit

- Professional credibility with vendors and clients

What an EIN is NOT:

- An Ohio state tax registration (that’s separate)

- Something issued by Ohio Secretary of State

- A business license or permit

- Proof that your LLC is legally formed

The EIN Scam Industry: Why People Pay for Free Services

Here’s the ugly truth: an entire industry exists to charge you for something the IRS provides free. These companies spend thousands on ads to appear in your search results, then charge $50-$300 for a 10-minute process.

Common EIN scam tactics:

- Websites designed to look like official government sites

- Claims that “professional assistance” is required

- “Expedited processing” fees (the IRS processes all EINs the same way)

- Scare tactics about “complicated government forms”

- Bait-and-switch pricing that adds fees during checkout

Red flags to avoid:

- Any website asking for payment before showing you the actual IRS form

- Claims that getting an EIN is “complex” or requires expertise

- “Express” services that cost extra

- Websites with URLs that aren’t IRS.gov

Jake’s rule: Never pay for free government services. The IRS EIN application is intentionally simple—you don’t need a middleman.

Ohio LLC EIN: Critical Timing Requirements

STOP: Do not apply for an EIN until your Ohio LLC is officially approved by the Ohio Secretary of State.

This is the most expensive mistake I see people make. Here’s the correct timeline:

Step 1: File Articles of Organization with Ohio Secretary of State

Step 2: Wait for approval (usually 1-3 business days for online filing)

Step 3: Verify your LLC appears in Ohio business records search

Step 4: THEN apply for your EIN with the exact approved LLC name

Why timing matters:

- EIN application must match your exact approved LLC name

- Name mismatches create banking and tax complications

- IRS verifies your business exists before issuing EIN

- Fixing mistakes later requires additional paperwork and delays

Exception: Professional formation services typically handle this timing correctly as part of their process.

Step-by-Step: Getting Your Ohio LLC EIN Online (Free)

Before You Start: Information You’ll Need

- Your approved Ohio LLC Articles of Organization

- LLC’s exact legal name (must match Ohio records perfectly)

- Your Social Security Number or ITIN

- LLC’s principal business address in Ohio

- Reason for applying (select “Started new business”)

- Number of LLC members

- Business activity description

The Free IRS Application Process

Step 1: Access the Official IRS Website

- Go to IRS.gov (not lookalike sites)

- Search for “Apply for EIN Online”

- Click “Apply Online” under Business section

Step 2: Verify Eligibility

- Confirm you have an SSN or ITIN

- Verify your Ohio LLC is approved and active

- Review eligibility requirements

Step 3: Select Entity Type

- Choose “Limited Liability Company (LLC)”

- Do NOT select “Sole Proprietorship” (even for single-member LLCs)

Step 4: Enter LLC Information

- Legal name: Exactly as shown in Ohio records (including “LLC”)

- Trade name: Leave blank unless you use a DBA

- Principal business address: Your LLC’s main Ohio address

- Mailing address: Where IRS should send correspondence

- County and state: Select Ohio county where LLC operates

- Country: United States

Step 5: Responsible Party Details

- Enter your personal information as the “Responsible Party”

- Use your SSN or ITIN

- This person receives all official IRS communications

Step 6: Business Classification

- Select the category that best describes your business activities

- Choose “Other” if your business doesn’t fit standard categories

- Provide brief, specific description of business purpose

Step 7: LLC Specifics

- Number of members: 1 for single-member, 2+ for multi-member

- Tax classification: Accept default (don’t elect special treatment unless advised by CPA)

- Business start date: When you plan to begin operations

- Employee projection: Enter 0 if you won’t have employees initially

Step 8: Submit and Receive

- Carefully review all information for accuracy

- Submit the completed application

- Receive your EIN immediately (online applications only)

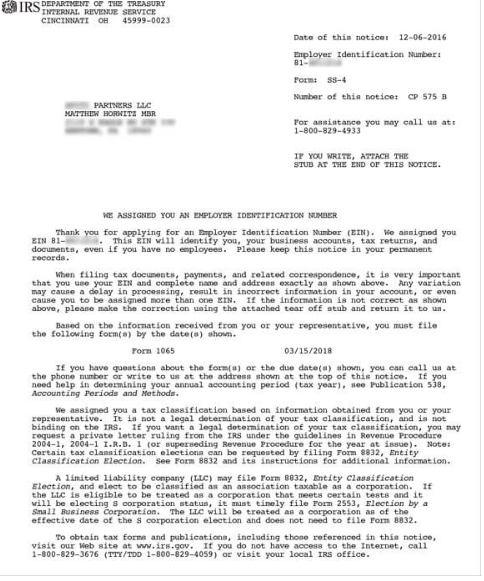

- Download and save EIN Confirmation Letter (CP 575) immediately

Total time required: 10-15 minutes with proper preparation

Non-US Residents: Alternative EIN Process for Ohio LLCs

If you don’t have an SSN or ITIN, you can still get an EIN for your Ohio LLC, but you must use the paper process:

Form SS-4 by Fax or Mail:

- Download Form SS-4 from IRS.gov

- Complete all sections accurately

- Fax to: 855-641-6935 (faster processing)

- Mail to: IRS processing center (4-6 weeks processing time)

Important notes for non-US residents:

- You don’t need to hire a “third-party designee” (despite claims by service companies)

- Your Ohio LLC must be approved before submitting SS-4

- Include a cover letter explaining your non-US resident status

- Processing takes longer, so plan accordingly

Ohio-Specific EIN Considerations

Ohio State Income Tax

Unlike some states, Ohio has state income tax that affects your EIN usage:

- LLC income tax: Ohio taxes LLC income at entity level (different from many states)

- Pass-through taxation: Members also report LLC income on personal returns

- Commercial Activity Tax (CAT): Applies to LLCs with gross receipts over $150,000

- Municipal taxes: Many Ohio cities have local income taxes

Ohio Business Registration

Your federal EIN is separate from Ohio state business registration:

- Ohio Business Gateway: Register at business.ohio.gov for state tax purposes

- Different ID numbers: Federal EIN vs. Ohio state tax account number

- Required for most businesses: Ohio registration usually required regardless of income

- Timeline: Can register for Ohio taxes immediately after getting federal EIN

Banking in Ohio

Ohio has strong regional banking options for LLCs:

Recommended Ohio banks for business accounts:

- Huntington Bank: Strong Ohio presence, good small business support

- Fifth Third Bank: Regional focus, competitive business banking rates

- KeyBank: Extensive Ohio branch network, solid online banking

- Local credit unions: Often better rates and more personalized service

Common Ohio LLC EIN Mistakes (And How to Avoid Them)

Mistake 1: Applying Before LLC Approval

The problem: LLC name on EIN doesn’t match approved name

The consequence: Banks reject your EIN, tax filing complications

The fix: Wait for Ohio Secretary of State approval before applying

Prevention: Always verify LLC status in Ohio business records first

Mistake 2: Wrong Entity Type Selection

The problem: Choosing “Sole Proprietorship” instead of “LLC”

The consequence: EIN attached to you personally, not your LLC

The fix: Apply for new EIN with correct entity type, cancel old one

Prevention: Always select “Limited Liability Company” regardless of member count

Mistake 3: Incorrect Member Count

The problem: Confusion about single vs. multi-member classification

The consequence: Wrong tax treatment and filing requirements

The fix: Determine correct classification, may need new EIN

Prevention: Count all LLC owners, including spouses in non-community property states

Mistake 4: Name Mismatches with Ohio Records

The problem: EIN name doesn’t exactly match Ohio Secretary of State records

The consequence: Banking problems, potential tax issues

The fix: Apply for new EIN with exact name match

Prevention: Copy LLC name exactly from Ohio business records

Mistake 5: Losing EIN Documentation

The problem: Can’t locate EIN Confirmation Letter when needed

The consequence: Delays in banking, licensing, and tax filings

The solution: Request EIN Verification Letter (147C) from IRS

Prevention: Save multiple digital and physical copies immediately

Single-Member vs. Multi-Member Ohio LLCs

Single-Member Ohio LLCs

- EIN requirement: Technically optional, practically essential

- Tax treatment: Default “disregarded entity” (taxed like sole proprietorship)

- Ohio taxes: May still owe Ohio business taxes depending on income

- Benefits of EIN: Banking, privacy, identity protection, business credit

- Tax filing: Business income/expenses on personal tax return

Multi-Member Ohio LLCs

- EIN requirement: Mandatory under federal tax law

- Tax treatment: Default partnership taxation

- Ohio taxes: Entity-level tax plus pass-through to members

- Tax filing: Form 1065 partnership return plus individual K-1s

- Complexity: Usually requires professional tax preparation

Ohio LLC Banking After Getting Your EIN

Once you have your EIN, business banking becomes straightforward:

Required documents for Ohio banks:

- EIN Confirmation Letter (CP 575)

- Ohio Articles of Organization (certified copy preferred)

- Operating Agreement (especially for multi-member LLCs)

- Personal ID for all account signers

- Initial deposit ($50-$500 depending on bank)

Ohio banking tips:

- Call ahead to confirm exact document requirements

- Ask about fee waivers for new Ohio businesses

- Inquire about business checking account promotions

- Set up online banking and mobile deposit immediately

- Consider business credit card from same bank for streamlined relationship

Husband and Wife Ohio LLCs

Ohio is not a community property state, which affects tax options for married couples:

Available tax treatments:

- Partnership taxation: Default treatment (most common)

- Corporate election: S-Corp or C-Corp taxation (complex, requires election)

NOT available in Ohio:

- Qualified Joint Venture: Only available in community property states

- Single-member treatment: Not allowed for husband-wife LLCs in Ohio

Recommendation: Most married couples should accept default partnership taxation unless advised otherwise by a CPA familiar with Ohio tax law.

Maintaining Your Ohio LLC EIN

Annual Tax Obligations

- Federal taxes: Required for all LLCs (form depends on classification)

- Ohio state taxes: LLC entity tax plus individual member obligations

- Municipal taxes: May apply depending on LLC location and member residence

- Quarterly estimates: Often required for profitable Ohio LLCs

Record Keeping Requirements

- EIN documentation: Keep multiple copies of confirmation letter

- Separate banking: Never mix LLC and personal finances

- Business records: Maintain for minimum 7 years

- Ohio-specific records: Keep state tax filings and CAT returns

Changes Affecting Your EIN

- Member changes: Adding/removing members may require new EIN

- Tax elections: S-Corp election requires notification to IRS

- Business dissolution: Cancel EIN when closing LLC permanently

- Structure changes: Converting to corporation requires new EIN

Ohio Sales Tax and Other State Requirements

Ohio Sales Tax Registration

If your LLC sells taxable goods or services:

- Separate registration: Not connected to your federal EIN

- Ohio Business Gateway: Register at business.ohio.gov

- Vendor’s license: Required for most retail sales

- Use your EIN: Federal EIN required for Ohio sales tax registration

Other Ohio Business Requirements

- Workers’ compensation: Required if hiring employees

- Unemployment insurance: Mandatory for Ohio employers

- Professional licenses: Industry-specific requirements

- Municipal licenses: Many Ohio cities require local business registration

Frequently Asked Questions

Do I Need an EIN for a Single-Member Ohio LLC?

While technically optional, I strongly recommend it. You’ll need an EIN for business banking, and it provides privacy protection by keeping your SSN off business documents.

Can I Use My SSN Instead of Getting an EIN?

For single-member LLCs, yes, but it’s not advisable. Using your SSN for business purposes increases identity theft risk and complicates business credit building.

How Long Does It Take to Get an Ohio LLC EIN?

Online applications: Immediate approval during IRS business hours Form SS-4 by fax: 1-2 weeks Form SS-4 by mail: 4-6 weeks

What If I Made a Mistake on My EIN Application?

Minor errors can sometimes be corrected by calling the IRS. Major mistakes typically require canceling the EIN and applying for a new one.

Do I Need a New EIN If I Add or Remove LLC Members?

Usually yes. Changing from single-member to multi-member (or vice versa) typically requires a new EIN because it changes your tax classification.

Can I Get an EIN Before Forming My Ohio LLC?

No, don’t do this. The IRS requires your LLC to exist before issuing an EIN. Apply only after Ohio Secretary of State approves your LLC.

The Bottom Line on Ohio LLC EINs

Getting an EIN for your Ohio LLC is free, fast, and essential for legitimate business operations. The process takes 15 minutes online if you’re prepared, and it opens doors to business banking, credit, and professional credibility.

Key takeaways:

- Always free: Never pay for EIN services from third parties

- Wait for LLC approval: Don’t apply until Ohio approves your LLC

- Save documentation: Keep multiple copies of your EIN letter

- Open business banking: Separate business and personal finances immediately

- Understand Ohio taxes: Ohio has unique state tax requirements

Complete Ohio LLC setup timeline:

- Form LLC with Ohio Secretary of State (1-3 business days)

- Get federal EIN from IRS (15 minutes online)

- Register with Ohio Business Gateway (immediate online)

- Open business bank account (same day with proper documents)

- Obtain required licenses and permits (varies by business)

Total setup time: 1-2 weeks for complete business registration

Ohio’s business-friendly environment, combined with the IRS’s streamlined EIN process, makes it straightforward to get your business up and running quickly. Don’t let scam companies complicate or overcharge for something you can easily do yourself.

The key is preparation, accuracy, and following the correct sequence. Your Ohio LLC needs an EIN to function professionally—get it done right the first time, and don’t pay a penny more than necessary (which is zero).

Ready to form your Ohio LLC and get your EIN? Check out my complete Ohio LLC formation guide and step-by-step state comparison at llciyo.com.

About Jake Lawson: With 15+ years helping entrepreneurs navigate U.S. business formation, Jake has guided over 1,200 successful LLC launches. His practical approach focuses on avoiding scams while ensuring proper compliance from day one.