Jake Lawson here. After helping over 1,200 entrepreneurs launch their businesses, I’ve learned that getting an EIN for your Pennsylvania LLC is one of those tasks that seems intimidating but is actually pretty straightforward—if you know the right process. The IRS provides these for free in about 15 minutes online, yet I still see people paying $200+ for “premium processing” of something that’s already instant. Let me show you exactly how to get your Pennsylvania LLC’s Federal Tax ID Number the right way.

Your Pennsylvania LLC needs an EIN (Employer Identification Number) for virtually every business activity: opening bank accounts, filing taxes, establishing business credit, applying for licenses. Think of it as your LLC’s Social Security Number with the federal government.

The process is free, fast, and standardized across all states—but there are timing considerations and scams to avoid. Let me walk you through everything you need to know.

What Is an EIN and Why Your Pennsylvania LLC Needs One

An EIN is a unique nine-digit identifier that the IRS assigns to your LLC for tax and identification purposes. It separates your business identity from your personal identity in the federal system.

Also known as:

- Federal Tax ID Number

- Federal Employer Identification Number (FEIN)

- Tax Identification Number

Key distinction: Your EIN comes from the IRS (federal government), not from the Pennsylvania Department of State. It’s completely separate from any Pennsylvania state tax numbers or registrations.

Essential Uses for Your Pennsylvania LLC’s EIN

Business Banking: No legitimate bank will open a business account without an EIN. Using your personal accounts for business transactions destroys your LLC’s liability protection.

Business Credit: Credit cards, loans, and lines of credit require an EIN to establish credit in your business name instead of personally.

Tax Filing: While single-member LLCs can technically use your SSN, having an EIN keeps business and personal finances clearly separated.

Licensing: Most Pennsylvania business licenses require an EIN on applications.

Payroll: Mandatory if you ever hire employees for payroll tax purposes.

Identity Protection: Using your SSN for business purposes increases identity theft risk. Your EIN provides a protective buffer.

Critical Timing: When to Apply for Your EIN

Golden rule: Wait until your Pennsylvania LLC is officially approved before applying for your EIN.

Here’s why this timing matters: Your EIN application must exactly match your approved LLC name. If you apply before approval and your name gets rejected or changed, you’ll need to cancel the EIN and start over—creating unnecessary complications.

The correct sequence:

- File Pennsylvania Certificate of Organization

- Wait for approval from Pennsylvania Department of State

- Apply for EIN using your exact approved LLC name

How to Get Your EIN for Free (The Right Way)

The IRS provides EINs at no cost. Any service charging you money is adding markup to something you can do yourself in 15 minutes.

For U.S. Citizens and Residents (With SSN or ITIN)

Step 1: Access the Official IRS Website Go to IRS.gov and search for “Apply for EIN Online.” Verify you’re on the official .gov site—scam sites use similar-looking domains.

Step 2: Begin the Online Application Click “Apply Online Now” and follow the prompts. You’ll need:

- Your Social Security Number or ITIN

- Your Pennsylvania LLC’s exact legal name (as approved by the state)

- Your LLC’s principal business address

- Reason for applying (select “Started new business”)

Step 3: Complete the Application Form Take your time with each section. Double-check everything—errors can cause delays or require cancellation and reapplication.

Step 4: Receive Immediate EIN At completion, you’ll get your EIN instantly.

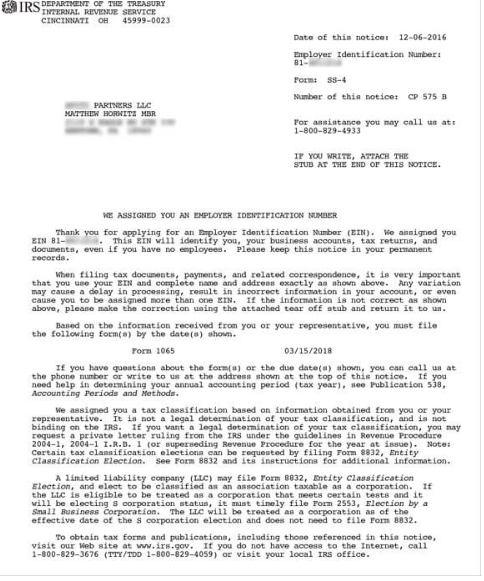

Critical step: Download and save your EIN Confirmation Letter (CP 575) immediately. This document cannot be reissued.

Time required: 10-15 minutes

Cost: $0

For Non-U.S. Residents (Without SSN or ITIN)

International entrepreneurs can still get EINs for Pennsylvania LLCs—you just can’t use the online application.

Step 1: Download Form SS-4 Get the paper application from IRS.gov. It contains the same information as the online form.

Step 2: Complete Form SS-4 Fill out all required sections. On line 7b (SSN/ITIN), write “Foreign” if you don’t have either number.

Step 3: Submit via Fax or Mail

- Fax: 855-641-6935 (faster processing)

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

Step 4: Wait for Processing Processing takes 1-2 weeks by fax, 4-6 weeks by mail. You’ll receive your EIN Confirmation Letter by mail.

Important note: Ignore advice about needing a “third-party designee.” That’s a common scam targeting international business owners. You can do this yourself.

Common EIN Mistakes That Waste Time and Money

After guiding over 1,000 entrepreneurs through this process, these are the mistakes I see repeatedly:

Mistake #1: Applying Too Early

Applying before your LLC is approved can create name mismatches requiring cancellation and reapplication. Be patient—wait for state approval first.

Mistake #2: Name Inconsistencies

Your EIN application must use the exact LLC name approved by Pennsylvania. “Smith Consulting LLC” and “Smith Consulting, LLC” are different to the IRS, even if Pennsylvania accepts both variations.

Mistake #3: Wrong Entity Classification

When asked about business type, select “LLC”—not “Corporation” or “Partnership.” This determines how the IRS expects you to file taxes.

Mistake #4: Paying for Unnecessary Services

The free online application is already instant for eligible applicants. Don’t pay $100-$300 for something that’s already fast and free.

Mistake #5: Not Preserving the Confirmation Letter

The IRS won’t reissue your original EIN Confirmation Letter. If you lose it, you’ll need to request an EIN Verification Letter (which takes weeks and serves the same purpose).

After Getting Your EIN: Next Steps

Open Your Business Bank Account

Your EIN Confirmation Letter is required for business banking. Banks also typically want:

- Copy of your Pennsylvania Certificate of Organization

- LLC Operating Agreement (even if not legally required)

- Government-issued photo ID

Pennsylvania banking recommendations:

- Local community banks: Often provide better small business service

- Credit unions: Frequently offer lower fees and better rates

- Major national banks: Convenient for multi-state operations

- Online banks: Good for basic banking with minimal fees

Establish Business Credit

With your EIN, start building credit in your business name:

- Apply for business credit cards

- Establish trade credit accounts with suppliers

- Build a business credit profile separate from personal credit

Understand Tax Obligations

Your EIN registers your LLC for federal tax purposes. Pennsylvania LLCs follow standard pass-through taxation:

- Single-member LLCs: Report on owner’s personal tax return (Schedule C)

- Multi-member LLCs: File Form 1065 partnership return; profits/losses pass through to members’ personal returns

Pennsylvania-Specific Tax and Licensing Considerations

State Tax Requirements

Your federal EIN is separate from Pennsylvania state obligations. Depending on your business, you may also need:

- Pennsylvania sales tax license

- Pennsylvania withholding account (for employees)

- Philadelphia business privilege license (if operating in Philadelphia)

- Industry-specific state registrations

Local Business Licenses

Many Pennsylvania municipalities require business licenses. Your EIN is typically required on these applications, so having it first streamlines the licensing process.

Workers’ Compensation

If you hire employees in Pennsylvania, workers’ compensation insurance is mandatory. Your EIN is required for coverage applications.

Married Couples: Special Tax Considerations

Pennsylvania is not a community property state, so married couples operating an LLC together are automatically treated as a multi-member LLC (partnership) for federal tax purposes.

This means:

- Must file Form 1065 (partnership return)

- Each spouse receives K-1 showing their share of profits/losses

- Cannot elect “qualified joint venture” status (only available in community property states)

Troubleshooting EIN Problems

Lost Your EIN?

If you lose your EIN Confirmation Letter, request an EIN Verification Letter (Form 147C) from the IRS. It serves the same purpose but takes 2-4 weeks to receive.

Incorrect Information on EIN?

Minor errors might be correctable by calling the IRS. Major errors (like wrong business structure) may require canceling the EIN and applying for a new one.

Applied Before LLC Approval?

If your LLC gets approved with the exact name you used on the EIN application, you’re fine. If the name changes, cancel the old EIN and apply for a new one with the correct name.

Red Flags and Scams to Avoid

“Instant EIN Services” Charging $200+: The official online application is already instant and free for eligible applicants.

“EIN Renewal” Notices: EINs don’t expire. These are scam letters trying to collect unnecessary fees.

Third-Party Services for International Applicants: Non-residents don’t need to pay someone to file Form SS-4. You can do it yourself.

Fake IRS Websites: Always verify you’re on IRS.gov. Scam sites use similar domains to steal personal information and money.

Your Pennsylvania LLC EIN Action Plan

Step 1: Confirm LLC Approval Verify your Pennsylvania LLC is officially approved and you have confirmation documentation.

Step 2: Gather Required Information

- Your SSN or ITIN (if you have one)

- Exact LLC name as approved by Pennsylvania

- LLC address and phone number

- Name and SSN of the responsible party (usually you)

Step 3: Apply Through Appropriate Channel

- With SSN/ITIN: Use free IRS online application

- Without SSN/ITIN: Complete and fax Form SS-4

Step 4: Save Your Confirmation Download/receive and safely store your EIN Confirmation Letter.

Step 5: Establish Business Banking Use your EIN to open business bank accounts and establish business credit.

IRS Contact Information (When You Need Human Help)

Phone: 1-800-829-4933

Hours: 7:00 AM – 7:00 PM, Monday-Friday

To reach a live person:

- Press 1 for English

- Press 1 for Employer Identification Numbers

- Press 3 for “If you already have an EIN but can’t remember it”

(Option 3 is the only path to a human representative, regardless of your actual issue)

Pro tip: Call right at 7:00 AM to minimize hold times.

Pennsylvania Business Environment Context

Pennsylvania offers a solid environment for LLCs:

- No publication requirement (unlike New York)

- Reasonable filing fees compared to other northeastern states

- Business-friendly regulations in most industries

- Access to major markets (NYC, Philadelphia, DC corridor)

The state’s diverse economy—from tech in Pittsburgh to finance in Philadelphia—provides opportunities across multiple sectors.

The Bottom Line on Pennsylvania LLC EINs

Getting an EIN for your Pennsylvania LLC is straightforward, free, and essential for legitimate business operations. The key is proper timing (after LLC approval), using official IRS channels, and avoiding the numerous scams targeting new business owners.

Don’t overthink this step, but don’t skip it either. Your EIN is required for virtually every other business activity you’ll need to undertake.

Ready to Get Your Pennsylvania LLC EIN Right?

Need help navigating the EIN application process or guidance on the next steps for your Pennsylvania LLC? I’ve walked hundreds of Pennsylvania entrepreneurs through federal requirements and can help you avoid the common pitfalls that delay business launch.

That’s exactly why I built llciyo.com—to provide business owners with practical, tested advice about LLC formation and federal requirements, without the sales pressure or unnecessary upsells.

Because getting your EIN should be quick and painless, not a source of stress or unexpected expense.

Jake Lawson has guided over 1,200 entrepreneurs through U.S. business formation, including hundreds of Pennsylvania LLCs. He’s helped clients navigate federal requirements, avoid EIN scams, and establish proper business banking relationships. Independent advice, no affiliate pressure, just the facts about getting your Federal Tax ID Number right.