Jake Lawson here. I’ve helped 90+ entrepreneurs form South Carolina LLCs, and I can tell you this: the Palmetto State makes LLC formation straightforward and affordable. Here’s exactly how to file your Articles of Organization the right way.

Ready to make your South Carolina LLC official? You’ve come to the right place. South Carolina offers one of the most user-friendly LLC formation processes in the country, with reasonable fees and fast processing times.

The bottom line: For $125 online (or $110 by mail), you can have your South Carolina LLC approved in 1-2 business days. The process is straightforward, but the details matter if you want to avoid delays or rejections.

Let me walk you through both filing options so you can choose the best path for your situation.

South Carolina LLC Filing: Your Options

Option 1: Online Filing (Recommended)

- Cost: $125

- Processing time: 1-2 business days (often same day)

- Payment: Credit/debit card

- Convenience: Complete from anywhere, immediate confirmation

Option 2: Mail Filing

- Cost: $110 (saves $15)

- Processing time: 3-4 business days plus mail time

- Payment: Check or money order

- Requirements: Two copies of form, self-addressed stamped envelope

Jake’s recommendation: Unless you’re really tight on cash, go with online filing. The extra $15 buys you speed, convenience, and immediate confirmation. Time is usually worth more than $15 to busy entrepreneurs.

Before You File: Essential Preparation

1. Verify Your LLC Name Availability

Critical step: Search South Carolina’s business database before falling in love with a name.

South Carolina naming requirements:

- Must include “LLC,” “L.L.C.,” “Limited Liability Company,” “LC,” or “L.C.”

- Cannot be identical to existing business names

- Cannot be deceptively similar to existing names

From my experience: About 30% of first-choice names aren’t available. Have 2-3 backup options ready.

2. Choose Your Registered Agent

Required: Every South Carolina LLC needs a registered agent with a South Carolina street address.

Your options:

- Yourself: Free, but your address becomes public record

- Professional service: $50-200/year, keeps your address private

- Attorney or friend: Must have South Carolina address and agree to serve

Jake’s registered agent strategy: If you live in South Carolina and don’t mind your address being public, serve as your own agent. Otherwise, hire a professional service for privacy and reliability.

3. Decide on Management Structure

Member-managed: All owners participate in daily operations (most common)

Manager-managed: Designated managers run the business, other members are passive investors

Most South Carolina LLCs choose member-managed unless they have silent partners or complex ownership structures.

Step-by-Step: Online Filing Process

Getting Started

Create Your Account:

- Visit South Carolina’s Online Business Filing System

- Register with email and create secure password

- Verify email address through confirmation link

- Set up security questions

Begin Your Filing:

- Click “Start a New Business Filing”

- Search your desired LLC name for availability

- If available, click “Add New Entity”

Completing Your Articles of Organization

Section 1: Entity Type

Most filers select: “Yes Domestic Entity”

Select this if: You’re forming a new LLC in South Carolina

Select “No Foreign Entity” only if: You already have an LLC in another state and want to register it to do business in South Carolina

Section 2: Business Type

Select: “Limited Liability Company” from dropdown

Then click: “Start Filing” next to “Articles of Organization”

Section 3: Contact Information

Provide: Your contact details for state communications

Note: This is for filing purposes only, not public record

Section 4: LLC Name

Enter your LLC name exactly as desired:

- Include proper capitalization

- Add designator: “LLC,” “L.L.C.,” “L.C.,” or “LC”

- Most entrepreneurs choose “LLC” for simplicity

Jake’s naming tip: Be consistent with capitalization. If you want “Charleston Marketing LLC,” don’t accidentally type “charleston marketing LLC.”

Section 5: Registered Agent Information

Required details:

- Full name of registered agent

- Complete South Carolina street address (no P.O. boxes)

- City, state, ZIP code

If using yourself:

- Enter your name and South Carolina address

- Understand this becomes public record

If using a service:

- Enter the service company name and address

- Make sure you’ve already arranged service

Section 6: Initial Designated Office

This is your LLC’s official business address:

- Must be a South Carolina street address

- Can be your home, office, or any South Carolina address

- Doesn’t have to be where you actually operate

Common options:

- Your home address

- Your actual business office

- Your registered agent’s address (if they allow it)

Section 7: Management Structure

For member-managed LLCs (most common):

- Leave the “LLC has managers” box unchecked

- This means all members manage the business

For manager-managed LLCs:

- Check the “LLC has managers” box

- Enter manager contact information in the fields that appear

Jake’s management advice: Unless you have passive investors or complex structures, stick with member-managed. It’s simpler and gives you more flexibility.

Section 8: Member Liability (Optional)

For most LLCs: Leave this blank

This section asks: If LLC members will be personally liable for business debts

Jake’s liability note: The whole point of an LLC is limiting personal liability. Unless you have very specific reasons (and legal advice), don’t check this box.*

Section 9: Company Term

For ongoing businesses: Leave blank for perpetual existence

For temporary ventures: Check box and enter dissolution date

Most entrepreneurs choose perpetual existence for maximum flexibility

Section 10: Effective Date

For immediate formation: Leave blank (LLC becomes effective when approved)

For future start date: Enter specific date (up to 90 days ahead)

Strategic timing considerations:

- If filing late in the year and don’t need LLC immediately, consider January 1st effective date

- Avoids partial-year tax complications

- Simplifies first-year accounting

Section 11: Organizer Information

Required: Name and address of person filing the documents

Note: Organizer doesn’t automatically become an LLC member

Digital signature process:

- Select “Organizer” from dropdown

- Check agreement box

- Type your full name as electronic signature

Tax Classification (CL-1 Form)

Default tax treatment:

- Single-member LLC: Taxed as sole proprietorship

- Multi-member LLC: Taxed as partnership

If electing S-Corp or C-Corp taxation:

- Must also file Form CL-1 with South Carolina Department of Revenue

- Consider consulting accountant for tax implications

Jake’s tax advice: Most new LLCs should stick with default taxation unless you have specific tax strategy reasons to elect corporate taxation.

Payment and Submission

Review everything carefully:

- LLC name spelling and capitalization

- All addresses complete and accurate

- Management structure selection

- Effective date if specified

Submit payment:

- $125 filing fee

- Credit or debit card accepted

- Transaction processed immediately

Confirmation:

- Save confirmation number

- Keep receipt for records

- State will email when approved

Mail Filing Process (If You Prefer)

Required Documents:

- Two identical copies of completed Articles of Organization

- $110 filing fee (check or money order payable to “South Carolina Secretary of State”)

- Self-addressed stamped envelope for return documents

Mailing Address:

Secretary of State

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

What You’ll Receive Back:

- Stamped and approved Articles of Organization

- Filing receipt

- Processing time: 3-4 business days plus mail time

Jake’s mail filing tip: Use a medium envelope if documents don’t fit in standard business envelope. Include proper postage for return envelope based on document weight.

After Filing: What to Expect

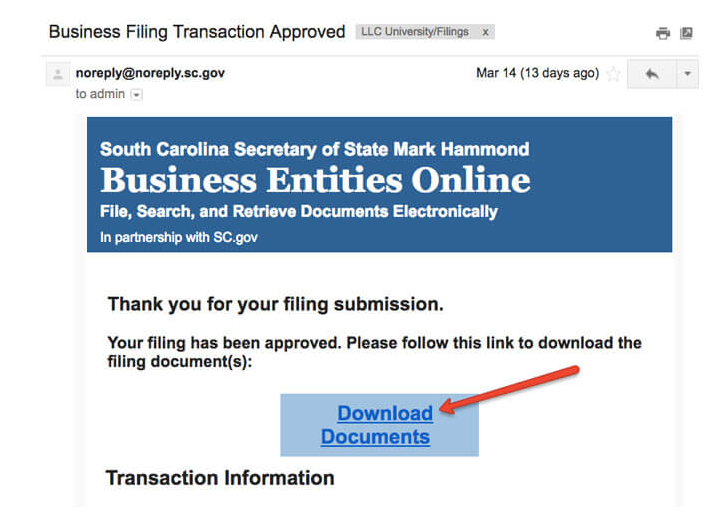

Online Filing Approval:

Timeline: 1-2 business days (often same day)

Notification: Email with download link

Documents received:

- Approved Articles of Organization

- Filing receipt

- Option to purchase certified copies

If Your Filing Is Rejected:

Common rejection reasons:

- Name not available or improperly formatted

- Incomplete address information

- Missing required information

- Improper designator

Next steps:

- Review rejection explanation

- Correct errors

- Refile (may require new filing fee)

From my experience: 95% of rejections are due to name conflicts or incomplete addresses. Double-check these before submitting.

Getting Certified Copies:

When you might need them:

- Opening business bank accounts

- Applying for business licenses

- Real estate transactions

- Professional licensing

Cost: Small additional fee

Convenience: Available immediately after online approval

Common South Carolina LLC Filing Mistakes

Mistake 1: Not Checking Name Availability Thoroughly

Problem: Filing with unavailable name

Solution: Search variations and similar names, not just exact matches

Mistake 2: Using P.O. Box for Registered Agent

Problem: Registered agent address rejected

Solution: Must use physical South Carolina street address

Mistake 3: Inconsistent Information

Problem: Different addresses or names in various sections

Solution: Review entire form before submitting

Mistake 4: Wrong Management Structure

Problem: Selecting manager-managed when meaning member-managed

Solution: Understand the difference before choosing

Mistake 5: Incomplete Address Information

Problem: Missing apartment numbers, suite numbers, or ZIP codes

Solution: Include complete, accurate addresses throughout

Jake’s quality control tip: Have someone else review your form before submitting. Fresh eyes catch mistakes you might miss.

Post-Formation Action Items

Immediate Next Steps (First 30 Days):

- Apply for EIN from IRS (required for banking and taxes)

- Create Operating Agreement (even single-member LLCs should have one)

- Open business bank account (separate business and personal finances)

- Get business insurance (general liability at minimum)

Ongoing Compliance:

Good news: South Carolina LLCs don’t have annual report requirements Still required:

- Annual tax filings

- Maintain registered agent

- Keep business records current

- File amended Articles if major changes occur

South Carolina LLC Advantages

Why Entrepreneurs Choose South Carolina:

- No annual report requirement (saves time and money)

- Reasonable filing fees ($110-125)

- Fast processing times (1-2 days online)

- Business-friendly legal environment

- No publication requirements (unlike some states)

Cost Comparison with Other States:

- South Carolina: $125 (online)

- Delaware: $90 + $300 annual tax

- Nevada: $425 + $325 annual fee

- Florida: $125 + $138.75 annual report

- North Carolina: $125 + $200 annual report

Jake’s state selection advice: South Carolina offers excellent value with low ongoing costs. The no-annual-report requirement is especially attractive for small businesses.

When to Get Professional Help

DIY Makes Sense If:

- You’re forming a straightforward single or multi-member LLC

- You understand the management structure options

- You’re comfortable with online forms

- You have time to handle the process

Consider Professional Help If:

- You have complex ownership structures

- You’re unsure about tax elections

- You want ongoing compliance support

- You value convenience over cost savings

Professional service costs:

- Basic filing service: $200-400 (including state fees)

- Full-service packages: $500-800 (including registered agent, EIN, operating agreement)

My philosophy: Professional services don’t do anything you can’t do yourself, but they handle details and provide ongoing support that many entrepreneurs find valuable.

South Carolina-Specific Considerations

No Franchise Tax:

Unlike Delaware and some other states, South Carolina doesn’t impose annual franchise taxes on LLCs

Business-Friendly Courts:

South Carolina has developed business-friendly legal precedents that favor entrepreneurs

Economic Development Incentives:

The state offers various tax incentives for businesses in certain industries or locations

Professional Services:

Strong network of business attorneys, accountants, and consultants familiar with South Carolina requirements

Final Thoughts: Launching Your South Carolina LLC

South Carolina makes LLC formation refreshingly straightforward. The state wants your business and makes it easy to get started. Whether you’re launching a Charleston tech startup, opening a Greenville restaurant, or starting a Columbia consulting practice, the formation process won’t be your biggest challenge.

My approach: Get the paperwork done efficiently so you can focus on what really matters—building your business.

Action plan:

- Choose and verify your LLC name

- Arrange registered agent service (if not serving yourself)

- File Articles of Organization online

- Apply for EIN immediately after approval

- Open business bank account

- Create Operating Agreement

- Get appropriate business insurance

The business community in South Carolina is welcoming and supportive. Don’t let formation paperwork delay your entrepreneurial dreams—but do it right the first time.

Ready to file? Follow the step-by-step process above, double-check your information, and submit with confidence. Your South Carolina LLC will be approved and ready for business before you know it.

About Jake Lawson: I’ve guided over 1,200 entrepreneurs through LLC formation, including 90+ South Carolina businesses. My goal is simple: help you navigate the formation process efficiently so you can focus on building your business.

Need ongoing South Carolina business support? Check out our comprehensive South Carolina LLC guide, or browse our reviews of the top LLC formation and registered agent services for 2025.

This guide covers standard South Carolina LLC formation. Some industries have additional licensing requirements. Consider consulting with a South Carolina business attorney for regulated industries or complex ownership structures.