By Jake Lawson, LLC Formation Strategist

Utah’s motto might be “Industry,” but when it comes to your LLC’s federal tax identification, you’re dealing with the same IRS machinery as every other state. The good news? Utah’s business-friendly environment and efficient state processes make the overall experience smoother, even though federal requirements remain constant across all 50 states.

I’ve helped hundreds of Utah entrepreneurs secure their EINs, from Salt Lake City fintech startups to Park City hospitality ventures. Here’s what I’ve learned: Utah LLCs face identical federal tax ID requirements as everyone else, but Utah’s streamlined business environment and Mountain Time Zone advantages make the process more manageable than in many other states.

Let me walk you through everything you need to know about getting your Utah LLC’s Federal Tax ID efficiently and correctly.

Understanding Your Utah LLC’s Federal Identity

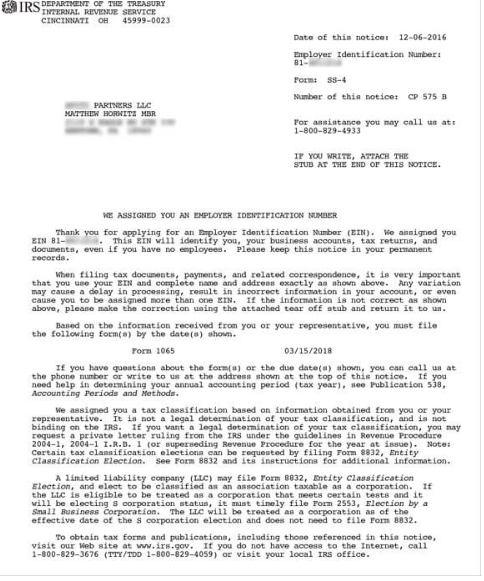

Your Federal Tax ID—officially called an Employer Identification Number (EIN)—is your LLC’s permanent identifier in the federal tax system. Think of it as your business’s Social Security number for all federal interactions, from the IRS to banking to business credit.

The fundamental distinction: Utah handles your LLC formation through the Department of Commerce, but only the IRS issues Federal Tax IDs. These are completely separate processes managed by different agencies with different requirements.

Utah advantage: While Utah keeps LLC formation simple and efficient, federal EIN requirements remain the same regardless of which state you choose. Utah’s benefit comes from faster state processing, which means you can move to the federal EIN step more quickly.

Why Your Utah LLC Needs an EIN

Federal tax compliance: Required for business tax filings and IRS communication

Banking necessity: Utah banks require EINs for business account opening across the board

Business credibility: Professional vendors and clients expect federal tax identification

Growth planning: Essential for hiring employees, obtaining loans, or attracting investment

Asset protection: Helps maintain separation between personal and business finances

Utah-specific benefit: With Utah’s reputation for business efficiency and innovation, having proper federal identification helps you fit into the state’s professional business ecosystem.

Federal vs. State Tax ID: Understanding the Difference

This distinction confuses many Utah entrepreneurs, so let’s clarify what you need from whom:

Federal Tax ID (EIN)

- Issued by: Internal Revenue Service (IRS)

- Purpose: Federal tax reporting and business identification nationwide

- Required for: All LLCs conducting business activities

- Cost: Free when obtained directly from IRS

- Validity: Permanent (follows your business across state lines)

Utah State Tax ID

- Issued by: Utah State Tax Commission

- Purpose: State tax reporting and Utah-specific business obligations

- Required for: Businesses with Utah tax obligations or employees

- Integration: Separate from federal EIN but often coordinated

Bottom line: You’ll likely need both if your LLC has Utah operations, but they serve different purposes and come from different government agencies.

Utah’s EIN Application Advantages

Utah entrepreneurs enjoy several advantages when applying for federal EINs:

Geographic and Time Zone Benefits

Mountain Time Zone: Excellent alignment with IRS business hours for phone support

Western location: Later IRS business hours relative to local time provide more application windows

Technology infrastructure: Utah’s strong tech sector means reliable internet access statewide

Professional services: Growing network of Utah-based professionals familiar with federal requirements

State Process Efficiency

Quick LLC approval: Utah’s Department of Commerce processes LLCs efficiently, enabling faster EIN applications

Clear documentation: Utah provides straightforward Articles of Organization that the IRS easily recognizes

Minimal complications: No publication requirements or complex state processes to delay federal applications

Business Environment Integration

Tech sector familiarity: Utah’s tech industry understands federal compliance requirements

Financial services growth: Expanding fintech sector means local expertise in business banking and federal requirements

Startup ecosystem: Growing entrepreneurial community shares knowledge about federal compliance

Application Methods: Your Path to Federal ID

Your EIN application method depends entirely on your citizenship and residency status—Utah residency doesn’t change federal requirements.

Online Applications (US Citizens and Residents)

Eligibility requirements:

- Valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Access to reliable internet connection during IRS business hours

- Ability to complete application in single session

The process:

- Access IRS online EIN application system during business hours

- Complete business and personal information accurately

- Receive instant EIN upon successful completion

- Download confirmation letter immediately

Utah advantages:

- Mountain Time Zone provides extended afternoon hours for East Coast IRS system

- Utah’s technology infrastructure supports reliable online applications

- State’s efficient LLC processing means faster transition to EIN application

Mail/Fax Applications (International Entrepreneurs)

When required:

- Non-US residents without SSN or ITIN

- Applicants experiencing online system technical difficulties

- Those preferring paper documentation trails

The process:

- Complete Form SS-4 thoroughly and accurately

- Mail or fax to designated IRS processing center

- Wait 4-8 weeks for processing and response

- Receive EIN confirmation via postal mail

Utah considerations:

- Generally reliable postal service throughout the state

- Some rural areas may have limited fax access

- Consider using certified mail for tracking and confirmation

Strategic Application Timing

Success with EIN applications requires proper sequencing and timing coordination.

Pre-Application Requirements

Utah LLC formation complete:

- Approved Utah Articles of Organization

- Clear record of LLC name and formation date

- Understanding of member structure and management

Personal information ready:

- SSN or ITIN for online applications

- Current address and contact information

- Clear understanding of your role in the LLC (member vs. manager)

Business information clarified:

- Number of LLC members and ownership percentages

- Primary business activities and industry classification

- Expected start date for business operations

Optimal Timing Sequence

The proper order:

- File Utah Articles of Organization with Department of Commerce

- Receive state approval confirmation

- Apply for federal EIN immediately after state approval

- Open business banking with EIN confirmation letter

Utah timing advantages:

- Relatively quick state processing (typically 1-3 business days online)

- No waiting periods for publication or additional state requirements

- Can proceed directly to EIN application without delays

Common Utah EIN Challenges and Solutions

Even with Utah’s business-friendly environment, certain challenges can arise:

Technology-Related Issues

Challenge: Online application system technical difficulties

Utah context: High expectations for digital efficiency sometimes clash with federal system limitations

Solution: Try different browsers, clear cache, or use alternative devices

Alternative: Mail/fax applications if online problems persist

Rural Connectivity Considerations

Challenge: Limited internet access in some rural Utah areas

Solution: Use public internet at libraries, coffee shops, or business centers in larger towns

Alternative: Mail/fax applications for areas with poor connectivity

Planning: Consider driving to areas with better connectivity for online applications

Multi-State Business Planning

Challenge: Utah LLCs planning operations in multiple states

Solution: Obtain EIN based on Utah formation, then register as foreign LLC in expansion states

Advantage: Utah EIN provides solid foundation for multi-state business growth

Utah Husband-Wife LLC Considerations

Utah’s non-community property status affects how married couples should approach EIN applications.

Tax Election Limitations

Utah reality: As a non-community property state, husband-wife LLCs must typically elect partnership taxation

EIN implications: Cannot elect Qualified Joint Venture status available in community property states

Filing requirements: Must file partnership returns and issue K-1s to both spouses

Strategic Considerations

Single vs. joint ownership: Consider single-member LLC structure if tax simplification is priority

Professional guidance: Consult Utah tax professionals familiar with state-specific implications

Documentation requirements: Ensure EIN application reflects chosen ownership structure accurately

Future planning: Consider how structure affects business growth and expansion plans

Banking Integration: Utah’s Financial Landscape

Utah’s evolving banking and financial services sector provides numerous options for new LLCs.

Major Banking Options

National banks: Wells Fargo, Bank of America, and US Bank have strong Utah presence

Regional institutions: Zions Bank (headquartered in Salt Lake City) offers local expertise

Credit unions: Utah’s credit unions provide competitive business banking services

Fintech integration: Utah’s growing fintech sector offers innovative banking solutions

Banking Preparation

Required documentation:

- EIN Confirmation Letter from IRS

- Utah Articles of Organization

- Operating Agreement (recommended but not always required)

- Personal identification for all signatories

Utah banking advantages:

- Business-friendly banking culture aligned with state’s entrepreneurial environment

- Understanding of technology and startup business models

- Competitive rates and terms due to local market competition

Tax Implications for Utah LLCs

Understanding tax obligations helps you use your EIN effectively from day one.

Federal Tax Requirements

Pass-through taxation: Utah LLCs default to pass-through status for federal taxes

Self-employment tax: Utah LLC profits typically subject to SE tax

Quarterly estimates: Required if annual tax liability exceeds $1,000

Business deductions: EIN enables proper business expense deduction tracking

Utah State Tax Integration

State income tax: Utah imposes state income tax on LLC profits at competitive rates

Sales tax: Utah sales tax obligations may require state tax ID registration

Employment taxes: Payroll taxes required if hiring employees in Utah

Coordination: Use EIN for both federal and state tax reporting consistency

International Entrepreneurs: Utah Advantages

Utah’s growing international business connections attract global entrepreneurs, but federal requirements remain standard.

Utah Benefits for International Applicants

Business-friendly environment: Streamlined state processes reduce overall complexity

Technology sector: Utah’s tech focus attracts international investment and expertise

Professional network: Growing community of professionals experienced with international business

Geographic advantages: Mountain Time Zone works well for Asia-Pacific business coordination

Federal Requirement Reality

EIN necessity: International entrepreneurs must obtain EINs for US business operations

Application method: Must use mail/fax method rather than online system

Documentation: May require additional identity verification and supporting documentation

Processing time: Plan for 4-8 weeks for international applications

Avoiding Common Utah EIN Mistakes

These errors appear frequently among Utah entrepreneurs:

Mistake #1: Premature EIN Applications

The problem: Applying for EIN before Utah LLC receives final state approval

The consequence: IRS confusion and potential application rejection

The solution: Wait for official Utah Department of Commerce approval confirmation

Mistake #2: Incorrect Business Activity Description

The problem: Vague or overly broad descriptions of intended business activities

The consequence: IRS follow-up questions or processing delays

The solution: Provide specific, accurate descriptions of your business operations

Mistake #3: Ownership Structure Confusion

The problem: Unclear or inconsistent information about LLC member structure

The consequence: Tax classification problems and potential compliance issues

The solution: Finalize ownership structure before applying and document clearly

Mistake #4: Address and Contact Issues

The problem: Using temporary addresses or incorrect contact information

The consequence: Communication failures and document delivery problems

The solution: Use stable, accurate business address and contact information

Professional Assistance vs. DIY Approach

Utah’s efficient business environment makes DIY approaches viable for most situations.

DIY-Friendly Situations

- Single-member LLCs with straightforward operations

- US citizens/residents with SSN access

- Simple business models without complex ownership structures

- Entrepreneurs comfortable with online applications

Professional Assistance Recommended

- Multi-member LLCs with complex ownership arrangements

- International entrepreneurs unfamiliar with US systems

- Businesses planning immediate multi-state operations

- LLCs with specific tax election considerations or timing requirements

Long-Term EIN Management in Utah

Your EIN is permanent, but understanding ongoing obligations prevents future complications.

Ongoing Federal Responsibilities

Annual tax filings: Use EIN consistently for all federal tax returns

Employment compliance: Required for payroll and employment tax reporting if hiring

Banking relationships: EIN remains constant across all banking relationships

Business credit: EIN forms foundation of business credit profile development

Utah-Specific Integration

State tax coordination: Use EIN for Utah state tax filings and reporting

Business licensing: Some Utah business licenses reference or require federal EIN

Compliance reporting: Maintain consistent federal identification across all Utah requirements

Growth planning: EIN supports expansion within Utah and to other states

Utah’s Business Environment Context

Utah’s “Silicon Slopes” reputation and business-friendly policies create unique considerations for EIN planning.

Technology Sector Integration

Startup ecosystem: Utah’s growing tech sector expects efficient federal compliance

Investment requirements: VCs and angel investors expect proper federal identification

Scaling considerations: EIN supports rapid growth common in Utah tech companies

Multi-state expansion: Utah companies often expand quickly, requiring solid federal foundation

Industry Diversification

Financial services: Utah’s growing fintech sector requires strong federal compliance

Outdoor recreation: Tourism and recreation businesses need federal identification for national marketing

Manufacturing: Traditional Utah industries benefit from professional federal identification

Professional services: Growing service sector requires federal ID for client credibility

The Bottom Line: Utah EIN Success

Utah provides an excellent environment for business formation and growth, but federal tax identification follows the same rules everywhere. The key is leveraging Utah’s efficient state processes to move quickly to federal compliance.

My recommendations for Utah entrepreneurs:

- Complete state formation first: Secure Utah LLC approval before attempting federal applications

- Choose appropriate method: Online for US residents, mail/fax for international entrepreneurs

- Prepare thoroughly: Gather all required information before starting applications

- Plan for integration: Coordinate EIN receipt with banking setup and business operations launch

- Think growth: Consider how federal identification supports Utah’s business expansion opportunities

Utah gives you a tremendous foundation for business success—make sure your federal tax identification supports that foundation properly.

Ready to get your Utah LLC’s federal identification handled professionally? Check out our Utah LLC formation guide for complete state requirements, or explore our EIN application services for professional assistance with federal compliance.

Have questions about Utah EIN applications or federal tax identification for your specific business situation? Drop me a line—I’ve probably helped someone with your exact Utah business model navigate these federal requirements successfully.

Jake Lawson is an LLC Formation Strategist and founder of llciyo.com. He’s guided over 1,200 entrepreneurs through U.S. business formation, including hundreds of Utah LLCs through both state formation and federal tax identification in the Beehive State’s dynamic business environment.