By Jake Lawson, LLC Formation Strategist

Getting an EIN for your Texas LLC costs absolutely nothing and takes about 10 minutes online. Yet every week, I meet Texas entrepreneurs who paid $200-$500 to companies that simply filled out the same free IRS form you can complete yourself during a coffee break.

Texas’s business-friendly reputation attracts a lot of scammers who prey on new LLC owners. They create official-looking websites, charge outrageous fees, and provide zero value beyond what the IRS offers for free. Don’t fall for it.

I’ve helped 380+ Texas LLC owners get their EINs over the past 12 years, and I’m going to show you the exact process that works—plus the Texas-specific advantages that make this state particularly attractive for business owners.

What Is an EIN and Why Every Texas LLC Needs One

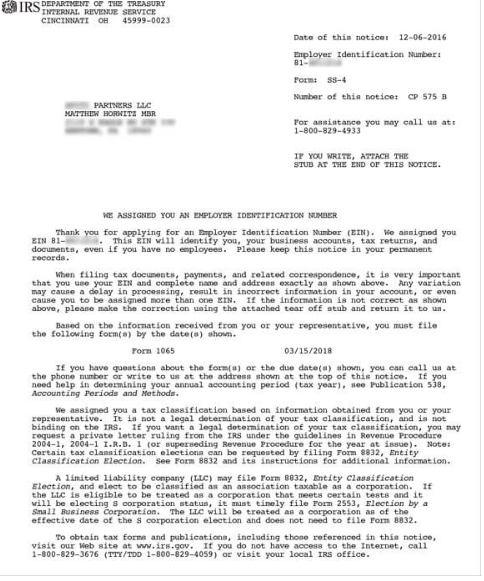

An EIN (Employer Identification Number) is your LLC’s federal tax identification number—basically your business’s Social Security number. The IRS assigns this 9-digit identifier to your LLC for all federal tax reporting and business identification purposes.

Important clarification: “Employer” doesn’t mean you need employees. Every business entity—even single-member LLCs with no employees—benefits from having an EIN.

Your Texas LLC needs an EIN for:

- Opening business bank accounts (absolutely required)

- Filing federal tax returns

- Registering with the Texas Comptroller for tax purposes

- Applying for Texas sales tax permits

- Obtaining business credit cards or loans

- Setting up payroll systems if you hire employees

- Building business credit separate from personal credit

- Professional credibility with Texas vendors and clients

- Qualifying for Texas business incentives and programs

What makes Texas unique:

- No state income tax means simplified tax obligations

- Texas Comptroller registration requires federal EIN

- Community property state status affects married couples

- Strong business banking infrastructure expects proper documentation

The Texas EIN Scam Problem: Don’t Get Fleeced

Texas’s reputation as a business haven makes it a target-rich environment for EIN scammers. These companies spend thousands on Google ads to appear when you search for Texas EIN information, then charge you for free government services.

Common Texas EIN scam tactics:

- “Texas EIN specialists” claiming special knowledge of state requirements

- Websites that look like official Texas or IRS sites but aren’t

- “Express Texas EIN processing” services (all EINs are processed the same way)

- Claims that Texas LLCs need special handling

- Bait-and-switch pricing that adds “Texas compliance fees”

Red flags to avoid:

- Any website charging for EIN services

- Claims about “complex Texas requirements”

- “Expedited processing” for additional fees

- Websites that aren’t IRS.gov asking for payment upfront

- “Professional assistance required” messaging

Jake’s Texas rule: The IRS doesn’t care what state you’re in—all EINs are free and simple to get online. Don’t let scammers exploit Texas’s business-friendly reputation to separate you from your money.

Texas LLC EIN Timing: Get the Sequence Right

CRITICAL: Do not apply for an EIN until the Texas Secretary of State officially approves your LLC.

This mistake costs Texas entrepreneurs significant time and headaches. Here’s the correct timeline:

Step 1: File Certificate of Formation with Texas Secretary of State Step 2: Wait for approval (usually 1-3 business days for online filing) Step 3: Verify your LLC appears in Texas SOSdirect database Step 4: THEN apply for EIN using exact approved LLC name

Why timing matters in Texas:

- Texas banks are particularly thorough about name matching

- The IRS verifies business existence before issuing EIN

- Name discrepancies create delays with Texas Comptroller registration

- Texas franchise tax reporting requires exact name matching

Step-by-Step: Getting Your Texas LLC EIN (100% Free)

Information You Need Before Starting

- Approved Texas Certificate of Formation

- LLC’s exact legal name (must match Texas SOSdirect records)

- Your Social Security Number or ITIN

- Texas business address for your LLC

- Principal business activity description

- Number of LLC members

- Responsible party information

The Free IRS Application Process

Step 1: Access the Official IRS EIN Application

- Go to IRS.gov (ignore all paid services)

- Search for “Apply for EIN Online“

- Click “Apply Online” in the Business section

Step 2: Verify Your Eligibility

- Confirm you have SSN or ITIN

- Verify your Texas LLC is approved and active

- Review basic eligibility requirements

Step 3: Select Entity Type

- Choose “Limited Liability Company (LLC)”

- Never select “Sole Proprietorship” (even for single-member LLCs)

Step 4: Enter LLC Information

- Legal name: Exactly as shown in Texas SOSdirect (including “LLC”)

- Trade name: Leave blank unless you use a DBA/assumed name

- Principal address: Your LLC’s main Texas business address

- Mailing address: Where you want IRS correspondence sent

- County and state: Texas county where LLC operates

- Country: United States

Step 5: Responsible Party Information

- Enter your personal details as “Responsible Party”

- Use your SSN or ITIN

- This person receives all official IRS communications about the LLC

Step 6: Business Activity Description

- Select category that best describes your business

- Choose “Other” if your business doesn’t fit standard categories

- Provide brief, accurate description of business activities

Step 7: LLC-Specific Details

- Number of members: 1 for single-member, 2+ for multi-member

- Tax classification: Accept default unless you have specific tax strategy

- Business start date: When you plan to begin operations

- Employee projection: Enter 0 if you won’t have employees initially

Step 8: Review and Submit

- Carefully verify all information matches Texas records exactly

- Submit the completed application

- Receive your EIN immediately (online applications processed instantly during business hours)

- Download and save EIN Confirmation Letter (CP 575) immediately

Total time required: 10-15 minutes with proper preparation

Non-US Residents: Paper Process for Texas LLCs

Foreign investors can still get EINs for Texas LLCs, but must use the paper filing process:

Form SS-4 Filing Method:

- Download Form SS-4 from IRS.gov

- Complete all sections accurately

- Fax to: 855-641-6935 (faster processing)

- Mail to: IRS processing center (slower option)

Texas-specific considerations for international applicants:

- Include copy of approved Texas Certificate of Formation

- Add cover letter explaining non-US resident status

- Processing takes 2-6 weeks depending on submission method

- No need for “third-party designee” despite what some services claim

Texas Community Property Laws and Your EIN

Texas is one of only nine community property states, which creates unique opportunities for married couples:

Qualified Joint Venture Option

Unique to community property states like Texas:

- Married couples can elect to treat their LLC as a “Qualified Joint Venture”

- Taxed as single-member LLC (simpler tax filing)

- Both spouses report 50% of income/expenses on individual returns

- No separate business tax return required

Traditional Partnership Treatment

Standard approach for husband-wife LLCs:

- Treated as multi-member LLC with partnership taxation

- Requires Form 1065 filing plus individual K-1s

- More complex but provides better audit protection

Jake’s Texas recommendation: Consult a Texas CPA familiar with community property law before making the election. The Qualified Joint Venture option can save on accounting fees, but partnership treatment offers stronger liability protection.

Texas-Specific Business Benefits of Having an EIN

Texas Comptroller Registration

- Required for most Texas business activities

- Franchise tax registration needs federal EIN

- Sales tax permit applications require EIN

- Unemployment insurance registration uses EIN

Texas Business Incentives

Many Texas business programs require proper federal identification:

- Chapter 380 agreements: Economic development incentives

- Texas Enterprise Fund: Business attraction and expansion

- Skills Development Fund: Employee training grants

- Research and Development Tax Credit: Innovation incentives

No State Income Tax Advantage

Texas’s lack of state income tax simplifies your EIN usage:

- Federal taxes only for most LLCs

- No state income tax returns to file

- Simplified record keeping requirements

- More focus on business growth vs. tax compliance

Common Texas LLC EIN Mistakes (And How to Avoid Them)

Mistake 1: Applying Before Texas Approval

The problem: LLC name doesn’t match because state hasn’t approved yet

The consequence: Banking delays, Texas Comptroller registration problems

The fix: Wait for Texas Secretary of State approval first

Prevention: Always verify LLC status in Texas SOSdirect database

Mistake 2: Wrong Entity Type Selection

The problem: Choosing “Sole Proprietorship” instead of “LLC”

The consequence: EIN attached to individual, not business entity

The fix: Apply for new EIN with correct entity type, cancel old one

Prevention: Always select “Limited Liability Company” regardless of member count

Mistake 3: Name Mismatches with Texas Records

The problem: EIN application name doesn’t exactly match state records

The consequence: Texas banks reject documentation, Comptroller issues

The fix: Apply for new EIN with exact name match

Prevention: Copy LLC name precisely from Texas SOSdirect

Mistake 4: Community Property Confusion

The problem: Married couples unclear about single vs. multi-member classification

The consequence: Wrong tax treatment and filing requirements

The fix: Determine desired tax treatment, may need new EIN

Prevention: Understand Texas community property options before applying

Mistake 5: Losing EIN Documentation

The problem: Can’t locate EIN Confirmation Letter when needed

The consequence: Banking and licensing delays

The solution: Request EIN Verification Letter (147C) from IRS

Prevention: Save multiple copies immediately upon receipt

Texas LLC Banking with Your EIN

Texas has excellent business banking infrastructure that expects proper documentation:

Required documents for Texas business banking:

- EIN Confirmation Letter (CP 575)

- Texas Certificate of Formation (certified copy preferred)

- Operating Agreement (especially for multi-member LLCs)

- Personal identification for all authorized signers

- Initial deposit ($50-$500 depending on bank)

Texas bank recommendations:

- Frost Bank: Texas-based, excellent local business support

- Comerica Bank: Strong commercial banking, good SBA relationships

- Wells Fargo: National presence, extensive Texas branch network

- BBVA (now PNC): Good international business banking for foreign investors

- Local credit unions: Often better rates and personalized service

Texas banking advantages:

- Competitive business banking rates

- Strong SBA lending network

- Business-friendly policies

- Technology-forward services

Single-Member vs. Multi-Member Texas LLCs

Single-Member Texas LLCs

- EIN requirement: Technically optional, practically essential

- Tax treatment: “Disregarded entity” (income on personal tax return)

- Texas advantages: No state income tax means simplified compliance

- Benefits of EIN: Banking access, privacy protection, business credit building

Multi-Member Texas LLCs

- EIN requirement: Mandatory under federal tax law

- Tax treatment: Partnership taxation (Form 1065 required)

- Community property consideration: Texas couples have special options

- Complexity: Usually requires professional tax preparation

Texas Franchise Tax and Your EIN

Texas’s franchise tax system is unique and requires your EIN:

No Franchise Tax Threshold

Good news for small LLCs:

- LLCs with gross receipts under $1.18 million owe no franchise tax

- Most small businesses qualify for this exemption

- Still must file informational return (but $0 tax owed)

Margin Tax Calculation

For larger LLCs:

- 0.375% tax rate on taxable margin

- Various deduction options available

- Requires detailed federal tax information

Annual Filing Requirements

- Form 05-163 due May 15th annually

- EIN required for all filings

- Public Information Report filed simultaneously

Texas Sales Tax and Your EIN

If your Texas LLC sells taxable goods or services:

Texas Sales Tax Registration:

- Separate from federal EIN but requires it for application

- Register through Texas Comptroller’s Webfile system

- Sales tax rate: 6.25% state + local taxes (up to 2%)

- Monthly, quarterly, or annual filing depending on volume

Texas Sales Tax Permit:

- Required for most retail sales

- Costs $0 to obtain

- Must display permit at business location

- Required for wholesale purchases

Maintaining Your Texas LLC EIN

Annual Compliance Requirements

- Federal taxes: Based on LLC classification and elections

- Texas franchise tax: Annual filing required (may owe $0)

- Sales tax: If applicable, based on filing frequency

- No state income tax: Major compliance simplification

Record Keeping for Texas LLCs

- EIN documentation: Keep multiple copies of confirmation letter

- Separate banking: Maintain distinct business and personal accounts

- Texas records: Retain franchise tax filings and supporting documents

- Federal records: Keep tax filings for minimum 7 years

Changes Affecting Your EIN

- Member changes: Adding/removing members may require new EIN

- Tax elections: S-Corp election requires IRS notification

- Business dissolution: Cancel EIN when closing LLC permanently

- Structure changes: Converting to corporation requires new EIN

Texas Business Licensing and Your EIN

Many Texas business activities require licensing that depends on having an EIN:

State-level licenses requiring EIN:

- Professional licenses (contractors, real estate, insurance)

- Regulated industries (healthcare, finance, transportation)

- Alcohol and tobacco businesses

- Environmental and safety-related activities

Local licenses and permits:

- City business permits

- County occupational licenses

- Special district requirements

- Zoning and building permits

Frequently Asked Questions

Do I Need an EIN for a Single-Member Texas LLC?

While technically optional, I strongly recommend it. Texas’s business environment and banking requirements make an EIN practically essential, even for single-member LLCs.

How Does Texas Community Property Law Affect My EIN Application?

Texas married couples have unique tax options. You can elect Qualified Joint Venture treatment (single-member LLC taxation) or traditional partnership treatment. This decision affects how you complete your EIN application.

Can I Use My SSN Instead of Getting an EIN?

For single-member LLCs, yes, but it’s not advisable. Using your SSN for business purposes increases identity theft risk and complicates business credit building.

How Long Does It Take to Get a Texas LLC EIN?

Online applications: Immediate approval during IRS business hours Form SS-4 by fax: 1-2 weeks

Form SS-4 by mail: 4-6 weeks

What If I Made a Mistake on My EIN Application?

Minor errors can sometimes be corrected by calling the IRS. Major mistakes typically require canceling the EIN and applying for a new one.

Do I Need a New EIN If I Change My LLC Structure?

Usually yes. Adding/removing members or changing tax elections typically requires a new EIN because it changes your federal tax classification.

The Bottom Line on Texas LLC EINs

Getting an EIN for your Texas LLC is free, fast, and essential for taking advantage of Texas’s business opportunities. The process takes 15 minutes online when done correctly, and it opens doors to banking, licensing, and business growth.

Key Texas takeaways:

- Always free: Never pay third parties for EIN services

- Wait for state approval: Don’t apply until Texas approves your LLC

- Understand community property: Texas offers unique tax options for married couples

- Keep documentation: Save multiple copies of EIN confirmation

- Leverage Texas advantages: No state income tax simplifies compliance

Complete Texas LLC setup timeline:

- Form LLC with Texas Secretary of State (1-3 business days)

- Get federal EIN from IRS (15 minutes online)

- Register with Texas Comptroller (immediate online)

- Open business bank account (same day with proper documents)

- Obtain required licenses and permits (varies by business)

Total setup time: 1-2 weeks for complete business registration

Texas combines business-friendly policies with straightforward compliance requirements. Your EIN is the foundation that enables everything else—banking relationships, tax optimization, business incentives, and professional credibility.

Don’t let scam companies complicate or overcharge for this simple process. Texas makes it easy to start a business, and getting your EIN should be the simplest part of your journey.

The Lone Star State rewards entrepreneurs who do things right from the beginning. Get your EIN the correct way—free, fast, and without any unnecessary middlemen—then focus your energy and money on building the business that brought you to Texas in the first place.

Ready to form your Texas LLC and get your EIN? Check out my complete Texas LLC formation guide and state-specific business advantages at llciyo.com.

About Jake Lawson: With 15+ years helping entrepreneurs navigate U.S. business formation, Jake has guided over 1,200 successful LLC launches. His expertise in Texas business law helps entrepreneurs leverage the state’s unique advantages while avoiding costly mistakes.