Updated January 2025 | By Jake Lawson

Time for your West Virginia LLC annual report? Don’t worry—I’ve got you covered. After helping over 1,200 entrepreneurs navigate LLC compliance across all 50 states, I can tell you that West Virginia strikes a nice balance between useful reporting and reasonable costs.

At just $25 per year and with a generous 6-month filing window, the Mountain State keeps annual reporting manageable. But there are still some quirks in the process that can trip up business owners, especially if you’re making changes to your LLC information.

Let me walk you through everything you need to know about West Virginia LLC annual reports, including the step-by-step filing process, common mistakes to avoid, and what happens if you miss the deadline.

West Virginia Annual Report Quick Facts

Annual fee: $25 per year

Filing deadline: Between January 1 and June 30

Late penalty: $50 per year (ouch)

Filing method: Online through West Virginia One Stop Business Portal

First report due: The year after your LLC was approved

Jake’s take: West Virginia’s annual report system is actually pretty user-friendly once you understand the process. The 6-month filing window gives you plenty of flexibility, and $25 is reasonable compared to some states that charge $300+ annually.

Why West Virginia Requires Annual Reports

Annual reports aren’t just bureaucratic busy work (though they can feel like it). Here’s what West Virginia is actually trying to accomplish:

Keeping State Records Current

- Your LLC’s contact information stays up to date

- Changes in management or ownership get recorded

- State can reach you if needed for legal or regulatory issues

- Maintains accuracy of public business records

Ensuring Business Viability

- Demonstrates your LLC is still actively operating

- Shows you’re committed to maintaining legal compliance

- Helps prevent abandoned business entities from cluttering state records

- Provides regular checkpoints for business health

Revenue Generation

- $25 annual fee helps fund state business services

- Much more reasonable than many other states

- Veteran-owned LLCs get first 4 years free (nice touch, West Virginia)

My perspective: Annual reports serve a legitimate purpose, and West Virginia handles them reasonably well. The process is straightforward, the cost is fair, and the deadline is flexible.

Understanding Your Filing Timeline

When Your First Report is Due

Your first annual report is due the year after your LLC was approved, not the same year.

Example timeline:

- LLC approved: March 15, 2024

- First annual report due: Between January 1 and June 30, 2025

- Every subsequent year: Between January 1 and June 30

The 6-Month Filing Window

Unlike some states with rigid deadlines, West Virginia gives you a full 6 months to file:

- Earliest filing date: January 1

- Latest filing date: June 30

- My recommendation: File in February or March to avoid the rush

Planning Your Filing Schedule

Early filing benefits:

- Avoid deadline stress

- Get it done during slower business periods

- Lower chance of system overload on state website

- Can address any issues with plenty of time

When to file later:

- If you’re making significant business changes

- Want most current information on file

- Prefer to batch all annual compliance tasks

Special Benefits for Veterans

West Virginia shows appreciation for military service with a great benefit:

Veteran LLC owners get:

- First 4 consecutive annual report fees waived

- Must still file the reports (paperwork required, fees waived)

- Potentially $100 savings over 4 years

- Filing process may look slightly different

Qualification requirements:

- LLC owner must be a veteran

- Must register for the benefit when filing

- Good standing required to maintain benefit

Jake’s note: This is one of the better veteran benefits I’ve seen among state LLC programs. If you qualify, make sure to take advantage of it.

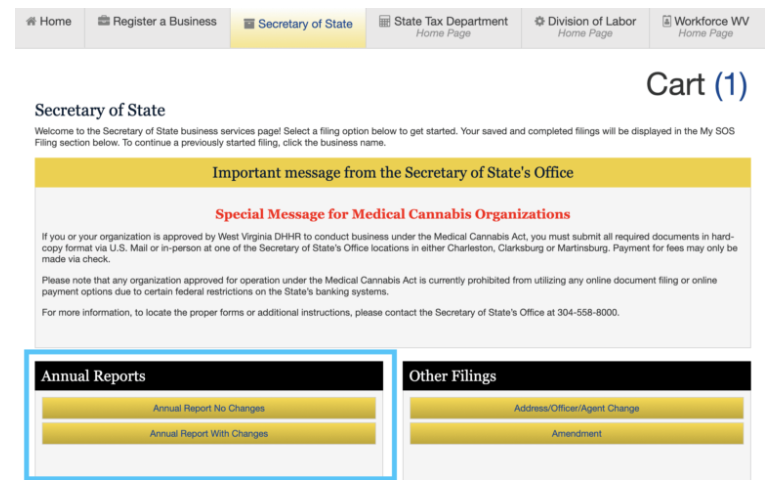

The Two Filing Paths: Changes vs. No Changes

West Virginia gives you two options based on whether you need to update your LLC information:

Annual Report No Changes

Choose this if:

- All your LLC information is current and accurate

- No changes to members, managers, or addresses

- Want the fastest filing process

- Don’t need to review all your information

Annual Report with Changes

Choose this if:

- Need to update addresses, members, or managers

- Want to review all information on file

- Making any changes to your LLC structure

- Not sure if your information is current

My advice: When in doubt, choose “with changes.” It takes a few extra minutes but lets you review everything and ensure accuracy.

Step-by-Step Filing: No Changes Process

If your LLC information is current, this is the faster path:

Getting Started

- Go to West Virginia One Stop Business Portal: onestop.wv.gov/B4WVPublic/

- Log into your account (or create one if needed)

- Click the Secretary of State tab

- Scroll to Annual Reports section

- Click “Annual Report No Changes”

Finding Your Company

- Enter your LLC name in the search box

- Click Search

- Select your LLC from the results list

Reviewing the Process

- Read the filing status page (confirms $25 fee)

- Click Continue

- Review your information on file

- Click Continue if everything looks correct

Certification and Payment

- Enter your full name as the person filing

- Select your capacity:

- “Manager” if your LLC is manager-managed

- “Member” if your LLC is member-managed

- Enter your phone number

- Click Checkout

Final Steps

- Select payment method

- Review fees (should be $25)

- Click Checkout

- Enter payment information

- Submit your filing

Confirmation: You should receive an email confirmation within minutes. Check your spam folder if you don’t see it.

Step-by-Step Filing: With Changes Process

If you need to update information or want to review everything:

Getting Started (Same as Above)

- Access West Virginia One Stop Business Portal

- Log into your account

- Navigate to Secretary of State tab

- Click “Annual Report with Changes”

Company Information Updates

Business Details:

- Select your business purpose from dropdown

- Choose your WV County (or “Out of State”/”Out of Country”)

- Click Continue

Address Updates:

- Principal Office: Your main business address

- Mailing Address: Where you receive business mail

- Designated Office: Legal address for your LLC

- Update any addresses that have changed

Registered Agent:

- Update agent information if changed

- Note: West Virginia doesn’t require registered agents, but you can list one

- Click Continue

Contact and Business Information

Company Email:

- Enter your best business email (not public record)

- Add website URL (optional)

- Click Continue

Employee Information:

- WV employees: Number of employees in West Virginia

- Total employees: All employees anywhere

- Remember: LLC owners are not employees

Member/Manager Information

- Review current members on file

- Click pen icon to edit member information

- Click “Add Record” to add new members

- Must have at least one member on record

- Review current managers on file

- Update manager information as needed

- Add new managers if necessary

Additional Questions

Scrap Metal Business:

- Click Yes if you deal in scrap metal

- Click No for most businesses

Export Information:

- List top 3 export countries if applicable

- Click No if you don’t export

- Optional: Request export assistance information

Ownership Demographics:

- Minority-owned business? Yes/No/Decline to answer

- Woman-owned business? Yes/No/Decline to answer

- Multiple WV businesses? Yes/No and provide details

Military Information:

- Employ veterans/active military? Yes/No with numbers

- Owner is veteran/active military? Yes/No/Decline

Business Assistance:

- Want SBDC contact? Free business coaching available

- Choose Yes or No

Final Review and Submission

- Review all information you’ve entered

- Click “Show” to expand each section

- Verify accuracy of all details

- Enter your name and capacity

- Provide phone number

- Proceed to payment

- Submit your filing

Common Filing Mistakes to Avoid

I’ve seen these errors repeatedly, so learn from others’ experience:

Wrong Filing Option

The mistake: Choosing “No Changes” when information needs updating

The consequence: Outdated information on state records

The prevention: When in doubt, choose “With Changes” to review everything

Incorrect Member vs. Manager Selection

The mistake: Selecting wrong capacity (Member vs. Manager)

The consequence: Inconsistent records with your LLC structure

The prevention: Review your Operating Agreement to confirm management structure

Missing the Deadline

The mistake: Filing after June 30

The consequence: $50 late fee per year missed

The prevention: Set calendar reminders for early filing

Incomplete Employee Information

The mistake: Counting LLC owners as employees

The consequence: Inaccurate state records

The prevention: Remember that LLC owners are not employees

Payment Processing Issues

The mistake: Not confirming payment went through

The consequence: Filing not complete, potential late fees

The prevention: Wait for email confirmation before considering it done

What Happens If You Miss the Deadline

West Virginia takes annual reports seriously, with escalating consequences:

Late Filing Penalties

- $50 late fee for each year missed

- Plus the $25 annual report fee for each year

- Example: Miss 2 years = $150 total ($50 + $50 late fees + $25 + $25 reports)

Administrative Dissolution

- After 4 consecutive years of non-filing

- State dissolves your LLC administratively

- Lose legal protection and business standing

- More expensive to fix than staying current

Reinstatement Process

If your LLC gets dissolved:

Requirements:

- File Articles of Reinstatement (by mail only)

- Pay $200 total: $25 reinstatement + up to $150 late fees + $25 current report

- Get Letter of Good Standing from WV State Tax Department

- Complete current year Annual Report

Timeline:

- Must reinstate within 2 years of dissolution

- After 2 years: Must form new LLC entirely

- Risk: Your LLC name might be taken by someone else

Jake’s reality check: The reinstatement process is a hassle and costs 8 times more than just filing on time. Set those calendar reminders.

Professional Services vs. DIY

When to Handle It Yourself

- Simple LLC structure with no changes

- Comfortable with online forms

- Have time to work through the process

- Want to save money on service fees

When to Consider Professional Help

- Complex member/manager changes

- Multiple LLCs to manage

- Time is valuable and you’d rather delegate

- Want professional oversight of compliance

Services I recommend:

- Northwest Registered Agent: Excellent annual report services

- MyCompanyWorks: Good service and reasonable rates

- Local CPAs: Often handle annual reports as part of tax services

Cost considerations: Professional services typically charge $50-150 for annual report filing. Sometimes worth it for the peace of mind and time savings.

Keeping Track of Multiple LLCs

If you have multiple West Virginia LLCs:

Organization Strategies

- Create a master calendar with all deadlines

- Use spreadsheets to track filing status

- Set individual reminders for each LLC

- Consider professional service for multiple entities

Bulk Filing Considerations

- File all at once to avoid missing any

- Use same login for all your LLCs

- Double-check you’re filing for the right entity

- Keep confirmation emails organized by LLC

Record Keeping Best Practices

What to Save

- Email confirmation of successful filing

- Copy of annual report (download from confirmation page)

- Payment confirmation for your records

- Screenshot of completion as backup

Organization Tips

- Create annual folder for each year’s compliance

- Include all LLCs in same organizational system

- Digital and physical copies for important documents

- Update your LLC records with new information

The Technology Side: Filing Tips

Browser and System Requirements

- Use updated browser for best experience

- Disable pop-up blockers for the state site

- Stable internet connection recommended

- Have backup browser available

Mobile vs. Desert Filing

- Desktop preferred for complex forms

- Mobile works for simple “No Changes” filing

- Larger screen helpful for reviewing information

- Better typing experience on desktop

Common Technical Issues

- Session timeouts: Complete filing in one session

- Payment processing: Wait for confirmation before closing browser

- PDF downloads: May require allowing downloads

- Email delivery: Check spam folders for confirmations

International Entrepreneurs: Special Considerations

If you’re a non-U.S. resident with a West Virginia LLC:

Address Considerations

- International addresses accepted in annual reports

- Use complete addresses including country

- Consider U.S. mailing address for faster communication

- Keep contact information current

Time Zone Management

- West Virginia uses Eastern Time

- Plan filing around time differences

- June 30 deadline is Eastern Time

- Consider professional help for complex situations

Looking Ahead: Future Compliance

Annual Report Reminders

- Set recurring calendar events for January filing

- Review business changes before each filing

- Update contact information as needed

- Plan for growth and structural changes

Business Evolution Considerations

- Adding members requires updated reports

- Changing management structure affects filing choices

- Address changes need timely updates

- Professional services might make sense as you grow

The Bottom Line: West Virginia Annual Reports

West Virginia handles LLC annual reports reasonably well—fair cost, flexible deadline, and straightforward online process. The key is staying organized and filing on time to avoid penalties.

Keys to success:

- Set calendar reminders well before the June 30 deadline

- Choose the right filing option based on your needs

- Review all information carefully before submitting

- Keep confirmation records for your files

- Address issues promptly if they arise

My recommendation: File early in the year when you’re not rushed, choose “With Changes” if you want to review everything, and don’t let multiple years pile up. The $25 annual cost is a small price for maintaining your LLC’s legal standing.

Frequently Asked Questions

Can I file my annual report before January 1st?

No, West Virginia only accepts annual reports between January 1 and June 30. The system won’t let you file earlier than January 1st.

What if I need to change my registered agent during the annual report?

You can’t change your registered agent through the annual report process. That requires a separate filing. However, you can update other agent information if you already have one listed.

Do I need to file an annual report if my LLC made no money?

Yes, annual reports are required regardless of business activity or income. Even dormant LLCs must file annual reports to maintain good standing.

Can I get an extension on the June 30 deadline?

West Virginia doesn’t offer extensions for annual reports. The deadline is firm, and late filing results in $50 penalties per year missed.

What happens if I file with incorrect information?

You can file an amendment to correct errors, but it’s better to get it right the first time. Use the “With Changes” option to review all information carefully.

Can someone else file my annual report for me?

Yes, anyone can file your annual report as long as they have the necessary information and login credentials. Many business owners have their CPAs or business service providers handle this.

Need help with your West Virginia LLC annual report? I work with professional services that specialize in LLC compliance and can handle your filing efficiently. Check out my recommended providers for hassle-free annual report filing.

Questions about West Virginia LLC compliance? Email me at [Jake’s email]. I personally respond to every message and can help you navigate any complications with your annual report filing.

Remember: Annual reports are a small but important part of maintaining your LLC. Stay organized, file on time, and focus on growing your business in the beautiful Mountain State.