By Jake Lawson, LLC Formation Strategist

Listen, I’ve guided over 1,200 entrepreneurs through the EIN maze, and here’s what I tell everyone: getting your Federal Tax ID for a South Dakota LLC isn’t rocket science—but the IRS sure makes it feel that way sometimes.

The good news? I’m about to walk you through the entire process, step-by-step, so you can get your EIN without the headache (or the overpriced “services” that charge $200 for something that’s completely free).

What Exactly Is an EIN? (And Why Your LLC Is Gasping Without One)

Think of your EIN (Employer Identification Number) as your LLC’s Social Security Number. It’s a unique 9-digit identifier that the IRS assigns to your South Dakota LLC, formatted like this: 12-3456789.

Here’s the thing most people don’t realize: your EIN isn’t issued by South Dakota’s Secretary of State. Nope. It comes straight from the IRS in Washington, D.C. The state handles your LLC formation, but Uncle Sam handles your tax identity.

I like to tell my clients that an EIN is like oxygen for your business—technically, you might survive without it for a hot minute, but you definitely won’t thrive.

EIN Goes by Many Names (Don’t Let This Confuse You)

The IRS loves their acronyms, and your Federal Tax ID has more aliases than a spy novel:

- EIN (Employer Identification Number)

- FEIN (Federal Employer Identification Number)

- Federal Tax ID Number

- Federal Tax Identification Number

- Business Tax ID

They all mean the exact same thing. Don’t get thrown off when your bank asks for your “FEIN” and you only see “EIN” on your paperwork—it’s all the same identifier.

Quick clarification: Your federal EIN is completely different from any South Dakota state tax ID you might need from the Department of Revenue. Think of them as your federal passport vs. your state driver’s license—different purposes, different agencies.

Why Your South Dakota LLC Actually Needs an EIN (Spoiler: It’s Not Just About Taxes)

After working with hundreds of South Dakota LLCs, I can tell you that an EIN unlocks doors you didn’t even know were closed. Here’s what becomes possible once you have your federal tax ID:

Banking (This One’s Non-Negotiable)

Try opening a business bank account without an EIN. Go ahead, I’ll wait.

Every legitimate bank in America will ask for your EIN confirmation letter. Your personal SSN won’t cut it for business banking—and mixing personal and business finances is like playing Russian roulette with your liability protection.

Business Credit and Lending

Want a business credit card? Business loan? Line of credit? Your EIN is the golden ticket. Lenders use it to evaluate your business credit profile separately from your personal credit.

Professional Licensing and Permits

Many business licenses and permits require an EIN during the application process. Whether you’re opening a restaurant in Sioux Falls or a consulting firm in Rapid City, that 9-digit number is going on your paperwork.

Payroll and Employment

Planning to hire employees? Your EIN becomes mandatory for payroll taxes, workers’ compensation, and unemployment insurance. Even if you’re starting solo, get the EIN now—trust me on this one.

Tax Filing (The Obvious One)

Federal tax returns, South Dakota state returns (if applicable), quarterly filings—your EIN ties everything together in the IRS system.

The Real Cost of Getting an EIN (Hint: It Should Be $0)

Here’s where I get a little fired up: the IRS charges exactly $0 for EIN applications. Zero. Zilch. Nada.

Yet I constantly see entrepreneurs getting charged $50, $100, even $300 by “EIN services” that are essentially filling out a free form on your behalf. It’s like paying someone $50 to mail a letter for you.

Save your money. The process takes 15 minutes online, and I’m about to show you exactly how to do it.

Timing Is Everything: When to Apply for Your EIN

This is crucial: do NOT apply for your EIN until your South Dakota LLC is officially approved and you have your filed Articles of Organization.

I’ve seen too many people jump the gun here. They get excited, apply for the EIN while their LLC is still pending, then run into complications when the business name doesn’t match exactly or the filing gets rejected.

The sequence should be:

- File your South Dakota LLC Articles of Organization

- Wait for state approval (usually 1-2 business days)

- Get your filed Articles back from the Secretary of State

- Then apply for your EIN

Patience pays off here, folks.

How to Get Your EIN: Two Paths, One Destination

The path you take depends on your citizenship status. Let me break down both routes:

Route 1: U.S. Citizens and Residents (The Fast Lane)

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), you get to use the express lane: online application through the IRS website.

Why this rocks:

- Takes about 15 minutes

- You get your EIN immediately upon completion

- Download your confirmation letter right away

- No waiting around for mail

The process:

- Go to IRS.gov (not some third-party site charging fees)

- Navigate to “Apply for an EIN Online”

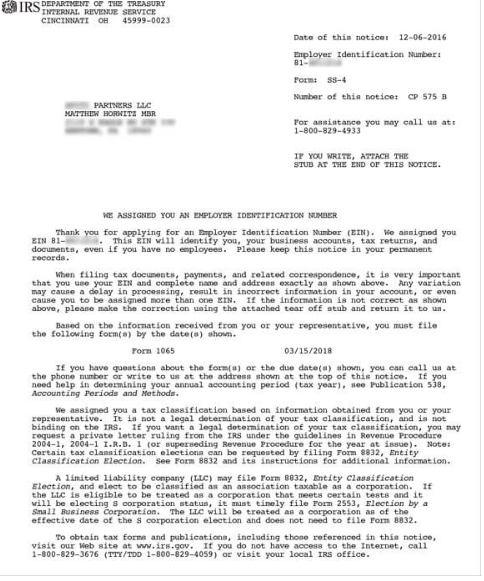

- Fill out Form SS-4 electronically

- Submit and get your EIN instantly

- Download and save your EIN confirmation letter (CP 575)

Pro tip from 15 years of experience: Complete the application in one sitting. If you start and stop, the system might time out and you’ll have to start over. Grab a coffee, eliminate distractions, and power through.

Route 2: Non-U.S. Residents (The Paper Trail)

No SSN or ITIN? No problem. You’ll need to go old-school with a mailed or faxed Form SS-4, but don’t let anyone tell you it’s impossible or that you need to hire an expensive service.

The reality:

- Takes 4-6 weeks for processing

- Requires mailing or faxing Form SS-4

- Your EIN confirmation arrives by mail

- Completely free (just like the online version)

Important myth-busting: You do NOT need a “third-party designee” despite what some websites claim. That’s just a way for services to justify their fees. You can absolutely handle this yourself.

Before You Apply: Get Your LLC Details Locked Down

Here’s something that trips up a lot of people: you need to finalize your LLC ownership structure before applying for an EIN.

Switching from a single-member LLC to multi-member (or vice versa) after getting your EIN creates a paperwork nightmare with both the IRS and South Dakota. You’ll need to:

- File additional forms with the IRS

- Update your South Dakota registration

- Amend your operating agreement

- Potentially get a new EIN

Save yourself the headache—know exactly how many members your LLC will have before hitting submit on that EIN application.

Your EIN Confirmation Letter: Don’t Lose This Golden Ticket

Once the IRS approves your EIN, you’ll receive an EIN Confirmation Letter (officially called CP 575). This document is like the birth certificate for your business tax identity.

If you applied online: You can download it immediately. Do this right away and save multiple copies.

If you mailed/faxed Form SS-4: The IRS will mail your confirmation letter to the address you provided.

What if you lose it? The IRS won’t reissue a duplicate, but you can request an EIN Verification Letter (Form 147C) which serves the same purpose. Banks and other institutions accept either document.

Opening Your Business Bank Account: The First Real Test

Your shiny new EIN gets its first workout when you open a business bank account. Here’s what you’ll need to bring:

- EIN Confirmation Letter (or EIN Verification Letter)

- Filed Articles of Organization from South Dakota

- Operating Agreement (even if not required by South Dakota, banks often want to see it)

- Valid photo ID

- Initial deposit (varies by bank)

For international entrepreneurs: Yes, you can absolutely open a U.S. business bank account for your South Dakota LLC as a non-resident. Some banks make it easier than others, but it’s definitely doable with the right documentation.

Common EIN Mistakes (And How to Fix Them)

In 15 years of doing this, I’ve seen every mistake in the book. Here are the big ones:

Mistake #1: “I Thought Getting an EIN Forms My LLC”

Nope. The EIN doesn’t create your LLC—it just gives your already-formed LLC a tax identity. If you got an EIN without forming an LLC first, you’re technically operating as a sole proprietorship, and that EIN is tied to you personally.

The fix: Form your South Dakota LLC properly, then get a new EIN for the LLC entity.

Mistake #2: “I Applied Before My LLC Was Approved”

If your LLC ultimately gets approved with the exact name you used on the EIN application, you’re golden. But if the name changes or the LLC gets rejected, you’ll need a new EIN.

The fix: Wait for LLC approval, then apply for the EIN with the exact approved name.

Mistake #3: “I Can’t Find My EIN Confirmation”

Lost paperwork happens. Request an EIN Verification Letter (147C) from the IRS. It serves the same purpose as your original confirmation letter.

FAQ: The Questions I Get Asked Most

Do Single-Member LLCs Really Need an EIN?

Technically? No. Legally, single-member LLCs can use the owner’s SSN for tax purposes.

Practically? Absolutely yes. Here’s why I always recommend getting an EIN:

- Identity protection: Keeps your SSN off business paperwork

- Banking requirements: Most banks won’t open business accounts without an EIN

- Business credit: You can’t build business credit using your personal SSN

- Future-proofing: If you ever add members or employees, you’ll need an EIN anyway

Getting an EIN takes 15 minutes and costs nothing. Just do it.

What About Husband and Wife LLCs?

South Dakota isn’t a community property state, so married couples can’t elect “Qualified Joint Venture” status (which would allow single-member LLC tax treatment).

Husband and wife LLCs in South Dakota are automatically treated as multi-member partnerships for tax purposes, which means an EIN is mandatory.

Do I Need an EIN for My DBA?

This one confuses people constantly. A DBA cannot have its own EIN—it’s just a nickname for your business.

If your South Dakota LLC operates under a DBA, the LLC itself gets the EIN. The DBA just uses the LLC’s tax ID number.

Can I Get an EIN for an LLC with No Employees?

Yes, and despite the name “Employer Identification Number,” you don’t need employees to get one. Think of it as a “Business Identification Number” and it makes more sense.

Even if you’re the only person in your LLC, you’re not considered an employee—you’re an owner. The EIN identifies your business entity, not your employment status.

When Things Go Wrong: Fixing EIN Problems

Canceling an EIN

Sometimes you need to start over. Maybe you got an EIN for a business that never launched, or you made an error in the application. The IRS doesn’t make this easy, but it’s possible.

You’ll need to write a formal cancellation letter to the IRS explaining why you want to cancel the EIN. Include your EIN, business name, and reason for cancellation.

Getting Help from the IRS

If you need to talk to a real person at the IRS (and good luck with that), here’s the secret sauce:

Call: 1-800-829-4933

Hours: 7 AM – 7 PM, Monday through Friday

The magic sequence to reach a human:

- Press 1 for English

- Press 1 for Employer Identification Numbers

- Press 3 for “If you already have an EIN, but can’t remember it”

Option 3 is the only path to a live person. Pro tip: Call right when they open at 7 AM to avoid the hold music marathon.

The Bottom Line: Your EIN Action Plan

Here’s your step-by-step roadmap:

- Form your South Dakota LLC first (get those Articles of Organization filed and approved)

- Gather your information (LLC details, member info, business purpose)

- Apply for your EIN (online if you have SSN/ITIN, mail/fax if you don’t)

- Download/save your confirmation letter (you’ll need this for everything)

- Open your business bank account (separate those business finances immediately)

Remember: this entire process should cost you exactly $0 in IRS fees. Don’t fall for expensive “EIN services” that are just middlemen charging you for a free government service.

Ready to Get Your South Dakota LLC Started Right?

Getting your EIN is just one piece of the South Dakota LLC puzzle. If you haven’t formed your LLC yet, or if you’re looking for the most efficient way to get everything set up properly, I’ve tested and reviewed every major formation service out there.

Want my honest take on the best LLC formation services for 2025? Check out my comprehensive reviews where I break down pricing, features, and which services actually deliver value (spoiler: some of the biggest names aren’t worth the premium).

Need help with your South Dakota LLC formation strategy? I’ve helped entrepreneurs from all 50 states and 40+ countries navigate the LLC formation process. Whether you’re a U.S. resident or international entrepreneur, the right approach depends on your specific situation.

Jake Lawson is an LLC Formation Strategist and Tax Advisor with over 15 years of experience helping entrepreneurs establish U.S.-based businesses. He’s guided over 1,200 LLCs to successful launch and is the founder of llciyo.com. Connect with Jake for independent, unbiased LLC formation advice.