Jake Lawson here with another straight-talk guide. After helping over 300 Wisconsin entrepreneurs navigate the EIN process, I’ve learned exactly where people get stuck. Let’s fix that.

Starting a Wisconsin LLC? Smart choice—America’s Dairyland has some of the most business-friendly policies in the Midwest. But here’s the reality check: your shiny new LLC paperwork is just the beginning. Without a Federal Tax ID Number (EIN), you’re basically running a very expensive hobby.

I’ve seen too many Wisconsin business owners stumble at this crucial step, so let me walk you through everything you need to know about getting your EIN—the right way, the first time.

Understanding Your Wisconsin LLC’s Federal Tax ID

Your EIN (Employer Identification Number) is like your business’s DNA—it’s a unique nine-digit identifier that tells the federal government, banks, and vendors exactly who you are. Think of it as upgrading from your personal social security number to a proper business identity.

The format looks like this: 12-3456789. Once you get it, that number stays with your LLC for life (unless you make major structural changes, which I’ll cover later).

Key point: Your EIN comes from the IRS, not the Wisconsin Department of Financial Institutions. Don’t confuse this with state-level tax registrations—those are separate beasts entirely.

Why Your Wisconsin LLC Absolutely Needs an EIN

Let me be blunt: I’ve never met a successful business owner who regretted getting an EIN, but I’ve helped plenty who regretted waiting too long.

Financial Operations That Require an EIN

Banking Essentials:

- Opening any business bank account (try walking into a Wisconsin bank without one—I dare you)

- Applying for business credit cards

- Securing business loans or lines of credit

- Setting up merchant processing for customer payments

Tax and Legal Compliance:

- Filing federal tax returns (obviously)

- Filing Wisconsin state tax returns

- Handling payroll when you hire employees

- Applying for most business licenses in Wisconsin

Business Growth Activities:

- Establishing trade credit with suppliers

- Getting business insurance policies

- Opening investment accounts for business funds

- Applying for government contracts

Jake’s insight: I’ve had clients miss out on six-figure contracts because they couldn’t provide an EIN when asked. Don’t let paperwork kill your opportunities.

The Truth About EIN Costs (Spoiler: $0)

Here’s where I save you from getting ripped off: The IRS charges absolutely nothing for EIN applications.

I see ads all over Wisconsin (especially in Milwaukee and Madison) for “expedited EIN services” charging $75, $150, even $300. These companies are selling you convenience, not necessity. The free IRS online application gives you your EIN instantly—can’t get more expedited than that.

Bottom line: If you’re paying for an EIN, you’re paying too much.

Perfect Timing: When to Apply for Your Wisconsin EIN

Critical rule: Wait until your LLC is officially approved by the Wisconsin Department of Financial Institutions before applying for your EIN.

I’ve fixed this mistake for dozens of clients, and it’s always a headache. Here’s why timing matters:

- Your EIN application must match your LLC’s exact legal name

- If Wisconsin rejects or modifies your LLC name, your EIN won’t match

- Mismatched names mean canceling the EIN and starting over

Pro tip:

Wisconsin typically processes LLC applications within 5-7 business days. Wait for that confirmation email, then immediately apply for your EIN.

Wisconsin EIN Application: Your Step-by-Step Roadmap

Route 1: Online Application (US Citizens and Residents)

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), this is your path:

What You’ll Need Ready:

- Your Wisconsin LLC’s exact legal name (from your Articles of Organization)

- Your SSN or ITIN

- LLC formation date

- Principal business activity description

- Wisconsin business address

The Process:

- Go to the official IRS website (look for .gov in the URL)

- Complete the online SS-4 form

- Submit your application

- Download your EIN Confirmation Letter immediately

Timeline: Instant gratification. You’ll have your EIN in about 15 minutes.

Route 2: Paper Application (International Entrepreneurs)

If you’re a non-US resident without a US tax ID, you’ll need to use the mail/fax route:

Required Documents:

- Form SS-4 (downloaded from IRS website)

- Copy of your passport or other identification

- Your Wisconsin LLC’s Articles of Organization

The Process:

- Download and complete Form SS-4

- Mail or fax to the IRS (fax is faster)

- Wait for your EIN Confirmation Letter

Timeline: 2-3 weeks by fax, 4-6 weeks by mail.

Jake’s note: Ignore outdated advice about needing a “third-party designee.” I’ve helped over 150 international clients get EINs directly—no middleman required.

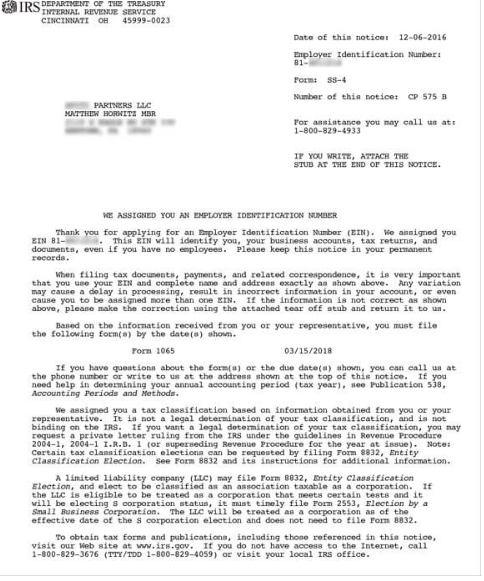

Understanding Your EIN Documentation

Once approved, you’ll receive an EIN Confirmation Letter (Form CP 575). This document is your business’s birth certificate—treat it accordingly.

What’s included:

- Your nine-digit EIN

- LLC’s legal name and address

- Tax classification

- IRS processing date

Storage tips:

- Keep physical copies in multiple locations

- Store digital copies in cloud storage

- Never laminate the original (banks sometimes need to photocopy it)

Wisconsin-Specific EIN Considerations

Married Couples and Wisconsin LLCs

Here’s something that trips up a lot of my Wisconsin clients. Contrary to some outdated information, Wisconsin is NOT a community property state. This means:

- Married couples with a Wisconsin LLC must be treated as a multi-member LLC

- You’ll need to file partnership tax returns

- No “qualified joint venture” option available

Jake’s recommendation: If you’re married and forming a Wisconsin LLC together, budget for partnership tax preparation—it’s more complex than single-member returns.

Wisconsin State Tax Registration

Your federal EIN is separate from Wisconsin state tax requirements. Depending on your business, you may also need:

- Wisconsin State ID Number (for state taxes)

- Sales tax permit (if selling taxable goods)

- Unemployment insurance registration (if hiring employees)

Industry-Specific Requirements

Wisconsin has specific licensing requirements for certain industries:

- Professional services (law, accounting, healthcare)

- Food service and retail

- Construction and contracting

- Transportation services

Your EIN will be required for virtually all professional license applications.

Banking Your Wisconsin LLC After Getting an EIN

Once you have your EIN, opening a business bank account should be your next priority. Here’s what works well for Wisconsin businesses:

Recommended Wisconsin Banks:

- Associated Bank (strong local presence)

- US Bank (excellent business services)

- Community First Credit Union (better fees for small businesses)

- Chase Bank (if you need nationwide access)

Required Documents:

- EIN Confirmation Letter

- Wisconsin LLC Articles of Organization

- Operating Agreement (if you have one)

- Government-issued photo ID

- Initial deposit ($25-$500 depending on bank)

International entrepreneurs: Several Wisconsin banks work with non-US residents, though you’ll need additional documentation. I maintain current lists of the most international-friendly options.

Common Wisconsin EIN Questions (From Real Clients)

“I’m a Single-Member LLC. Do I Really Need an EIN?”

Technically, the IRS allows single-member LLCs to use the owner’s SSN for tax purposes. Practically, this is terrible advice.

Reality check: Try opening a business bank account in Milwaukee or Madison with just your SSN. Most banks will send you packing. Plus, using your EIN instead of SSN provides crucial identity theft protection.

Jake’s rule: Get the EIN. It’s free, takes 15 minutes, and saves massive headaches later.

“What About DBAs and EINs?”

This confuses a lot of Wisconsin entrepreneurs. Here’s the straight answer:

- DBAs cannot have their own EINs—they’re just business nicknames

- If your LLC has a DBA, the LLC gets the EIN, not the DBA

- If you have a DBA without an LLC, you’re operating as a sole proprietorship or partnership

Example: “Madison Marketing LLC” doing business as “Badger Digital” would get one EIN for the LLC.

“I Applied for an EIN Before My LLC Was Approved. Now What?”

Don’t panic—this happens to about 10% of my clients. Here’s how to fix it:

If names match exactly: You’re fine. Use the EIN once your LLC is approved.

If names don’t match: Cancel the incorrect EIN and apply for a new one with the correct LLC name.

Prevention: Always wait for Wisconsin approval before applying for federal tax ID.

Red Flags: Wisconsin EIN Scams to Avoid

Wisconsin entrepreneurs are frequent targets for EIN scams. Here’s what to watch for:

- “Urgent renewal” notices: EINs never expire

- Fake IRS letters: Real IRS communications come from .gov addresses

- High-pressure sales calls: The IRS doesn’t call about EINs

- “Express processing” fees: The real process is already instant

Jake’s scam detector: If it creates false urgency or asks for money, it’s probably fake.

Fixing EIN Mistakes: A Wisconsin Perspective

Mistakes happen. Here’s how to fix the most common ones:

Lost EIN Confirmation Letter:

- Request an EIN Verification Letter (Form 147C) from the IRS

- Both documents are accepted by banks and government agencies

Wrong business structure:

- Major changes may require a new EIN

- Single-member to multi-member (or vice versa) usually requires a new EIN

Incorrect information:

- Minor errors can often be corrected by contacting the IRS

- Major errors may require canceling and reapplying

When to Get Professional Help

DIY is fine if:

- You have an SSN or ITIN

- Your LLC has straightforward ownership

- You’re comfortable with online forms

Consider professional help if:

- You’re a non-US resident

- You have complex business structures

- You’ve made mistakes before

- You’re planning significant business changes

Advanced Wisconsin Considerations

Multi-State Operations

Many Wisconsin LLCs do business in neighboring states (Illinois, Minnesota, Iowa). Your federal EIN works everywhere, but you may need separate state registrations.

Hiring Employees

Wisconsin has specific requirements for employers:

- Register with Wisconsin Unemployment Insurance

- Set up workers’ compensation (if required)

- Register for Wisconsin withholding tax

Professional Services

Wisconsin has strict licensing requirements for professional LLCs. Your EIN will be required for:

- Professional license applications

- State board registrations

- Professional liability insurance

Getting IRS Help When You Need It

If you need to contact the IRS about your Wisconsin LLC’s EIN:

Phone: 1-800-829-4933 Hours: 7 AM – 7 PM, Monday through Friday

Pro tip: Call right when they open to avoid hold times. Press 1 for English, then 1 for EIN questions, then 3 to reach a live person.

Final Thoughts: Your Wisconsin LLC Success Strategy

Your EIN isn’t just a number—it’s your ticket to business legitimacy. Without it, you’re stuck in entrepreneurial limbo, unable to access the banking, credit, and growth opportunities that make businesses successful.

Wisconsin offers excellent opportunities for entrepreneurs, from Milwaukee’s thriving tech scene to Madison’s innovation ecosystem. Don’t let missing paperwork hold you back from capitalizing on what the Badger State has to offer.

Action steps:

- Form your Wisconsin LLC

- Wait for state approval

- Apply for your EIN immediately

- Open a business bank account

- Start building your business credit history

The process is straightforward when you know the steps. Follow this guide, avoid the common pitfalls, and you’ll have your Wisconsin LLC properly set up for success.

About Jake Lawson: I’ve guided over 1,200 entrepreneurs through US business formation, including 300+ Wisconsin LLCs. My philosophy is simple: give you the facts without the fluff, so you can make informed decisions about your business future.

Ready for the next step? Check out our comprehensive Wisconsin LLC formation guide, or browse our reviews of the top LLC formation services for 2025.

This information covers standard situations. Every business is unique—consider consulting with a qualified tax professional for complex scenarios or specific questions about your Wisconsin LLC.