Utah charges just $18 for annual reports—second cheapest in America behind only Colorado’s $10. They even give you a 60-day grace period with no penalties. Sounds perfect, right? Here’s the trap: That generous grace period makes people complacent. “I have 60 extra days!” turns into a dissolved LLC faster than you’d think.

After watching dozens of Utah LLCs expire because owners treated the grace period as the deadline, I’ll show you exactly how Utah’s anniversary date system works, why the 30+30 day structure creates false security, and how to file this report in under 10 minutes without ever needing that grace period.

Utah’s Annual Report: Cheap, Simple, and Still Missed

Here’s what Utah actually requires:

The basics:

- Cost: $18 (only Colorado is cheaper)

- Due date: Last day of anniversary month

- Grace period: 30 days no penalty

- Late period: Next 30 days with $10 penalty

- Dissolution: After 60 days total

Utah structured this to be business-friendly. They practically beg you not to miss it. Yet LLCs still expire daily.

The Anniversary Month System (Why It Confuses Everyone)

Utah doesn’t use a fixed date like April 15th. They use your LLC’s anniversary month—the month your LLC was approved.

How Anniversary Dates Actually Work

Formation vs. Due Date:

- LLC approved August 12, 2025

- Anniversary month: August

- Annual report due: August 31 (not August 12!)

- Every year: August 31

The confusion: People think it’s due on the exact anniversary date. Nope. Last day of the anniversary month.

Finding Your Anniversary Month

Don’t know when your LLC was approved?

Option 1: Check documents Your Certificate of Organization shows approval date.

Option 2: Search online

- Go to businessregistration.utah.gov

- Search your LLC name

- Check “Date Registered”

Option 3: Call 801-530-4849 – They’ll tell you immediately.

First Report Timing

Your first report is due the year AFTER formation:

Examples:

- Form LLC January 2025 → First report January 31, 2026

- Form LLC December 2025 → First report December 31, 2026

- Form LLC February 29, 2024 → First report February 28, 2025 (leap year fun)

Key point: You get at least a full year before your first report.

The 60-Day Grace Period Breakdown

Utah’s grace period is generous but structured oddly:

Days 1-30: The Free Pass

Miss your deadline by up to 30 days? No problem:

- No late fee

- No penalties

- No consequences

- File normally

Example: Due August 31, file September 25? Still just $18.

Days 31-60: The $10 Penalty Phase

Miss by 31-60 days? Small penalty:

- $10 late fee

- Total becomes $28

- Still easy to fix

- No other consequences

Example: Due August 31, file October 15? Pay $28 total.

Day 61: Death

Miss by 61+ days? LLC expires:

- Status changes to “Expired”

- No longer in good standing

- Can’t legally operate

- Need reinstatement ($59)

Example: Due August 31, don’t file by October 31? LLC dead November 1.

The Psychology of Grace Periods (Why They’re Dangerous)

Grace periods create procrastination:

Month before due date: “I have plenty of time”

Due date passes: “I have 30 days grace”

Day 20 of grace: “Still have time”

Day 35: “Just a small penalty”

Day 55: “I’ll do it tomorrow”

Day 61: “Wait, my LLC is dissolved?”

My advice: Pretend the grace period doesn’t exist. File 30 days BEFORE your due date, not 30 days after.

Filing Your Utah Annual Report Online (The Only Way)

Yes, you can file by mail. No, you shouldn’t. Online is instant and actually easier.

Step 1: Access the System

Navigate to: businessregistration.utah.gov

Need Utah ID?

- Create at id.utah.gov

- Use real email

- Save password (annual use)

Already have Utah ID?

- Login directly

- System remembers you

Step 2: Choose Report Type

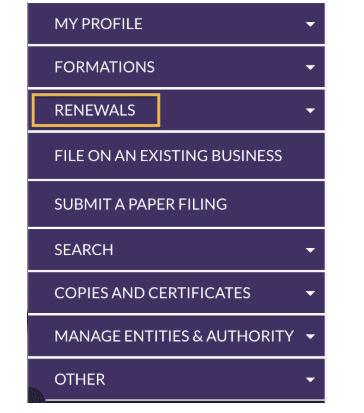

Click “Renewals” from dashboard.

You’ll see two options:

- “Annual Report/Renewal” (no changes)

- “Annual Report/Renewal with Changes” (pick this)

Always pick “with changes” even if nothing changed. More flexibility.

Step 3: Find Your LLC

Search by name. Select from results.

Can’t find it? Try partial name without “LLC”

Review basic info. Click “Next.”

Step 4: Purpose Statement (Leave Blank!)

Utah asks for business purpose.

My strong advice: Leave blank.

Why? Blank = “any lawful purpose” = maximum flexibility.

Specific purpose = potential limitations.

Click “Next.”

Step 5: Principal Office Address

Review/update addresses:

- Principal office (business location)

- Mailing address (can be different)

- Email (CRITICAL for reminders)

No email listed? Add one immediately. This is how you get reminders.

Step 6: Registered Agent

Current agent displays.

No changes needed? Click “Next”

Changing agents?

For individual (person):

- Search their name

- Click “Create Agent”

- Enter their info

- Select them

For commercial service:

- Search company name (without LLC/Inc)

- Select from results

- Confirm address

Step 7: Principal Information

Utah requires at least one “Principal” (member or manager).

Add Principal:

- Title: Member or Manager (not “Organizer“)

- Start Date: Leave blank

- Name Type: Individual or Entity

- Name: Full name

- Address: Optional (leave blank for privacy)

Click “Add Principal”

Privacy tip: Only list one principal if possible. Public record.

Step 8: Skip Optional Sections

Supporting Documentation: Skip Just click “Next”

Step 9: Sign as Authorized Person

Signature section:

- Check agreement boxes

- Enter your name

- Title: Select “Authorized Person”

- Click “Next”

Step 10: Review and Pay

Review everything. Click “Add to Shopping Cart.”

System logs you out? Common Utah glitch. Login again, go to “Filings in Progress,” continue where you left off.

Payment:

- $18 by credit/debit card

- Processes instantly

- Email confirmation immediately

The Mail Filing Option (Why You Shouldn’t)

You can mail form with $18 check. Takes 2 weeks. No confirmation. Risk of loss. Just file online.

What Happens When Your LLC Expires

Day 61 after deadline, Utah marks your LLC “Expired.”

Immediate consequences:

- Can’t legally operate

- No good standing certificate

- Banking problems

- Contract issues

- Insurance questions

Reinstatement Within 2 Years

Can reinstate within 2 years of expiration:

- File reinstatement online

- Pay $59 fee

- Restore good standing

- Continue as before

Process: Usually instant online.

After 2 Years: Start Over

More than 2 years expired? Can’t reinstate. Must form new LLC:

- New Certificate of Organization

- New $59 formation fee

- New EIN potentially

- Lost name possibly

The tragedy: Someone else might take your LLC name during expiration.

Building Your Never-Miss System

Utah sends email reminders IF you have email on file. Don’t rely solely on these.

The Triple Reminder Strategy

60 days before: “Utah report coming due”

30 days before: “File Utah report this month”

Day 1 of month: “FILE UTAH REPORT NOW”

Set these as recurring annual reminders.

The Early Bird Approach

File 60 days early (maximum allowed):

- Due August 31? File July 1

- Due December 31? File November 1

- Never stress about deadlines

The Professional Service Option

For $50-100/year, registered agents will:

- Track your deadline

- Send multiple reminders

- Some file for you

- Never miss

Worth it if you’re forgetful or have multiple LLCs.

Common Utah Annual Report Mistakes

Mistake #1: Confusing Anniversary Date with Due Date

Approved August 12 doesn’t mean due August 12. Due August 31.

Mistake #2: Relying on Grace Period

“I have 60 extra days” becomes “My LLC is dissolved.”

Mistake #3: No Email on File

No email = no reminders = missed reports.

Mistake #4: Listing Unnecessary Principals

Every principal becomes public record. List minimum required.

Mistake #5: Specifying Restrictive Purpose

Specific purpose limits flexibility. Leave blank for “any lawful purpose.”

Utah-Specific Quirks

The UtahID Requirement

Need separate account just for business filings. Another password to manage.

The System Timeout

Logs you out randomly. Save progress frequently.

No Report Copies

Can’t download copy of filed report, only changes made.

The Postcard Reminders

Utah sometimes sends physical postcards. Quaint but unreliable.

The Two-Year Reinstatement Window

More generous than most states. Use if needed but better to never need it.

Strategic Considerations

Multi-State Operations

Own LLCs in multiple states? Utah’s anniversary system complicates tracking:

- Utah: Anniversary month

- Colorado: Specific date chosen

- Wyoming: Anniversary month

- Nevada: Specific month assigned

Create master calendar or miss something.

The Inactive LLC Question

Not doing business? Still must file. Only way out is formal dissolution.

The Banking Verification

Banks randomly check good standing. Expired status triggers:

- Account restrictions

- Loan complications

- Credit line freezes

The Name Protection Value

Even if inactive, $18/year protects your name. Let it expire? Anyone can take it after 2 years.

Cost Comparison Reality

Utah’s $18 is fantastic value:

- Wyoming: $60

- Delaware: $300

- California: $800 minimum tax

- Montana: $20

- Colorado: $10

Only Colorado beats Utah on price.

When Professional Help Makes Sense

For an $18 filing, professional help rarely needed unless:

Registered agent services:

- Include reminder service

- Some file for you

- $50-150/year total

- Worth it for multiple LLCs

Formation services:

- Often include first year

- Ongoing compliance calendar

- Convenient but pricey

Attorneys/CPAs:

- Overkill for simple report

- Only if complex changes needed

Your Annual Report Action Plan

Two months before due date:

- Mark calendar

- Verify information current

- Check email on file

One month before:

- File online

- Pay $18

- Save confirmation

- Set next year reminder

If you’re late:

- Don’t panic if under 30 days

- File immediately if 31-60 days

- Pay the $28 total

- Never reach day 61

The Bottom Line on Utah Annual Reports

Utah made this as easy as possible: $18 fee, online filing, 60-day grace period, two-year reinstatement window. They’re practically begging you not to screw this up.

Yet LLCs still expire daily. Why? Because anniversary dates are forgettable, grace periods encourage procrastination, and people assume they’ll remember next year.

The successful Utah LLC owners treat the grace period as emergency backup, not standard procedure. They file early, set multiple reminders, and never test that 60-day limit.

For $18—less than a pizza—you maintain your LLC’s existence, liability protection, and good standing. There’s literally no excuse for missing this except poor planning.

File early. File online. Forget the grace period exists. Your future self will thank you.

Jake Lawson has formed over 1,200 LLCs nationwide and considers Utah’s annual report system nearly perfect—except for the false security that 60-day grace period creates. He’s helped reinstate dozens of expired Utah LLCs and always asks owners the same question: “Was saving 10 minutes worth losing your LLC?” Get unfiltered LLC compliance advice at llciyo.com.