By Jake Lawson, LLC Formation Strategist

Washington State makes LLC compliance straightforward: file an annual report by the end of your anniversary month every year and pay $60. Miss the deadline, and they’ll dissolve your LLC faster than you can say “coffee shop startup.” I’ve seen too many Washington entrepreneurs lose their businesses because they forgot this simple requirement.

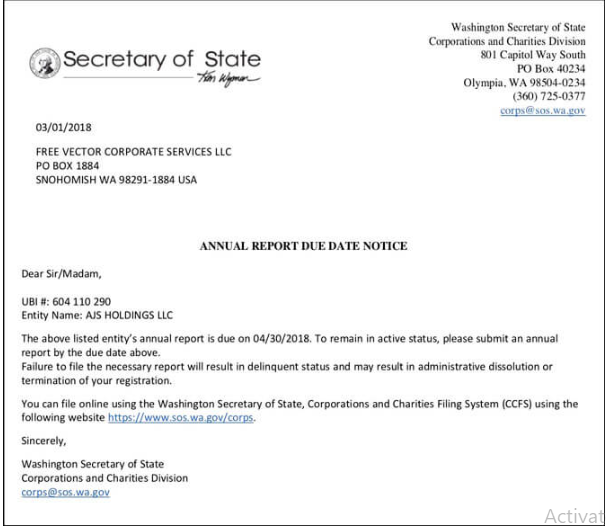

Here’s what makes Washington’s system both simple and dangerous: they only give you one reminder, and if you miss the 90-day grace period after your deadline, your LLC is permanently dissolved. No appeals, no second chances.

Let me walk you through Washington’s annual report requirements and show you how to build a system that ensures you never miss this critical deadline.

Understanding Washington’s Annual Report System

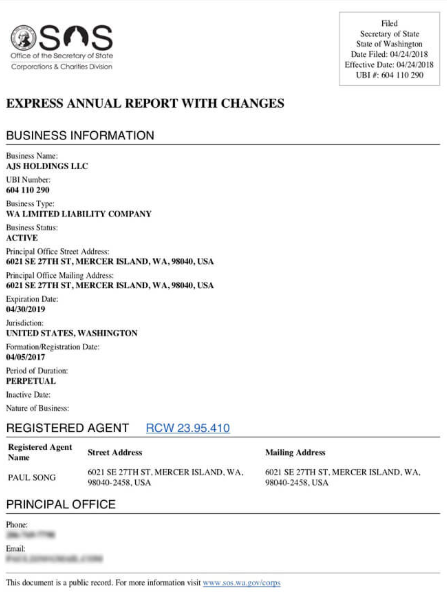

What it is: Washington’s annual report is essentially a compliance check-in where you confirm your LLC’s current information and pay an annual fee to maintain good standing.

What it’s NOT: This isn’t a financial report with profit and loss statements. You’re not reporting income, expenses, or business performance to the state.

Key details:

- Annual fee: $60 (plus $25 penalty if late)

- Due date: Last day of your LLC’s anniversary month

- Grace period: 90 days after the due date

- Consequence of non-filing: Administrative dissolution (your LLC is shut down)

Critical Deadline Information

Your annual report deadline is based on when your LLC was originally approved, not when you filed your paperwork.

How to find your anniversary month:

- Check your stamped Certificate of Formation (upper right corner)

- Use Washington’s business search and look for “formation/registration” date

- Check your initial report filing if you have those records

Example timeline:

- LLC approved: August 5, 2024

- First annual report due: August 31, 2025

- Every subsequent year: August 31st

- Late penalty begins: September 1st ($85 total)

- Administrative dissolution: December 1st (90 days after deadline)

Important distinction: Don’t confuse your annual report with your initial report. The initial report is due within 120 days of formation. Annual reports start the following year.

The Real Cost of Missing Your Deadline

Immediate consequences:

- $25 late penalty (total becomes $85 instead of $60)

- Administrative dissolution after 90 days

- Loss of legal protections and business authority

Long-term implications:

- Contracts may become invalid

- Personal liability exposure

- Inability to file legal documents

- Banking and licensing complications

- Reinstatement costs and complications

Bottom line: A forgotten $60 annual report can cost you your entire business. It’s not worth the risk.

Step-by-Step Annual Report Filing

Preparation: Set Up Your CCFS Account

Before you can file, you need access to Washington’s Corporations & Charities Filing System (CCFS).

First-time setup:

- Go to ccfs.sos.wa.gov

- Create your account with business information

- Verify your email address

- Save your login credentials securely

Pro tip: Set up your CCFS account immediately after forming your LLC, even if your first annual report isn’t due for a year. This prevents last-minute access issues.

Filing Your Annual Report Online

Step 1: Access the Filing System

- Log into your CCFS account

- Click “Business Maintenance Filings” in left navigation

- Select “Annual Report”

Step 2: Locate Your LLC

- Search using your UBI number or LLC name

- Select your LLC from the search results

- Click “Continue”

Step 3: Review and Update Business Information

Most information will pre-populate from your Certificate of Formation, but review everything carefully:

Registered Agent Section:

- Verify current registered agent information

- Update if you’ve changed services or addresses

- Remember: Washington requires a registered agent with a Washington address

Principal Office Section:

- Confirm your principal business address

- Add email address (required)

- Phone number is optional

- Don’t check the Address Confidentiality Program unless you’re actually enrolled

Governors Section: In Washington, “Governor” means any LLC member or manager. Update this section if:

- You’ve added new members or managers

- Someone has left the LLC

- Ownership percentages have changed

- Management structure has changed

Nature of Business:

- Select your primary business activity from the dropdown

- Choose “Any Lawful Purpose” for maximum flexibility

- You can always update this in future annual reports

Step 4: Handle Special Considerations

Controlling Interest (Real Estate): If your LLC owns any Washington real estate (including leases), select “Yes” and be prepared to notify the Washington Department of Revenue.

Return Address:

- Leave blank unless you want approval mailed somewhere other than your registered agent

- Whatever you enter here becomes public record

Email Opt-in:

- Check this box to receive reminders by email only

- Leave unchecked to continue receiving mail reminders

- Consider your technology comfort level when deciding

Step 5: Authorization and Payment

- Confirm you’re an authorized person (typically an LLC member or manager)

- Review all information for accuracy

- Add to cart and proceed to checkout

- Pay $60 by credit or debit card

- Submit your filing

Processing time: Online filings are approved instantly. You’ll receive immediate confirmation and can download your approved annual report right away.

Filing by Mail (Not Recommended)

If you prefer paper filing:

- Download the paper annual report form

- Complete all sections by hand or computer

- Include check or money order for $60 payable to “Secretary of State”

- Mail to: WA Corporation & Charities Division, PO Box 40234, Olympia, WA 98504-0234

Processing time: 10-12 business days (much slower than online)

Advanced Compliance Strategies

Creating a Foolproof Reminder System

Multi-layer approach:

- Phone calendar: Set recurring reminder 60 days before deadline

- Email reminder: Use your calendar app’s email notification feature

- Physical reminder: Write the deadline on your office calendar

- Professional backup: Include in your accountant’s annual task list

Timing recommendations:

- 60 days before: Initial reminder to begin gathering information

- 30 days before: Second reminder to complete filing

- 7 days before: Final urgent reminder if not yet filed

Managing Multiple Washington LLCs

If you own several Washington LLCs:

- Create a master calendar with all anniversary dates

- File all reports at the same time if deadlines are close

- Use the same CCFS account for all entities

- Consider staggering formation dates for future LLCs to spread workload

Handling Ownership Changes

During the year: You can file an amended annual report if ownership changes between annual filings.

Process for amendments:

- Log into CCFS

- Select “Amended Annual Report” under Business Maintenance Filings

- Update only the changed information

- No additional fee required

Documentation needed:

- Sale or assignment of membership interest agreements

- Updated Operating Agreement

- Washington Department of Licensing Form 700-306 (for ownership changes)

Common Filing Mistakes and Solutions

Mistake #1: Wrong Anniversary Date

Many LLC owners confuse their formation filing date with their approval date.

The fix: Always use the date your LLC was approved by Washington Secretary of State, not when you submitted your paperwork.

Mistake #2: Outdated Business Information

Using old addresses or outdated member information can cause compliance issues.

The fix: Review all LLC information annually, not just at filing time. Update registered agent, principal office, and member information as changes occur.

Mistake #3: Ignoring Real Estate Ownership Questions

LLCs that own Washington real estate have additional reporting requirements with the Department of Revenue.

The fix: If you answer “Yes” to real estate ownership, follow up with the Department of Revenue at 360-534-1503.

Mistake #4: Not Downloading Approved Documents

Many filers complete the process but forget to save their approved annual report.

The fix: Immediately download and save your approved annual report. Store it with other important business documents.

What Happens After You File

Immediate Results

- Instant approval for online filings

- Updated public record showing current filing

- Continued good standing status

- Download access to stamped approval

Annual Cycle Continues

- New reminder notice sent ~45 days before next deadline

- Same process repeats the following year

- Fees and requirements remain consistent

Record Keeping

Documents to save:

- Approved annual report (stamped by Secretary of State)

- Payment confirmation

- Any correspondence with the state

- Updated Operating Agreement (if changes were made)

Reinstatement After Administrative Dissolution

If you miss the 90-day grace period, your LLC will be administratively dissolved. Reinstatement is possible but complicated:

Reinstatement requirements:

- File articles of reinstatement

- Pay all past-due annual report fees

- Pay reinstatement fees

- File all missing annual reports

- May require additional documentation

Costs add up quickly: A two-year delinquency could cost $200+ in back fees plus reinstatement costs.

Time restrictions: You typically have 5 years from dissolution to reinstate, but requirements become more complex over time.

Professional vs. DIY Filing

DIY Territory

- Single LLC with straightforward structure

- No changes to business information

- Comfortable with online government systems

- Current on all business record-keeping

Consider Professional Help

- Multiple LLCs requiring coordination

- Recent ownership or management changes

- Complex business structure

- History of missing deadlines

- Want ongoing compliance monitoring

Professional service costs: Expect to pay $100-200 for annual report filing services. This might be worthwhile for complex situations or if you manage multiple entities.

Your Washington LLC Compliance Calendar

60 Days Before Anniversary Month

- Review current LLC information for accuracy

- Confirm registered agent and principal office addresses

- Update any changes to ownership or management structure

- Gather information needed for filing

30 Days Before Anniversary Month

- Log into CCFS and begin annual report filing

- Complete all sections carefully

- Review for accuracy before submitting

- File and pay online for instant approval

Anniversary Month

- Confirm filing was completed successfully

- Download and save approved annual report

- Update business records with any changes made

- Set reminders for next year’s filing

Year-Round

- Keep business information current

- Update registered agent changes immediately

- Document ownership or management changes

- Maintain good record-keeping practices

The Bottom Line on Washington Annual Reports

Washington’s annual report requirement is straightforward: file by your anniversary month deadline every year and pay $60. The simplicity makes it easy to comply, but the harsh consequences for non-compliance make it dangerous to ignore.

Key takeaways:

- Annual reports are due by the last day of your anniversary month

- Late filing incurs a $25 penalty

- Missing the 90-day grace period results in dissolution

- Online filing provides instant approval

- Set up multiple reminder systems to avoid forgetting

Most importantly: This is a mandatory cost of doing business in Washington. Budget for it annually, file early, and treat it as seriously as any other critical business obligation.

Ready to Keep Your Washington LLC Compliant?

Annual reports are just one aspect of maintaining your Washington LLC in good standing. From formation through ongoing compliance, staying current with state requirements protects your business investment and personal liability protection.

Need help with Washington LLC compliance? Our comprehensive guides cover everything from formation requirements to ongoing obligations like annual reports, registered agent management, and tax considerations.

Looking for ongoing compliance support? We help Washington business owners build systems that ensure they never miss critical deadlines and maintain good standing with the state.

Jake Lawson has guided over 1,200 entrepreneurs through business formation and compliance across all 50 states. His Washington expertise comes from 15+ years of helping business owners navigate the state’s streamlined but unforgiving compliance requirements. This information is for educational purposes only and should not replace professional legal or business advice.